2024 dividend portfolio review: rising income despite dividend cuts

In my 2024 dividend portfolio review, I report an inflation-beating cash income, discuss changes to the portfolio and consider the key financial metrics I monitor.

The primary goal of my quality dividend model portfolio is to produce a market-beating dividend yield with above-inflation income growth from UK shares.

Although the portfolio suffered two dividend suspensions last year, I am happy (and slightly surprised) to report that this goal was met in 2024.

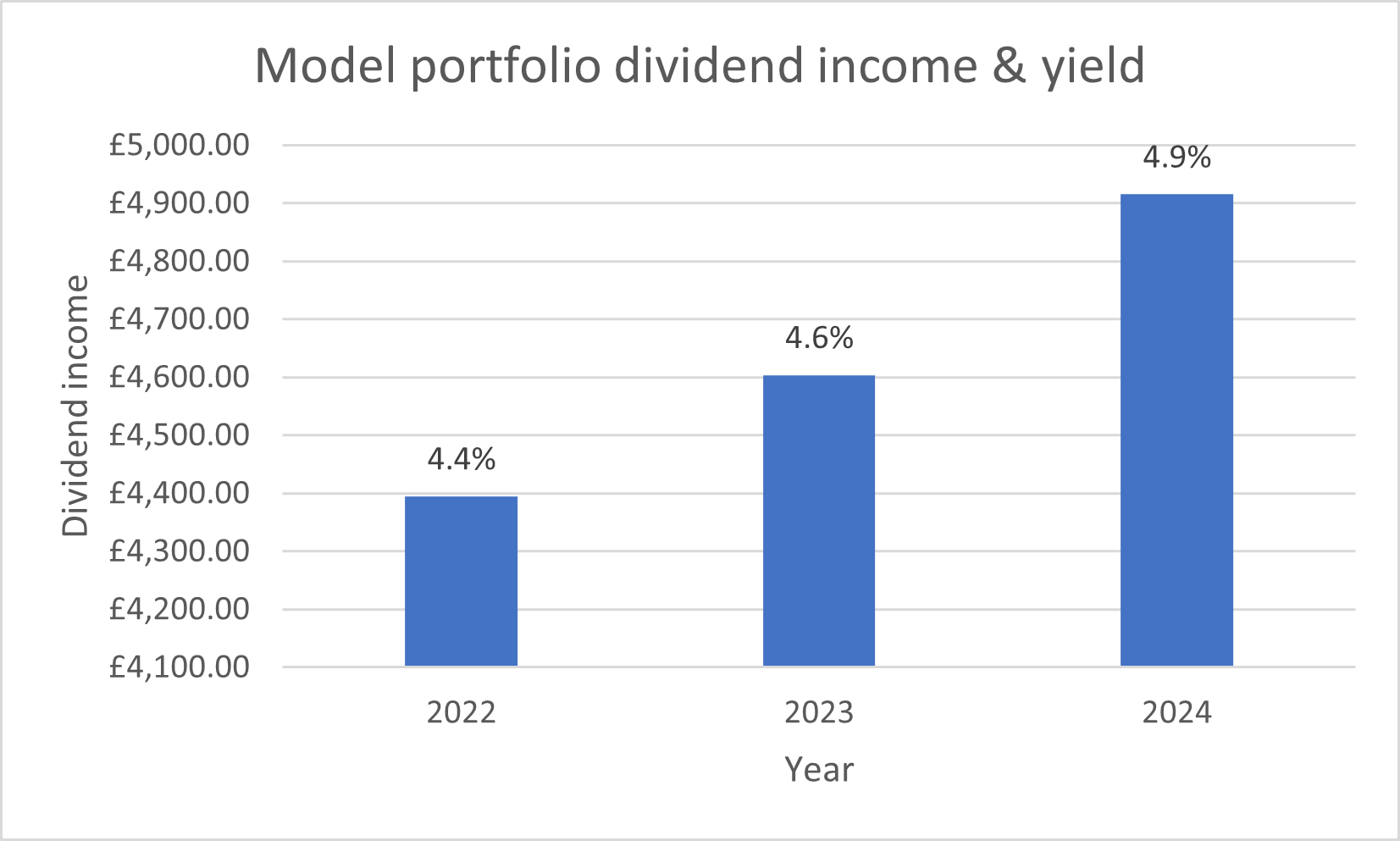

Income generated by the model portfolio rose by 6.8% to £4,915 last year (FY23: £4,604). This represents a yield of 4.9% on the model portfolio's £100k initial capital.

The most recent UK CPIH inflation reading is 3.5% (Nov 24) and the FTSE 100 dividend yield is around 3.6%.

Read on for a more detailed review of the portfolio's performance in 2024, including details of the dividend suspensions mentioned above and the subsequent changes I've made to the portfolio.

- 2024 portfolio performance review

- Portfolio changes in 2024

- Position weightings

- Key financial metrics for the portfolio

- Final thoughts

2024 portfolio performance review

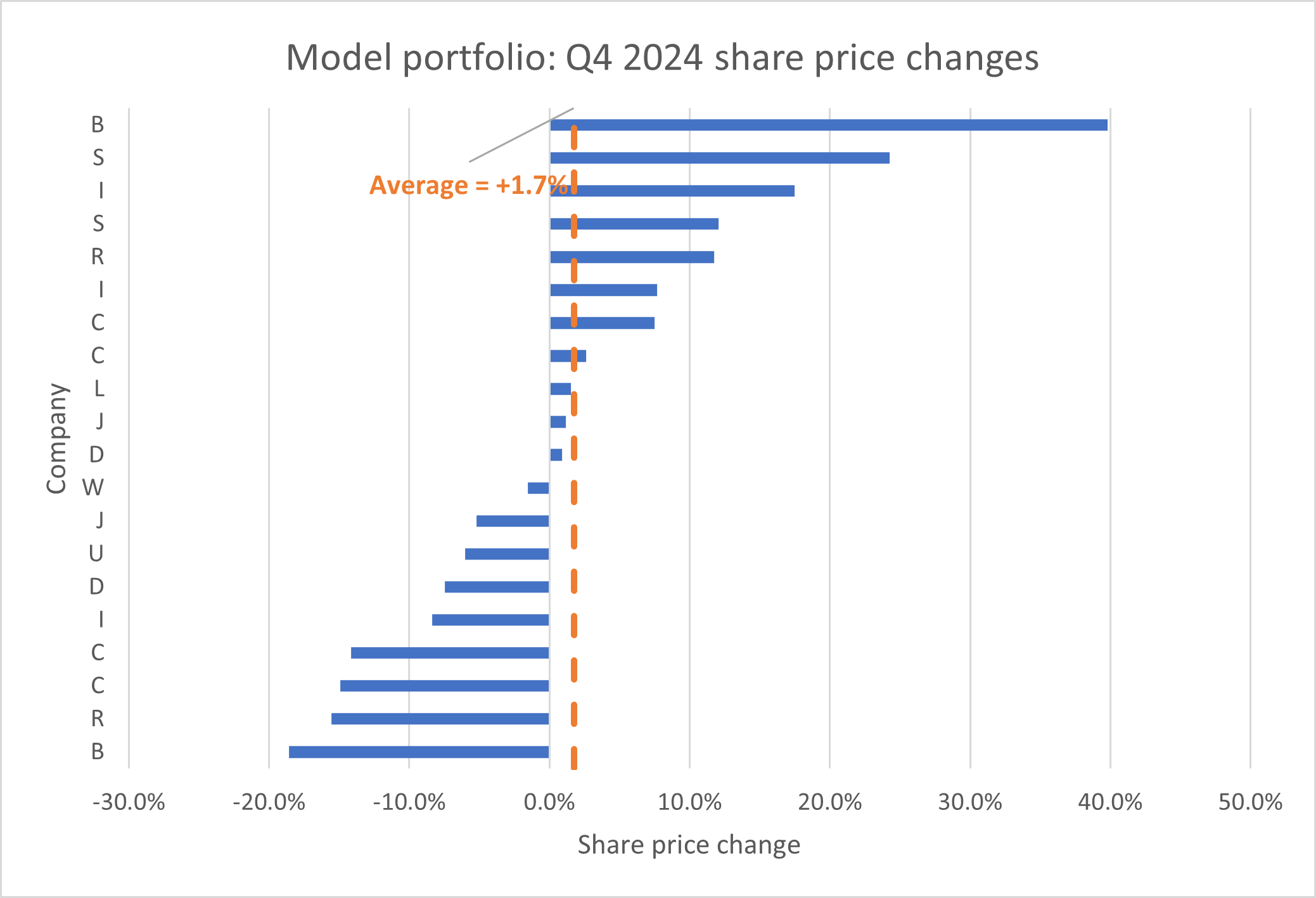

Individual stocks within the portfolio saw the usual wide range of share price movements last year. Here's a snapshot of the changes seen during Q4 alone:

Share price movements can be gratifying and frustrating in equal measure. But short-term changes are often not that significant.

For long-term investment, I prefer to focus on the total return delivered by the portfolio over time.

My aim is to beat the FTSE 100 Total Return index. Sadly, I did not achieve this goal last year, as a healthy dividend income was largely offset by adverse share price movements.

2024 performance:

- RH model portfolio total return: 1.3%

- FTSE 100 total return index: 9.7%

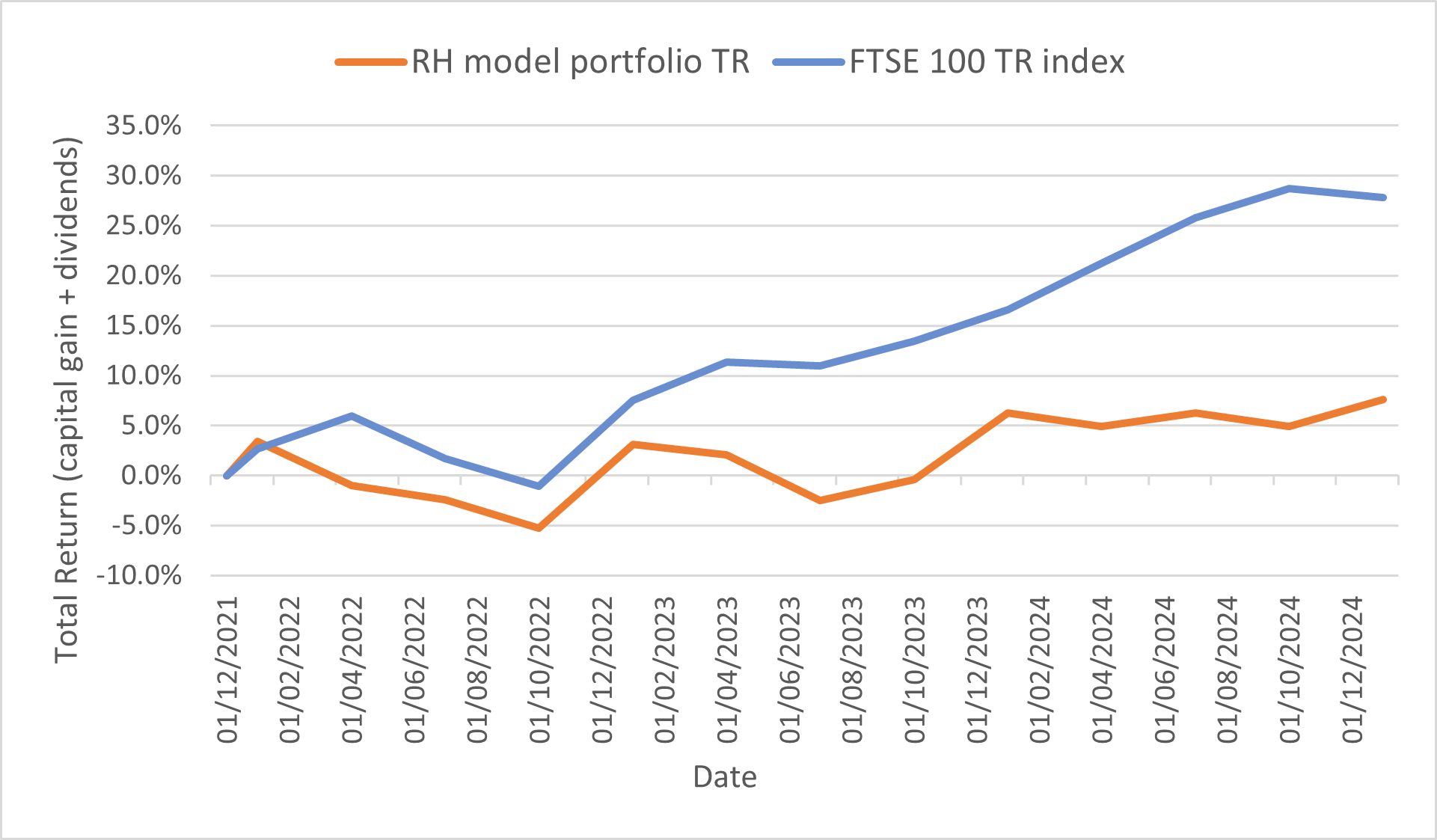

For a broader view, here's how the portfolio has performed against the FTSE 100 Total Return index since its inception in December 2021:

The strength of some big FTSE 100 names has made the big cap index a more formidable opponent than usual over the last three years.

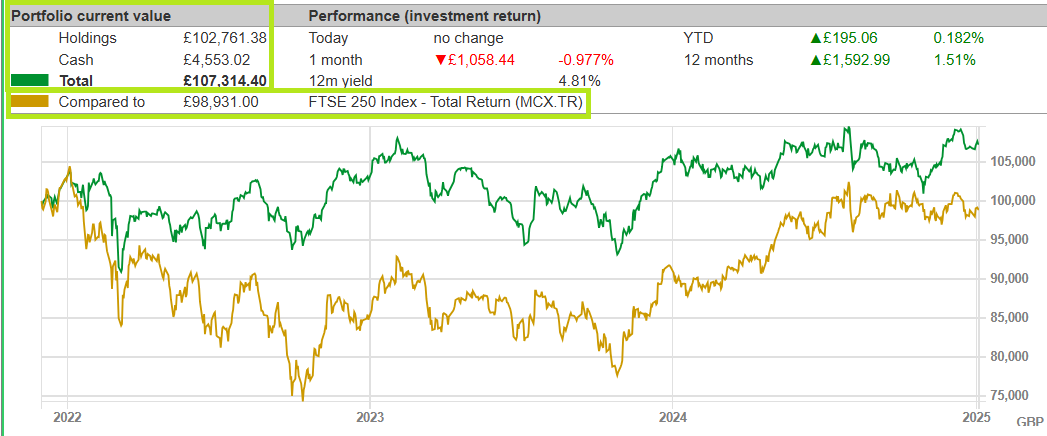

My model portfolio has a median market cap of £1bn and is weighted towards FTSE 250 and small cap stocks – areas of the market that have been weaker since 2022.

As I discussed in my Q3 2024 update, the portfolio has beaten the FTSE 250 since inception. This remained true at the end of 2024:

I'm hoping that my mixed-cap portfolio may benefit from a renewed appetite for smaller UK stocks in 2025.

I'm confident plenty of value remains at this end of the market, but I'm aware UK stocks remain a tough sell to retail investors when compared with the Mag 7 US tech stocks.

Portfolio changes in 2024

My slow trading policy allows me to make up to two changes to the model dividend portfolio at the end of each quarter.

Last year saw the highest level of portfolio turnover so far:

- 2024: five stocks sold

- 2023: three stocks sold

- 2022: four stocks sold

This is higher than I would really like, but I don't have any regrets about the stocks I sold or the ones I bought to replace them (at least, not yet...).

Here's a summary of the stocks I sold in 2024, together with links to the write-ups I published on each new buy.

Q1 2024

I exited merchant banking group Close Brothers (LON:CBG) as the motor finance commission storm grew.

The company battened down the hatches to face a barrage of claims and suspended its dividend. It's since also sold its asset management arm.

I think management are doing the right things, but I concluded that "there's a risk the overall impact of the FCA motor finance review could be greater and longer-lasting than expected". I sold for a near-50% loss at 451p.

- Replacement: I replaced Close Brothers with a small-cap engineer that has a strong balance sheet, 35-year dividend record and a leading reputation in its niche.

Q2 2024

Israeli electronics group MTI Wireless Edge (LON:MWE) was the next stock to leave the portfolio. I like some aspects of this business as an investment and would probably still own the shares if it was a UK company.

However, I concluded that "I am increasingly reluctant to shoulder the unknowable additional risks of investing in overseas businesses listed in the UK.".

I exited MTI at 39.5p for a total loss of 40%.

- Replacement: I replaced MTI with a UK-based family business whose operations look more transparent to me and (hopefully) carry less geopolitical risk.

Q3 2024

I made two changes, exiting the portfolio's positions in FTSE 250 housebuilder Bellway (LON:BWY) and consumer goods group PZ Cussons (LON:PZC).

Bellway: I exited Bellway at 3,114p, delivering a total return of 97% in two years.

I decided to sell Bellway as I felt the balance of risk and reward had changed since I added the stock to the model portfolio in September 2022. At £31, the discount to NAV had closed and – in my view – a substantial recovery was priced into the shares.

The dividend had also been cut, leaving Bellway as the model portfolio's largest and lowest-yielding position. Given the political and cyclical exposure of housebuilders, I decided it might be a good time to recycle some capital into a higher-yielding opportunity.

- Replacement: I replaced Bellway with a cyclical stock trading at a deep discount to book value, in the hope that I could repeat the success of my housebuilding trade. The company in question is an AIM-listed small cap with a 20-year record of dividend growth and a 5%+ yield. Read my full write-up here.

PZ Cussons: the consumer goods group's oversized exposure to the Nigerian economy has proved disastrous for investors. Currency devaluation led to a £121m cash loss for PZC last year and the outlook for this market remains uncertain, as far as I can see.

Elsewhere, the performance of the company's flagship brands has been somewhat mixed.

I probably should have decided to sell PZC sooner than I did. In the event, I exited at the end of September 2024 at 96p, for a total loss of 44%.

- Replacement: I chose a small-cap financial specialist with a high yield and strong balance sheet to replace PZ Cussons. You can read my buy report here.

Q4 2024

Unfortunately, Close Brothers was not the only member of my portfolio to suspend its dividend last year. Luxury fashion group Burberry (LON:BRBY) also paused its payout, as a 22% sales slump caused the company crash to a half-year loss.

I waited for new CEO Joshua Schulman to take charge to see what he'd say. But while I think his plans are sensible, I have no view on the likely scale or pace of a potential recovery.

Perhaps worse, I concluded that Burberry may not have the intrinsic value or dependability of some of the other stocks in my portfolio. Some conservative modelling suggested to me that c.1,000p could be close to fair value, at least in the short term.

I exited Burberry on 31 December 2024 at 980p for a total loss of 35%.

- Replacement: to replace Burberry, I chose a market-leading British business with a long track record of providing differentiated products to its customer base. While end-user demand is currently depressed, I think it will recover over time. A modest valuation, 5% yield and long-term management focus persuaded me to take the plunge.

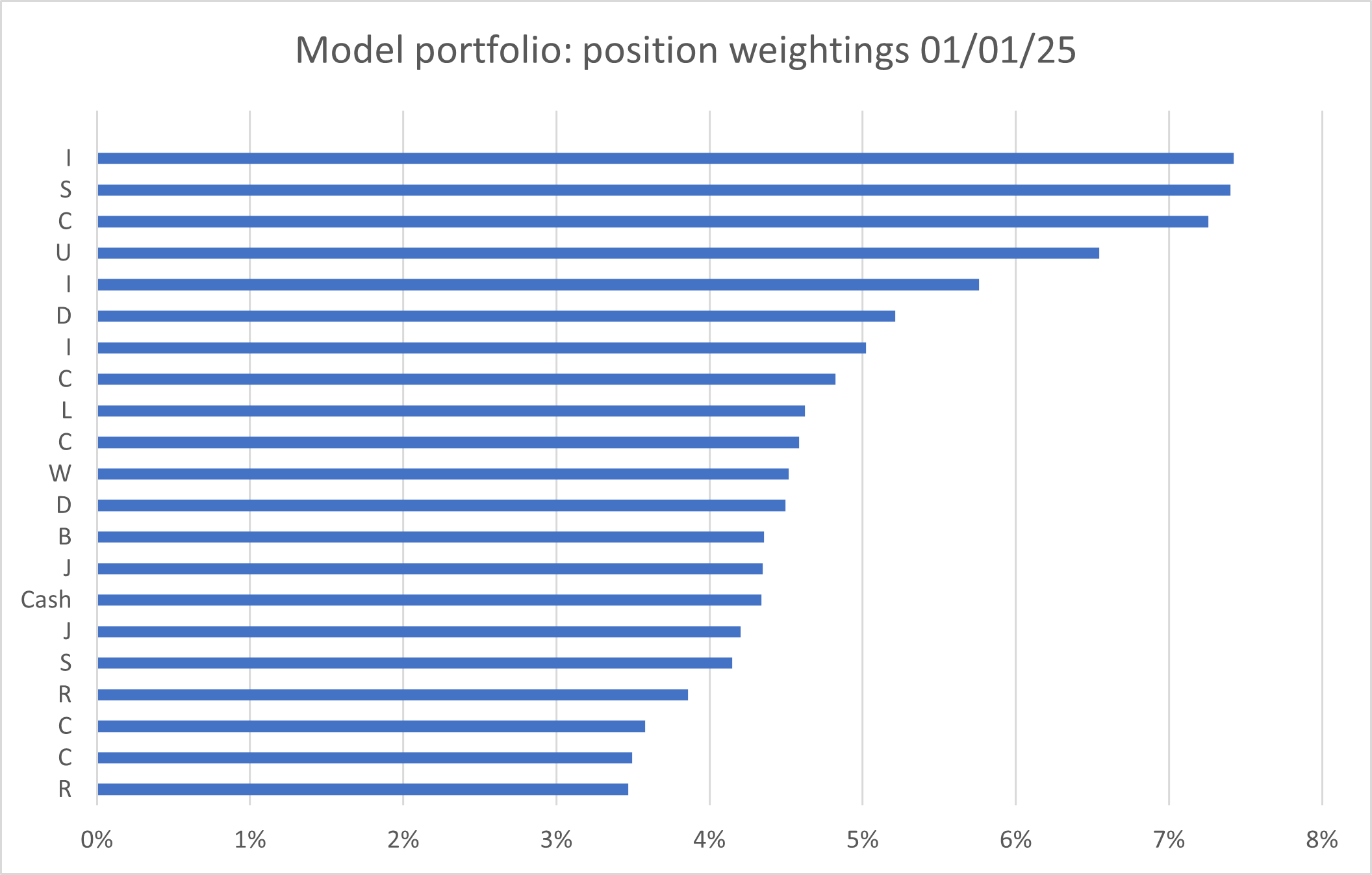

Position weightings

My model portfolio positions are all initiated with a weighting equivalent to about 4.7% of the original portfolio capital. Occasionally I make top ups – although there was only one in 2024, which I discussed in December.

Here's how the model portfolio looked at the end of 2024, after the transactions discussed above. Subscribers can see this chart with company names on my portfolio page:

As a rule of thumb, I aim for cash to be between about 4% and 8%. If cash continues to accumulate in Q1, I may consider some further top ups as the year unfolds.

I don't have any limits on position sizing, but any holding dropping towards 2% is likely to be under review. Equally, if a holding rose above 10%, I might take a fresh look at the situation.

Model dividend portfolio: key financial metrics

Every quarter, I average together the financial metrics that are most important to me for the stocks in the model portfolio. I find this a useful tool for tracking the underlying characteristics of the portfolio – and hopefully, its ability to produce a rising stream of surplus cash.

Of course, I know that a benign average can mask a multitude of problematic individual data points. On the other hand, I know that the perfect stock doesn't exist. So instead, I try to synthesise it across a portfolio of shares.

Time will tell if this method can deliver the results I hope for. But here are the average metrics for the model portfolio at the end of 2024:

| Median mkt cap |

TTM ROCE | TTM EBIT yield |

TTM FCF yield |

Net debt/5yr avg net profit |

TTM div yield |

5yr avg div grth |

F'cast div yield |

No. yrs div paid |

| £983m | 22.5% | 11.0% | 8.0% | -0.3x | 5.4% | 6.3% | 5.4% | 24 |

Scroll L-R (Data source: SharePad/author analysis 03/01/2025. Some adjustments were needed, e.g. for financial stocks. Please DYOR and don't take this as gospel.)

(Here's how these statistics looked at the end of Q3 2024.)

These metrics reflect the qualities I think are most important in a dividend stock – profitability, valuation and cash generation. But there's also a certain method to this selection and I find it useful to work through the numbers each quarter.

Starting at the left, the portfolio's median market cap of £983m is significantly lower than the £1.7bn I reported at the end of Q3.

This drop reflects the new stocks added to the portfolio in Q3 and Q4 – all three of them were significantly smaller than the companies they replaced (these metrics are compiled after any trades take place).

Moving along, I'm reassured to see return on capital employed (ROCE) is broadly unchanged at a level I see as very attractive.

Equally, an EBIT yield of 11% is firmly in value territory, for me, while a trailing free cash flow (FCF) yield of 8% is also appealing.

As I saw last year, portfolio free cash flow doesn't guarantee that individual companies won't need to cut their dividend. But in aggregate, I'm pleased to see that the portfolio's free cash flow yield is greater than its dividend yield of 5.4%. This shows that on average, my companies' payouts are covered by surplus cash.

As an equity investor, balance sheet strength is also very important to me. My measure of net debt/5yr average net profit is intended to give me an idea of how quickly a company could repay debt if needed. In this case, a ratio of -0.3x indicates that on average, my companies reported a net cash position in their most recent accounts.

Finally, while past performance is not a guide to future returns, I do find it useful. On average, the companies in my portfolio have paid a dividend in each of the last 24 years.

Over the last five years, their payouts have risen by an average of 6.3% per year.

However, based on current consensus forecasts, it's not clear if this record will be maintained in 2025. The portfolio's forecast dividend yield of 5.4% is the same as its trailing 12-month yield. That suggests zero or at least minimal growth this year.

I'm hopeful that I'll be able to report some income growth in 12 months' time. But at this point, there seems to be a risk that portfolio income may not maintain its past growth rate in 2025.

Final thoughts

2024 was an eventful year on the macro front and a pretty mixed period for UK stocks.

While I'm pleased by the income growth from the portfolio, I can't deny I'm disappointed by the total return generated.

I can't rule out a change to my approach at some point if this portfolio continues to underperform. But for now I remain committed to a systematic income approach and intend to continue to focus on companies that are profitable, cash-generative and reasonably priced.

Good luck in the markets in 2025 – and as always, thank you for reading.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.