The Dividend Note - buybacks vs dividends + MONY, WIL (23/02/24)

Welcome back to The Dividend Note. This is a weekly review of results from dividend stocks that look potentially interesting to me.

My eye was caught this week by the number of companies declaring sizeable share buybacks with their full-year results. This trend was especially noticeable among FTSE 100 firms, especially the big banks.

The list from this week alone included Barclays (£1bn), BAE Systems (£1.5bn), HSBC Holdings ($2bn), Intercontinental Hotels ($800m), Lloyds Banking Group (£2bn), Standard Chartered ($1bn) and Plus500 ($100m).

In fairness, it can make sense for banks trading below net asset value to buyback their own stock. Assuming asset values remain stable and no higher-return opportunities are available, buying back shares at a discount to their book value should create value for shareholders.

Even so, I was surprised by Barclays' statement that it intends to keep the total dividend flat, going forwards. Dividend per share growth will come from "increased buybacks" reducing the bank's sharecount.

This seems a remarkable choice to me. I could only imagine taking this decision if I felt that the medium-term profit outlook for my business was flat or declining.

Have we reached peak buyback?

In the right circumstances, I accept that buybacks can create value for shareholders. Albeit, investors must sell shares to realise any of that value.

What buybacks can't do is to provide an income for the owners of the business. That's the role of the dividend.

Dividend investing has fallen out of fashion in recent decades, especially in the US. US fund manager Daniel Peris, of Federated Hermes, believes this could be about to change – and with good reason, in my view.

In an interview with the Investor's Chronicle this week, Peris – who was a history professor before becoming a fund manager – makes the point that throughout history, business owners have expected their assets to provide a cash income.

The idea of suggesting to a business owner (or a buy-to-let landlord) that they should sell fractions of their business or borrow against their assets each year simply to provide an income would be laughable in most circumstances. But this is exactly the stance that's been adopted by many investors in recent years.

Peris argues that the trend towards focusing on capital gains (and buybacks) can be seen as a recent anomaly, in historical terms.

He links this change to a 40-year downtrend in interest rates and suggests that with this period now seemingly at an end, dividends could regain their former importance to stock market investors.

The interview also covers some specific dividend stocks, including Shell, and is well worth a listen in my view, even if you disagree with the premise.

To me, many buyback decisions seem to me to be driven by the need to engineer earnings per share growth, thus supporting a higher valuation. Few companies follow Next's example in providing a costed explanation of why buybacks are the optimum use of surplus capital.

With the interest rates now higher than they've been for more than a decade, I think companies' capital allocation between debt, buybacks, and dividends may need to evolve.

Obviously I'm talking my own book here (as is Peris, I imagine). But I'm a big believer in the value of historical context for investors. I think it's a good way to understand events and to identify both opportunities and risks.

Let's move on and take a look at some company results.

Companies covered:

- Moneysupermarket.com Group (LON:MONY) - a solid set of results from this extremely profitable business, but management warn of tougher comparisons this year. On balance, the shares look fair value to me.

- Wilmington (LON:WIL) - I'm impressed by my initial review of this training and information services business and have added it to my watch list to follow more closely in the future.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my personal view and are provided solely for information and education purposes. They are not advice or recommendations.

Moneysupermarket.com Group (MONY)

"Record revenue at £432m, despite no material revenue from energy switching"

2023 full-year results/ Mkt cap: £1.4bn

FY24 forecast dividend yield: 5.0%

One company that has not made any mention of buybacks in its latest results is Moneysupermarket.com Group.

I haven't covered this FTSE 250-listed price comparison group here before, but it's a business I've followed in recent years thanks to its strong brand, high margins and good cash generation.

Concerns around the maturity of the market and the level of competition between the top players have stopped me owning the stock, but it's a business I've considered buying on more than one occasion.

One characteristic of Moneysupermarket's business that has become more obvious to me over the last few years is the extent to which it's at the mercy of external events.

Even if we ignore the pandemic, rising interest rates and changes in the insurance and energy markets have had a sizeable impact. So too has the resurgence in inflation.

Let's move on and take a look at Moneysupermarket's 2023 results.

Results summary: 2023 seems to have been a fairly good year for the business, driven by a particularly strong performance in insurance.

At a group level, revenue rose by 11% to a record of £432.1m, while pre-tax profit was 4% higher, at £72.3m.

A net profit of £72.3m was converted into free cash flow of £73.3m, including £10m of acquisition spend. This supported a reduction in net debt to £19.8m (FY22: £39.0m) and gives the stock a free cash flow yield of 5.4%.

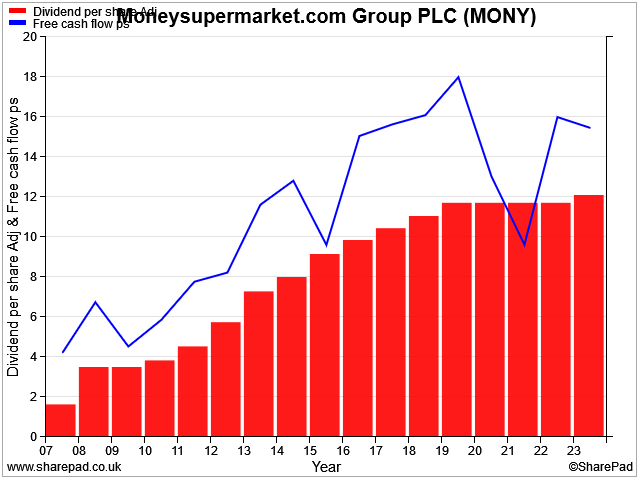

Dividend: the full-year dividend for 2023 was increased by 3% to 12.1p per share, giving a yield of 4.9%.

This increase ends a run of flat payouts, with a welcome recovery in free cash flow per share:

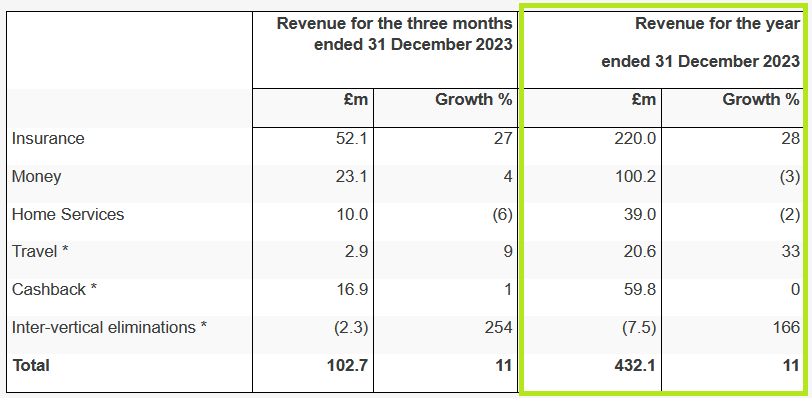

Segmental results: I mentioned earlier the influence of external events on customer behaviour. The company singles out "exceptional trading in insurance" as the main driver of last year's results.

Looking at the segmental breakdown of revenue, we can see clearly that insurance (home/motor) did all the heavy lifting:

Management says the business gained market share in insurance, but admits that the growth was primarily driven by a surge in the number of customers looking for cheaper deals. There were two main reasons for this:

- Inflation has led to significant increases in motor insurance costs

- Regulatory changes at the start of 2022 meant that insurers were no longer allowed to charge new customers lower prices than renewal customers

I wonder whether insurance switching may now moderate to more normal historical levels. Inflation is easing and we've now had a full renewal cycle since the regulatory changes at the start of 2022.

Travel insurance made a strong recovery last year, for obvious reasons, but remains a small part of the business.

Home services (broadband, mobile, energy) remained soft, in part due the absence of energy switching. This market has pretty much disappeared since energy prices surged in 2022.

Theoretically, competition (and switching opportunities) may return if/when energy prices fall below the energy price cap once more. However, the energy market shakeout has seen many of the lowest-priced domestic energy suppliers fail and disappear from the market.

The domestic energy supply market is now controlled by a smaller number of larger and stronger suppliers. My suspicion is that energy switching opportunities will be less compelling in the future than they were prior to 2022.

Moneysupermarket says it does not expect any recovery in energy switching in 2024.

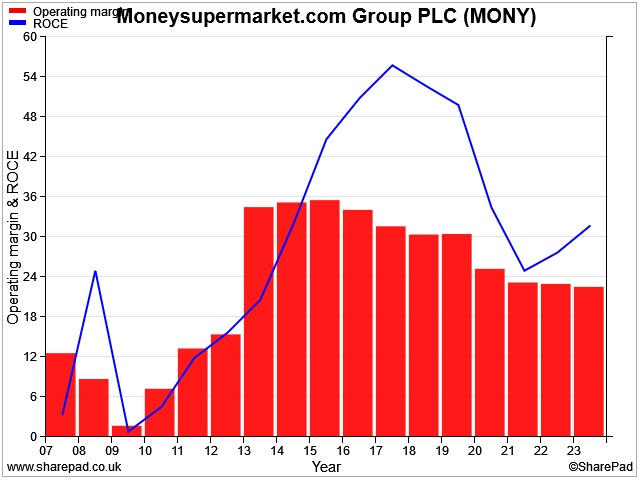

Profitability: my calculations suggest Moneysupermarket achieved an operating margin of 22.5% in 2023, with a return on capital employed of 36.4%.

While both of these numbers are clearly above average, I think it's worth remembering that profit margins have declined steadily over the last decade:

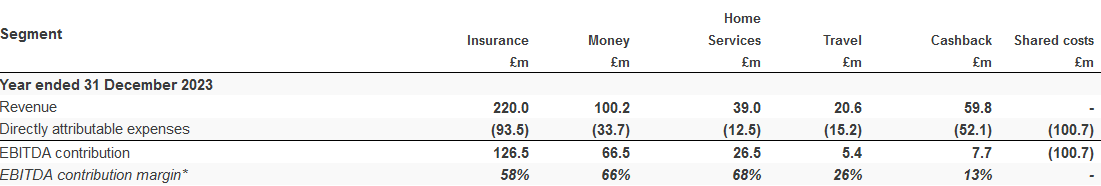

Looking across the busines, margins appear to vary widely across different market verticals:

Assuming the £100.7m in shared costs are distributed in proportion to revenue across the business, the numbers show that insurance generated more than half the group's profits last year.

At the other end of the spectrum, cashback is notably low margin.

Although the 2021 acquisition of Quidco has provided a decent boost to revenue, it hasn't contributed much to profits. Moneysupermarket bought this cashback site for cash payments of between £87m and £101m, depending on performance.

Based on last year's cashback EBITDA of £7.7m (excluding shared costs), my sums suggest Quidco may only be generating a single-digit return on capital employed.

At face value this does not seem like very impressive capital allocation.

However, Quidco's userbase was given as "around one million transacting users" at the time of the acquisition.

I would hope that having these additional users within the Moneysupermarket ecosystem might also generate higher-margin revenue elsewhere in the business, especially as Moneysupermarket is now incorporating some of its services into Quidco's own comparison tool.

Outlook: Moneysupermarket's outlook statement for 2024 sounds broadly positive to me, although management does flag up the risk that insurance growth will level out (my bold):

In the first few weeks of 2024, we have had similar trends to those seen at the end of Q4 2023 continue. We don't expect any increase in energy switching revenue in 2024. We expect the comparatives in Insurance will become tougher, particularly as we move into the second half. However, our trading performance and momentum in our strategic execution, gives the Board confidence that Group EBITDA will be within the current market consensus range.

Broker consensus forecasts I can see in SharePad suggest 2024 EBITDA of £140.4m, 6% above the 2023 figure of £131.9m.

Earnings per share are expected rise by 8% to 17.3p per share, supporting a 4% increase in the dividend to 12.6p. These estimates put the stock on a forecast P/E of 14.6, with a 5% yield.

My view

I think that Moneysupermarket's brand and its ownership of Money Saving Expert (420k active monthly users) may provide a small competitive advantage over rivals such as Go Compare and Compare the Market.

However I don't think the differentiation is all that strong – all three sites essentially offer quite similar services to the majority of users. Hence the ever-sillier television advertising campaigns employed by all three.

Mortgage comparison was touted as an exciting growth opportunity for Moneysupermarket a few years ago, but still appears to be a work in progress. However, a new partnership with Rightmove suggests the company's offering is credible and I think mortgages could still be an interesting area.

The last two times I have remortgaged (with my existing lender) I have simply gone to its website and selected a new deal. If my experience is representative, then the barriers to online-only mortgage lending have come down significantly over the last decade or so.

I feel more confident in the future potential of this business than I did a couple of years ago. As far as I can see, CEO Peter Duffy is doing a decent job.

However, I continue to wonder about the maturity of the core business. For me, the dividend yield and payout ratio often tell a story.

In this case, Moneysupermarket's dividend yield of c.5% is attractive, but the company is now paying out a fairly large proportion of earnings and free cash flow and is only guiding for dividend growth of 3% this year.

Adding the dividend yield and growth rate together suggests an expected return of 8% this year. That's similar to the long-term average total return from the UK market.

I still think this is a good business, but increasingly mature and perhaps without the tailwinds of the last couple of years. On balance, Moneysupermarket shares look fairly priced to me at current levels.

Wilmington (WIL)

"strong sustainable organic growth, both for revenue and profits"

2023/24 half-year report/Mkt Cap: £326m

FY24 forecast dividend yield: 3.0%

Wilmington specialises in providing training and information services to professionals in the governance, risk and compliance markets. Key market segments are law and financial services.

This isn't a business I looked at very much before, but Wilmington is now one of the highest-ranking shares in my dividend screening results. The company's score of 77/100 suggests to me that I should know a little more about it, so I've been taking a look at this week's results.

Results summary: Wilmington sold its healthcare business and made another acquisition late last year, so I've focused on the numbers provided for continuing operations.

These numbers cover the six months to 31 December 2023:

- Revenue from continuing operations +7% to £41.4m

- Recurring revenue rose by 11%, total repeat revenues now account for 73% of total revenue

- Adjusted pre-tax profit up 23% to £8.1m

- Net cash: £28.0m

- H1 adjusted operating margin: 22%

- TTM return on capital emplouyed (ROCE) of c.22%

- Interim dividend +11% to 3.0p per share

Segmental commentary: looking at the segmental results, we can see that while Training & Education drives the majority of revenue, the Intelligence division earns significantly higher margins.

This is now surprise - data-driven insight for professional services markets is a high margin area, as I highlighted with Relx in last week's dividend note.

- Training & Education: growth was said to be broadbased. Revenue from continuing operations rose by 8% to £30.8m, generating a profit contribution of £6.5m (H1 FY23: £6.2m).

- Intelligence: growth was said to be particularly strong in financial services, driven by insurance customers. Revenue for the half year fell by 5.5% to £13.0m, but profit contribution rose by nearly 9% to £4.3m, implying a margin of more than 30%.

Outlook: trading is said to be in line with expectations, suggesting full-year adjusted earnings of 22.5p per share and a dividend of 10.8p.

Those numbers price the stock on 16 times earnings, with a well-covered 3% dividend yield.

My view

My initial impression of this business is that it's better than I've previously realised. I don't see any obvious concerns, with a cash-rich balance sheet, ongoing growth and strong profitability.

Strategically, law and financial services seem likely to remain perennially strong markets for governance, compliance and risk management services.

Focusing on these markets makes sense to me and the combination of data-driven subscription services and training/education also seems logical.

In valuation terms, my sums suggest a trailing 12-month EBIT yield of around 7%. SharePad data suggest that profit conversion to free cash flow is generally strong, too.

The shares don't look too expensive to me, for a high-margin, growing business and I'm less concerned about valuation here than with Moneysupermarket (above).

However, I wonder if it might be worth noting the decidedly cyclical shape of the company's share price chart:

I'm going to keep a closer eye on Wilmington and will look forward to reviewing its full-year results in the summer.

For now, it's one for my watch list.

Roland Head

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.

Member discussion