Is Macfarlane a good dividend share?

I run small-cap packaging specialist Macfarlane Group (LON:MACF) through my dividend screen to see if it makes the grade as a potential portfolio stock.

Glasgow-based packaging specialist Macfarlane Group (LON:MACF) is expected to report record revenue and profits this year, but its shares are back at levels first seen in 2018.

Has the small-cap market slump created an opportunity for me to invest in this interesting business at a reasonable price?

I've reviewed trading updates from Macfarlane twice this year in my dividend notes (in May and August) – and have been left with a positive impression of the business.

I've started to wonder whether this stealth multibagger – the shares have doubled in 10 years – could be a potential candidate for my quality dividend portfolio.

To learn more, I decided to run Macfarlane through my dividend scoring system and take a closer look at its business. Here's what I found.

Table of contents

- History - 50 years on the LSE

- Crunching the numbers - how does Macfarlane score in my screening system?

- Dividend culture - pretty good

- Dividend safety - excellent

- Dividend growth - well supported

- Dividend yield - average

- Valuation - potentially cheap

- Profitability - consistent

- Fundamental health - good

- Conclusion - could Macfarlane win a place in my portfolio?

Macfarlane: 50 years on the LSE

Macfarlane was founded by Norman Macfarlane in 1949 as a Glasgow stationery supplier. The company was listed on the LSE Main Market in 1973. I haven't checked, but I would guess that makes it one of the older small-cap shares on the market today.

This video, narrated by Lord Macfarlane of Bearsden – as he became – provides an interesting introduction to the company's history:

The group is now a specialist in protective packaging, with annual sales approaching £300m and operations at 37 sites across the UK, Ireland, Netherlands and Germany.

Althlough there doesn't seem to be any significant Macfarlane family involvement anymore, chief executive Peter Atkinson has run the business since 2003 and has a shareholding worth nearly £1.5m, according to SharePad. This suggests to me that he may have something of an owner's eye.

Macfarlane is both a distributor and a manufacturer, and reports its results under two operating segments:

- Packaging distribution (FY22: 90% of sales / 80% of profit): management describe this business as the "UK market leader" in the sourcing and supply of protecting packaging. FY22 operating margin: 6.5%

- Manufacturing operations (FY22: 10% of sales / 20% of profit): this side of the business specialises in the design and manufacture of bespoke protective packaging, typically for high-value industrial items. It's smaller, but much higher margin. FY22 operating margin: 14.3%

Macfarlane's customers are mainly in the ecommerce, logistics, electronics, aerospace, and automotive sectors.

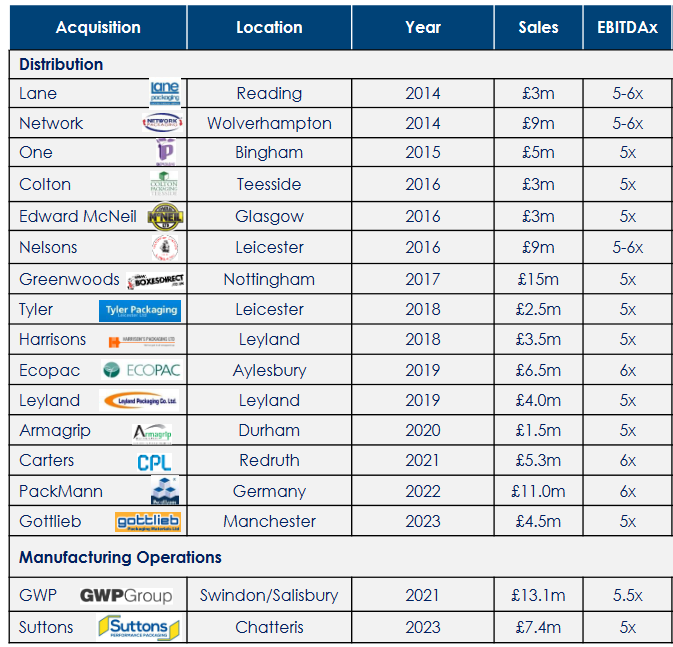

The group's business model is to expand through a mix of organic growth and regular, small acquisitions – there have been 18 since 2014:

In general, these deals either improve Macfarlane's geographic coverage or expand its product range, allowing to target new customers. For example:

- May 2023: acquisition of Manchester-based Gottlieb Packaging Materials for a maximum of £3.55m (5x EBITDA). This deal was said to improve Macfarlane's ability to serve customers in north-west of England.

- October 2023: acquisition of specialist protective packaging firm B&D 2010 Group for a maximum of £3.85m (7.7x EBITDA). B&D supplies customers in the aerospace, defence and space sectors "throughout the UK and internationally".

In my experience, small bolt-on deals that fit within a company's core business can be a good way to supplement organic growth without the risks attached to larger acquisitions.

Current trading: Macfarlane's financial year follows the calendar year, so the most recent results cover the six months to 30 June 2023.

Sales rose by 2% to £141,612 during this period, while pre-tax profit climbed 13% to £10.0m.

In packaging distribution, organic sales fell by 5% due to weakness in the UK and Ireland. However, this was offset by progress in Europe and contributions from recent acquisitions. Overall, distribution revenue was flat at £124m during the period, with operating profit up 6% at £8.0m.

The manufacturing division turned in a stronger performance. This was credited to a strong contribution from the acquisition of Suttons in February 2023 and the benefit of price rises to offset higher costs.

Manufacturing revenue rose by 12.6% to £17.7m, while operating profit was 34% higher, at £2.8m. The operating margin for this division was a healthy 16.0% (H1 2022: 13.4%).

Outlook: full-year guidance was left unchanged, despite a uncertain outlook:

"Whilst we expect the second half of 2023 to remain challenging, our good progress in Europe, diverse customer base, strong new business momentum and effective management of pricing and costs mean that our profit expectations for the full year remain unchanged."

Broker forecasts suggest earnings of 11.9p per share for 2023, with a 3.6p dividend. That prices the stock on a modest nine times forecast earnings, with a 3.3% yield.

Macfarlane Group: crunching the numbers

Description: a specialist distributor and manufacturer of protective packaging, serving customers in consumer, logistics, medical, and industrial markets.

| Macfarlane Group (LON:MACF) |

Quality Dividend score: 72/100 | Forecast yield: 3.3% |

| Share price: 109p | Market cap: £175m | All data at 16 November 2023 |

Latest accounts: half-year results for the six months to 30 June 2023

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Macfarlane could be a suitable addition to my quality dividend portfolio.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: pretty good

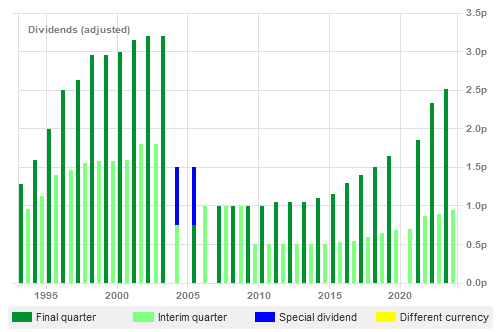

Since chief executive Peter Atkinson took charge in 2003, I don't think Macfarlane has cut its dividend payout, except during the pandemic.

My screening system scores shares based on the number of years of continuous payouts, which I would put at 19. This isn't quite up their with true dividend royalty, but I think it's a pretty good record for a growing small cap.

I am not entirely sure what happened prior to 2003 – I have to confess that my research has not (yet) extended this far back.

Macfarlane scores 3/5 for dividend culture in my screening system.

Dividend safety: excellent

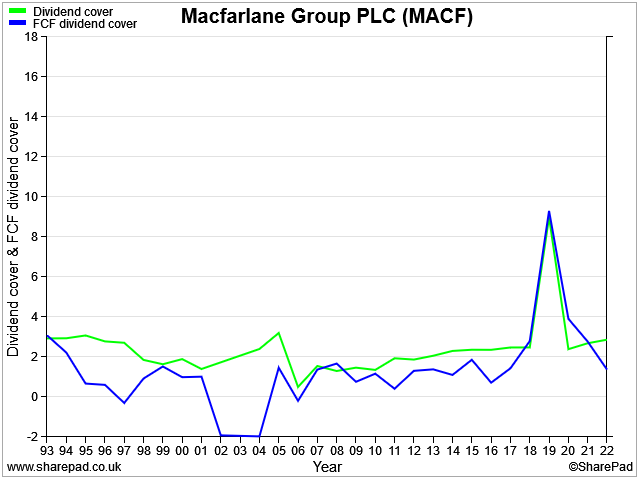

I score stocks for dividend safety based on dividend cover by both earnings and free cash flow. I also include a weighting for leverage, which I will look at separately later.

The chart below shows that for the period from 2003 onwards, dividend cover by both earnings and free cash flow has generally been between 1.5x and 3.0x, which looks reasonable to me.

In addition, the closeness of the blue and green lines tells me that Macfarlane's cash conversion from earnings has been consistently good.

Overall, I feel that Macfarlane's dividend payout looks quite safe.

Macfarlane scores 4/5 for dividend safety in my screening system.

Dividend growth: well supported

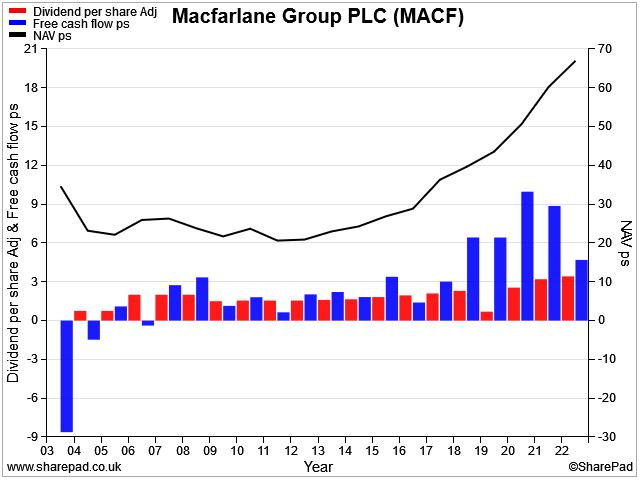

When I look at dividend growth, what I really want to see is that the increases in the payout have been sustainable. For me, this means they should have been supported by growth in free cash flow and net asset value per share.

We can see that this is true here. Since CEO Peter Atkinson took charge in 2003, Macfarlane's aggregate free cash flow has covered the dividend. NAV growth took a little longer to get started, but has been strong since 2011.

I focus on net asset value because I see this as a key driver of long-term returns.

If NAV isn't growing, then profit and dividend growth can only be driven by increased profitability or increased leverage (which boosts return on equity). In my view, neither of these are generally sustainable for more than a limited period.

I'm looking for businesses that can deploy new capital at attractive rates of return, without relying on excessive leverage. Over time, this growth should compound to increase the equity value of the business. In turn, the share price and dividends should also rise steadily (and sustainably), assuming I haven't overpaid for my shares.

We'll look at profitability shortly. But in terms of dividend growth, Macfarlane's dividend appears to have increased at a sustainable rate, reducing the chance that a cut will be needed.

Macfarlane scores 4/5 for dividend growth in my screening system.

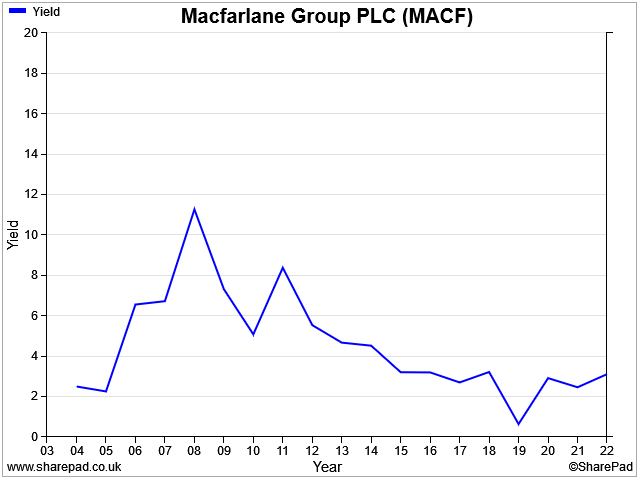

Dividend yield: average

Macfarlane's current forecast yield of 3.3% is decidedly average and at the lower end of what I'd consider for my dividend portfolio.

But it wasn't always that way. Anyone who was willing to buy during the aftermath of the 2008 crash was able to lock in very high dividend yields.

Macfarlane's current dividend is expected to be covered three times by earnings this year. So the company could perhaps afford a slightly larger payout.

However, management appear to be prudently reserving cash to support the continued growth of the business during a more uncertain period for the UK economy. This seems sensible to me.

Macfarlane scores 2/5 for dividend yield in my screening system.

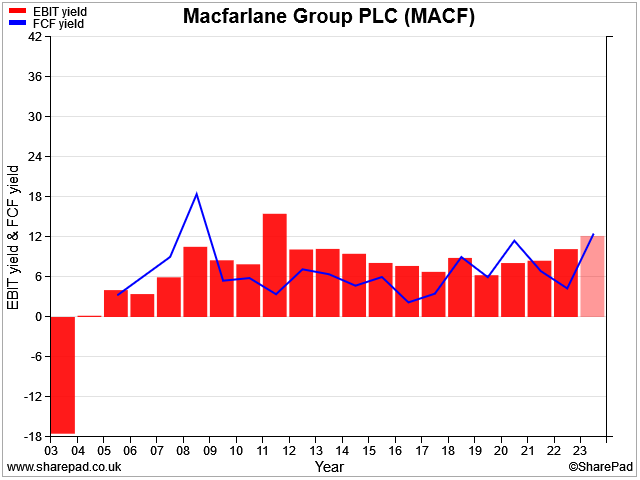

Valuation: potentially cheap

Macfarlane's dividend yield is low by historic standards, which can sometimes be a sign that a business is not especially cheap.

However, I don't think that's true here. The group's relatively conservative dividend payout ratio means that the yield could be low, even if the business is trading on an attractive valuation.

Indeed, that seems to be the case here:

Macfarlane shares look fairly decent value to me in terms of both EBIT/EV yield and free cash flow yield. Indeed, if the company matches consensus forecasts this year (the pale bar on the right), then I think the shares could be outright cheap at current levels.

It's also interesting to see that the company's valuation is at the lower end of the range seen over the last decade or so. This suggests to me that the shares could re-rate to a (modestly) higher valuation if market sentiment improves and Macfarlane's earnings remain stable.

On balance, the shares look attractively priced to me at the moment.

Macfarlane scores 4.5/5 for valuation in my screening system.

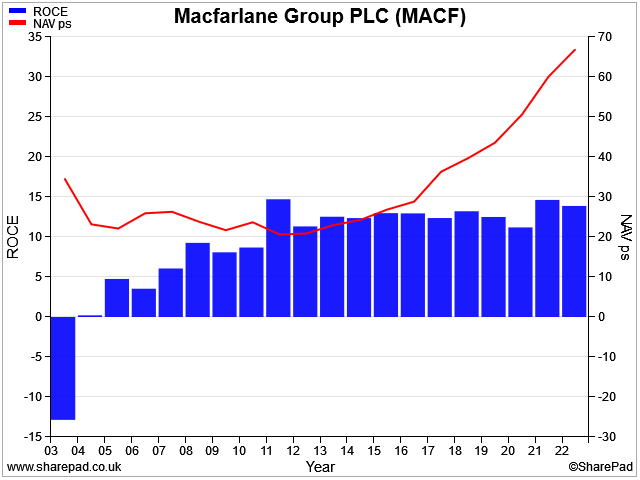

Profitability: consistent

In the Dividend Growth section above, I mentioned how important net asset value growth is for me. Here's the other half of that story – Macfarlane's profitability.

This is a great example of what I look for – stable return on capital employed and rising net asset value per share.

This tells me is that the company has been able to deploy new capital (rising NAVps) while maintaining a stable and attractive level of profitability (ROCE).

It's probably fair to say that Macfarlane isn't quite profitable enough for me to view it as a true high quality business. For that, I'd probably look for ROCE consistently above 15%.

However, Macfarlane's consistency and double-digit ROCE is still quite attractive, in my view.

Macfarlane scores 4/5 for profitability in my screening system.

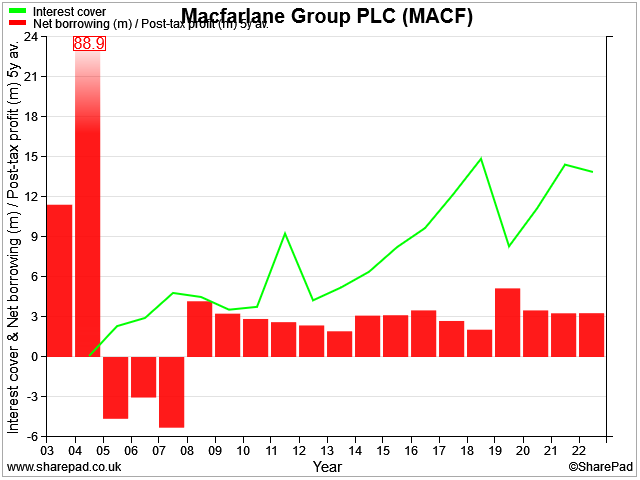

Fundamental health: good

This section of my screen is really all about making sure that a company's leverage is not too high and that it can service its debts comfortably. I don't take a completely standard approach to this, so let me explain what I do.

Leverage: company reporting generally compares net debt to EBITDA for the trailing 12 months. On this metric, I prefer to see a leverage multiple below 2x, or at most 2.5x.

However, I'm not a fan of EBITDA, which includes many real cash costs.

As far as it's of any use at all, I think EBITDA is only really relevant as a debt service metric; for a lender, EBITDA can be a useful guide to a company's ability to pay interest on its loans.

As an equity investor, this isn't conservative enough for me. I want to try and get an idea of a company's ability to repay its debt, should it become necessary. For this reason, I use net profit rather than EBITDA in my leverage ratio.

In addition, I'm also aware that most debt is long term. Profits (whether EBITDA or otherwise) can fluctuate from year to year. This alters a company's leverage multiple, even if net debt is unchanged.

For these reasons, I measure (non-financial) companies' leverage by comparing last-reported net debt with five-year average net profits. As a rule of thumb, I prefer this ratio to be under four.

(When I last reviewed my dividend portfolio's performance at the end of September, the average leverage multiple across the portfolio was just 0.3x.)

Debt service capacity: historically I have used fixed charge cover to measure a company's ability to meet its interest and rent payments.

However, I don't find this metric as useful as it once was, at least for screening purposes, due to the impact of IFRS 16 lease accounting. This became compulsory in 2019 and has altered the way in which companies report rental and lease payments.

As an alternative, I'm experimenting with using interest cover, which simply compares operating profit with net interest paid. The downside of this is that it doesn't include lease payments. But it is more consistently reported and available in screening results.

Finally: after that somewhat lengthy preamble, here's a chart showing my view of Macfarlane's fundamental health:

We can see that Macfarlane's leverage has mostly been between two and three times average net profit since 2008. This looks acceptable to me given the group's steady growth, especially as the figure for more recent years also includes a sizeable chunk of lease liabilities (which were not shown on the balance sheet prior to IFRS 16).

Excluding lease liabilities, my sums suggest Macfarlane's net debt is less than 0.5x five-year average profits.

Macfarlane scores 3.7/5 for fundamental health in my screening system.

Conclusion: a good business at a reasonable price

My quality dividend system awards Macfarlane an overall score of 72/100 at the time of writing (November 2023).

My view: Overall, I don't see very much to worry me with Macfarlane. My impression is that it's a well-run business with long-term management and a sensible strategy for growth.

Here's a summary of the main points, as I see them.

Pros:

- Clearly-defined strategy and market segment

- Fairly attractive levels of profitability

- Bolt-on acquisition model appears to have delivered steady growth

- Good cash generation and solid balance sheet

- Long-term management, committed to a progressive dividend

Cons:

- Cyclical exposure - the company has already seen volumes weaken in some markets. In a proper recession, things could get worse

- The chief executive has been in charge for 20 years – he could be a tough act to follow

- Risk that future acquisitions will be less successful, perhaps due to the loss of key personnel, mispricing, or failure to integrate successfully

I would want to do some additional research if I was considering buying Macfarlane for my dividend portfolio. But my initial inspection suggests to me that the business may have many of the qualities I look for in a dividend share.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.