Dividend shares: should I add Hargreaves Lansdown to my portfolio?

FTSE 100 dividend stock Hargreaves Lansdown looks cheaper than it has done since 2008 and offers a tempting 5% yield. Should I consider buying this market leader for my income portfolio?

Most private investors today take for granted the ability to choose and manage our own investments through easy-to-use, low-cost online platforms. But this functionality was unheard of 40 years ago, when Peter Hargreaves and Stephen Lansdown launched Hargreaves Lansdown (LON: HL).

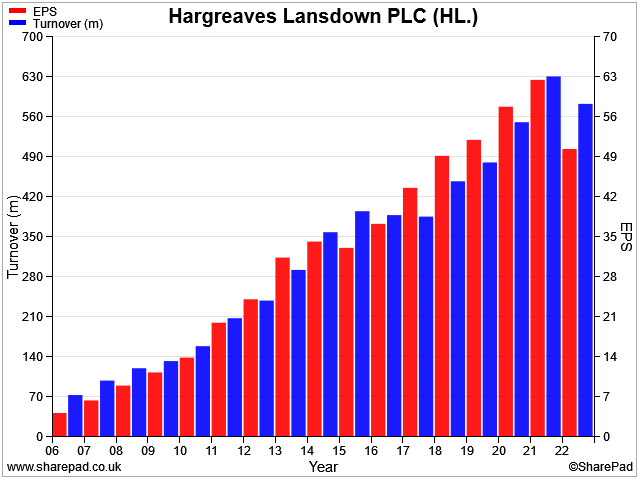

The story since then has been one of relentless growth – until now:

In this piece, I'll look at HL's impressive financial track record and the current challenges being faced by the business. I'll also explain why I might not be adding this FTSE 100 stock to my quality dividend portfolio just yet.

The story so far: Hargreaves and Lansdown saw the opportunity and demand for private investors to play a more active role in managing their own investments. Although the financial planning sector was already established, these services weren't (and still aren't) designed to provide good quality investment information directly to clients.

The two men started to provide information on unit trusts (funds) and tax planning directly to clients through a regular newsletter. HL then launched a discretionary investment management service in 1986, followed by the Hargreaves Lansdown PEP – a predecessor of the ISA.

All of this happened just as the 1980s stock market boom was approaching its peak. However, when the market crashed in 1987, HL continued to answer the phone to clients, offering help and constructive advice where possible. According to the firm, some competing brokers and fund managers simply stopped answering the firm, sacrificing client trust and goodwill.

This eventful first decade laid the foundations for the company's development into a leading discount stockbroker during the 1990s, culminating in the launch of the UK's (then) cheapest online dealing service.

Hargreaves Lansdown has continued to expand since then, offering an ever-increasing selection of investment products and information for investors. Both founders remain shareholders (albeit reduced), despite having retired from the business.

HL helped to create and define the market it now leads. But the competition hasn't stood still. Hargreaves Lansdown faces a wealth of strong competition today, including tech startups offering free trading, as well as direct rivals such as AJ Bell and Interactive Investors (now owned by ludicrously-named fund manager Abrdn).

Hitting the wall

Since touching record highs of more than 2,000p in 2019, Hargreaves Lansdown's share price has fallen by more than 50%.

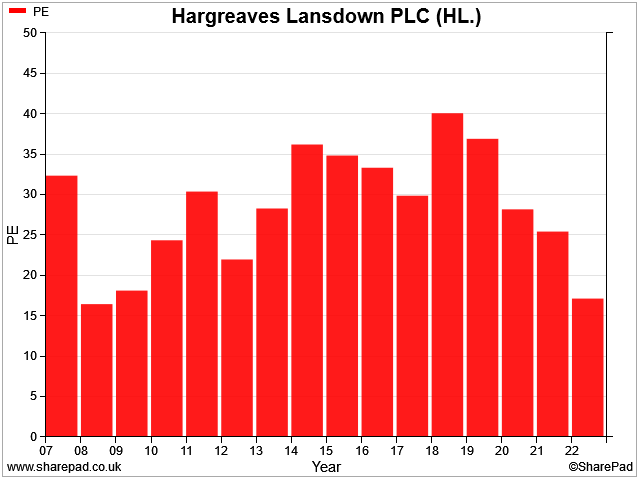

The company has shed its premium valuation and now trades on 15 times forecast earnings, with a near-5% dividend yield. That's unusually affordable – the shares are now trading on a P/E rating last seen during the 2008/9 financial crisis, shortly after the company's 2007 IPO:

I think it's fair to say that HL's de-rating is at least partly due to investor fears that this business may finally have gone ex-growth. Fee costs may be another problem. Having once been a low-cost pioneer, HL is now more expensive than some rivals.

Customer numbers doubled to 1.7m during the six-year tenure of CEO Chris Hill. But after launching a comprehensive plan to invest in new digital-led services in February, Mr Hill has recently announced his departure.

News of his decision came after news reports that HL is facing a lawsuit from more than 3,000 investors who suffered losses when Neil Woodford's funds collapsed in 2019. HL listed Woodford's flagship Equity Income Fund on its best-buy fund list until trading in the fund was suspended in 2019.

The claims against HL are said to be for "hundreds of millions of pounds", according to this FT report. At this stage, there's no way to predict any eventual outcome, but I think it's worth being aware of the potential for liabilities in this area.

Interestingly, the Woodford affair seemed like a scandal at the time, but it doesn't seem to have damaged HL's general reputation (except among affected investors...).

Should I add HL to my dividend portfolio?

Today, Hargreaves Lansdown is the UK's leading DIY investment platform and a FTSE 100 business. The group has £120bn of assets under administration (AuA) and over 1.7m clients.

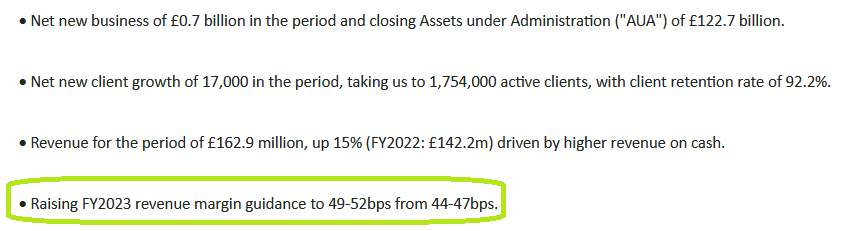

Profit margins are high; HL is expected to generate a net profit of £250m this year, on revenue of £655m. Although the firm's Q3 trading statement showed new client growth slowing, net inflows remained positive and third-quarter revenue was up by 15%. Management even felt sufficiently confident to increases margin guidance for the year (slightly).

My quality dividend model portfolio will shortly have a vacant slot, assuming the takeover of software group EMIS (I hold) completes as expected.

Does Hargreaves Lansdown has the qualities I'm looking for in a potential member of the portfolio?

Hargreaves Lansdown: crunching the numbers

Description: Market-leading UK DIY investment platform providing access to equities, funds and a wide range of other investments.

| Hargreaves Lansdown (LON: HL) | Quality Dividend score: 76/100 | Forecast yield: 5.0% |

| Share price: 813p | Market cap: £4.0bn | All data at 18 November 2022 |

Latest accounts: Final results for the year ended 30 June 2022

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Hargreaves Lansdown could be a suitable addition to my quality dividend portfolio .

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: strong

I score a company's dividend culture using one simple metric – the number of years of unbroken dividend payments.

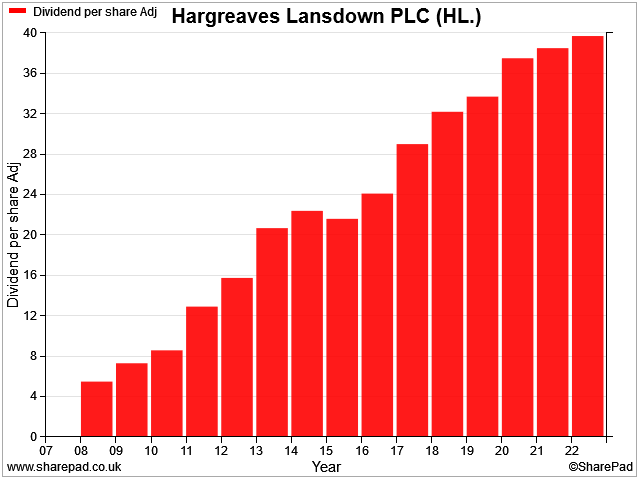

The company has paid a dividend in every full financial year since its listing in 2007. This may partly be due to the fact that both founders have always been significant shareholders and remain so, even after retiring from the business.

Hargreaves only gets a middling score from my algorithm, but this reflects the company's relatively short spell as a listed company – just 15 years. All the evidence so far suggests to me that this business has a strong dividend culture.

Hargreaves Lansdown scores 3/5 for dividend culture in my screening system.

Dividend safety: armour-plated

My dividend safety score compares a company's dividend payout with its earnings and free cash flow per share.

I also look at debt and leverage, to ensure that shareholders aren't receiving cash that would be better used repaying debt.

Dividend cover of two times earnings is often used as a benchmark for dividend safety. As a useful rule of thumb, I share that view. However, I don't think it always makes sense to apply a one-size-fits-all approach.

A highly cyclical company that's prone to big profit swings – BP, for example – might need a higher level of cover to ensure the dividend remains sustainable.

At the other end of the spectrum, Hargreaves Lansdown is a capital-light business with high margins, good cash generation and stable earnings. In this scenaraio, I think that a lower level of earnings cover is probably sufficient to provide a reasonable level of safety.

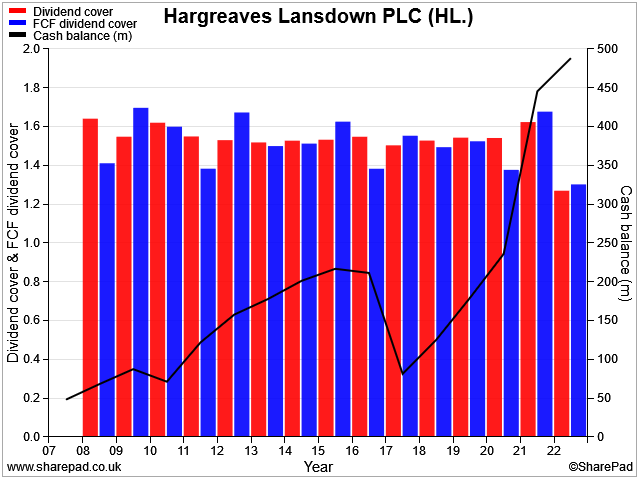

That's what we see here – the dividend has consistently been covered around 1.5x by free cash flow and earnings since 2008. Despite these regular payouts, the group's cash balance has steadily trended higher:

It's clear that if earnings fall much below last year's level, dividend cover could become stretched. I don't think this is too likely, but it's certainly a possibility.

However, the group's last-reported net cash position of c.£500m would be sufficient to fund two years' dividends at the current level. On balance, I think a dividend cut is unlikely.

Hargreaves Lansdown scores 4.7/5 for dividend safety in my screening system.

Dividend growth: solid foundations

As a long-term investor, I want my dividends to grow, or at worst, be flat. Dividend cuts will erode my income and may indicate wider problems with a business.

My dividend growth score is intended to give me a clear view of the factors I believe are needed to support sustainable increases to the shareholder payout:

- Free cash flow growth

- Net asset value growth

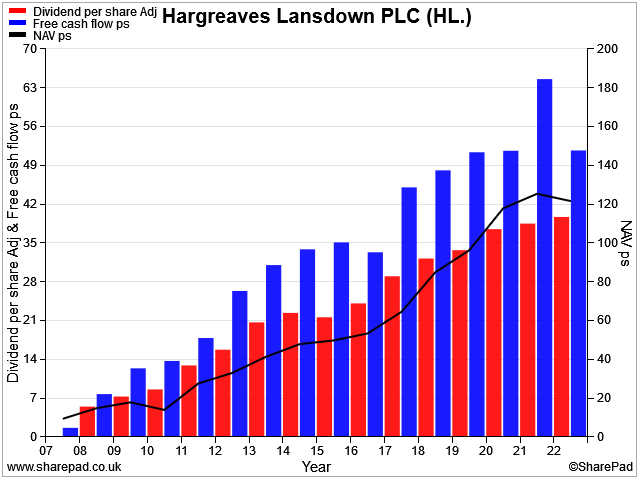

In this chart we can see that HL's dividend growth has been supported by matching free cash flow growth, as well as steady NAVps growth

(As a quick reminder, I include NAVps growth as an indicator that the underlying business is expanding. If this isn't happening, then management may be relying on cost-cutting or increasing the payout ratio to fund dividend growth – not always sustainable)

My algorithm blends a company's five-year growth rates for dividend, free cash flow and NAV to give a score for dividend growth.

Last year's fall in free cash flow and NAV dampen HL's overall score here, but the stock still earns an above-average score for dividend growth.

Hargreaves Lansdown scores 3.5/5 for dividend growth in my screening system.

Dividend yield: bucking the trend

My intention is to buy shares in companies that are able to deliver long-term dividend growth. In some cases, I'm willing to accept lower yields today in order to (hopefully) benefit from future compounding.

However, yield is still important to me and I aim to maintain a portfolio yield that's comfortably ahead of the FTSE 100 average. (At the end of September 2022, the portfolio had a forecast yield of 5.3%, compared to 4% for the FTSE 100.)

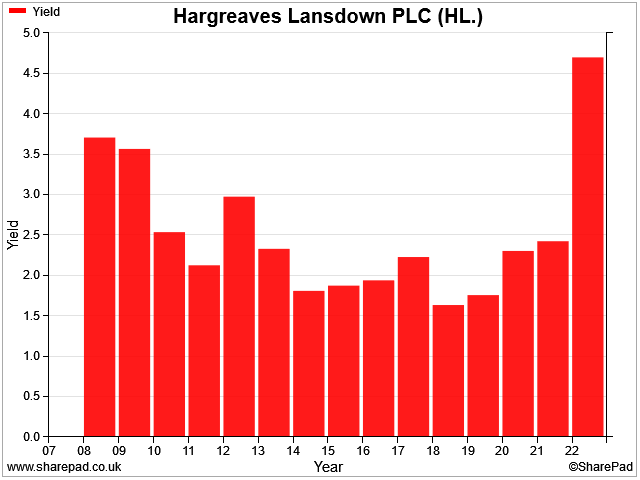

Until very recently, Hargreaves has been a relatively low-yielding stock, due to its premium valuation. That has now changed – this year's share price slump means HL's dividend yield is now higher than at any point in its listed history:

HL's 5% dividend yield looks attractive to me, at least at face value.

But I also think it's worth reflecting on the sudden change in the valuation that's implied by this sharp rise in yield. The market appears to be pricing in a future that's rather different to the recent past. This might be a short-term misvaluation by Mr Market – or it might not be.

Hargreaves Lansdown scores 2.8/5 for dividend yield in my screening system.

Profitability: falling to earth?

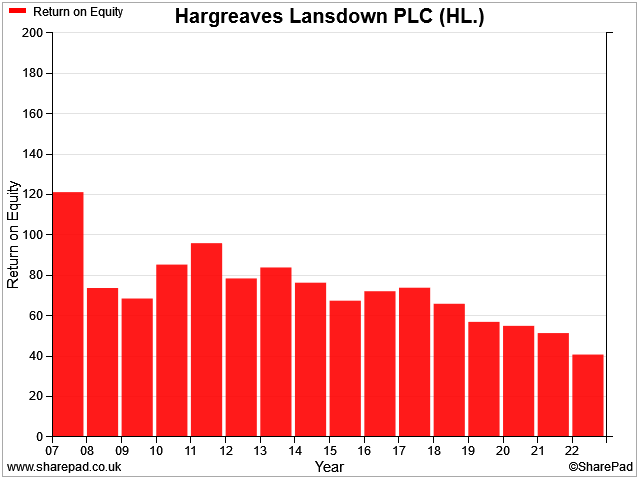

Hargreaves Lansdown has long been one of the most profitable businesses on the UK market. But the company appears to be in danger of losing this reputation. Return on equity has been trending lower for the last decade:

I don't think this falling profitability indicates any underlying problem. But it does seem to indicate that the business is not quite as profitable at its current scale as it was 10 years ago.

I can see three possible reasons for this loss of profitability:

- Competitive pressures pt I: HL operates in a more crowded market place than it did even 10 years ago. In addition to other mainstream investment platforms like ii and AJ Bell, HL faces competition from a new generation of trading apps with no dealing fees.

- Competitive pressures pt II: The fees charged by active fund managers have come under growing pressure from cheaper passive investing products in recent years. HL offers a wide choice of third-party funds on its platform, but the revenue margin it receives from selling these products has fallen from 0.62% (FY13) to 0.39% (FY22). There's also a second reason for this decline – regulatory change.

- Regulatory change: The Retail Distribution Review (RDR) restricted fund commission payments to advisers and platforms. RDR came into force at the end of 2012, with further changes from 2014.

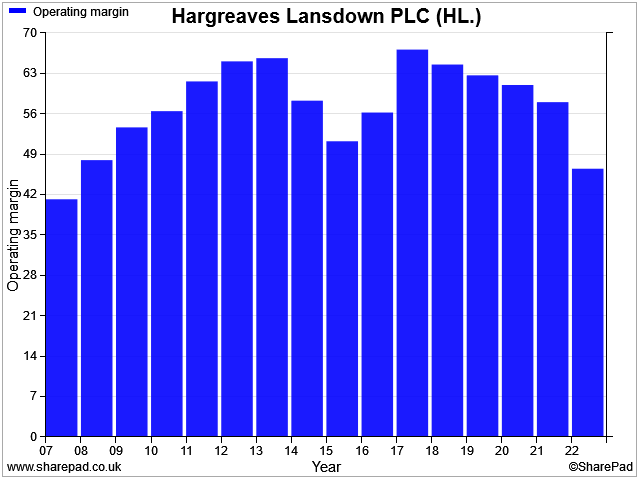

We can see that HL's operating margin dipped fell when RDR was introduced, before recovering from 2016 onwards, when the phased implementation of RDR changes was completed. As part of this change, HL introduced an updated pricing structure, presumably recovering some lost margin.

However, from 2017, the group's operating margin entered a more persistent downtrend. I suspect this is due to competitive pressures, and perhaps HL's growing scale and cost base:

Hargreaves Lansdown remains an outstandingly profitable business. But there's no sign yet that the group's profitability has stabilised. Nor is there any sign that competition from a growing host of rivals – recently joined by CMC Markets – is about to ease.

In my view, one of the biggest risks to Hargreaves Lansdown's current valuation is that the group's profitability will normalise at a lower level yet. If combined with slower growth, this could justify a further step down in valuation and share price.

For example, let's imagine that HL's operating margin falls to 38% – the level achieved by rival AJ Bell last year. At this level, my sums suggest that operating profit would fall by 17%, and that last year's dividend would not have been covered by earnings.

Despite this future risk, HL's history of excellent profitability earns the stock a top score in my screen, which does not attempt to predict the future.

Hargreaves Lansdown scores 5.0/5 for profitability in my screening system.

Conclusions: a good business, but what next?

My quality dividend system awards Hargreaves Lansdown an overall score of 76/100 at the time of writing (November 2022).

Hargreaves Lansdown's past performance has seen it benefit from first-mover advantage and sure-footed strategy to become the UK's market-leading private investor platform.

The business remains hugely profitable and I think it has a very strong balance sheet.

On a medium-term view, I think HL will remain successful and could be an attractive investment. However, the near-term looks potentially challenging.

The group faces strong competitive pressures and the risk – unquantifiable to me at this stage – of significant legal damages relating to Woodford funds.

There's also the broader question of growth. Peter Hargreaves and Stephen Lansdown sure-footedly identified and took ownership of a large, growing niche. Departing CEO Chris Hill was able to continue this work, doubling the group's client count in six years.

However, HL now has 1.7m clients. That's 2.5 out of every 100 people in the UK. I think it's worth asking where future growth might come from. Here's what we know right now:

- Rising interest rates are likely to boost income from investors' cash deposits. However, HL's own cash savings service may cannibalise this income. It makes it easier for investors to move cash into interest-paying accounts when it's not needed for investments.

- Mr Hill's February strategy laid out plans to scale up the company's own fund management operation, which attracts pre-RDR levels of margin.

- Other plans included an expanded advice service, and using data analytics to provide "data-driven insights" for clients.

All of these seem plausible to me, but they will require investment and don't look like easy or quick fixes to me.

My view: On balance, I think HL is a good business that could be an attractive investment at the right price.

With the shares trading on 15 times earnings and offering a 5% yield, the price may already be attractive.

Personally, I'm not yet convinced. I'm interested to see what happens next. But I won't be adding Hargreaves Lansdown to my portfolio at this time.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.