Portfolio shares: a high-yield stock to replace Direct Line

In March I decided to sell UK insurer Direct Line Insurance from my model dividend portfolio and my own personal holdings. In line with my quarterly trading schedule, it's now time to add a new stock to the portfolio to replace Direct Line.

The company I've chosen has been in business for 145 years and has generated an average return on equity of just under 15% since 2008. Its shares currently offer a forecast dividend yield of more than 6%.

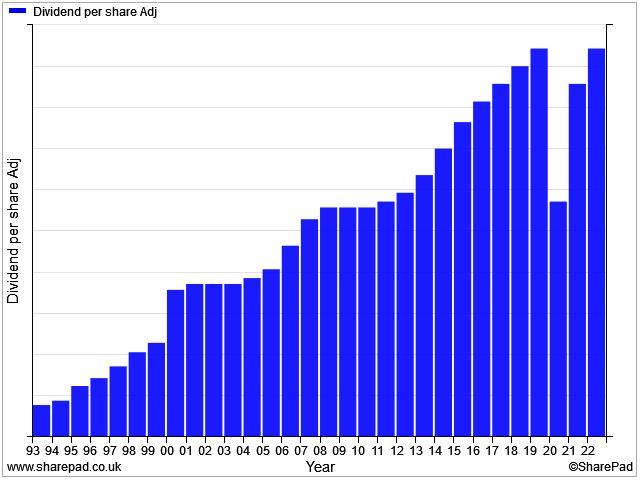

This business also has an unbroken dividend record stretching back 37 years with only one cut – during the pandemic – that's since been reversed:

I think it's cheap, too. Based on valuation measures I use for cyclical businesses, the shares currently look cheaper than at any time since 2008.

Of course, this business isn't perfect. There are some problems that could affect near-term earnings. But I think the dividend will be safe and I believe the long-term outlook is strong, with the potential for significant share price gains.

The company I've chosen is FTSE 250 merchant banking group Close Brothers (LON:CBG).

In this piece I'm going to explain why I've selected Close Brothers to replace Direct Line Insurance in my quality dividend portfolio.

Close Brothers: crunching the numbers

Description: a FTSE 250 merchant bank providing business lending, savings, wealth management and stockbroking services.

| Close Brothers (LON:CBG) |

Quality Dividend score: 67/100 | Forecast yield: 6.9% |

| Share price: 960p | Market cap: £1.5bn | All data at 07 June 2023 |

Latest accounts: half-year results for six months to 31 January 2023

In the remainder of this review, I'll take a look at Close Brothers' history, business model and recent trading.

I'll then step through the different stages in my dividend screening system to explain why Close Brothers scores well in my systema and why I've decided to add this stock to my quality dividend portfolio.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Disclosure: I already own shares in Close Brothers as part of a historic holding. I will be buying more CBG shares for my personal portfolio at the same time and price as I add them to the model portfolio.

Table of contents

This is a long report, so here's a link to each section (I'm aware these links don't work in some email clients - apologies).

- History: a Gold Rush pioneer

- What does Close Brothers do?

- Recent trading - a mixed picture

- Valuation - why I think the shares look seriously cheap

- Dividend culture - very strong

- Dividend safety - good

- Dividend growth - taking a pause

- Dividend yield - high

- Profitability - above average

- Conclusions - I'm buying

History: Gold Rush pioneer

Close Brothers' core banking business is built around providing asset-backed lending and other forms of finance to small and medium-sized businesses. Today the company has a reputation for accurately pricing risk and generally being fairly prudent.

But like most entrepreneurs, founders William Brooks Close and his brothers Fred and James took bigger risks in the early days of their partnership. The company was founded in 1878 as a London-based partnership. But William Close was based on the USA at that time, exploring the opportunities on offer in this frontier market.

Reports suggest his early deals involved bulk-buying land in the mid-west and then reselling it lucratively to settlers arriving from the UK.

In 1897 he secured the rights to build a railway from Skagway in Alaska into the Yukon, at the height of the Gold Rush in this region.

When William Close died in 1923 his will stipulated that Close Brothers should be wound up and a new company formed to continue the business.

The company subsequently spent time as part of the Consolidated Gold Fields business, before being taken private in a management buy-out in 1978 and floated on the LSE in 1984.

Since then, the company has evolved into the business that exists today, expanding through a mix of organic growth and acquisitions.

What does Close Brothers do?

The company's tagline is "Modern Merchant Banking". It's not a clearing bank (does not offer current accounts) but it does provide a wide range of other services.

These are divided into three divisions:

Banking: Close Brothers' banking business generates the majority of group profits and has three main lines of activity.

- The firm is a specialist lender to small and medium businesses. It typically lends against asset backing such as equipment or vehicle fleets, or provides services such as invoice factoring and bridging loans for property transactions.

- Close's Customer Finance business is a major provider of motor finance to dealers and brokers across the UK and Ireland. For example, many used car dealers arrange finance for buyers from Close Brothers. Premium finance is another key area (allowing customers to pay insurance by monthly instalments).

- Savings - the bank provides savings products for personal and business customers. These are typically fixed-term or notice accounts, providing reliable and relatively cheap funding for the bank's lending operations. At the end of April, savings deposits totalled £7.4bn – almost two-thirds of the group's £11.9bn funding base. The interest rates on offer seem very competitive to me.

One attraction of this model for me is that it's far more profitable than the majority of UK banks. Close Brothers' net interest margin was 7.8% over the last year, compared to around 3% for Lloyds Banking Group.

Net interest margin reflects the difference between interest charged on lending and interest paid on deposits.

Close achieves higher margins on lending by serving specialist sectors that attract higher interest rates, while carefully managing its funding costs.

A higher net interest margin should support higher returns on equity and help generate surplus capital for dividends.

Of course, there's a risk that this strategy could lead to higher levels of bad debt in a recession. However, Close has a long history of pricing risk accurately and lending profitably through the cycle – this is a bank that maintained its dividend through the 2008 financial crisis. Unless I start to see evidence this core competency is weakening, I'm comfortable with the risks here.

Wealth Management: Close entered the asset management market in 1987. This business has expanded steadily since then. Close Brothers Asset Management (CBAM) now has £16bn of assets under management and provides a range of private client and investment services

Stockbroking: in 1993, Close acquired Winterflood Securities. This brokerage provides market-making, dealing and custody services to institutions, retail stockbrokers and wealth managers.

Winterflood covers a full range of UK equities and fixed income but from what I understand, it has particular strength in AIM and small caps.

This business also provides an element of counter-cyclicality, as its profits are heavily dependent on trading activity. During the pandemic, Winterflood's profits surged from £20m in FY19 to £61m in FY21. This helped to offset weaker profits from banking during this time.

Recent trading: a mixed picture

The company's latest accounts cover the half year to 31 January 2023 and showed a broadly stable picture.

On an adjusted basis, operating profit fell by 2% to £174.8m for the half year and the bank's CET1 capital ratio edged lower to 14.0% (H1 '22: 14.6%). The bank's loan book fell by 1% to £9.0bn, while total client assets rose 2% to £16.9bn.

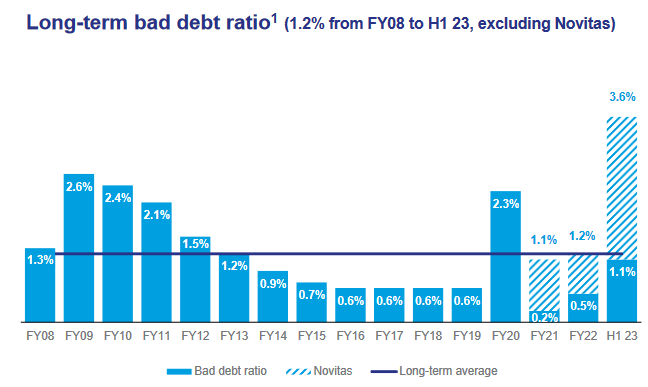

In an early sign of a possible recession, the bank reported an increase in arrears in its motor finance business. This led to an underlying bad debt ratio of 1.1% annualised, up from just 0.2% one year earlier.

This trend appears to be in line with the performance seen during the last recession:

However, the chart above also highlights an exceptional loss this year relating to the Novitas Loans business. This is a disappointing event that I need to explain.

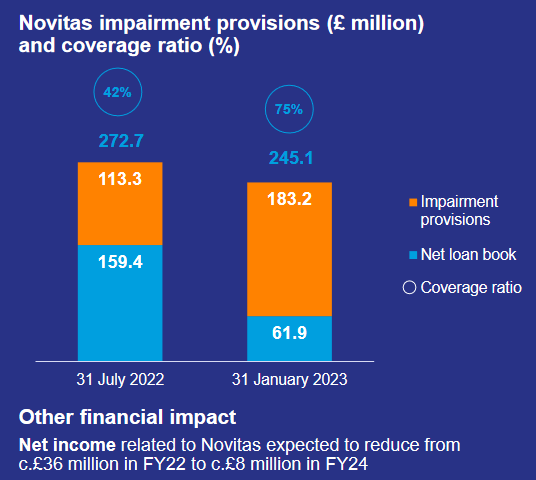

Novitas: in 2017, Close Brothers bought a litigation financing business called Novitas Loans. Unfortunately this business has unravelled badly. Novitas was closed to new lending in 2021 and is currently being wound down.

In a series of impairment charges over the last 12 months or so, Close has written off the majority of the Novitas loan book. The half-year results included a £90m provision for further losses, taking the total amount booked to £183m.

Current chief executive Adrian Sainsbury was in charge of the banking division at the time of this deal. In my view, he appears to have jumped on a trendy bandwagon without proper due diligence.

This is disappointing, but it appears to be a rare mistake from this business. Sainsbury has now promised to resume the group's "track record of earnings growth and returns by focusing on disciplined growth, cost efficiency and capital optimisation."

Fortunately, it looks like Close Brothers' strong balance sheet can absorb the Novitas losses while maintaining the dividend.

The Novitas fiasco is a black mark against Adrian Sainsbury, in my view. But if I'm right – and there are no other serious problems – then I think the sell-off we've seen this year may have left the stock trading at an unusually attractive valuation.

Valuation: I think the shares look very cheap

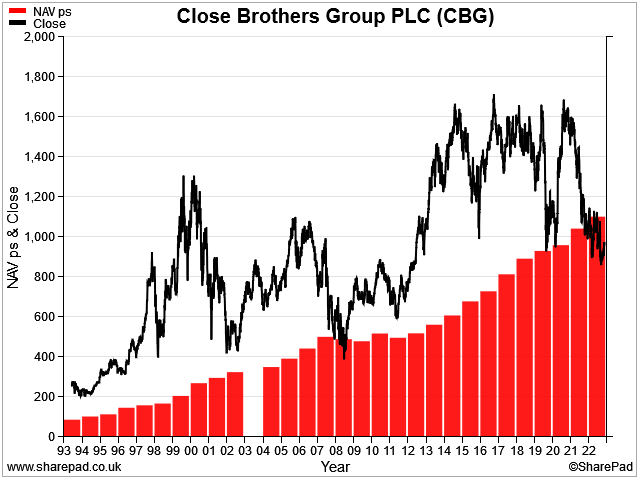

We've grown used to seeing the big high street banks trading at a discount to their book value since 2008. This has reflected their sub-par profitability and other problems.

However, these are not issues that have affected Close Brothers, which has only traded at a discount to book value twice in the last 30 years – in 2008, and right now:

Superior profitability and double-digit returns on equity mean that these shares have generally been valued at a premium to book value, even during more difficult periods.

As I write, the shares are trading at around 960p, about 10% below the bank's book value of 1,068p per share. This discount is unusual and in my view, a sign of cyclical value.

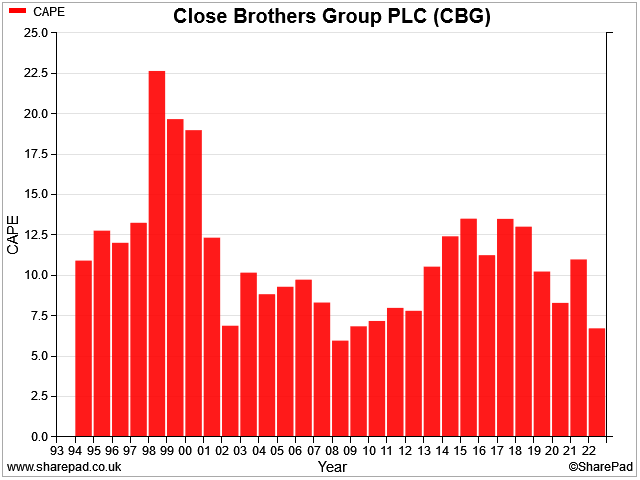

Another valuation metric that looks very attractive to me at the moment is the cyclically-adjusted price to earnings ratio, or CAPE.

This measure compares the current share price with 10-year average earnings. It can be a useful tool to value cyclical businesses whose profits tend to swing up and down through the business cycle.

Close Brothers' CAPE is currently at the lowest level seen since the financial crisis, according to SharePad data:

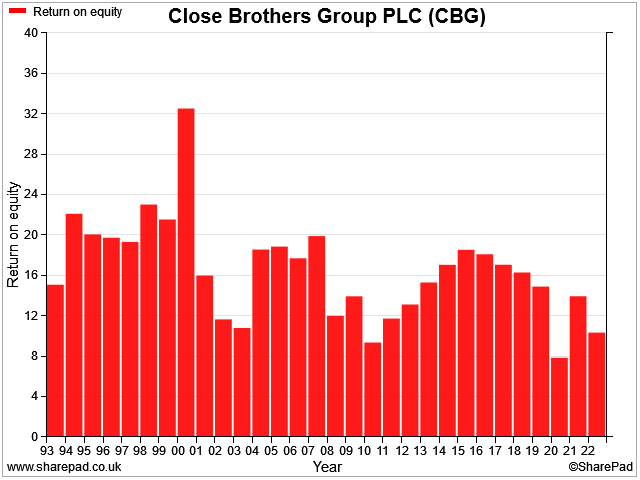

Taking a slightly different approach, the data suggest that Close Brothers' profitability may also be at a cyclical low:

I think there's a strong case for thinking that this banking group's shares are already priced for recession.

Assuming the group's business model remains robust and continues to perform as it has done in the past, I think Close Brothers' shares could look very cheap at current levels when economic conditions improve.

While I'm not a chartist, the long-term trend on the share price chart also seems to support this view:

With that in mind, let's move on to take a look at how Close Brothers scores in my dividend screening system.

Dividend culture: very strong

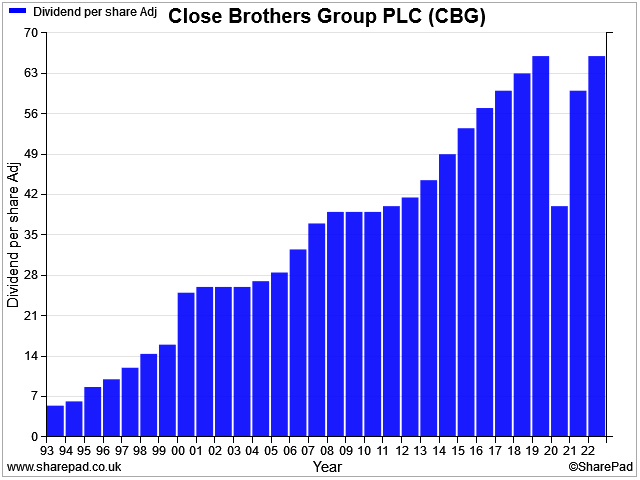

Close Brothers has always had a strong commitment to its dividend. Until 2020, had maintained an unbroken record of dividend payments without a cut since 1987.

The pandemic achieved what the 2008 financial crisis did not and forced the board to cut the payout – but it's rapidly been rebuilt and is expected to exceed its pre-pandemic level this year:

I'm confident Close Brothers has a strong dividend culture.

Close Brothers scores 5/5 for dividend culture in my screening system.

Dividend safety: good

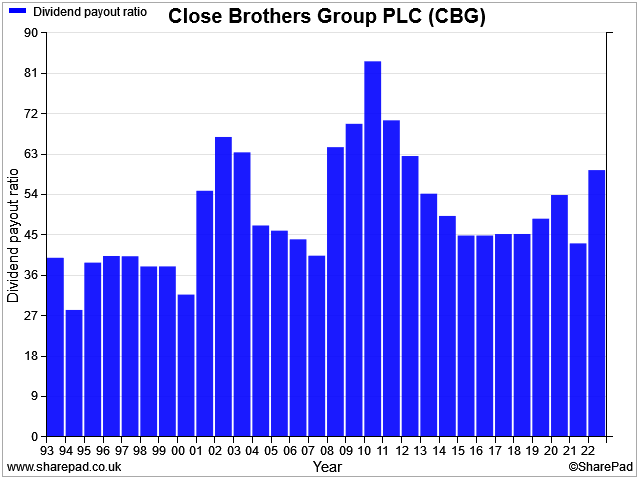

In my experience, companies with a long history of dividends tend to have reasonably conservative payout ratios.

There's a good reason for this. Earnings will inevitably fluctuate over long periods. Very few companies achieve straight-line profit growth for more than a few years at a time.

Only by maintaining a margin of safety in dividend payouts can a company deliver reliable dividends over many years or – as here – decades.

Close Brothers is a good example of this. Although we can see that the payout ratio has risen during recessions (when bank earnings dip), the long-term average payout has been around 50% over the last 30 years:

The payout ratio is a useful general guide to dividend safety, in my experience. But it's not perfect. As it is measured against accounting earnings, it does not provide a direct comparison with free cash flow (non-financial stocks) or surplus capital (banks and insurers).

The main regulatory measure of surplus capital used by banks is the Common Equity Tier 1 (CET1) ratio. This is relevant to income investors because dividends reduce a bank's surplus capital – cash is being taken out of the business.

Close Brothers' CET1 was 14.0% at the end of April. This ratio has fallen slightly over the last couple of years, but remains comfortably above the regulatory minimum of 8.5% that applies to this bank.

In my view, Close should remain comfortably able to maintain its dividend this year, despite the hit to earnings from the Novitas fiasco I discussed earlier.

Close Brothers scores 3.6/5 for dividend safety in my screening system.

Dividend growth: taking a pause

Ultimately, I believe dividend growth needs to be reflected by underlying growth in the productive assets of a business. Otherwise the payout will eventually become unsustainable.

My screen scores stocks for dividend growth based on two metrics:

- five-year average dividend growth

- five-year average net asset value per share growth (NAVps)

Close's dividend has not risen since 2016 and has only just regained its pre-pandemic level. So the shares score badly in this regard.

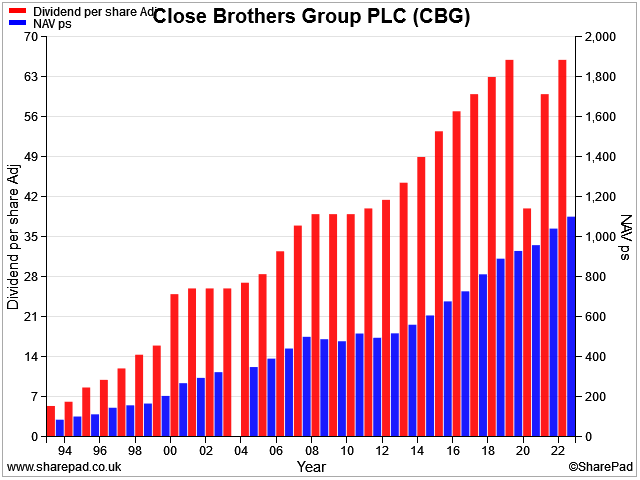

But when I take a longer view, I can see that this banking group has generated exactly the kind of consistent NAVps and dividend growth I'm looking for over the last 30 years:

Naturally, there have been some periods when growth has paused. But the overall trend is exactly what I'm looking for in a bank. Barring the risk of mismanagement, I don't see any reason why this long-term record shouldn't be extended over the coming years.

Close Brothers scores 1.5/5 for dividend growth in my screening system.

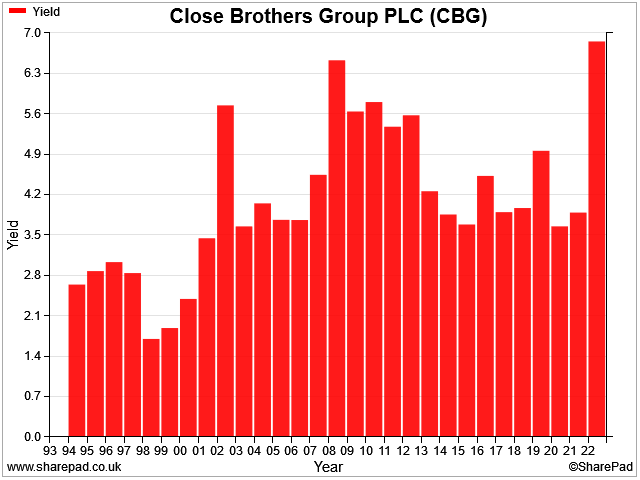

Dividend yield: high

This isn't a growth stock; returning surplus capital to shareholders each year is part of the business model.

I'd expect a reasonable level of dividend yield at any point in the cycle, but Close Brothers' current yield is the highest seen since the 2008 crash:

Based on my assessment that the dividend remains sustainable, I see the stock's current high yield as a strong indicator of value.

More cautiously, I would also argue that this yield suggests the near-term outlook for the UK economy isn't great.

Close Brothers scores 4/5 for dividend yield in my screening system.

Profitability: above average

I score financial stocks for profitability based on the return on equity ROE they generate.

My scoring system combines five-year average ROE and trailing 12-month ROE. I do this to try and get a balanced view of a company's performance, reflecting both typical and recent actual profitability.

It's not perfect, but I find it a useful approximation for sorting and ranking stocks.

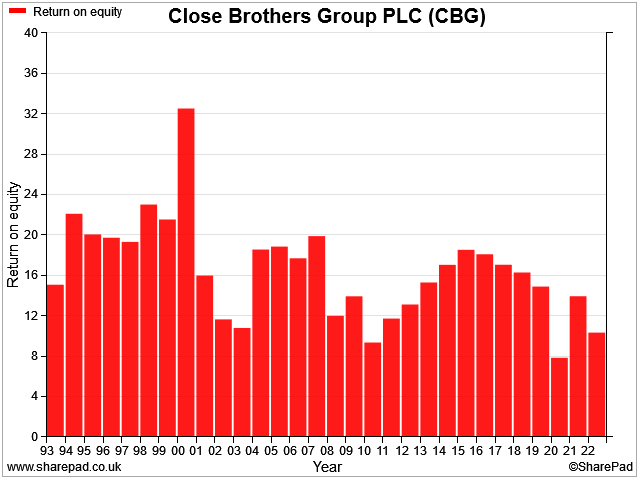

Banking profitability tends to be cyclical, of course. The chart below shows Close Brothers' return on equity over the last 30 years. Three clear cycles are visible, in my view, with low points in 2003, 2010 and 2022:

I've already shown that Close's CAPE ratio, price/NAV and dividend yield are at the lowest levels seen since the 2008 financial crisis. So too is the bank's profitability (excluding 2020).

I think this is a further sign that the shares are priced at a cyclical low and likely to offer medium-term value.

Of course, this doesn't mean that further problems won't lie ahead. Nor does it rule out the risk that the quality of this business is slowly deteriorating.

However, my view is that the bank's franchise and business model remain attractive.

SharePad data suggests a long-term average return on equity of about 14% since 2008. I don't see any reason why this record can't be maintained over the next decade or so.

Close Brothers scores 2.7/5 for profitability in my screening system.

Conclusions: I'm buying

My quality dividend screening system awards Close Brothers an overall score of 67/100 at the time of writing (June 2023).

I aim to have a mix of defensive and cyclical stocks in my dividend portfolio. While the consistency of high-quality defensive shares is an attraction from an income perspective, this tends to come at a price. Lower yields, and sometimes quite slow growth.

My experience suggests that I should be able to boost returns over time by adding good quality, dividend-paying cyclical stocks when they're attractively valued. In other words, when their valuations are at cyclical lows.

This strategy isn't without risk:

- my timing may be wrong and trading may get much worse

- if I'm not careful, I could fall victim to style drift and end up with a portfolio of value stocks, not quality dividends

However, I think a measure of opportunism is a necessary element of investing.

I've followed Close Brothers' progress carefully for several years. As I mentioned earlier, I already hold some CBG shares as part of a legacy position.

While the Novitas Loans episode is very disappointing, this group does have a long and fairly consistent record of NAV growth, dividend progression, and double-digit profitability.

In my view, it scores highly enough for quality to merit a place in my portfolio.

Right now, the valuation looks historically cheap to me on several measures. By buying the shares at a (rare) discount to book value and a high dividend yield, I'm comfortable with the balance of risk and reward.

If this investment works out in the way I hope, then I believe Close Brothers shares should benefit from re-rating to a higher valuation as the group's performance recovers. The shares have traded 50% higher in the recent past.

If things don't go so well, my hope is that the current valuation provides some margin of safety.

Decision: I'm going to add Close Brothers to my model dividend portfolio. In line with my policy for selling and replacing shares, I'll add them to the model portfolio at the end of this quarter, on 30 June 2023.

I will also buy additional CBG shares for my personal real-money portfolio at the same time.

Disclosure: Roland owned shares in Close Brothers at the time of publication.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.

Member discussion