Is new GSK a quality dividend share?

FTSE 100 pharma group GSK (LON:GSK) has streamlined its business and its financial health seems to be improving. Should I consider the shares for my dividend portfolio?

Like Aviva, I've always felt that FTSE 100 pharmaceutical giant GSK (LON: GSK) should be a good dividend investment. However, the evidence has not really supported this view in recent years.

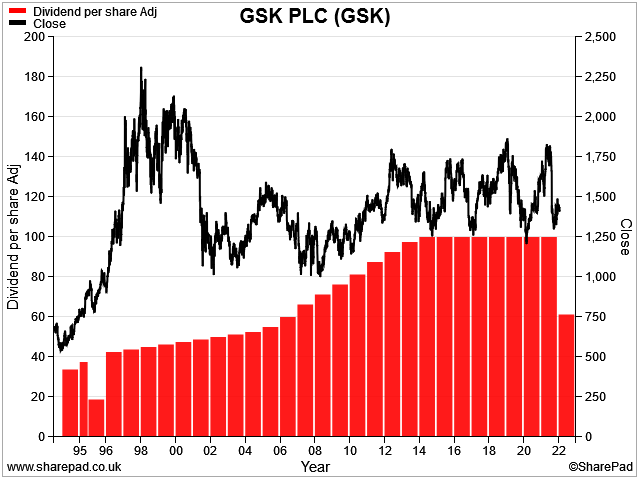

GSK's share price is at a level first seen 25 years ago, while its dividend has just been cut.

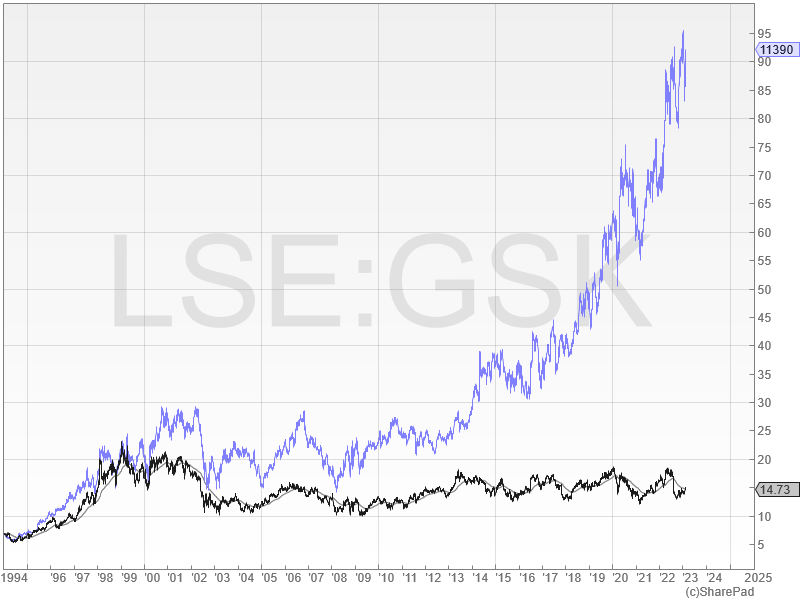

GSK shares have also underperformed FTSE 100 rival AstraZeneca to an extent that can only be described as chronic:

Although investors supported CEO Dame Emma Walmsley's decision to spin out GSK's consumer healthcare business (now Haleon), Walmsley has faced criticism for failing to deliver change quickly enough.

Cancer allegations against heartburn medicine Zantac added to investor concerns last year. However, a US court ruling in December seemed to suggest major penalties are now less of a risk.

Meanwhile, the company's recent results suggest that progress is being made in the core pharma business. Revenue from continuing operations rose by 13% to £29bn last year, while adjusted earnings were 15% higher, on a constant currency basis.

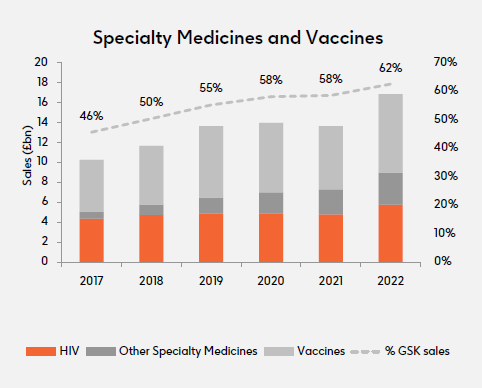

A growing proportion the group's revenue now comes from its targeted growth areas. Specialty medicine and vaccine sales now account for 62% of revenue, up from 46% in 2017, when Walmsley became CEO.

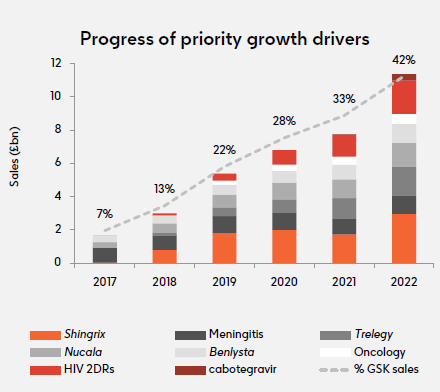

Key growth products now account for 42% of sales, up from just 7% in 2017:

Although GSK still needs to prove that it can deliver a regular supply of successful new medicines, this progress seems encouraging to me.

I think there's a reasonable chance that the changes GSK has set in motion since 2017 – including the dividend cut – could make this an attractive income investment once again.

GSK's 2022 results were published on 1 February, so I've now been able to download the group's latest numbers from SharePad into my screen.

I'm currently looking for a new dividend stock to replace EMIS in my quality dividend portfolio, so in this piece I'm going to consider whether GSK could be a good choice for the portfolio.

Table of contents

- GSK: history and recent organisational changes

- Crunching the numbers - how does GSK score in my screening system?

- Dividend culture - 30 years without a break

- Dividend safety - improving after a difficult patch

- Dividend growth - poor, but new policy looks promising

- Dividend yield - no longer a high-yield share?

- Valuation - looks very reasonable to me

- Profitability - decent overall, with one caveat

- Fundamental health - improving following Haleon split

- Conclusions - my view

From pharmacy to FTSE 100 in 308 years

GSK's origins can be traced back to the Plough Court Pharmacy in London, in 1715. From this location, apothecary Silvanus Bevan offered "medical advice and medicinal products", according to GSK's heritage website.

In 1856, Plough Court became Allen & Hanburys and was later acquired by Glaxo Laboratories. Around that time, companies were being formed on both sides of the Atlantic that eventually became Smith, Kline & Co, Beecham, and Burroughs Wellcome & Co.

Collectively, these businesses were responsible for helping to commercialise insulin and penicillin in the UK. They then went on to develop more effective antibiotics. GSK predecessors also developed some of the first drugs used to treat malaria, leukaemia and asthma, along with early polio vaccines.

In 1984, Burroughs Wellcome & Co scientists discovered a treatment for HIV. Further drugs have followed since, and HIV remains a core part of GSK's business, through its ViiV joint venture with Pfizer and Japanese firm Shionogi.

The 1980s also saw the first of a string of mega-mergers that created the company we know today:

- 1989: SmithKline Beckman merged with Beecham Group to form SmithKline Beecham.

- 1995: the Wellcome Trust sold its remaining shares in Wellcome plc to Glaxo plc, forming Glaxo Wellcome.

- 2000: Glaxo Wellcome merged with SmithKline Beecham to form GlaxoSmithKline.

- 2022: GlaxoSmithKline separated its consumer healthcare division (Sensodyne, Panadol, Nicorette, etc) into a new business, Haleon. The remaining biopharma business was renamed GSK.

Today, GSK's portfolio is divided into three main areas.

Vaccines (2022 sales: £7.9bn) - the company is one of the world's largest vaccine producers, with 2m doses of its vaccines administered every day. Jabs in GSK's portfolio include polio, flu, meningitis and measles. Shingles vaccine Shingrix is one of the group's newest blockbusters, achieving sales of £3bn last year.

Specialty medicines (2022 sales £11.3bn) - this is a key growth area, focusing on medicines that are prescribed by specialists. Therapeutic areas targeted by GSK include cancer, HIV, and other immune conditions such as lupus.

General medicines (2022 sales £10.1bn) - this is the slowest-growing of the group's divisions. It produces medicines typically prescribed by GPs. These include antibiotics and inhalers for respiratory conditions, such as COPD and asthma.

For many years, asthma drug Advair was a key moneyspinner for GSK. However, this former blockbuster has now lost its patent protection, opening the market to cheaper generic alternatives.

GSK is clearly a sizeable and very profitable business that's not going to disappear. However, this isn't necessarily enough to make it a good investment for me. With that in mind, I'm going to move on to take a closer look at GSK's financials.

GSK: crunching the numbers

Description: FTSE 100 pharmaceutical group, one of the world's largest vaccine producers. Focus on four therapeutic areas: infectious diseases, HIV, oncology and immunology.

| GSK (LON: GSK) |

Quality Dividend score: 60/100 | Forecast yield: 3.7% |

| Share price: 1,502p | Market cap: £61.5bn | All data at 9 February 2023 |

Latest accounts: results for the year ended 31 December 2022

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think GSK could be a suitable addition to my quality dividend portfolio .

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: excellent

I score companies for dividend culture based on how many consecutive years they've paid dividends, regardless of any cuts.

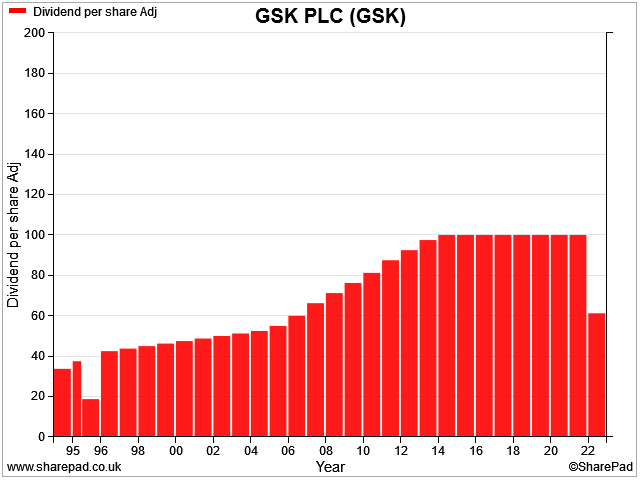

GSK scores well here, with an unbroken record of 31 years according to SharePad. However, the flat 80p per share payout of recent years should probably have been cut sooner than it was, in my view.

Nevertheless, I think there's no question that this business is committed to dividend payments.

GSK scores 5/5 for dividend culture in my screening system.

Dividend safety: improving

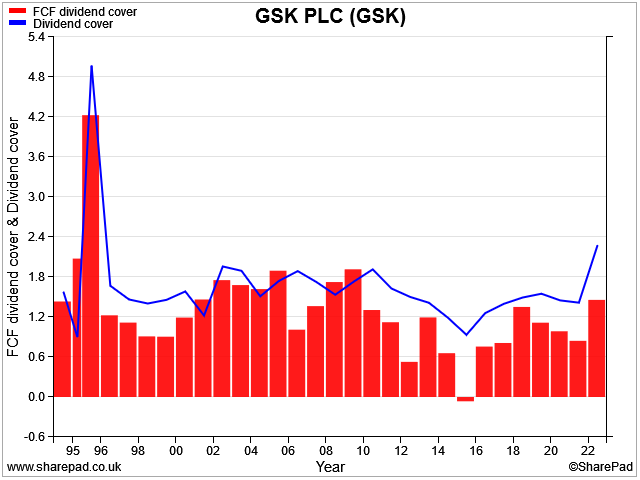

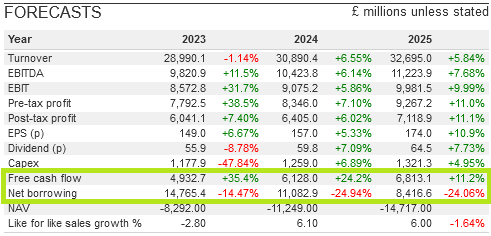

This is why GSK's dividend should probably have been cut sooner. The payout has looked stretched against earnings and free cash flow for some years now. Free cash flow cover – ultimately the most important – has been particularly weak:

Last year's results represented the best level of cover for some time. Further improvement seems likely in 2023, based on the company's new policy of maintaining a 40%-60% payout ratio through the cycle.

GSK's guidance is for a payout of 56.5p per share in 2023, giving a total dividend of £2.3bn. According to SharePad, consensus forecasts for 2023 show a net profit of £6bn, with free cash flow of £4.9bn.

The dividend has looked precarious in recent years. I think it should now be on a more secure footing, even if 2023 results fall below expectations.

GSK scores 2.9/5 for dividend safety in my screening system.

Dividend growth: poor

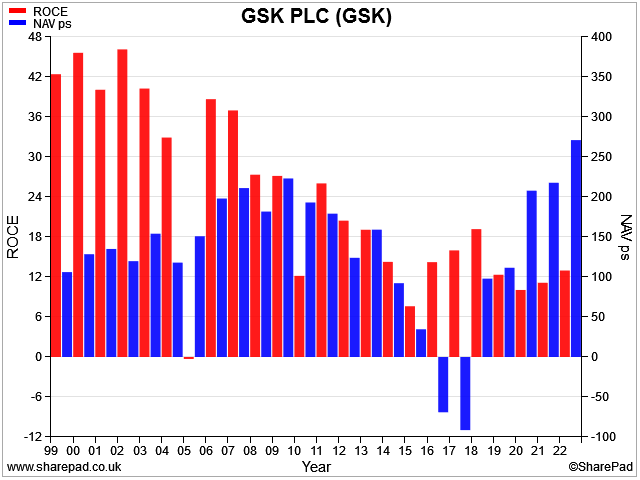

I score stocks for dividend growth based on historic free cash flow growth and net asset value per share growth. My aim is to measure the sustainability of past dividend growth.

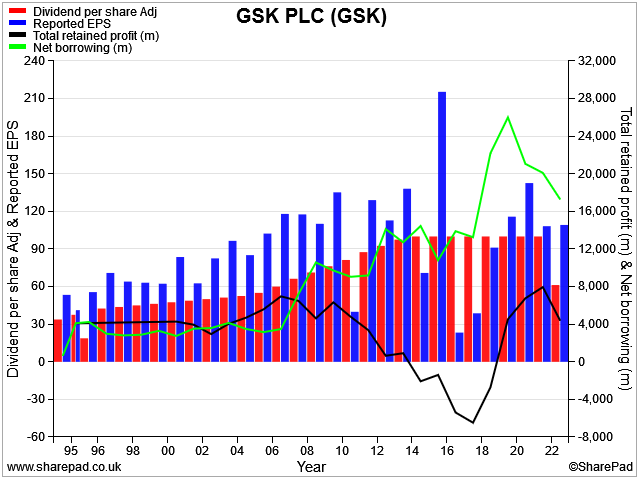

Unfortunately, GSK hasn't delivered any dividend growth since 2014 and has just cut its payout. This suggests the previous payout wasn't sustainable.

Admittedly, last year's cut was a planned move to reflect the disposal of the consumer healthcare business.

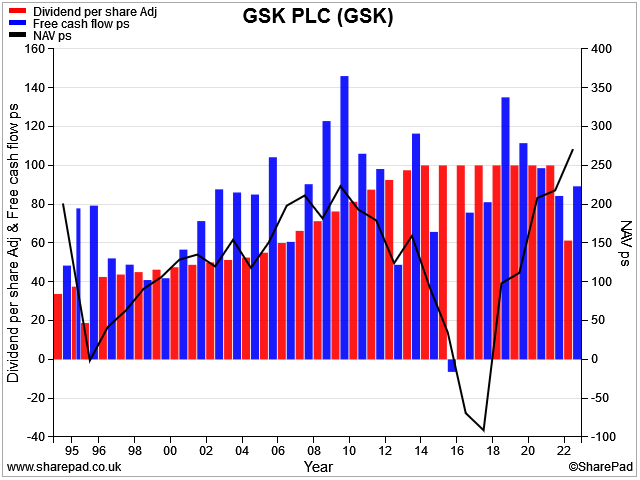

However, a cut had been an obvious risk for a number of years, due to insufficient free cash flow:

The fall in net asset value between 2009 and 2018 is also a concern. There are lots of moving parts here. But in broad terms, I think the decline in NAVps reflects weaker earnings, rising net debt, an expanded pension deficit, and the impact of some asset disposals.

Perhaps a simpler way of looking at things is that from 2014, GSK regularly paid dividends that weren't covered by earnings. The shortfall ate into the company's retained profits (black line), eroding its balance sheet equity:

Current consensus forecasts on SharePad suggest that the improvement seen over the last year is expected to continue:

These forecast numbers imply a free cash flow yield of 8% for 2023, rising to 10% in 2024. If GSK can hit these numbers, I would argue that the stock could be attractively priced at current levels, with good potential for progressive dividend growth.

Based on recent performance, however, I'm afraid my system awards GSK a deservedly poor score for dividend growth.

GSK scores 0.3/5 for dividend growth in my screening system.

Dividend yield: not as good as it was

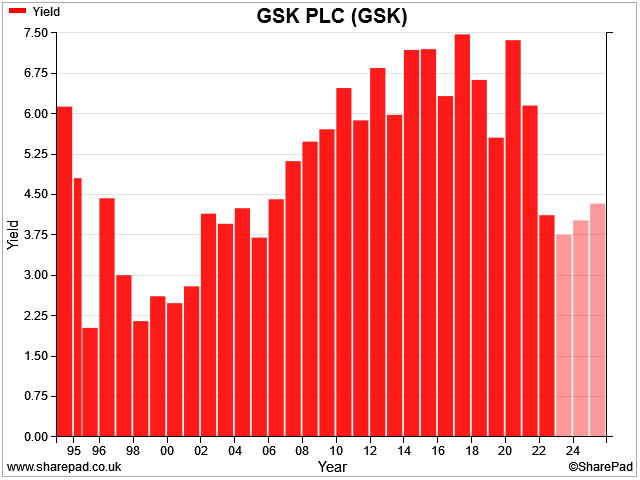

GSK has enjoyed a reputation as a high yield stock over the last decade.

The new reality for the stock seems likely to be that it will offer a lower but more sustainable yield, with growth potential. This is shown in the chart below (the paler bars show forecast yield through to 2025:

GSK's historic high yield status means that it scores well in my screening system, but I think the forecast yield is a more realistic indicator of the income shareholders can expect for the next few years.

GSK scores 4/5 for dividend yield in my screening system.

Valuation: reasonable

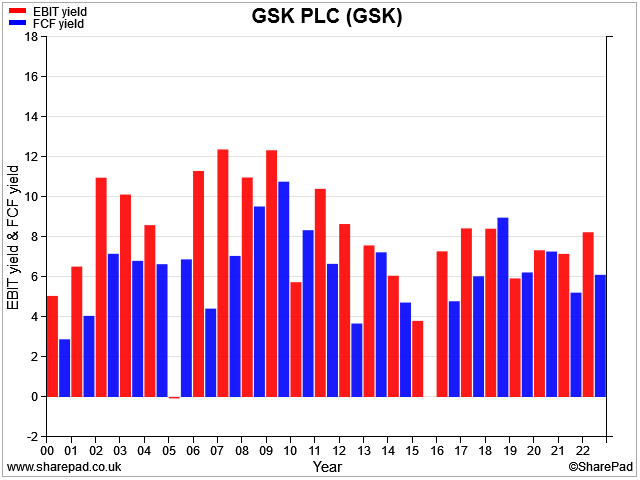

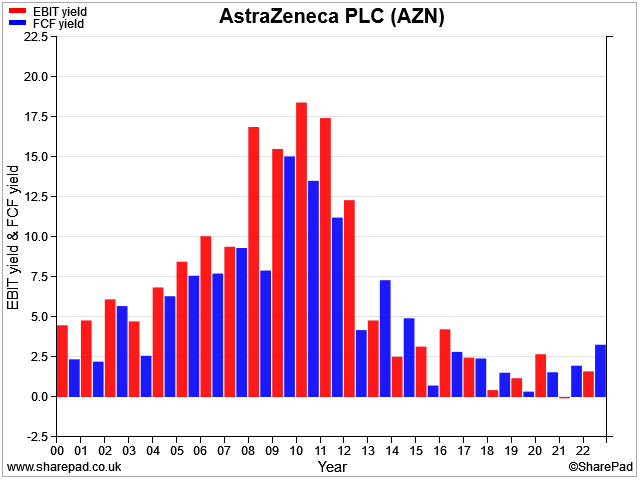

I score stocks for valuation based on their trailing 12-month EBIT yield and free cash flow yield.

My calculations compare EBIT and FCF to a company's enterprise value (mkt cap + net debt), so debt is included. This gives a more holistic view and helps to neutralise the impact of difficult debt/equity mixes.

GSK looks quite reasonably valued to me based on its 2022 results. EBIT yield is around 8%, according to SharePad data, while free cash flow yield is c.6%. These figures are fairly typical of recent years – GSK has looked cheap for a while, arguably:

Based on these measures, GSK trades at a very substantial discount to FTSE 100 rival AstraZeneca:

At current levels, I'd argue that GSK's valuation looks undemanding and could be attractive, if the company can deliver expected rates of growth.

GSK scores 3.5/5 for valuation in my screening system.

Profitability: mixed picture

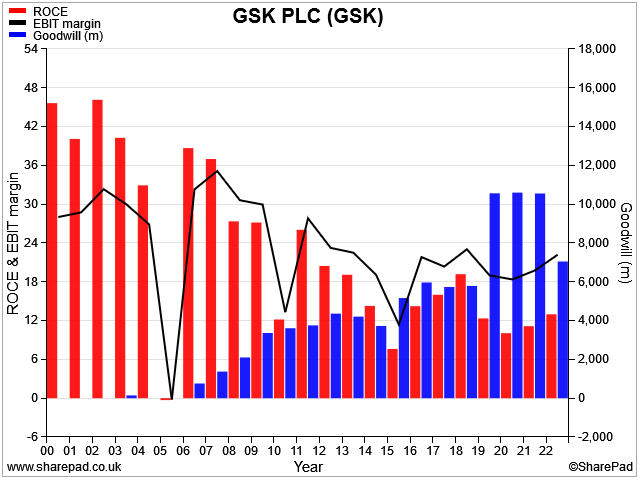

GSK has high profit margins. The group reported an continuing operating margin of 21.9% for 2022. However, the business does not score so well using my preferred measure of return on capital employed.

My sums suggest GSK generated a ROCE of 13.9% last year, which is close to SharePad's figure of 13%.

We can see from the chart below that while the group's operating margin and ROCE used to be closely aligned, ROCE has fallen away while margins have stayed high.

As with Savills a few weeks ago, I think this diverging trend can be at least partly explained by a growing amount of goodwill from acquisitions:

Does this matter? I prefer to include goodwill in ROCE because it represents capital allocation decisions by management. As a potential investor, I want to see how these investments have affected the returns generated from the company's assets.

The counter argument to this view is that if the same assets had been developed in house, there would be no goodwill. All else being equal, that would make ROCE higher.

This view is also correct, but for me the key thing is that these assets weren't developed in house. Perhaps they couldn't have been. Or perhaps management thought it would be cheaper or quicker to acquire them.

In any case, acquired assets are purchased at an upfront price based on expectations of future returns. I want to see how those decisions have panned out, in terms of ROCE.

The other key metric I use to score stocks for profitability is net asset value per share growth. I do this to help me gauge the sustainability of the dividend and of any recent profit growth.

For example, if a company is generating stable returns (ROCE) on a shrinking asset base, then mathematically profits are likely to be falling. This could put the dividend under pressure.

Conversely, rising net assets and stable ROCE imply that profits are rising. In turn, this should provide a sustainable base for dividend growth. On that basis, I'm reassured to see that GSK's NAVps returned to growth in 2019, after a nine-year period of decline:

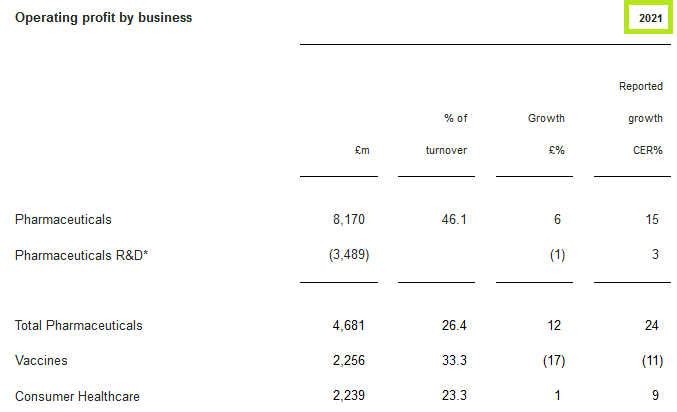

A frustrating exclusion: it's useful to look at GSK's profitability at a group level. But the company is composed of three divisions operating in different markets. It would be interesting to know the profit margins of each division, which have historically varied.

Until last year, GSK did report the operating profit for each of its three divisions:

Sadly, the company has used the disposal of its consumer healthcare business as an excuse to rejig its segmental reporting to provide much less transparency.

For reporting purposes, GSK now divides its operations into two segments, Commercial Operations and Research and Development. This seems very odd to me, as R&D is presumably always likely to be loss making when isolated in this way.

Commercial Operations includes Vaccines, Specialty Medicines and General Medicines. We do get a revenue breakdown of sales across these businesses, but profits are no longer split out. This means we can't compare the profit margins of each business line.

I'm not sure what the intent of this change was, but its effect is to obscure the different levels of profitability across the business. Frustrating.

GSK scores 2.6/5 for profitability in my screening system.

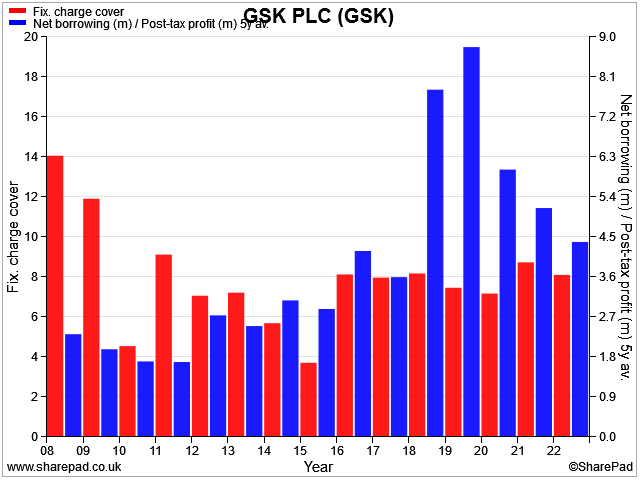

Fundamental health: in recovery

For this final score, my main concern is debt. I consider the leverage of the business and how easily its able to service its debt costs.

One concern with GSK in recent years was that its debt burden had become stubbornly high. The spin-off of the consumer healthcare division into Haleon included a £7.2bn debt repayment, which has helped somewhat.

This enabled GSK to reduce net debt by £2.6bn to £17.2bn last year, despite spending £3.1bn on acquisitions, £3.5bn on dividends and losing £1.4bn due to adverse exchange rate movements (ouch).

The chart below shows fixed charge cover also gradually improving, together with the welcome reduction in leverage.

To clarify, I measure leverage here using the multiple of net debt to 5yr average net profit. In this case, the falling multiple represents both lower net debt and higher profit.

As a rule of thumb, I prefer to see my measure of leverage below 5x, preferably under 4x. GSK scrapes under my threshold but remains quite heavily geared, compared to the majority of companies in my portfolio.

I don't expect the group's debt to become problematic, but I do think there's a risk it could continue to constrain GSK's flexibility to invest in growth.

GSK scores 2.7/5 for fundamental health in my screening system.

Conclusions: good but not compelling?

My quality dividend system awards GSK an overall score of 60/100 at the time of writing (Feb 2023).

My feeling is that GSK is likely to be a better business as a pure pharma group than it was in its previous conglomerate format. Although the firm has yet to prove that it can deliver a reliable stream of big winners, progress is certainly being made.

The company is also on an improved financial footing and appears to be generating stable and improving cash flow.

Fortunately, it looks like the legal risks associated with the Zantac case have largely receded.

Broker forecasts for the year ahead suggest that revenue will be broadly flat, but that adjusted earnings per share will rise by 7% to 149p. That puts the stock on 10 times forecast earnings, with a 3.7% dividend yield.

My view: I think that GSK looks like a reasonably priced, reasonably healthy FTSE 100 business. I'd be more tempted to invest if debt levels were lower still, but I don't see any particular cause for concern.

I'm not convinced that the shares are a compelling buy, but I wouldn't be too unhappy about owning them. If things go well, I think there could be decent upside from here. But I'm not sure how likely this is.

For this reason, I prefer to invest in companies that only need to repeat their past performance to be a good investment. That always seems a less risky prospect to me.

For now, I'll put GSK on the short list of possible replacements for EMIS in my portfolio. However, I suspect I'll end up choosing a different stock.

Disclosure: At the time of publication, Roland did not own shares of GSK.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.