New stock: a new family firm to (hopefully) improve the sleep-easy score of my portfolio

This 100-year-old business boasts enviable profitability and an impressive dividend track record. I hope it will provide me with more peace of mind than the stock I'm selling.

I've decided to sell one of the small-cap dividend shares in my quality income portfolio at the end of this quarter.

Unusually, I don't have any serious concerns about the performance or valuation of this business. Instead, what's concerning me is a different type of risk – potential problems that I can imagine, but whose impact and likelihood I cannot understand.

All investments come with a measure of such risks, of course. But in this case, I feel the balance has tilted beyond my comfort zone.

As a result, I am spending too much time worrying about the unknowable.

After some consideration, I've decided to take advantage of my quarterly trading window to remove this source of stress from the portfolio and replace it with a dividend stock I believe should be easier to live with.

New stock: a family dividend stock

The departing stock is a family firm, and in its place I am going to add another UK-listed family firm to my dividend portfolio.

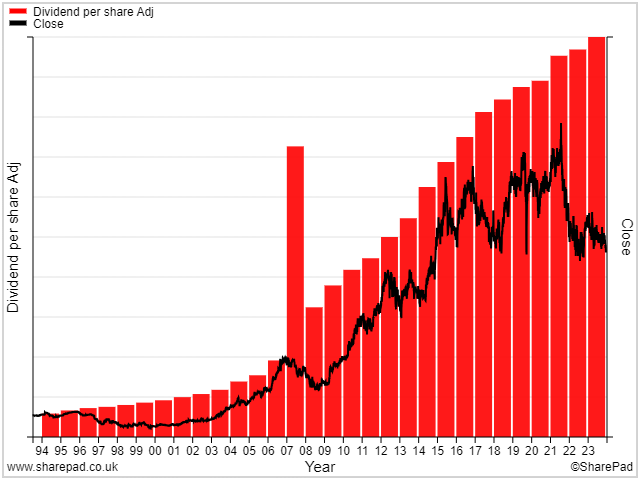

The company in question is a business I've followed with interest for some time and have previously commented on in The Dividend Note. It has an unbroken dividend history stretching back more than 30 years.

I believe the valuation of this business has now fallen to a level that's attractive, assuming its long-term track record of growth remains intact.

I don't have a specific policy of investing in family-controlled businesses, but I find myself being drawn to them increasingly often. This may be because of their tendency to have reliable dividends, strong balance sheets and a long-term focus.

These attributes are certainly present in this new stock, in my view, and reflect my main goals for the model portfolio and my own investments.

I will be making both trades on the final working day of the quarter (28 June 2024), in line with my normal quarterly trading policy.

Paid subscribers can read on below for full details of the dividend stock I'm selling and the new share I'm going to buy.