Is multibagger RS Group a quality dividend buy?

After falling nearly 40% from their 2022 highs, are RS Group (LON:RS1) shares priced to buy? I consider the attractions of this distribution specialist, which has paid a dividend for at least 35 years.

Today I'm looking at a stock that's consistently been one of the top-scoring shares in my dividend stock screen in recent months.

In this in-depth share review, I'll consider whether this FTSE 250 industrial component distributor could be the kind of quality dividend growth stock I might want to include in my dividend portfolio.

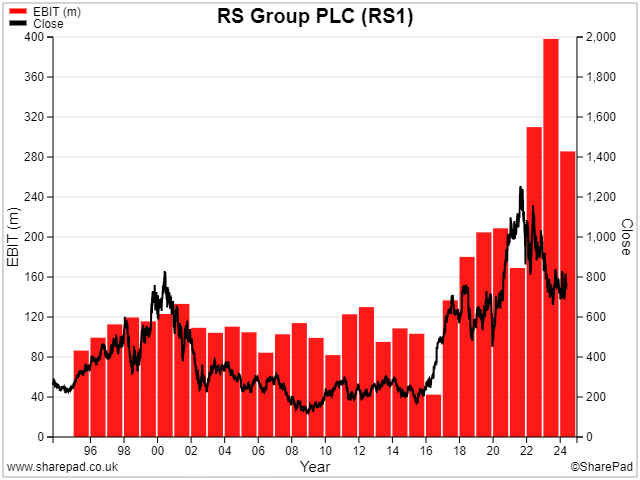

The group's performance over the last decade has certainly been strong. Despite the sell-off seen over the last two years, RS shares have three-bagged since 2014.

Shareholders enjoyed a total return (including dividends) of 14% annualised during this period, according to SharePad data.

Much of the 2014-2024 period was spent under the leadership of former CEO Lindsley Ruth. He was in role from 2015 until December 2022, when he stepped down for health reasons.

During this time, RS Group's operating profit tripled from £101m to £309m.

The company also changed its name in 2022, from Electrocomponents to RS Group.

However, a longer-term view – from 1994 until August 2024 – provides a reminder that this business was somewhat sleepier before Ruth's arrival. The share price in 1994 was roughly the same as in 2015, when Mr Ruth was appointed.

As a result, the annualised total return delivered by the stock since 1994 has been just 5.2%, according to SharePad.

Current CEO Simon Pryce only took charge in March 2023, although he'd been a non-executive director since 2016. He has since spent most of his first 15 months dealing with a severe round of customer destocking and the impact of supply chain normalisation.

"Our financial performance in 2023/24 reflected weakness in global industrial production and the unwinding of unusual post-pandemic trading tailwinds."

This situation left inventory levels raised, and profits down. But this destocking process won't continue indefinitely. I expect conditions to return to normal sooner or later.

Mr Pryce certainly seems confident he can return the business to growth:

"The actions we are taking are improving the fundamentals of the business and will support stronger and more sustainable outperformance when markets return to growth, which will deliver excellent, first choice outcomes for all our stakeholders."

I wonder if Mr Pryce's CV also points to another possibility for RS Group.

His previous two roles were as CEO of Ultra Electronics and BBA Aviation. Both firms were UK-listed equities at the time of his appointment. Both received takeover offers and were taken private during Pryce's tenure.

In this in-depth share review, I'll take a closer look at RS and explain why it's caught my eye as a potential purchase.

I'll also run the stock through my dividend scoring system, to see how well it scores on important factors (for me), such as dividend growth, profitability, and valuation.

Table of contents

- What does RS Group do?

- History - 87 years of spare parts

- Recent trading & outlook

- Crunching the numbers - how does RS score in my dividend screen?

- Dividend culture - 35 years of payouts, one big cut

- Dividend safety - no serious concerns

- Dividend growth - intermittent, but well supported

- Dividend yield - average, but historically informative

- Valuation - could be cheap if RS meets forecasts

- Profitability - the business has generated attractive returns on capital

- Fundamental health - no serious concerns

- Conclusion - would I consider buying RS Group shares for my portfolio?

What does RS Group do?

RS Group sources and resells a vast range of industrial products – such as electronic components – to customers all over the world.

The company serves the MRO (Maintenance, Repair and Operations) market and carries more than 750,000 products in stock, in order to meet customer demand quickly and reliably.

This £3.6bn group is one of a number of distribution specialists listed on the UK market. What they have in common is that they link suppliers and customers who cannot trade directly with each other (my emphasis):

"Our suppliers do not tend to have the distribution capabilities, or desire, to service or deliver directly to these customers in such small volumes. RS plays a very important role connecting over 2,500 suppliers and 1.1 million customers."

Another – very different – example of this type of business is AIM-listed fuel, food and feed supplier NWF Group (LON:NWF), which I've looked at in a previous review and liked.

History: 87 years of spare parts

Electronic engineering students of a certain age (including me) will remember the RS catalogue. These multi-volume tomes were the size of pre-internet telephone directories and were regularly reissued.

In the 1990s, at least, the RS catalogue was filled with pages such as this:

When you wanted some electronic components, you looked them up and then ordered them by phone or post. The company's first transactional website was launched in 1998, while I was at university.

1937 - 2024 timeline: RS Group's history stretches back to 1937, when JH Waring and PM Sebestyen launched Radiospares from a garage in London.

The pair sold spare parts for radios – which were readily repairable – later expanding to offer parts for televisions.

In the 1950s, the world was becoming increasingly electrified. Radiospares saw the opportunity and expanded to offer a broader range of electronic components.

In 1967, the business listed on the London Stock Exchange as Electrocomponents, a name that persisted until 2022.

In the 1970s, the core trading business was renamed from Radiospares to RS Components. RS remains the group's core branding, leading to the the 2022 name change.

Since the 1990s, RS has grown steadily through a mix of organic growth and acquisitions.

Today, the business generates annual sales of £3bn and and operates in more than 30 countries.

About 60% of sales come from the EMEA region, with, c.30% from The Americas and the remainder from Asia Pacific.

Recent trading & outlook

As I've mentioned already, trading over the last 18 months has been challenging. Many of the group's customers built up their parts inventories to meet elevated order books during the 2022 supply chain crisis.

As demand weakened in 2023, many RS customers were left with too many parts in stock and shrinking order books. To bring the situation back into balance, they cut their orders to RS.

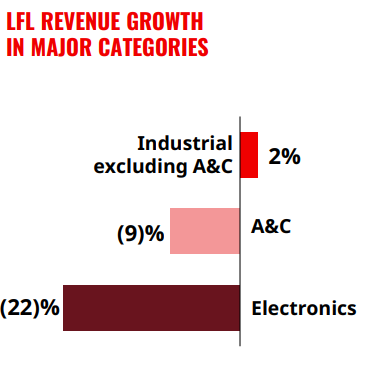

The electronics industry suffered a particularly big slump in demand, leading to a 22% drop in like-for-like revenue from RS customers in this sector:

In turn, this left RS facing a combination of elevated inventories and weaker orders.

2023/24 results (y/e 31 March 24): Full-year revenue fell by 1% to £2,942m.

The acquisition of Distrelec (June '23) and Risoul (Jan '23) provided contributions that helped to offset an 8% drop in like-for-like sales.

Pre-tax profit for 23/24 dropped by 33% to £249m, with earnings down 36% to 38.8p per share.

The dividend was lifted 5% to 22p, remaining comfortably covered by earnings.

I reviewed these results in more detail back in May – see here.

AGM update 11 July 2024: revenue for the three months to 30 June 2024 was 3% lower on a like-for-like basis.

However, contributions from acquisitions provided a further contribution, lifting total sales by 3%.

The company said that trading conditions have continued to normalise as expected:

"As trading conditions stabilise and comparatives get easier, the pace of decline in like-for-like revenue across all three regions continues to slow as anticipated."

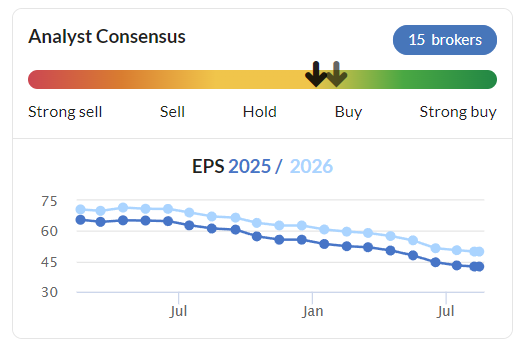

Outlook: Broker forecasts appear to have remained unchanged following the recent AGM update.

Consensus estimates suggest adjusted earnings of 42.4p per share in 2024/25. This would be a 3% decline from 2023/24's adjusted figure of 43.8p per share.

Based on these forecasts, RS shares trade on a forecast price-to-earnings ratio (P/E) of 18 at the time of writing, with a potential dividend yield of 2.9%.

One possible note of caution is that although forecasts appear to be stabilising, they have been cut extensively over the last year. This useful broker consensus chart from Stockopedia highlights the decline in expectations since February 2023:

While I'm optimistic that the downtrend is levelling out, it's probably too soon to really be sure.

I might be tempted to wait (at least) for November's half-year results before taking a positive stance on a return to earnings growth.

Let's move on and take a broader look at the financial qualities of this business through the lens of my dividend screening system.

RS Group: crunching the numbers

Description: RS Group is a distribution specialist that provides industrial customers with access to a huge range of parts and products. The company carries more than 750,000 items in stock globally.

| RS Group (LON:RS1) |

Quality Dividend score: 73/100 | Forecast yield: 2.9% |

| Share price: 760p | Market cap: £3.6bn | All data at 09 August 2024 |

Latest accounts: final results y/e 31 March 2024 and AGM Update (11 Jul '24)

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think RS Group could be a suitable addition to my quality dividend portfolio.

As a reminder, this is a scoring system I've developed to rank shares for the qualities that are important to me, from a quality dividend perspective.

My choice of scoring factors is of course highly subjective. These scores are not intended to be used as a guide on when to buy or sell shares. They're simply one factor I use to assess a stock's potential attractions, in addition to broader, company-specific analysis.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: very good

I score stocks for dividend culture by counting the number of consecutive years they've made a payout, including any cuts.

RS Group's record looks good by any standard, I think.

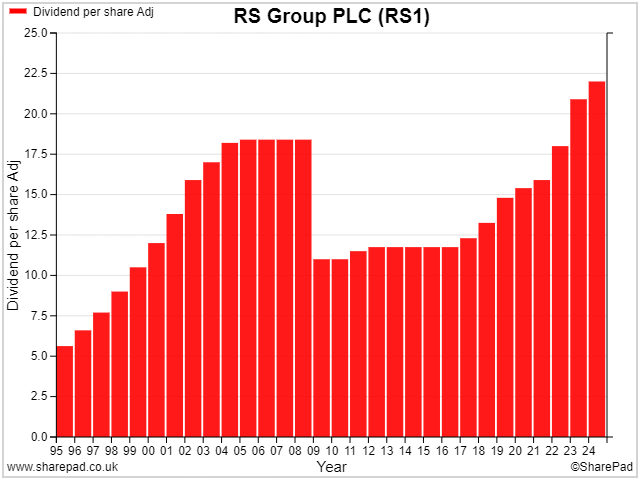

The company has been listed on the London stock market since 1986. SharePad only shows payouts back to 1995, but in Stockopedia I can see a record of payouts stretching back to 1989.

In the 35 years since then, the dividend has never been passed and has only been cut once, in 2009. However, subsequent growth was almost non-existent until 2015, when former CEO Lindsley Ruth took over – a theme I'll return to:

Despite this, I don't have any concerns about RS Group's commitment to the shareholder payout. This business appears to have consistently prioritised dividends over the last 30 years.

RS Group scores 5/5 for dividend culture in my screening system.

Dividend safety: comfortable

For dividend safety in non-financial stocks I score companies based on their historic payout ratios, free cash flow dividend cover and leverage.

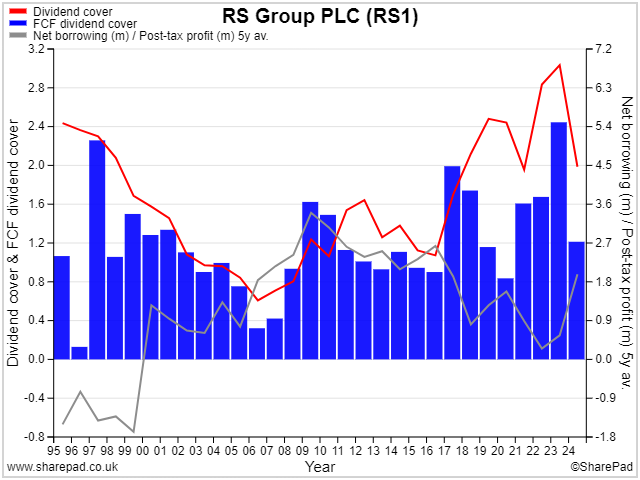

The chart below is slightly complicated but provides a fairly positive picture, in my view.

- RS Group's dividend has been consistently covered by earnings (red line), except briefly during the 2008 financial crisis.

- The dividend has also been covered by free cash flow (blue bars) on a rolling average basis, although year-on-year results have been somewhat lumpy. I suspect this reflects stocking/destocking cycles in the business, acquisitions and wider economic trends.

- Leverage (grey line) has never been excessive, by my measurement, and looks comfortable at the moment.

This dividend isn't the safest I have ever scored, but looks pretty reliable and well supported to me. I don't have any serious concerns on this score.

RS Group scores 3.6/5 for dividend safety in my screening system.

Dividend growth: well supported

Much as I like to receive rising dividends, I get uncomfortable if I feel they are not well supported by underlying growth in the business.

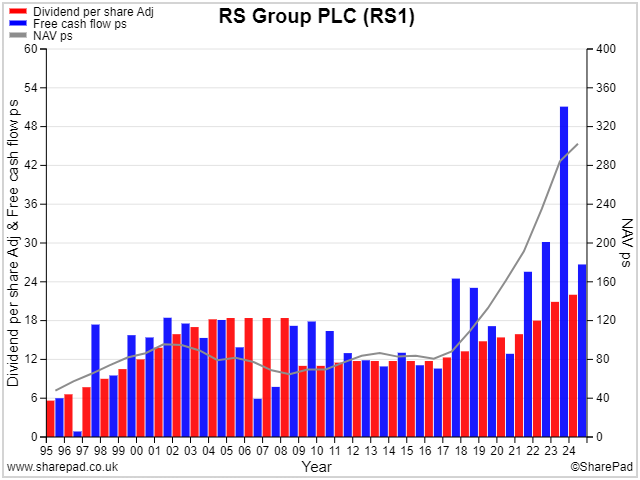

The two main criteria I use to gauge the fundamental support for dividend growth are free cash flow per share and net asset value per share. This reflects my belief that good quality business growth will normally be reflected by increasing book value and increased cash generation.

Without an increase in book value, profit growth requires a continual increase in returns on capital. Likewise, if a business is growing profits but not producing any extra surplus cash, then I would have doubts about the quality of the underlying growth.

RS Group scores well on these quality measures. However, a long-term view of the company's history again highlights a long period (2005-17) without meaningful growth:

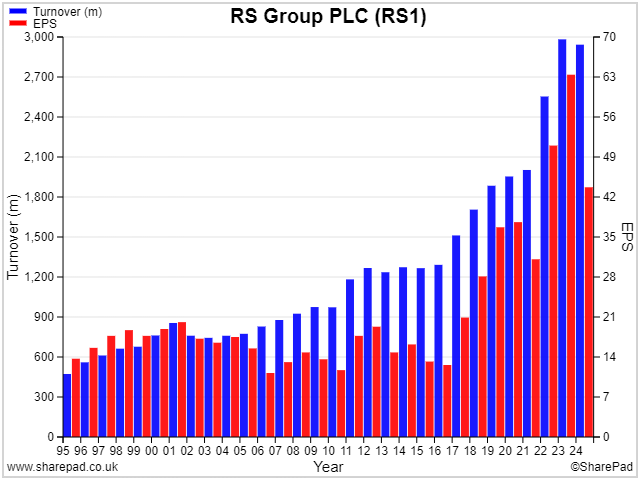

Looking more closely at the underlying performance of the business over the last 30 years, we can see that revenue generally continued to rise each year, but earnings did not:

I'd want to understand a little more about the pressures on margins from 2012-2016 before buying the shares.

In summary, dividend growth has been inconsistent over the years. But when RS has increased its dividend, it has done so without sacrificing the quality of the payout, in my view.

RS Group scores 3.7/5 for dividend growth in my screening system.

Dividend yield: average

As I write, RS shares offer a forecast dividend yield of 2.9% for the 2024/25 financial year.

This is at the lower end of what I'd consider for my quality dividend portfolio, but I'd consider it if I was confident of the quality and growth potential on offer.

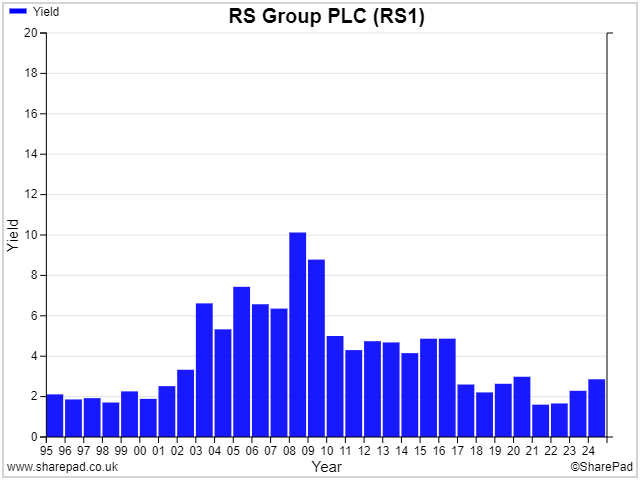

In this case I'm also interested to see if the yield can tell me anything about the valuation of this business.

The chart of RS's historic dividend yield below suggests to me that the current valuation may not be all that compelling, unless the company can return to strong growth fairly quickly:

In terms of yield, this business looked most attractive prior to the 2008 financial crisis and then between 2010 and 2016. Despite a 40% dividend cut in 2009, RS shares continued to offer an appealing 4%-5% yield during the subsequent period.

The chart below provides some interesting context to this. RS's profits appear to have been relatively flat between 2002 and 2016.

Profit growth then accelerated from 2017, presumably as then-CEO Lindsley Ruth's strategy began to deliver results following his appointment in 2015.

Shareholders then enjoyed a corresponding share price re-rating, hence the lower dividend yield since that time:

The question now, for me, is whether the company is about to resume its previous growth trajectory, or whether a period of flatter performance is likely.

In the former case, the current yield could be attractive for me. In the latter, I might prefer to hold out for a lower valuation.

RS Group scores 2/5 for dividend yield in my screening system.

Valuation: middling

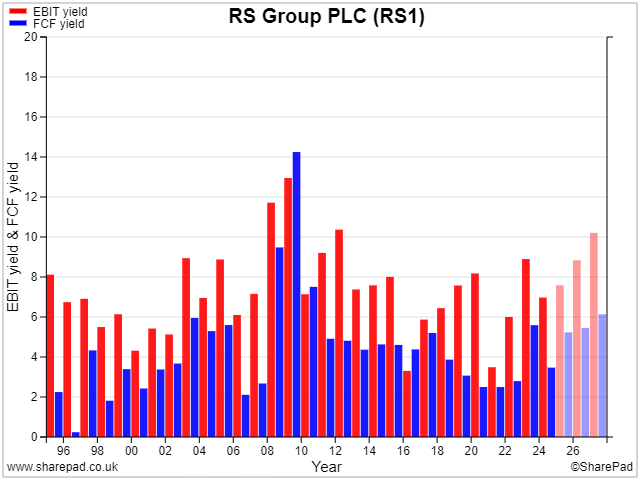

I think dividend yield can be a useful part of a valuation toolkit, but it's not the main metric I use. My scoring system relies on EBIT/EV yield and free cash flow yield to gauge the current valuation of a stock.

Looking at these measures on a long-term chart provides useful historical context, in my opinion. How has the company been valued in the past, and how does this compare to today's valuation?

In this case, I would suggest that the business is potentially quite reasonably valued, with a trailing EBIT yield of c.7%.

Although trailing free cash flow is depressed, this reflects the major customer destocking cycle the company was going through last year, which resulted in elevated inventories. Half-year results, which I looked at here, suggest this situation is now unwinding and returning to normal.

Looking ahead (shaded lines), broker forecasts suggest both EBIT and free cash flow will be on an improving trend. These forward valuations look reasonably appealing to me, although of course there is no guarantee they can be delivered.

I think RS Group is potentially reasonably valued at current levels, with the caveat (again) that if the business is facing a period of stagnation, a further de-rating might be justified.

RS Group scores 3/5 for valuation in my screening system.

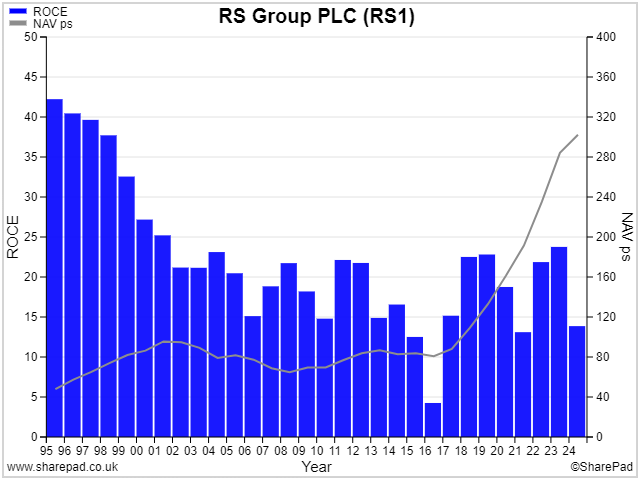

Profitability: strong

Distributors often have quite low margins, but large-scale operators can achieve high returns on capital due to favourable working capital arrangements.

Quite often, supplier credit terms allow such companies to sell stock and collect payment from customers before having to pay suppliers.

RS says it holds more than 750,000 products in stock in order to be able to fulfil customer orders quickly and reliably. My previous analysis has suggested that at least some of this stock sits in RS warehouses for more than 90 days before being sold.

Even so, my number crunching led me to believe that the company took an average of 135 days to pay its suppliers last year. This highlights the attractive economics of this type of business; when it's well run, your suppliers effectively provide free credit that can be used to stock your warehouses.

These characteristics are reflected in RS Group's historic profitability, especially when measured using my preferred metric of return on capital employed:

The rapid growth in net asset value per share from 2017 onwards reflects higher stock levels and receivables, plus additional goodwill as RS made acquisitions.

That fact that RS was able to maintain ROCE within a stable range during that period suggests to me that the acquisitions were – on the whole – successful and reasonably priced.

When external market conditions recover, I don't see any reason why RS cannot achieve 15%-20% returns on capital, as it has done previously.

Assuming a cost of capital of 8%-10%, ROCE of >15% implies the business is generating significant excess capital that can be reinvested or returned to shareholders.

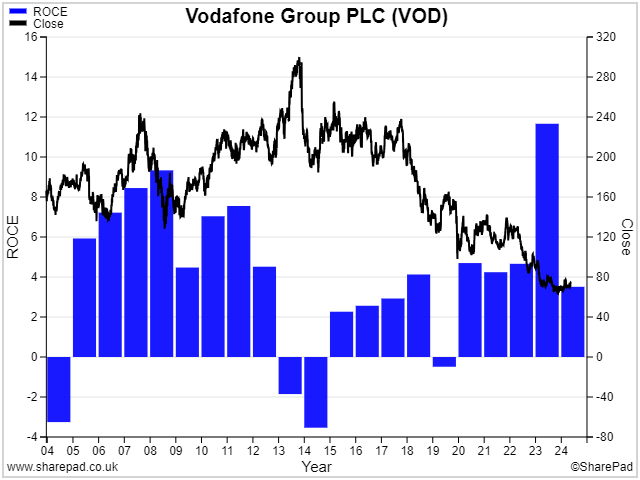

This is why ROCE is so important to me – it's the engine of value creation for shareholders. For an example of what happens when ROCE is too low, we need only consider the progress of Vodafone shares over the last 20 years.

Turning back to RS Group, I believe this business enjoys above-average profitability. If this can be paired with a return to growth, then I think shareholders could benefit.

RS Group scores 4.2/5 for profitability in my screening system.

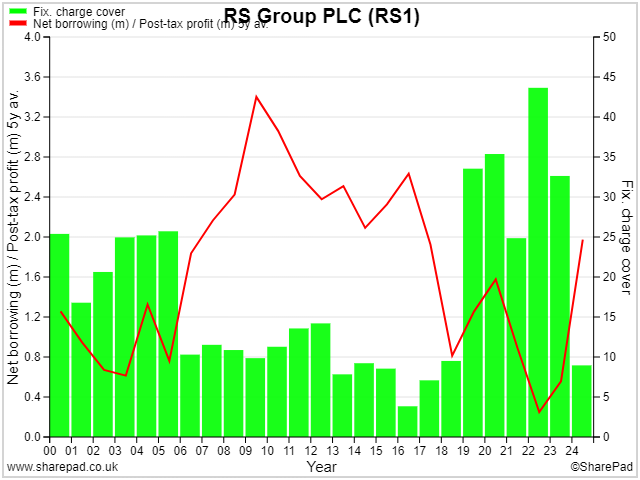

Fundamental health: robust

My fundamental health score is intended to give a rough indication of whether a company's debt and other financial obligations could potentially put its dividend at risk.

To score this I use two metrics:

- Fixed charge cover (operating profit plus rent/lease costs divided by net interest plus rent/lease costs)

- Leverage - the measure I use is net debt divided by five-year average post-tax profit.

I don't have any serious concerns about RS's balance sheet. Fixed charge cover is ample and leverage is well below my preferred limit of 5x.

As a side note, RS's generous use of supplier credit means that I would see elevated debt levels as a serious risk.

In a downturn, this combination could leave the company struggling to fund the cash outflows needed to unwind inventory while also servicing its borrowings.

Fortunately, that doesn't seem to be a concern here.

RS Group scores 4/5 for fundamental health in my screening system.

Conclusion: I am interested

My quality dividend system awards RS Group an overall score of 73/100 at the time of writing (August 2024).

By my reckoning, CEO Simon Pryce has spent around £1.1m buying RS shares since taking charge in March 2023. As far as I can see, he's bought at prices ranging from 907p down to 647p.

Some of these purchases may simply be to meet his contractual obligation to "start to build up" a personal shareholding of 400% of his £750k base salary. But I would like to think he has some personal conviction buying at these levels.

I also think RS shares could be a reasonable purchase below 800p, although I still have some concerns.

Here's a summary of the main points, as I see them.

Pros:

- RS has good scale in a fragmented market and has the potential to continue expanding through consolidation;

- The economics of the business appear attractive – the company is able to generate high returns on capital, fairly consistently;

- Cash generation has generally supported the dividend and RS appears to have a strong commitment to shareholder returns;

- If the business returns to growth as forecast, the shares could be quite reasonably valued.

Cons:

- RS shares currently trade on 18 times forecast earnings. Any further downgrades to expectations could see the stock de-rate to a more compelling valuation;

- In the last 30 years, the company has struggled to deliver consistent earnings growth, only achieving this during the tenure of former CEO Lindsley Ruth;

- The business is unavoidably exposed to the economic cycle. Recessions in any major markets, especially the US, could further delay a return to growth.

My view: I still have some concerns about the timing of a recovery in this business, especially as it appears to be largely dependent on external conditions.

I'm mindful of Jim Slater's warning about investing in turnarounds in his classic book The Zulu Principle:

"It is absolutely essential that the forecast for the year ahead shows rising profits or a return to profits"

That criteria isn't yet satisfied here. Consensus forecasts suggest adjusted earnings for the year to 31 March 2025 will be slightly lower than in FY24.

Despite this niggle, on balance my view of RS Group is positive. I believe the shares could be attractively valued at under 800p, on a medium-term view.

RS stays on my watch list, for now.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.