Has Moneysupermarket.com really returned to growth?

FTSE 250 stock Moneysupermarket.com Group (LON:MONY) offers 5%+ dividend yield backed by ample free cash flow. With a recovery seemingly underway, should I consider buying the shares for my dividend portfolio?

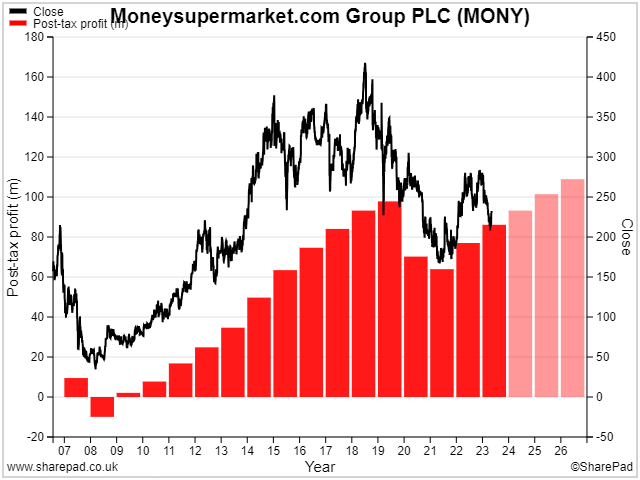

FTSE 250 price comparison group Moneysupermarket.com (LON:MONY) reported record revenue in 2023, as its post-pandemic recovery continued. But profits – and its share price – remain well below all-time highs.

The market seems inclined to value this stock as an ex-growth business. To be fair, that was my general view of this sector too, until recently. But MONY's apparent return to growth has persuaded me to take a closer look.

MONY's profits are still below their historic high watermark. But this remains a very profitable and cash-generative business. Last year's results showed a 22% operating margin, reduced debt levels, and a 34% return on equity.

Against this backdrop, the stock's forecast P/E of 14 and a well-supported 5.4% dividend yield don't look expensive to me.

My sums suggest that a sustainable growth rate of just under 5% might be enough to justify the current valuation, based on my target of a 10% annualised return.

I'm wondering if MONY could be the kind of quality dividend growth stock I'd like to add to my portfolio.

In this in-depth share review, I'll take a closer look at Moneysupermarket.com's performance over the last decade and explain why it's caught my eye as a potential purchase.

I'll also run this business through my dividend scoring system, to see how well it scores on core factors such as dividend culture, profitability and growth.

Table of contents

- 1999-2023 - the story so far

- Recent trading & outlook - insurance switching is boosting profits

- Where is the growth coming from? - some segments are performing better than others

- Crunching the numbers - how does MONY score in my dividend screen?

- Dividend culture - the payout has never been cut

- Dividend safety - improving after a difficult patch

- Dividend growth - are we seeing a return to form?

- Dividend yield - an above-average income generator

- Valuation - are the shares really cheap?

- Profitability - this business generates high returns

- Fundamental health - a reassuring picture

- Conclusion - would I consider buying MONY shares for my portfolio?

1999-2023: the story so far

The MoneySuperMarket website was originally launched by an offline mortgage listing company in 1999, just as dot-com fever peaked. I'm not sure exactly what was on offer at first – mostly static listings of financial products, I think.

Car insurer Admiral clearly also sensed an opportunity and launched Confused.com in 2002 – confusingly, it now claims to be the UK's "first comparison site".

In 2006, competition intensified with the launches of both Go.Compare (now owned by Future plc) and privately-owned market leader, Compare the Market.

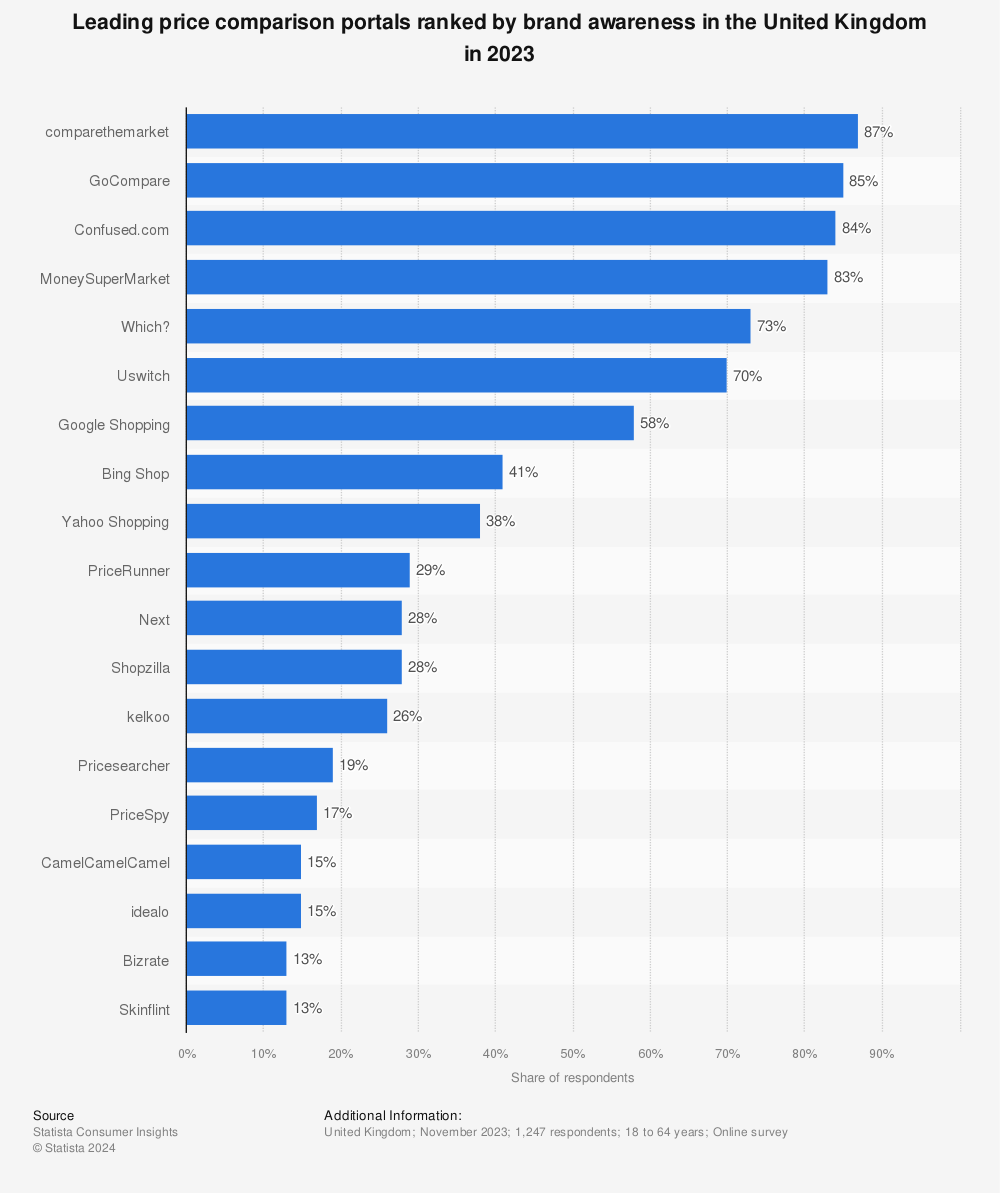

Market share: lagging behind

Unfortunately, being a first mover does not necessarily guarantee market leadership.

According to this 2023 survey, MoneySuperMarket sits in fourth place for brand awareness among UK consumers, albeit by a narrow margin:

I haven't been able to find any conclusive data relating to market share, but this piece in Motor Finance Online references a 2023 GlobalData report that places MoneySuperMarket second in the key car insurance segment, with a 14.8% share.

However, it's a distant second. Compare The Market is said to have a 54.5% share of this lucrative sector of the market. Go.Compare and Confused.com are both close behind MONY.

This does highlight a potential weakness of this business. In terms of user experience, there isn't much to divide the big market leaders. Branding and marketing are all-important, hence the tradition of wacky advertising that's a characteristic of all four of these businesses.

Remember this classic, featuring Snoop Dogg?

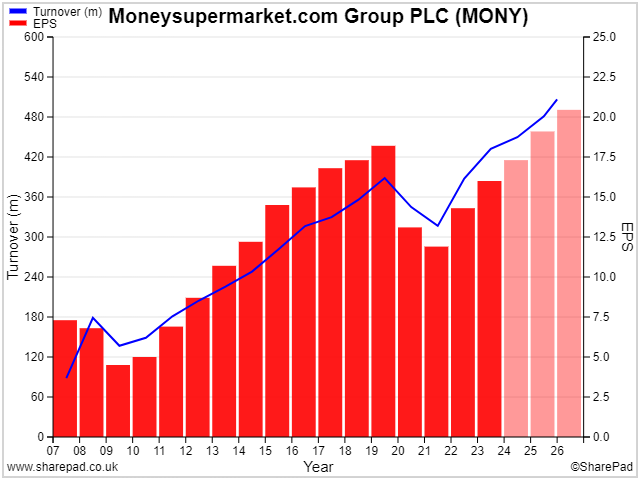

2007 IPO + 12 years of growth

Moneysupermarket.com Group floated on the London market in 2007 at 170p, just ahead of the financial crisis.

The shares crashed in 2008, providing a wonderful opportunity to buy this business for less than 50p per share:

It took until 2013 for the shares to regain the 215p high first seen in 2007. But the price then kept motoring until late 2019, when MONY hit an all-time high of just over 400p.

MONY's profits soared too, rising tenfold from £9.4m in 2007 to almost £95m in 2019.

Pandemic recovery

I suspect that the current ad campaign featuring Dame Judi Dench has helped to deliver a much-needed recovery from the impact of the pandemic.

COVID-19 triggered a series of headwinds for MONY, some of which are only just starting to ease:

- Slump in motor insurance sales during lockdown

- Travel bans

- Tighter bank lending criteria affected credit card and loan sales

- Near-total loss of energy switching activity

- Cost inflation

- Higher interest rates make loans and mortgages more expensive, reducing user conversion

Quidco acquisition

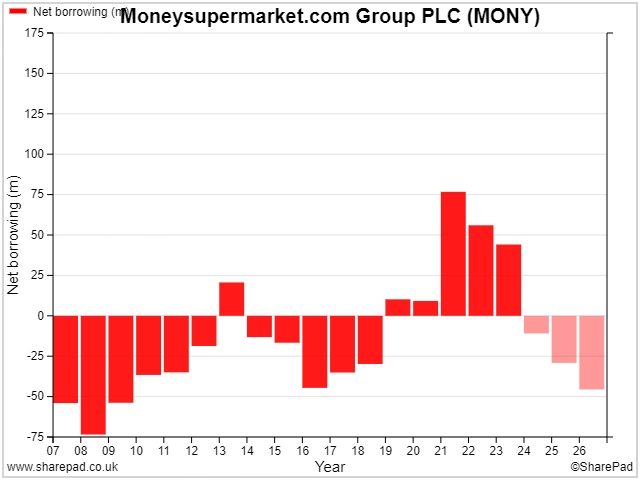

In 2021, profits were down by c.40% from their 2019 high. MONY then made a decisive (or possibly desperate) effort to return to growth by buying leading UK cashback site Quidco for a total consideration of up to £101m.

However, while Quidco added volume and revenue, it diluted the group's overall profitability. This is because cashback is much lower margin than price comparison – with cashback, most of the margin is handed back to the users.

This was highlighted in MONY's 2023 results. Cashback achieved an EBITDA margin of 13%, versus 58%-68% for the core insurance, money and home services segments.

Buying Quidco also caused an unwelcome spike in debt, adding risk to a business whose balance sheet had previously been pristine:

The Quidco acquisition was priced at £87m, plus £14m in deferred consideration, giving a maximum of £101m.

As far as I can see from the accounts, Moneysupermarket.com ended up paying a total of £97m for the cashback site.

Unfortunately, Quidco only generated £7m of EBITDA last year, down from £9.5m in 2022. At this rate, the payback period on Quidco could be more than 10 years, even before making allowance for extra interest, tax and depreciation charges.

For a long-lasting asset like property, such a long payback period might be acceptable.

But the 2023 accounts revealed that MONY has now reduced the amortisation period on acquired "brand and member relationship assets" (principally Quidco) from 10 years to five years. This is said to reflect "a change in the period of economic benefit that is expected to be generated by these assets".

I'm not convinced buying Quidco for £97m was a good idea. But as a seemingly isolated incident, it's not a dealbreaker for me.

Current strategy

Fortunately, CEO Peter Duffy has steered clear of any big deals since 2021.

Instead, he seems to be focusing on improving the company's technology and marketing execution, making better use of its data, and developing new incremental income streams with B2B clients.

The business is also trying to build closer relationships with its core consumer users through initiatives such as the SuperSaveClub rewards scheme.

Trying to 'own' customers who are ultimately only passing through is something of a holy grail for price comparison businesses, but it's not an easy challenge.

Mr Duffy's current strategy seems sensible to me, although I think it's probably also a sign of the how mature the core business has now become.

Recent trading & outlook

Q1 2024 update (16/04/24): group revenue rose by 8% to £114.6m during the first quarter.

Insurance was the standout performer, with revenue up 21% to £61.4m. The company says this was driven by continued high levels of switching in car insurance as drivers faced with big renewal hikes seek out better deals. Presumably this momentum will ease over time as price rises level out.

Travel revenue rose by 10% to £6m in Q1 as the market continues to recover, but revenue from Money and Home Services fell by 3% and 8% respectively. Cashback revenue was flat.

Outlook: full-year guidance was unchanged and confirmed the company expects to achieve adjusted EBITDA in line with consensus of £139.8m. That would represent a 6% increase on 2023.

Consensus estimates suggest earnings of 17.1p per share and a dividend of 12.6p per share in 2024. That's equivalent to a forecast P/E of 13.4 and a 5.4% yield, at the time of writing.

2023 full-year results: MONY reported revenue up 11% to £432m and pre-tax profit up 4% to £72.3m in 2023. Net debt fell to just £19.8m as strong cash generation allowed the company to repay borrowing used to buy Quidco.

The dividend was lifted 3% to 12.1p per share, marking a return to growth after four years of flat payouts.

I covered the 2023 results in more detail in this Dividend Note.

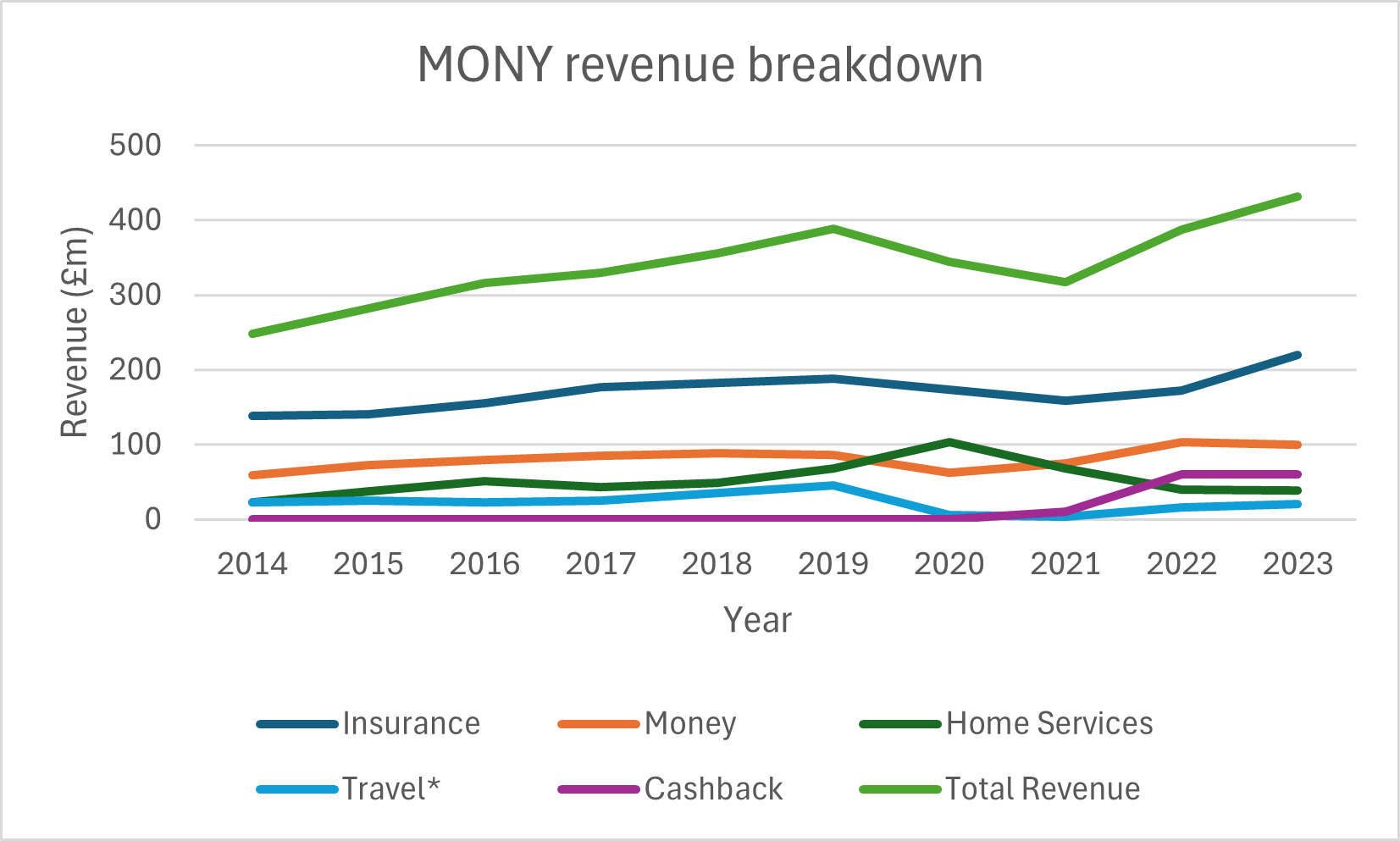

Where is the growth coming from?

Last year's results and this year's Q1 update seem to suggest that MONY is returning to growth.

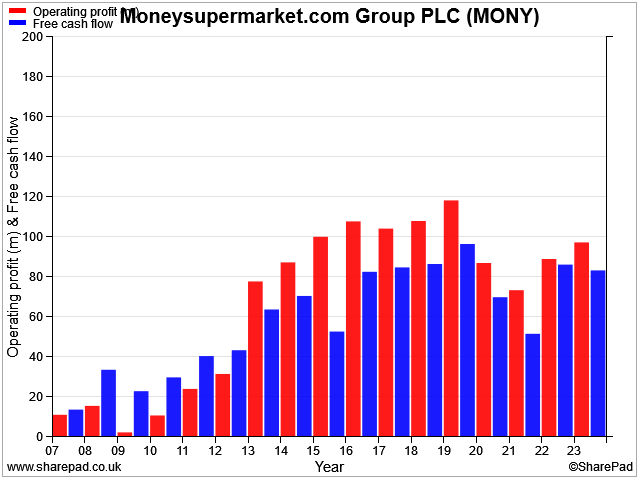

However, this SharePad chart shows that neither operating profit nor free cash flow have yet returned to the peak levels seen in the past:

If we look at the results from the last year at a segmental level, we can see why. Although revenue from the Insurance and Money verticals is now above 2019 levels, Travel and Home Services (which includes energy switching) remain depressed.

The contribution from cashback has helped to lift total revenue to new highs, but the low-margin nature of this business means this hasn't yet offset the loss of higher-margin business elsewhere:

MONY expects energy switching revenue to remain negligible in 2024. My feeling is that this market may have changed for the foreseeable future.

High prices and the failure of many smaller suppliers mean that the market is now effectively in the hands of six large suppliers. I suspect pricing will be less competitive and more rational than it was, so I'm not sure that switching opportunities will be so attractive.

To sum up – I think MONY is exiting a difficult period in good shape. But some historic growth drivers have weakened and profits have not yet reached new highs.

Broker forecasts suggest that revenue could set a new record high in 2024, while earnings will take until 2025.

As things stand now, I don't see any obvious reason to doubt these forecasts.

With that in mind, let's take a look at how my screening system rates MONY's financials. Are the shares cheap and good enough to make them a potential buy for my portfolio?

Moneysupermarket.com: crunching the numbers

Description: Moneysupermarket.com is one of the UK's leading price comparison businesses. MONY also operates a number of B2B services and owns the Money Saving Expert and Travelsupermarket.com businesses.

| Moneysupermarket.com Group (LON:MONY) |

Quality Dividend score: 59/100 | Forecast yield: 5.4% |

| Share price: 228p | Market cap: £1.3bn | All data at 08 May 2024 |

Latest accounts: 2023 full-year results

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think MONY could be a suitable addition to my quality dividend portfolio.

As a reminder, this is a scoring system I've developed to rank shares for the qualities that are important to me, from a quality dividend perspective.

My choice of scoring factors is of course highly subjective. These scores are not intended to be used as a guide on when to buy or sell shares. They're simply one factor I use to assess a stock's potential attractions, in addition to broader, company-specific analysis.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

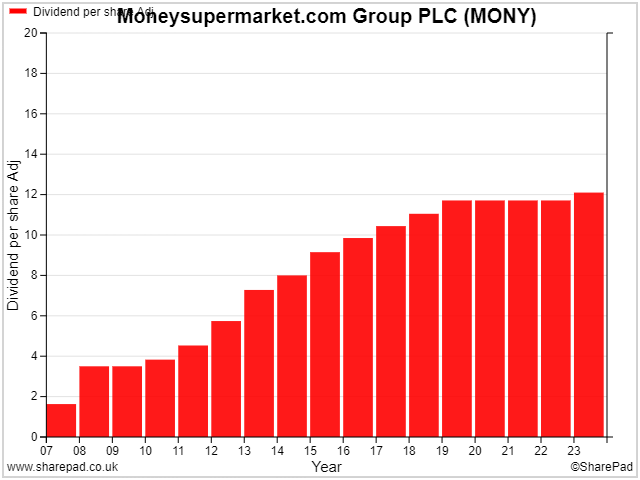

Dividend culture: pretty good

MONY has not cut its dividend since its IPO in 2007 and has increased the payout in the majority of years.

However, growth has been minimal since 2019, highlighting the profit slump and external headwinds suffered during this period:

MONY doesn't have the longevity as a listed business to earn a top score in my screen, but its track record so far is good. I'm comfortable there's a strong culture of dividend payments.

MONY scores 3/5 for dividend culture in my screening system.

Dividend safety: recovering

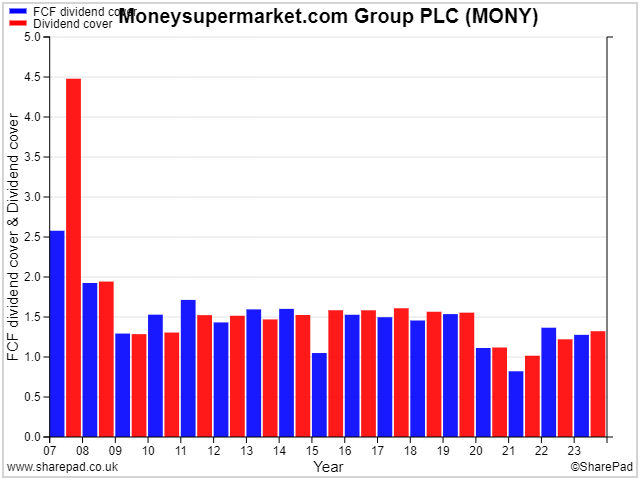

I score stocks for dividend safety based on a combination of earnings and free cash flow cover, plus leverage.

I've excluded leverage from this chart as it's not really a concern for me here. But when we look at the dwindling level of free cash flow cover in recent years it's easy to see why payout growth has stalled since 2019.

Fortunately, free cash and profit performance now appears to be on an improving trend.

Incidentally, the similar height of the blue and red bars show us how wonderfully consistent MONY's cash conversion from earnings has been historically. That's something I always like to see.

I suspect MONY's rather middling dividend safety score will improve over the next 12 months.

MONY scores 2.7/5 for dividend safety in my screening system.

Dividend growth: returning to form?

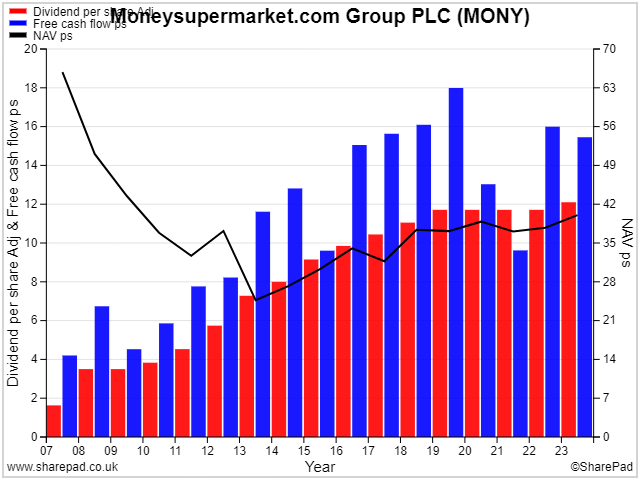

My scoring system for dividend growth is designed to assess the sustainability of any increases to the payout. For this reason I compare the rate of dividend growth with that of free cash flow and net asset value (NAV) growth.

Payouts that aren't backed by rising free cash flow ultimately tend to be unsustainable. Similarly, payout growth that isn't supported by any increase in capital employed tends to rely on improved profit margins. That's also typically a finite opportunity, in my experience.

The chart below shows us how growing free cash flow provided solid support for the dividend until the pandemic struck.

A couple of lean years have been followed by a recent recovery in cash generation. This gives me hope that the dividend can also now return to sustainable growth:

The sharp decline in NAV per share between 2007 and 2013 relates to the financial structure of the group's flotation and was not a reflection of problematic trading. Steady NAVps growth since 2013 is more representative of the growth of this asset-light business, I think.

My screen scores shares based primarily on data from the last five years. This hasn't been a good time for this business, hence the low score. Assuming trading remains stable, I expect a significant improvement to this score over the next 12-18 months.

MONY scores 0.3/5 for dividend growth in my screening system.

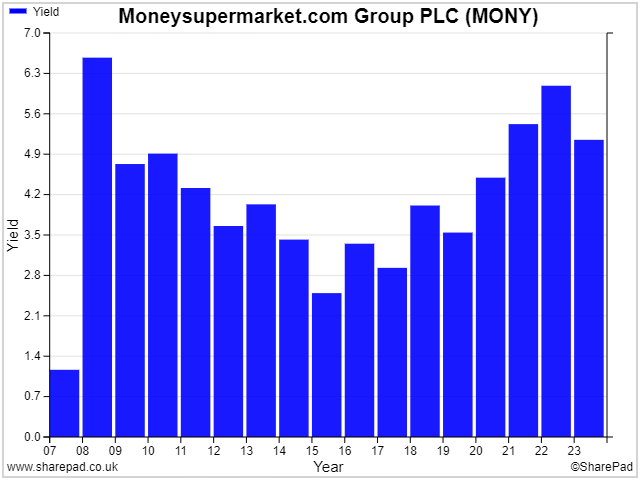

Dividend yield: above average

The shares have generally offered a yield that's been in line with or above the FTSE 250 average.

Although I'm not convinced that buying today will offer the same kind of returns investors who bought from 2008-2012 enjoyed, I think the current 5%+ income does look potentially attractive, for a business of this quality.

MONY scores 3.4/5 for dividend yield in my screening system.

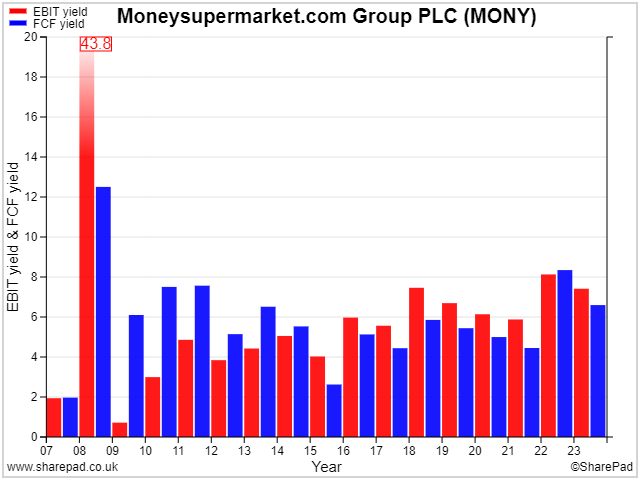

Valuation: affordable

I score stocks for valuation based on their EBIT/EV and free cash flow yields.

MONY looks decent value on both of these metrics, in my opinion, with a trailing EBIT yield of 7.4% and a free cash flow yield of 6.7%:

The obvious question to ask is whether there is a good reason for the business to be cheap. In other words, are current levels of profit sustainable – and is further growth possible?

I can certainly see some possible risks:

- Consumer demand will remain fickle

- Changing market conditions will lead to a reduction in available comparison savings

- Unexpected regulatory action will lead to a reduction in profitability or exceptional cash costs

I can't rule out these possibilities entirely. But on balance, I think it's fair to say that the shares look affordable at current levels.

MONY scores 3.5/5 for valuation in my screening system.

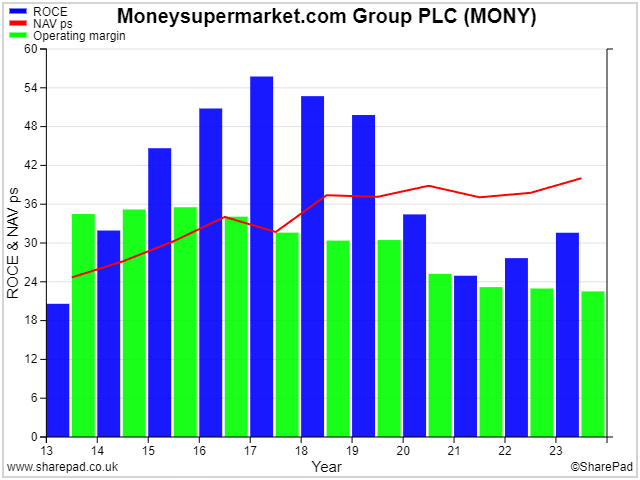

Profitability: very good

There's no escaping the fact that MONY isn't quite as profitable as it was a few years ago.

Operating margins have fallen from a peak of almost 36% to under 25% today. Return on capital employed is also much lower.

Even so, this is still a very profitable business:

My dividend screen scores stocks for profitability based on ROCE and net asset value per share growth. I'm looking for companies that can continue to deploy new capital and generate attractive levels of return on that investment.

In my view, ROCE and NAVps growth are two of the best indicators of a non-financial company's ability to deliver attractive long-term shareholder returns.

My score doesn't use operating margin, but I included it in the chart above as I thought it provided useful additional context.

MONY scores 3.4/5 for profitability in my screening system.

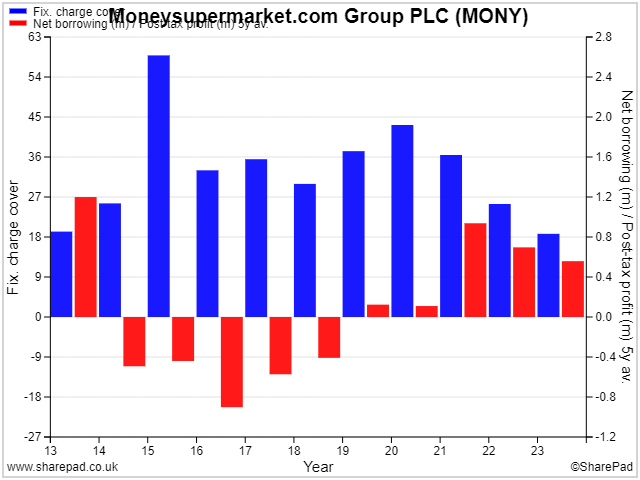

Fundamental health: strong

My fundamental health score is intended to measure whether dividend payments could be at risk from debt service costs. Beyond this, I also want to know whether the business has more debt than I'm comfortable with.

I use two metrics to form a fundamental health score:

- Fixed charge cover (compares operating profit with finance and lease costs)

- Net debt/5yr average net profit – I prefer to use this measure to get an idea of how easily a company could repay its debt if needed, rather than just servicing it.

This chart shows how MONY has performed on these measures over the last 10 years:

One of my main concerns as an equity investor is to avoid debt-related dividend cuts or any other debt-related problems. While lenders may eventually be made whole in such scenarios, shareholders are much less likely to escape without a permanent loss.

I don't think there's really a one-size-fits-all systematic way of measuring debt-related risks. What's appropriate varies across different companies and sectors.

However, I find the method I've chosen to be a useful way of flagging up potential risks for further investigation, if needed.

In this case, I don't see anything to be concerned about. Indeed, I'm hopeful the business will return to a net cash position over the next 12-18 months.

MONY scores 4.4/5 for fundamental health in my screening system.

Conclusion: I could be tempted

My quality dividend system awards Moneysupermarket.com an overall score of 59/100 at the time of writing (May 2024).

I started this write-up with a broadly favourable view of this business. While I can see some potential concerns, on balance I remain positive.

Here's a summary of the main points, as I see them.

Pros:

- Price comparison is high margin, capital light and cash generative

- MONY is one of four UK market leaders

- Ownership of Quidco and MSE provide additional consumer reach

- Balance sheet and valuation look potentially attractive to me, from an income perspective

- Current management strategy of incremental gains and improvements looks sensible to me

Cons:

- Price comparison is starting to look like a fairly mature market, I don't expect rapid growth

- Quidco acquisition was probably overpriced, in my view

- Regulatory and competitive risks remain

- Risk that some market sectors will no longer offer attractive opportunities for comparison

- Little differentiation between market leaders except branding and advertising

My view: I think MONY shares are probably reasonably priced at current levels. I would not be entirely surprised if the company attracted bid interest at some point, given its modest valuation and strong cash generation.

Consensus forecasts on SharePad suggest that free cash flow could rise from £96.5m to £112.8m from 2024 to 2026. Those estimates imply a free cash flow yield from 7.7% to 9.0%, based on the current £1.26bn market cap.

On these numbers, the FY24 forecast yield of 5.4% looks well supported with room for further growth, in my view.

However, these are only forecasts. Price comparison sites have attracted the regulator's attention before and could do so again. MONY might also fail to maintain its market share in a competitive marketplace.

So has MONY returned to growth? And would I be interested in buying the shares for my portfolio?

- I think the business probably has returned to (modest) growth.

- I wouldn't be unhappy owning the shares at this level, but I do have some concerns about the long-term durability of earnings and the lack of competitive differentiation versus key rivals.

As always, thank you for reading – and please share your views on MONY and the wider price comparison sector in the comments below.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.