After falling 30%, are Diageo shares too cheap to ignore?

FTSE 100 drinks group Diageo (LON:DGE) was formed when Guinness merged with Grand Metropolitan in 1997.

The combination created a group with heritage stretching back to the 17th century – some of the group's oldest brands are Haig whisky (1627), Guinness (1759) and Johnnie Walker (1820).

Over the years following the merger, Diageo divested non-core food and hospitality businesses such as Burger King and Pillsbury. This created a pure-play drinks business that was primarily focused on spirits, although Guinness has always remained an important part of the mix.

Today, the company now has a world-leading portfolio of 200 of mass-market and premium brands that are sold in nearly 180 countries.

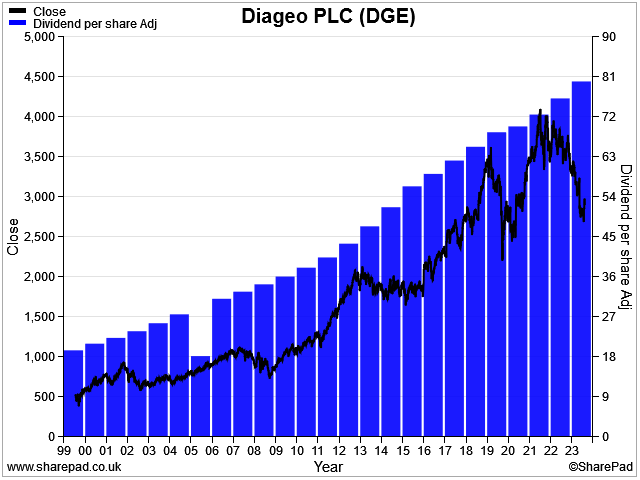

For investors who spotted the opportunity and got in early, Diageo shares have been a solid long-term investment that's delivered impressive income growth:

According to SharePad total return data, £1,000 invested in 2004 – following the divestment of the food businesses – would be worth about £5,500 today, including dividends. That's equivalent to an annualised total return of just under 9% over 20 years.

A 9% annualised return may not sound spectacular, but I think it's a decent record over such a long period.

Of course, these total return numbers would have been higher in early 2022.

Diageo's share price has fallen by around 30% from the record highs of £41 seen in January 2022. The stock is now trading in line with the pre-pandemic levels of five years ago:

A buying opportunity?

I've always viewed Diageo as a quality compounder, with some attractive defensive characteristics. In principle, I think it's a stock I'd like to hold in my dividend portfolio.

In recent years, I have generally ruled out investing on valuation grounds, but the company's recent share price weakness has prompted me to take a fresh look.

- Are Diageo shares cheap enough to offer an attractive entry point?

- Can I see any warning signs in the numbers to suggest the company's long-held advantages are weakening?

To find out more, I've run Diageo through my dividend scoring system and taken a closer look at its financials. Here's what I found.

Table of contents

- Recent trading & outlook - falling volumes and a surprise profit warning

- Crunching the numbers - how does Diageo score in my screening system?

- Dividend culture - 26 years of continuous payouts

- Dividend safety - pretty good, could do slightly better

- Dividend growth - lacking support, but long-term record inspires confidence

- Dividend yield - below average

- Valuation - are the shares cheap enough for me after recent falls?

- Profitability - an impressive record of high returns

- Fundamental health - borrowings are slightly high, for me

- Conclusion - would I consider buying Diageo for my dividend portfolio?

Recent trading & outlook

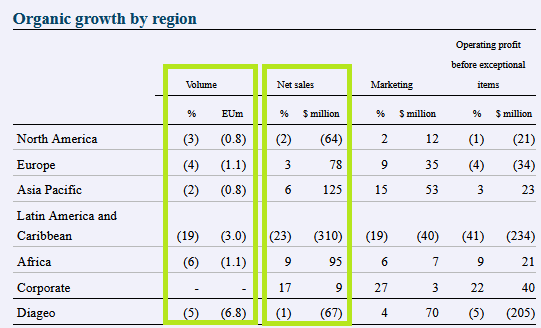

Diageo surprised the market in November with a profit warning, blaming a slump in sales in Latin America.

Chief executive Debra Crew said that weaker consumer demand, downtrading and associated destocking meant that half-year sales in its Latin America and Caribbeann region would be around 20% lower than the same period last year.

At the time, I wondered whether other regions were also seeing weaker sales, despite the company's claim that "momentum was continuing" elsewhere.

January's interim results do indeed suggest to me that Diageo has seen a broader slump in demand. In addition to the expected slump in LAC, volumes fell in all regions on an organic (comparable) basis, including North America:

Price rises appear to have offset some of the fall in volumes. But net sales still fell by 1% to $10,962m during the half year, compared to the same period last year. Net profit was 18% lower, at $2,342m.

Conversely, free cash flow for the period rose by $518m to $1,426m, which the company says was due to careful working capital management and the timing of one-off tax payments last year.

A look at the accounts shows that Diageo's working capital requirements still absorbed a further $719m during H1, but this looks largely like a seasonal movement to me (reflecting the peak Christmas period). I'd expect some improvement over the full year.

Excluding the working capital outflow, my sums suggest free cash conversion of 92% during the half year, showing good underlying cash performance.

Dividend: Diageo's interim dividend was increased by 5%, to 40.5 cents per share.

FY24 outlook: despite the negative performance during the first half – notably the weakness in North America – guidance for the full year appears to have been left broadly unchanged.

Consensus forecasts have only moved slightly lower since these results were published at the end of January, suggesting analysts remain confident in Ms Crew's H2 guidance for an "improvement in organic net sales and organic operating profit growth at the group level, compared to the first half."

Diageo has changed its reporting currency from the UK pound to the US dollar this year, as the dollar reflects a greater part of its trading activity.

This complicates comparisons between years, but the company has provided recast financials for the last three years. According to these numbers, FY23 earnings would have dropped out at $1.96 per share.

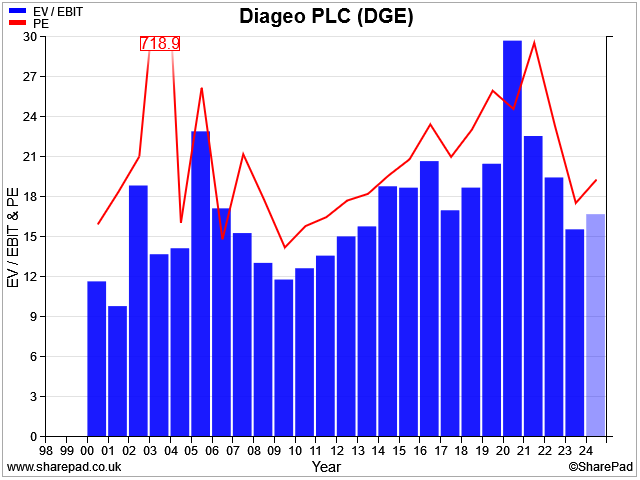

Current broker estimates are for a figure of $1.91 per share this year, according to Stockopedia. This prices Diageo shares on about 19 times forecast earnings, based on current exchange rates.

This appears to be the stock's lowest P/E multiple since 2014/15, according to SharePad. The stock's EV/EBIT ratio – a more important metric for me – is also similarly reduced:

I don't see the current headwinds as a lasting setback for Diageo. I expect trading to recover over time. On this basis, the current valuation dip makes this a logical time for me to take a look at the business as a possible investment.

Let's take a look at how my screening system rates Diageo's financials.

Diageo: crunching the numbers

Description: Diageo is a global drinks business with a portfolio of brands including Johnnie Walker, Smirnoff, Tanqueray and Guinness.

| Diageo (LON:DGE) |

Quality Dividend score: 48/100 | Forecast yield: 2.8% |

| Share price: 2,899p | Market cap: £64.8bn | All data at 12 Feb 2024 |

Latest accounts: half-year results for the six months to 31 December 2023

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Diageo could be a suitable addition to my quality dividend portfolio.

As a reminder, this is a scoring system I've developed to rank shares for the qualities that are important to me, from a quality dividend perspective.

My choice of scoring factors is of course highly subjective. These scores are not intended to be used as a guide on when to buy or sell shares. They're simply one factor I use to assess a stock's potential attractions, in addition to broader, company-specific analysis.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: very strong

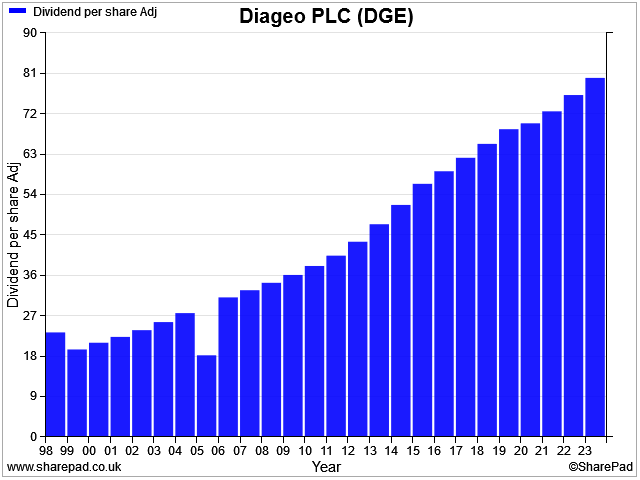

Diageo has paid an ordinary dividend every year since 1998 and has increased its payout in almost all of these years:

The company clearly has a strong and consistent commitment to the shareholder payout. Unsurprisingly, my screen awards Diageo a perfect score for dividend culture.

Diageo scores 5/5 for dividend culture in my screening system.

Dividend safety: fairly good

My dividend safety score looks at three factors:

- dividend cover by earnings

- dividend cover by free cash flow

- leverage (which I define here as net debt/5yr average net profit)

My aim is to gauge the safety and affordability of the dividend. I want to know if the payout might be vulnerable to a cut during a period of difficult trading.

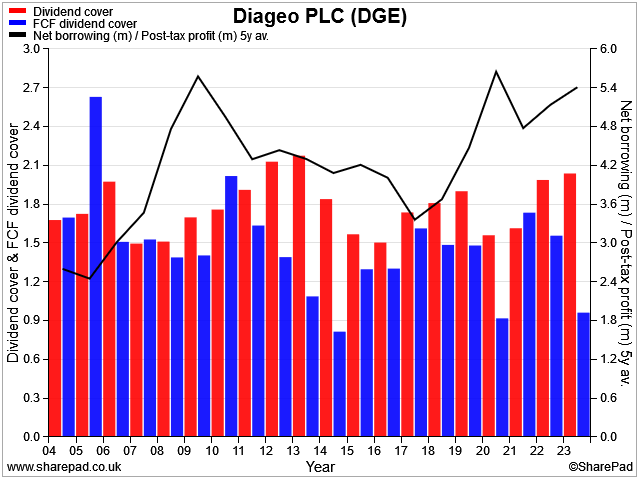

In this case, we can see that Diageo has generally maintained earnings and free cash flow cover for its dividend, although free cash flow conversion has become slightly less consistent since 2011:

Using SharePad data, I estimate that dividends have consumed about 75% of free cash flow over the last 10 years.

Where additional cash has been needed, particularly to fund acquisitions, Diageo has made relatively generous use of debt, in my view.

I'll comment on my views on the group's debt and profitability shortly. For now, I would say Diageo's dividend is probably safer than the score below suggests. But I do think there is room for improvement.

Diageo scores 2.6/5 for dividend safety in my screening system.

Dividend growth: lacking support?

As with dividend safety, my main concern with a company's dividend growth is over its sustainability.

In my view, two of the main drivers of sustainable dividend growth are a company's net asset value and its free cash flow. Over the long term, I believe both of these need to increase to deliver sustainable dividend growth.

Without growth in net asset value, a company may need to increase its profitability to support a dividend growth. While companies can increase their profitability, in my experience this process tends to reach a limit at some point.

Similarly, without free cash flow growth, companies run the risk of relying on debt or cash reserves to support dividend growth – ultimately, this may also become unsustainable.

With these factors in mind, my dividend growth score compares the five-year growth rates for NAV and free cash flow with the five-year dividend growth rate.

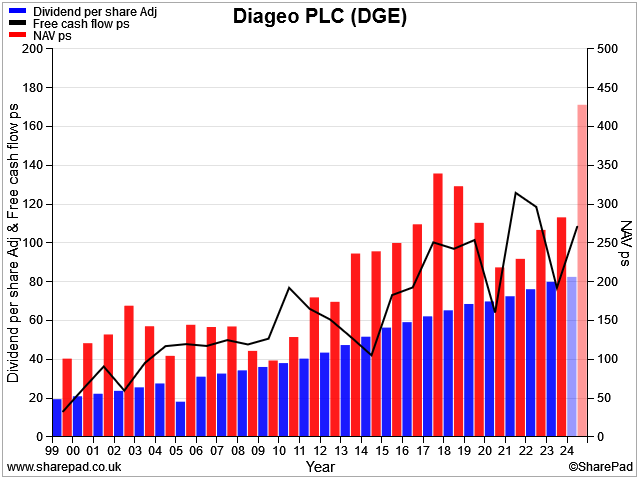

This is quite hard to show in a chart, so I tend to just plot the values of these metrics in order to visualise whether they have grown in step with each other:

This chart provides a nice visual representation of the way that Diageo's free cash flow has kept pace with its dividend growth over the last 25 years.

Free cash flow and net asset value growth have both slowed over the last few years, depressing my five-year growth rate estimates.

However, performance is expected to improve over the coming year and the group's long-term growth trend looks very reassuring to me. Rescoring this stock on a 10-year view would give a stronger result.

On balance, I think Diageo's long-term track record suggests that the score below is probably too harsh.

Diageo scores 0.3/5 for dividend growth in my screening system.

Dividend yield: a little low

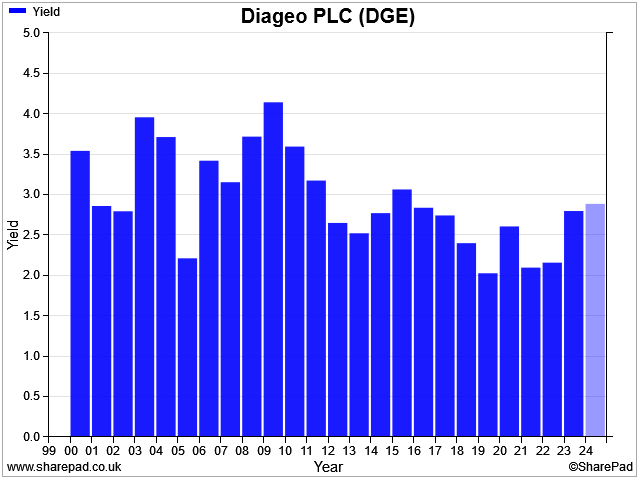

Diageo shares have rarely offered a dividend yield of more than 3% over the last decade or so:

The stock's five-year average dividend growth rate is about 4%. If I add this to the current yield of 2.8%, I get an expected return of 6.8%.

What this tells me is that if the stock's dividend growth rate and P/E rating remain stable, then an investment might deliver an annual total return of just under 7% over the next few years.

That certainly wouldn't be a disaster. It would be in line with the long-term average return from the UK market.

However, in general I tend to target an expected return figure of at least 10%, in the hope of gaining a greater margin of safety and improving my chances of beating the market.

Diageo scores 2/5 for dividend yield in my screening system.

Valuation: cheap enough?

I don't normally buy stocks in the hope of benefiting from a re-rating unless they look exceptionally cheap to me. Let's see if that's the case here.

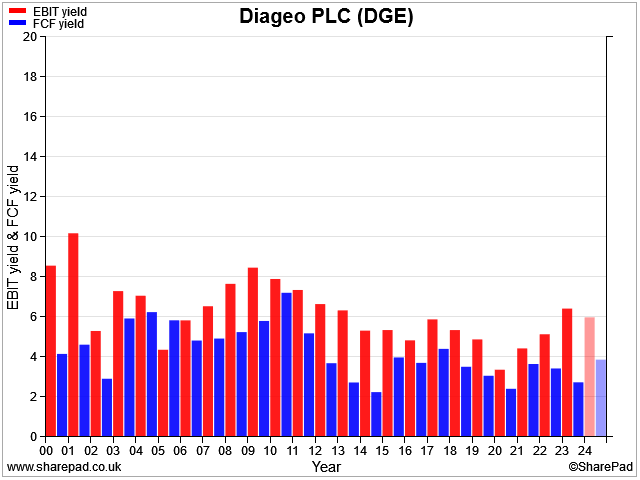

The two main metrics I use for scoring stocks on valuation are EBIT yield (EBIT/EV) and free cash flow yield. I prefer these over the P/E ratio as they – respectively – include debt and reflect surplus cash generation. Both are important factors in the quality of a dividend, in my view.

Here's how Diageo's valuation stacks up on my metrics:

Consensus forecasts for the year ending 30 June 2024 suggest Diageo shares are trading on an EBIT yield of 6%, with a free cash flow yield of around 4%.

In terms of valuation, that's at the upper end of what I might want to consider. I would be more tempted with an EBIT yield of 8% and a free cash flow yield of 6%.

However, I don't think Diageo's current valuation looks too unreasonable for a good quality, high-margin defensive with a long track record.

Interestingly, Diageo's forecast dividend yield of 2.8% suggests that the 75% average free cash flow payout ratio I mentioned remains representative of what to expect from the business.

Although I would like to pay a little less for Diageo shares, I wouldn't rule them out on valuation grounds alone at this level.

Diageo scores 2.5/5 for valuation in my screening system.

Profitability: very good

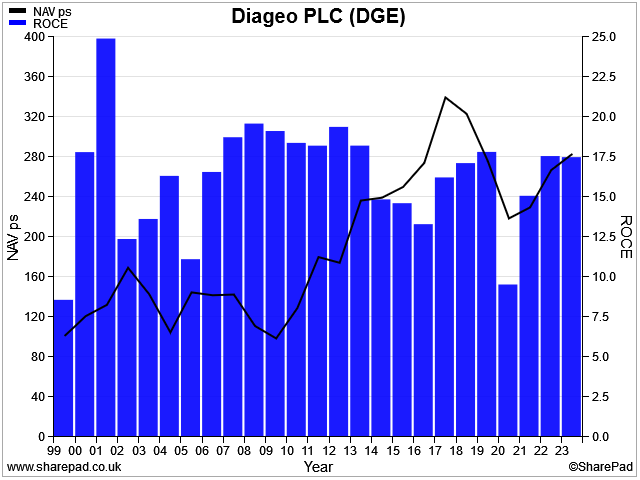

As I mentioned earlier, I see net asset value per share (NAVps) growth as a key indicator of sustainable growth.

If a non-financial company's net assets aren't growing, then it may be relying on increased profitability or greater leverage to achieve higher profits and dividend payments. That's not ideal, from my perspective.

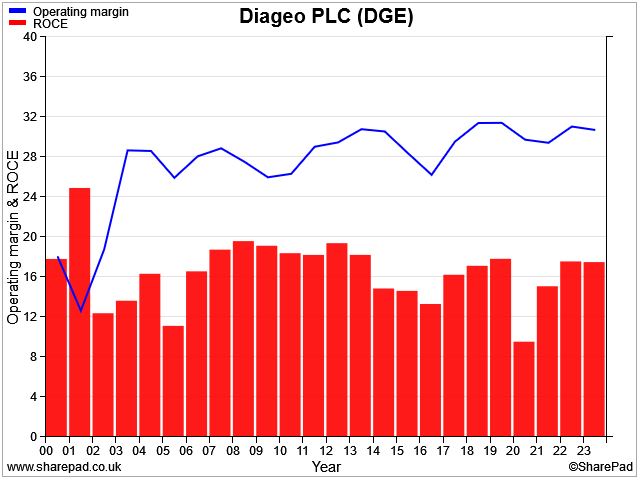

Ultimately, profitability is driven by the returns on a company's assets. So my preferred measure of profitability for non-financials is return on capital employed (ROCE), rather than operating margin (although both are useful).

To score stocks for profitability, I look at ROCE and NAVps growth. What I hope to see is consistent or improving ROCE, alongside steady NAVps growth.

If we exclude the impact of the pandemic, then I think that Diageo has delivered this quite reliably over the last 25 years:

Once again, Diageo's five-year average ROCE (the measure used in my score) has dropped somewhat due to the pandemic.

However, the company's long-term track record of high operating margins and above-average ROCE looks very reassuring to me. I don't have any serious concerns about the profitability of this business:

Overall, I think it's fair to say that Diageo has delivered consistently strong profitability for a long time.

Once again, I think it might be reasonable to score the business slightly higher than my system suggests.

Diageo scores 2.8/5 for profitability in my screening system.

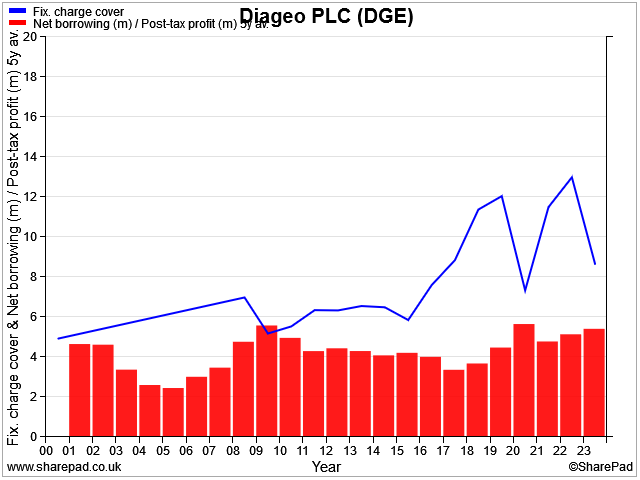

Fundamental health: too much debt?

Together with valuation, my only other real reservation about Diageo is that it uses slightly too much debt for my liking.

The group's net borrowing has risen from $17.6bn to $20.9bn since 2021. Diageo's net debt/EBITDA leverage multiple returned to its previous high of 2.9x at the end of December. That's above my preferred limit for this measure of 2.0x-2.5x.

To be clear, I don't think the group's debt is likely to be problematic. But with interest rates rising, I think that switching capital allocation from share buybacks to debt repayment might be prudent and could result in a modest reduction in finance costs.

Looking at the numbers, Diageo's FY23 results indicated that the group's effective interest rate was expected to be "just above 4%" in FY24.

The half-year results revealed that the actual H1 result was 4.4%, but management expect the full-year result for FY24 to "reduce slightly".

If I assume a full-year figure of 4.2%, I estimate that interest costs might reduce to around 3.2%, after tax. Even so, this is still more costly than the 2.8% cost of the dividend at current levels.

Diageo bought back $500m of shares during the first half of the year and paid net interest of $352m. So the numbers involved are not necessarily trivial.

I suspect that repaying debt instead of buying back shares could result in a net saving to the business. It would also have the added benefit of strengthening Diageo's balance sheet and improving its financial flexibility, perhaps to support future growth investments.

My fundamental health score combines my own measure of leverage (net debt/5yr average net profit) with fixed charge cover (the ratio of EBIT to rent and lease costs):

Diageo's fixed charge cover looks comfortable enough, but leverage appears to be at the upper end of the group's historic range, based on my measure.

Consensus forecasts do suggest a reduction in net debt over the next couple of years, so perhaps my cautious view on share buybacks is unecessary.

Even so, if I added Diageo to my dividend portfolio today, it would be the most highly-geared company in the portfolio. That's not something that fills me with enthusiasm.

Diageo scores 1.7/5 for fundamental health in my screening system.

Conclusion: a contrarian opportunity?

My quality dividend system awards Diageo an overall score of 48/100 at the time of writing (February 2024).

My view: on balance, my view remains that Diageo is a good quality business that is starting to look reasonably priced.

Although my dividend screen score of 48/100 seems uninspiring and is below the current portfolio average of 69, I can see scope for this to improve over the next 12-18 months.

Here's a summary of the main points, as I see them.

Pros:

- Global market leader with an enviable portfolio of brands, many of which have proved extremely durable

- Consistently high margin, high ROCE business

- Good cash generation

- Long and consistent record of prioritising dividend returns

- The current valuation is not completely unreasonable and might represent a decent buying opportunity

Cons:

- Diageo is currently going through a difficult patch; there's a risk that a recovery will take longer than expected, which could further depress the valuation and create better, safer buying opportunities.

- Debt levels and leverage are a little higher than I'd like

- I feel that debt reduction might be a better use of cash than share buybacks at the moment

- Although I accept the arguments for paying a premium for quality, the shares are not as cheap as I'd like for a new purchase

I would still want to do some additional research before deciding to add Diageo to my dividend portfolio.

But on balance, I expect this business to continue generating fairly consistent and attractive returns for the foreseeable future. I do not have any serious concerns about Diageo and would be happy to own its shares.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.

Member discussion