Portfolio shares: Is Air Partner a takeover bargain at 125p?

Aviation services group Air Partner is set to exit the London market after a takeover bid. Roland Head looks at this portfolio share and explains why he's sad to see it go.

This week I was going to write about small-cap Air Partner (LON: AIR). This air charter specialist is a member of my quality dividend model portfolio and my personal portfolio, which holds broadly the same stocks.

I'd already started writing before the stock surged 50% higher on Thursday, when a 125p takeover offer was announced by US firm Wheels Up Experience. This deal values Air Partner at £84.8m and has been recommended by the group's board.

In my view, the takeover is likely to go ahead. Wheels Up appears to be seriously cashed-up and looking to expand after a SPAC flotation last year. (This Seeking Alpha piece by Vince Martin has an interesting review of Wheels Up's prospects. On balance, I think I'd prefer to own Air Partner...)

Major shareholders controlling 27.5% of Air Partner stock have indicated that they intend to accept the offer, through a mix of irrevocable commitments and non-binding letters of intent. Among the latter is the well-known private investor and ISA millionaire Lord Lee, who has 4.88% stake in Air Partner. To me, these undertakings indicate that unless a higher bid emerges, Air Partner will be sold.

Is 125p a fair price? The offer price is around 50% above the level where Air Partner has been trading recently, so it's a reasonable premium based on the company's recent performance.

However, Air Partner shares have traded at 150p within the list five years, so I'd guess it's possible that some shareholders or rival bidders might see room for improvement on the 125p offer. We have seen a few bidding wars on UK stocks recently, especially as the stronger dollar has improved relative value for US buyers.

My back-of-the-envelope calculations suggest that a price of 125p is probably reasonable, but not expensive.

I estimate that the offer values Air Partner's business at around 11 times average free cash flow since 2016. That's equivalent to a FCF yield of around 9%. The group also generated an average return on capital employed of 24% over that period.

Based on this past performance, I would certainly argue that Air Partner is worth buying at 125p, especially for a trade buyer.

I've no idea how likely it is that a rival bidder will emerge, but on balance I suspect I'm unlikely to write about Air Partner again. I'll be a little sad to see this stock go, but I can't complain at a 50% profit in less than two months for the model portfolio.

I'll now start work on finding a replacement stock, but that's a subject for another day - watch this space.

What I'd like to do today is to revisit the reasons why I chose Air Partner for the portfolio. I think there's still some value in this exercise, because Air Partner is a very different business to DCC and Unilever (the portfolio shares I've covered so far).

What does Air Partner actually do?

Air Partner's origins stretch back to 1961, when it was founded as a school to retrain military pilots for civilian flying. By the 1980s, it had evolved into a charter broking business, matching charter clients with a pool of available aircraft.

This charter specialty has remained at the core of the group's operations. Today, Air Partner can call on around 7,000 planes as needed – although it doesn't own aircraft (an attraction, in my view!). Charter operations are divided into three segments, commercial, private and freight.

Air Partner has also acquired adjacent businesses over the year to expand its operations into areas such as emergency planning (e.g. evacuations), security and training.

I'd normally be wary about a diverse, acquisitive group like this, but in this case, I believe there's a natural fit between the group's businesses. Put another way, I think the combination offers greater value than the constituent parts.

CEO Mark Biffa has been in role since 2010 and has done a good job, in my view. Air Partner's financial performance and strong balance sheet are also attractive, as I'll explain now in a truncated version of my usual screening review.

Air Partner: crunching the numbers

- Air Partner (LON: AIR)

- Share price: 81p (pre bid) / 123p (after 125p offer)

- Market cap: £51.5m (pre bid) / £78.2m (after 125p offer)

- Shares in issue: 63.6m

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain why Air Partner scored highly for me. Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Note: Any calculations I've made which relate to Air Partner's share price/market cap were completed before the offer was made. I've not recalculated them since.

Dividend Culture: beyond question

I measure dividend culture by simply counting the number of consecutive years of dividend payments.

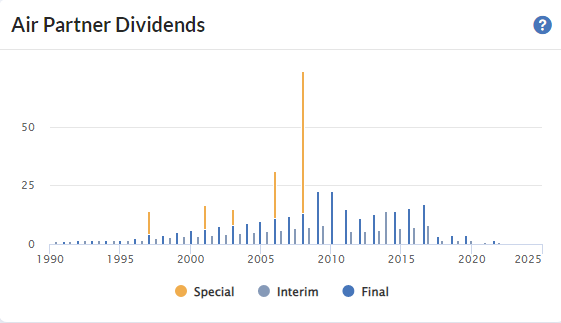

Air Partner floated on the London Stock Exchange in 1989. It's paid a dividend every year since 1990, according to Stockopedia (whose dividend history for AIR seems to go back slightly further than SharePad).

This record hasn't been achieved without a few cuts along the way, but then air travel is a cyclical industry. Perhaps that's to be expected. In any case, I think it's fair to say that this business has had a strong dividend culture. Unsurprisingly, Air Partner scores 5/5 for dividend culture in my screen.

Dividend Safety: robust

My dividend safety score is a blend of historic dividend cover, free cash flow cover and leverage. Despite the impact of the 2020 dividend cut and earnings slump, Air Partner scores well here. In normal times the group's dividend has decent cash flow cover and is comfortably covered by earnings. A debt-free balance sheet also helps to bolster the score.

The end result is that Air Partner scores 5/5 for dividend safety in my screen.

I think this is a fair comment – despite the payout becoming stretched at some points in the past, Air Partner's forecast dividend for the current year should be covered more than three times by earnings.

Dividend Growth: a mixed record

Unsurprisingly, Air Partner scores badly for dividend growth. The two metrics I use – free cash flow growth and dividend growth – have both been weak on a five-year view.

Air Partner scores 2/5 for dividend growth in my screen.

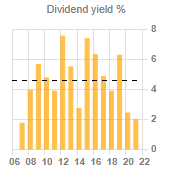

Dividend yield: sustainable

Air Partner has been a high yielder in the past but isn't anymore.

The stock's forecast yield of 3.1% puts it firmly in the mid-range.

Air Partner scores a middling 3/5 for dividend yield in my screen.

Valuation: decent underlying value

I use a blend of free cash flow yield and earnings yield (EBIT/EV) to score stocks for value.

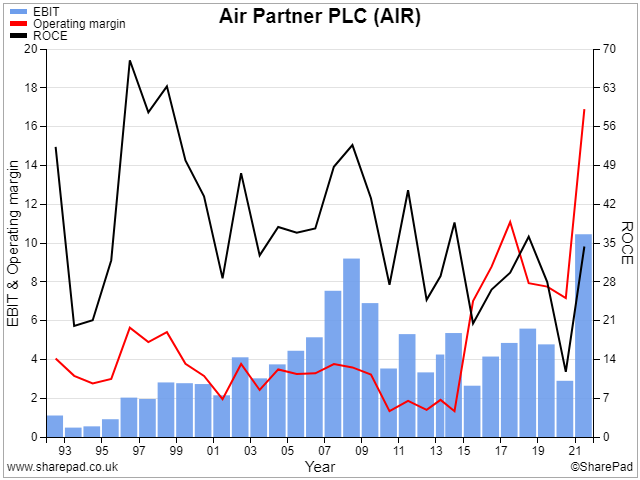

Unlike regular airlines, Air Partner saw demand boom during the pandemic thanks to Covid-related freight and private jet activity. Operating profit doubled from pre-Covid levels to £10.4m in FY21 (y/e 31 Jan), but has since pulled back somewhat.

Even so, my sums indicate a trailing 12-month (TTM) earnings yield of 12%, which looks attractive to me.

The free cash flow situation is weaker, due to a £2.3m outflow of working capital during H1 FY22. This was triggered by an upturn in business which caused a £6.6m increase in receivables. I'd expect the full-year picture to look more favourable, but as things stand, my sums suggest that free cash flow for the 12 months to 31 July was negative.

As a result, the shares don't score as well for value as I might have expected. Air Partner scores 3/5 for valuation in my screen.

Profitability: attractive

I use return on capital employed and return on equity to score stocks for profitability. I believe these metrics best capture the likelihood of value creation for shareholders.

One of the attractions of Air Partner's business is its record of strong profitability. Although operating margins are fairly average, the group's asset-light model means that it generates attraction returns on capital employed:

As a result of this attractive profitability, Air Partner scores 4/5 for profitability in my screen.

Fundamental Health: strong

My final factor score is designed to flag up companies with inappropriate leverage or onerous debt servicing charges. For this I look at fixed charge cover and the ratio of net debt to five-year average profits.

Air Partner has reported a net cash position for some years. However, the cash flow statement shows regular interest payments, reflecting the occasional use of a revolving credit facility.

As a result of this mixed picture, Air Partner scores 4/5 for fundamental health in my screen.

Conclusions: a fond farewell

Air Partner's profits have not always progressed upwards as smoothly as shareholders might have liked (see chart above). But I believe this is fundamentally a good business under strong management.

I'm a little disappointed to be losing Air Partner to a takeover bid, but we are where we are. On many measures, I believe this business looks attractively valued, even at 125p. Congratulations to holders and good luck to Wheels Up.

To make sure you don't miss out on future articles, please hit subscribe to receive all my posts by email and gain access to member-only areas of the site.

I'll be adding a comment facility to this site as soon as I'm able to; I look forward to your feedback over the coming months. In the meantime, you can always reach me on Twitter @rolandhead or by email.

Disclaimer: This is a personal blog. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.