September 2022 dividend portfolio news

I review September's results and news from my quality dividend model portfolio.

Yes, you read that right. This is the monthly review of my quality dividend portfolio for September. I would normally publish my monthly portfolio update more promptly than this, but events got in the way last month. Apologies for being so tardy.

September's financial news was dominated by events outside of investing. Fortunately, the companies in my portfolio continued to turn in respectable performance and did not suffer unduly in the markets.

Although the businesses in my quality dividend portfolio are not immune to outside pressures, I continue to believe that over the long term, a strong balance sheet, a clear strategy, and positive cash flow should prevail over most headwinds.

Portfolio news updates

In September, five of my portfolio stocks reported results. These included FTSE 250 retailer Dunelm (LON: DNLM), consumer goods group PZ Cussons (LON:PZC) and three members-only small cap stocks.

A free sign-up is required to read my coverage of these small caps. I'd strongly recommend this – you'll also get full access to my model dividend portfolio and all portfolio share reports.

As a reminder, the model dividend portfolio contains the same shares I own myself.

Disclosure: unless otherwise specified, Roland owns all the shares discussed in this article.

For an explanation of my Quality Dividend score, see here.

Dunelm

Description: Homewares retailer with a network of out-of-town stores and online presence. A family-controlled business. Click here for an archive of past posts.

| Dunelm (LON: DNLM) | Quality Dividend score: 74/100 | Forecast yield: 5.2% |

| Share price: 875p | Market cap: £1.7bn | All data at 01 Nov 2022 |

RNS release: Preliminary results for the 53 weeks ended 2 July 2022

"Strong sales growth of 16.2%6 with total sales 41% higher than FY19"

I rate Dunelm as one of the best quality retailers in the UK. Over the last year, various less retailers have complained of problems relating to cost inflation, supply chain disruption and labour shortages.

Dunelm simply said that its sales had been 41% higher than in FY19 and said that its share of the homewares market had risen by 1.4% to 10.2%.

Revenue rose by 18% to £1,581m, while pre-tax profit for the year was 35% higher, at £213m. Impressive stuff, in my view.

Dunelm is currently working to broaden its range and expand into the furniture market. A new warehouse was opened this year to fulfil furniture orders. But management says that historically, 85% of growth has come from market share gains.

I initially wondered whether this might be a sign that Dunelm's growth would reach a natural limit. However, I don't think a 10% market share is likely to be the ultimate limit for the group's low-cost, big-box store and online offering. In my view, constraints on growth are not yet a serious concern.

This view is supported by Dunelm's surprisingly broad demographic appeal. According to the company, the number of active customers rose by 8.5% last year, with gains across all income groups:

"We have seen growth in customer numbers across all income levels, with a year-on-year increase of more than 10% in both the <£20k per annum and >£100k per annum income groups13. We have also increased the appeal across all age ranges, with customers aged between 16 and 24 growing by 8.5% and those aged 65 and over growing by 16.2%."

I suspect that Dunelm should be able to continue expanding for some years. I'd imagine this is also the view held by incoming chair Alison Brittain. Ms Brittain is the outgoing chief executive of Premier Inn owner Whitbread and is a highly-rated FTSE 100 executive. I think she's an impressive hire for Dunelm.

Financial review: In my view, Dunelm's latest results highlight most of the reasons why it's a member of my quality dividend portfolio.

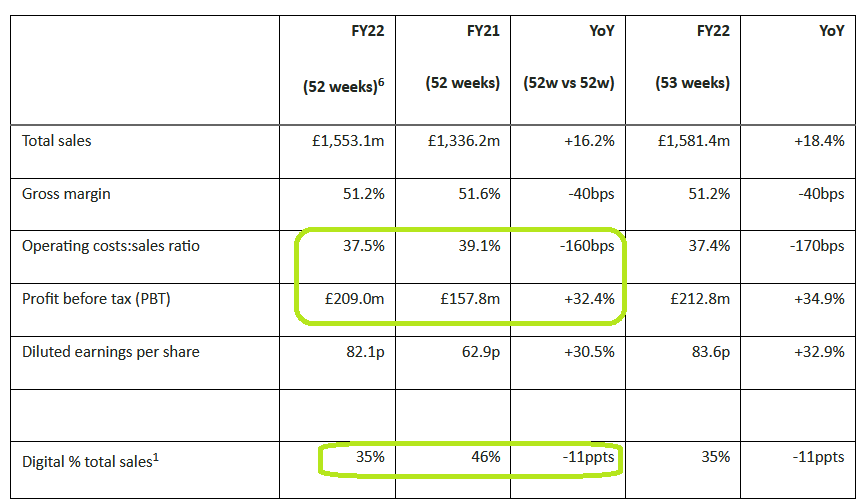

Revenue rose by 18% to £1,581m last year, or by 16% when normalising for a 52-week financial year (last year had 53 weeks).

The proportion of digital sales fell from 46% to 35%, but this seems logical given the broader return to store shopping over the last 12 months. Digital sales were just 20% of total sales in FY19, demonstrating the progress made during the pandemic.

Finally, pre-tax profit climbed by 34.9% to £212.8m last year, while gross margin was steady at 51.2%.

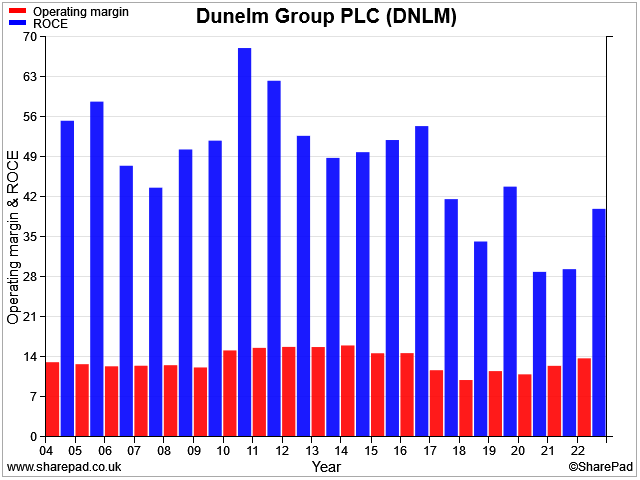

Operating costs as a percentage of sales fell by 1.6%, lifting Dunelm's operating margin rose to 13.8%. That's the highest level for six years. Return on capital employed also rose sharply:

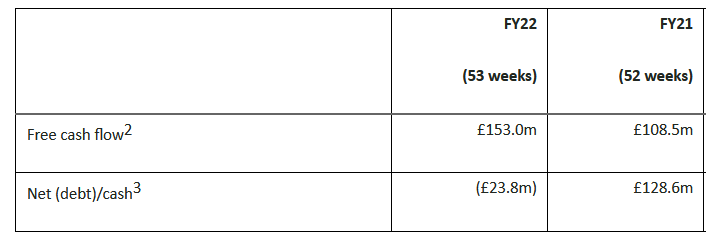

Cash generation remained good, despite some inventory build to protect against supply chain disruption. The balance sheet is largely free of debt:

Shareholders benefited from Dunelm's strong cash generation with a generous stream of dividends.

Dividend: Dunelm's ordinary dividend rose by 14% to 40p per share. The company also declared a special dividend of 37p, giving the stock a total trailing yield of 10% at recent share prices.

The ordinary dividend was covered 2.1x by adjusted earnings and roughly 2x by free cash flow. My sums indicate that the total dividend paid, including the special, would have cost around £155m – almost exactly equalling last year's £153m free cash flow.

In my view, Dunelm's ordinary dividend continues to look very robust. I think there's probably scope for more special dividends over the coming years, too.

Based on SharePad consensus forecasts, the shares offered a FY23 forecast yield of around 5.2% on 1 November 2022.

Outlook: CEO Nick Wilkinson says that sales have been robust during the first 10 weeks over the year (July/August '22).

Looking ahead, Wilkinson expects to achieve a 50% gross margin this year, in line with past years' performances.

Full-year results are expected to be in line with current expectations. This suggests that Dunelm shares may be trading on around 11 times forecast earnings.

My view: In my view, last year's results showed robust profitability, good cash generation and continued execution of the company's proven strategy.

I have no qualms about continuing to hold Dunelm in my model portfolio. With a trailing free cash flow yield of nearly 10%, I think the shares are probably cheap.

PZ Cussons

Description: Family-controlled consumer goods group with a focus on hygiene brands, such as Carex and Imperial Leather. Click here for an archive of past posts.

| PZ Cussons (LON: PZC) | Quality Dividend score: 52/100 | Forecast yield: 3.2% |

| Share price: 199p | Market cap: £858m | All data at 01 Nov 2022 |

RNS release: Full-year results for the year ended 31 May 2022

"...we expect to deliver FY23 results in line with current consensus estimates"

PZ Cussons seems a little slow to report for a FTSE 250 company; it took nearly four months for the group to deliver its full-year results.

However, the numbers look pretty solid to me. They reinforce my impression that CEO Jonathan Myers is doing a competent job of turning around this venerable business.

UK sales fell last year as the pandemic hand hygiene boom tailed off (PZ Cusson's Carex brand is the market leader). However, the group reported like-for-like sales growth in its other key markets of Asia Pacific (Australia/Indonesia) and Africa (primarily Nigeria).

Myers' focus on a smaller number of core brands and markets appears to be bearing fruit. Like-for-like sales were positive at a group level last year, while underlying operating margins also improved.

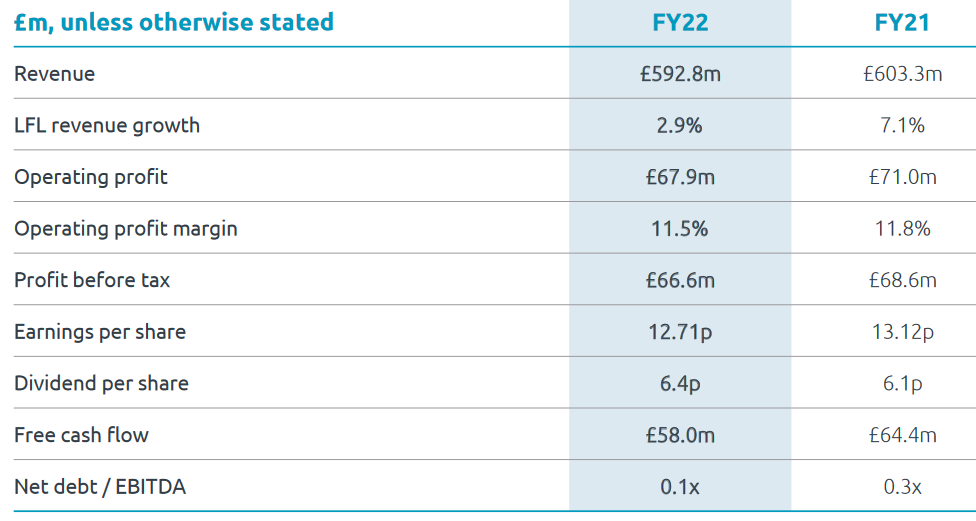

Financial review: I've included a summary of PZ Cusson's adjusted results below. The revenue drop can be explained by the disposal of the group's low-margin yoghurt business (five:am) and by adverse FX movements.

The statutory results included a number of adjustments last year, but they netted out to a reduction of £1.3m in pre-tax profit. Having reviewed the (lengthy) list of adjusting items, I'm comfortable that they're all legitimate and likely to be one-off in nature.

Although I generally prefer to use statutory results, in this case I think these adjusted numbers provide a more useful picture of operating performance:

Profit margins: I think it's interesting to drill down a little further into PZ Cussons' margins. While the group's overall operating margin is 11.5%, regional figures vary widely:

- Europe/Americas (UK/US): 18.1%

- Asia Pacific (Australia/Indonesia): 12.0%

- Africa (Nigeria/broader West Africa): 10.0%

While the AsiaPac and Africa margins are much lower, both improved significantly last year thanks to a combination of pricing, product mix and cost savings.

ROCE: My preferred measure of return on capital employed (ROCE) was 10.8%, by my calcuation.

(To reach this, I stripped out PZC's pension surplus from each of the last two years (as it's not capital employed) and then averaged capital employed for the 12-month period to calculate ROCE.)

Free cash flow: Reassuringly, cash flow remained strong. Stripping out disposals and acquisitions, my calculations suggest that free cash flow rose from £31.8m to £48.5m last year. This covered the £27.4m dividend comfortably.

PZC sold £18.4m of surplus property in Nigeria last year and collected £6.4m from the sale of the five:am yoghurt brand. Despite investing £37m in the acquisition of Childs Farm, this cash inflow enabled the group to reduce net debt by £20.9m to £9.8m.

Financially, this looks like a resilient picture to me. Although profitability is significantly lower than larger peer Unilever (which I also hold), leverage is much lower at PZ Cussons.

Dividend: The ordinary dividend has been increased by 5.1% to 6.4p per share. That gives PZC shares a yield of 3.2% at the time of writing.

Outlook: CEO Myers says that he's confident of hitting full-year expectations, despite pressures from cost inflation and [weaker] consumer spending.

Looking further ahead, the group's revenue growth target has been increased from "low-mid single digits" to "mid-single digits". I'd imagine this reflects inflation rather than more rapid growth, but it seems reassuring in the current environment.

Adjusted operating profit margins are expected to rise into the mid-teens over time.

Further investments (acquisitions?) of £20m are expected over the next three years to continue the transformation of the business.

I remain optimistic about PZC's ability to expand in emerging markets, where high birth rates should support the development of brands such as Cussons Baby.

My view: I'm quite happy with PZ Cussons latest results and am encouraged by the group's stabilised performance. I think the shares are probably trading close to their fair value, but I think there's room for continued gains over time.

I remain very happy to hold this family-owned stock in my dividend portfolio

The remainder of this post is only available to registered members. Please sign up to read on – I'll never spam you and will generally email no more than once a week.