Down 60%! Is Churchill China a dividend share I should buy?

After a challenging few years, AIM dividend share Churchill China (LON:CHH) offers a 4.6% yield and looks in good shape to me. Is this a chance to lock in an attractive income from a company that's been a reliable payer for nearly 25 years?

In this review I'm considering a company that looks like it could offer an appealing mix of value and quality.

Stoke-on-Trent based tableware manufacturer Churchill China (LON:CHH) can trace its roots back to 1795 and remains a UK-based pottery today.

While most other commercial potteries in the UK have fallen by the wayside since the 1970s, Churchill has survived to become a leading supplier of quality tableware to the hospitality trade.

If you check underneath your mug or plate next time you eat out, there's a good chance you'll find the name Churchill.

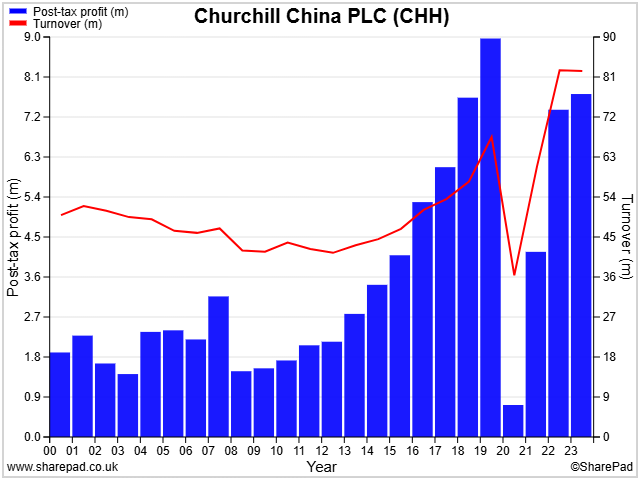

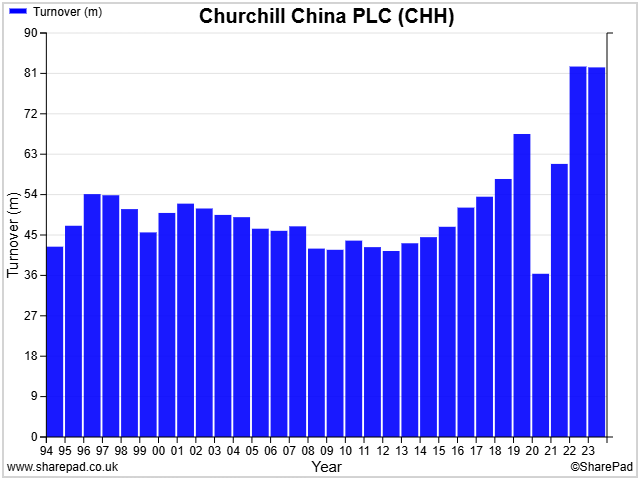

However, although the group's profits have quadrupled over the last 23 years, it hasn't all been smooth sailing. Earnings appear somewhat cyclical and sales growth has clearly been a struggle at times:

More recently, inflation, supply chain problems and labour issues have all had an adverse impact on the business.

So too have the commercial pressures facing hospitality operators – Churchill's customers. This is a sector whose growth has slowed markedly following the pre-pandemic boom.

For these reasons, I probably wouldn't want to pay too much of a premium for Churchill shares. And until recently, that's ruled the company out of consideration for me. This stock has often looked expensive to me in the past, perhaps because it's popular with AIM IHT funds.

However, the pressures I've mentioned above have combined with wider UK small cap weakness to leave Churchill's share price more than 60% below the 2,025p high seen in 2012. The stock is now trading at levels first seen eight years ago:

Churchill shares now offer a forecast dividend yield of 4.6% and look quite modestly valued to me.

In this share review, I'm going to take a closer look at the business through the lens of my dividend share scoring system. Could Churchill China be a useful addition to my dividend portfolio?

Table of contents

- What makes Churchill China special?

- Recent trading & outlook (updated 20 Nov 24 to include new comments following the profit warning)

- Crunching the numbers - how does Churchill China score in my dividend screen?

- Dividend culture - family ownership underlies a strong history

- Dividend safety - is the payout well supported?

- Dividend growth - short-term headwinds have weighed on cash conversion

- Dividend yield - the stock's yield has recently risen to a 12-year high

- Valuation - the shares look cheap to me, but is the growth outlook a concern?

- Profitability - looking for evidence the business can deliver compound returns

- Fundamental health - strong foundations support long-term planning

- Conclusion - should I buy Churchill China for my dividend portfolio?

What makes Churchill China special?

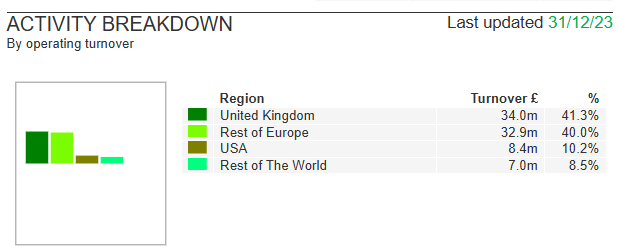

Churchill is one of the leading suppliers of tableware to the UK hospitality sector and has a growing following abroad. Overseas sales accounted for nearly 60% of revenue in 2023.

Since 1980, the company has been focused solely on the hospitality market, producing vitrified tableware that's significantly stronger and more durable than conventional household tableware.

For example, Churchill's ceramic glaze is tested to withstand 5,000 industrial dishwasher cycles. For domestic use, that would be equivalent to one wash every day for over 13 years!

This short video provides an interesting overview of the company's manufacturing process:

The group also has a materials business, Furlong Mills. This supplies raw materials to both Churchill's own factory and other ceramic manufacturers.

The materials division contributes c.15% of revenue at slightly lower margins than the core tableware business, but it's complementary and helps to provide security of supply for the business.

Recent trading & outlook

Update 20/11/24: a few days after publishing this article, Churchill China issued a profit warning, as I suggested could happen in my comments below.

The company says it hasn't seen the normal Q4 seasonal uplift, particularly from independent hospitality operators. As a result, management now expect 2024 profits to be "materially below market expectations".

The "softness in our key hospitality markets" is also expected to continue into 2025, so expectations for next year are also being cut.

While this is clearly not good news, in many ways it does not change my view on this business as a potential investment. As the company says:

"This situation does not change the fundamentals of our business. We have high-quality differentiated products with significant growth potential as markets recover, particularly where we currently have low market share. All of which is backed by solid financials of operational cash generation and a strong unencumbered balance sheet."

At the time of writing, the shares are now trading close to 700p, giving a potential dividend yield over more than 5%, assuming the payout isn't cut. This slump has left the stock trading closer to its £60m NAV, as well.

My view: in my piece below I discuss the group's strong balance sheet, cash generation, long history and market leadership.

Looking ahead, I don't think the hospitality sector is going to disappear and nor do I think customers are going to desert Churchill for an alternative supplier.

Given this combination of circumstances, I'm increasingly interested in this stock given the newly depressed valuation. I think the shares may be starting to offer interesting value.

--

For some background, I covered Churchill China's 2023 results here, in April.

2024 half-year results (05/09/24): these accounts covered the six months to 30 June 2024. Sales fell by 7.8% to £40.6m during the period as volumes weakened but productivity improved. Pre-tax profit for the half year rose by 3.1% to £3.6m.

This improvement in margins was driven by more normal energy costs and improved yields from production as staff training and automation delivered benefits.

The interim dividend was increased and Churchill ended the half year with a robust (albeit reduced) net cash position of £7.8m.

The narrative suggested to me that Churchill was sensibly continuing to invest in factory efficiency and operational improvements while awaiting a recovery in customer demand.

With a strong balance sheet and freehold property assets, management can afford to stay focused on the medium term. However, the timing of a recovery remains unclear, a point that was emphasised chairman Robin Williams' outlook statement:

"We remain dependent on the stronger demand normally experienced in the final four months to meet our expectations for the year."

Guidance was left unchanged and broker consensus forecasts seem to have remained flat since the results were published. But I think it's fair to say there's a meaningful risk of late H2 profit warning if conditions don't improve.

However, markets may already have priced in some of this risk. Churchill shares fell sharply following the publication of the interim results:

It this latest dip a buying opportunity? Let's take a look.

Churchill China: crunching the numbers

Description: founded in 1795, this Stoke-on-Trent pottery produces high quality tableware for the global hospitality trade.

| Churchill China (LON:CHH) |

Quality Dividend score: 64/100 | Forecast yield: 4.6% |

| Recent share price: 825p | Market cap: £91m | All data at 16 November 2024 |

Latest accounts: interim results for six months ended 30 June 2024

In the remainder of this review, I'll step through the different stages in my dividend screening system and explain whether I think Churchill China could be a suitable addition to my quality dividend portfolio.

As a reminder, this is a scoring system I've developed to rank shares for the qualities that are important to me, from a quality dividend perspective.

My choice of scoring factors is of course personal and highly subjective. These scores are not intended to be used as a guide on when to buy or sell shares. They're simply one factor I use to assess a stock's potential attractions, in addition to broader, company-specific analysis.

Unless specified otherwise, the financial data I use in this process is drawn from SharePad.

Dividend culture: family roots

Family ownership is often a reliable way to find companies with a strong dividend culture. That's certainly true here. The Roper family gained a controlling shareholding in 1922. They remain major shareholders today, with around 20% of shares through multiple family holdings.

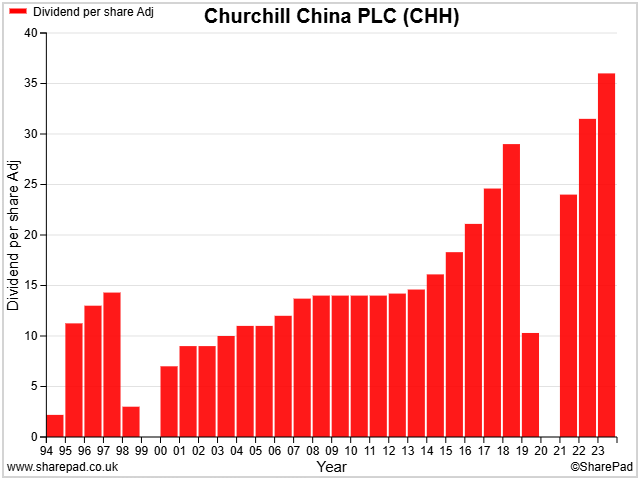

This constancy is also reflected in Churchill's dividend history:

Barring a a pandemic pause, Churchill has paid an unbroken dividend for the last 23 years. I'm confident the dividend is likely to remain a priority for the company.

Churchill China scores 4/5 for dividend culture in my screening system.

Dividend safety: solid

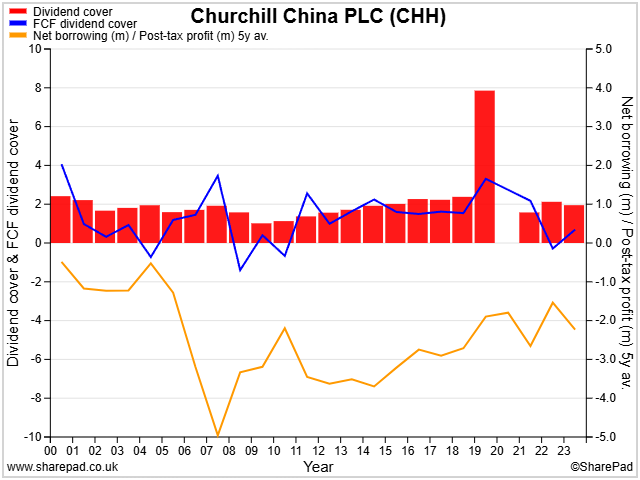

I score stocks for dividend safety by looking at dividend cover by earnings and free cash flow, combined with leverage.

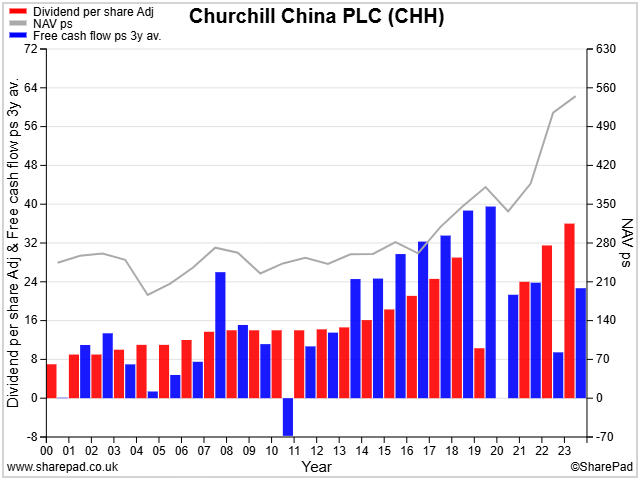

This chart shows how Churchill has generally maintained dividend cover at two times earnings, with a similar level of free cash flow cover.

We can also see that Churchill has consistently reported a year-end net cash position for the last 24 years.

Free cash flow cover for the dividend is inevitably more lumpy than earnings cover. But barring a major slump in profits, I don't see any obvious reason to fear a dividend cut in the near future.

Churchill China scores 3.9/5 for dividend safety in my screening system.

Dividend growth: short-term headwinds?

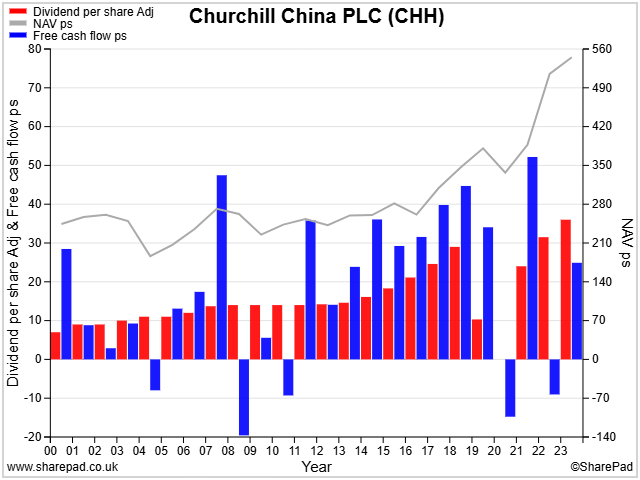

My dividend growth score is intended to test the sustainability of dividend growth, rather than the scale of the growth itself.

Unsustainable dividend growth often ends up leading to dividend cuts, so it's something I want to avoid where possible.

To gauge the underpinning of a dividend, I compare dividend growth with the growth of a company's net asset value and free cash flow. In my view, these are the truest indicators of a company's sustainable dividend-paying capacity.

The only caveat to this is that free cash flow is often lumpier than earnings, due to capex and other irregular cash flows. This can introduce short-term distortions to my scoring. That's what's happening here, unfortunately.

If I redo this chart using three-year average free cash flow, dividend growth looks more sustainable, albeit less so since the pandemic:

There is some room for improvement here. But on balance, I think Churchill's dividend growth score of 1/5 understates the quality of dividend growth in this business.

A number of factors have depressed free cash conversion in the years since the pandemic. These include energy price inflation, supply chain issues, rising labour costs.

More recently, the 2023 accounts show that Churchill spent £5.4m on improving productivity and yields in its factory last year. £6m of additional stock was also added to its UK, European and US fulfilment centres, to improve customer service levels.

Stripping out these cash outflows shows continued strong underlying cash generation. I would expect to see free cash flow strengthen over the next year or so as trading conditions normalise for hospitality operators.

I don't see this low score as a dealbreaker at the moment.

Churchill China scores 1/5 for dividend growth in my screening system.

Dividend yield: a 12-year high

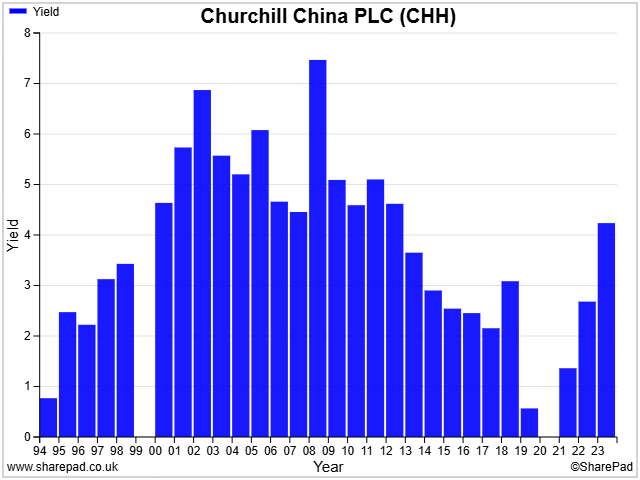

As a dividend investor, I see a stock's dividend yield as a useful indicator of its valuation. One area where I think yield is particularly useful is to provide long-term historic context on valuation.

For example, for investors whose experience has been gained in the low interest rate era, low dividend yields from mature businesses might seem unremarkable.

However, looking back beyond the 2008 financial crisis suggests that in Churchill's case at least, such low yields are not necessarily normal:

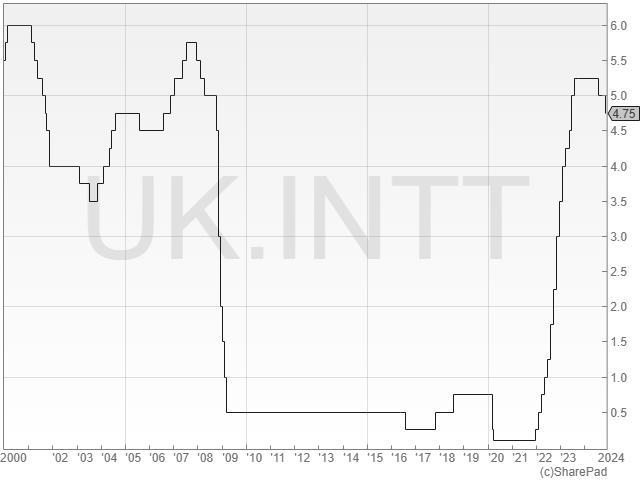

While interest rates aren't the only determinant of dividend yields, I think they are a factor.

In this context, I think one possible view of Churchill's falling share price and rising yield is that the stock is being repriced to reflect the return to a more normal interest rate environment.

That might suggest that a return to the lofty share price and low yields of the past is unlikely, at least for the foreseeable future.

Even so, I think the yield on offer here may be starting to offer quite reasonable value, using one of my favourite rule-of-thumb valuation methods.

Adding the forecast dividend yield of 4.6% to next year's expected dividend growth of 5.3% suggests an expected return from the shares of 9.9%. This is in line with the 10% minimum I usually look for.

Churchill China scores 2.4/5 for dividend yield in my screening system.

Valuation: starting to look cheap?

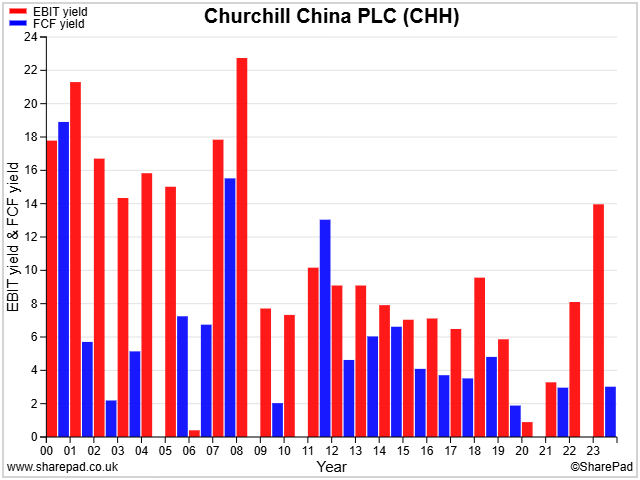

Looking at Churchill's valuation relative to its earnings also suggests to me the share price may be approaching value territory.

A trailing 12-month operating profit of £10.3m gives me an EBIT/EV yield of over 12%. That's comfortably above the 8% level I use as a benchmark for value.

Of course, there are a couple of caveats to consider.

The first is that profits could fall in the near term if demand remains weak.

The other is the recent poor conversion to free cash flow, which I've already discussed:

I'm happy to trust that free cash flow conversion will recover.

But more broadly, I am wondering if Churchill China is simply a mature business with limited growth potential.

The company's long-term record of revenue growth does not provide much evidence to suggest otherwise, especially if we strip out the impact of price rises in 2022, which I estimate at 10-15% of FY22 revenue:

The company says that export markets form its main focus for revenue growth.

Europe now generates equal sales with the UK and is considered to be the main focus for near-term growth. Sales in the US are much lower, but presumably could grow significantly if Churchill can manage to crack this market:

I think it's reasonable to expect further growth in some export markets. However, I would imagine competition for overseas sales is much tougher than in the UK, where the company is already the market leader. This could mean that growth rates and/or margins are lower than in the core UK business.

Another factor that's not clear to me is the level at which UK sales volumes might normalise. The last few years have seen significant distortion to volumes that I suspect is not typical.

For example, my reading of the 2022 accounts suggest that UK volumes rose by more than 20% in 2022, before falling by 17% in 2023.

Total group volumes are said to have fallen again during the first half of 2024.

I suspect we may have to wait until 2025 to get an idea of a normalised level of trading. That adds some risk to the current valuation, in my opinion.

I don't have access to any recent broker notes for this business, as they're not available on Research Tree.

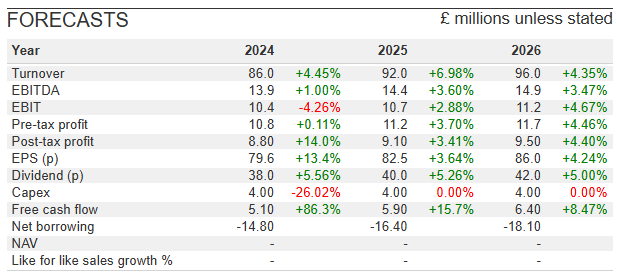

But for what it's worth, consensus forecasts on SharePad currently suggest modest growth in profits and a substantial recovery in free cash flow over the next couple of years.

If Churchill can deliver results somewhere close to these forecasts, I think the shares could offer value at current levels.

Churchill China scores 3/5 for valuation in my screening system.

Profitability: a modest compounder

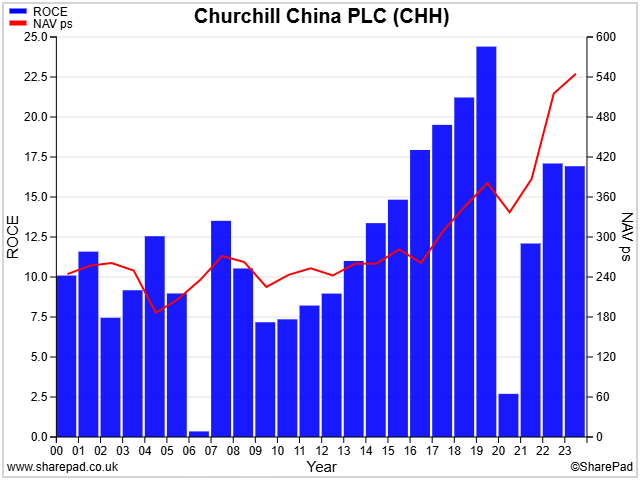

I score (non financial) stocks for profitability using a combination of return on capital employed and net asset value per share (NAVps) growth.

What I hope to see is stable ROCE and rising NAVps. This tends to suggest the company is able to reinvest surplus profits and generate all-important compound returns.

Over time, this process should support a sustainable increase in a company's capacity to pay dividends.

Churchill's track record on these metrics is a little mixed, but appears to have improved significantly over the last decade:

What will happen next? I think the outlook here is linked to the company's ability to gain market share in its main export markets. If it does, then Churchill may be able to invest in additional factory capacity and generate attractive returns on this spending.

If growth proves difficult or sub-profitable, then the picture could be less favourable. At this point in time, after a difficult few years, I am inclined to give the company the benefit of the doubt.

Churchill China scores 3.2/5 for profitability in my screening system.

Fundamental health: reassuringly strong

If Churchill had a weak balance sheet with lots of debt and few assets, I would be far more cautious. I probably wouldn't be interested. But that's not the case.

Like many of my small and mid-cap holdings, Churchill has a remarkably strong balance sheet.

The interim accounts showed net tangible assets of £60m against a market cap of £91m.

Highlights from the debt-free balance sheet include net cash of £7m, £21m of inventories and unencumbered freehold land and buildings with a depreciated value of c.£12m.

As the company notes in its results, these property holdings represent a potential source of funding if ever required.

Strong financial foundations also give companies the ability to make good quality long-term decisions during difficult times. I think that's probably been happening here over the last 18 months.

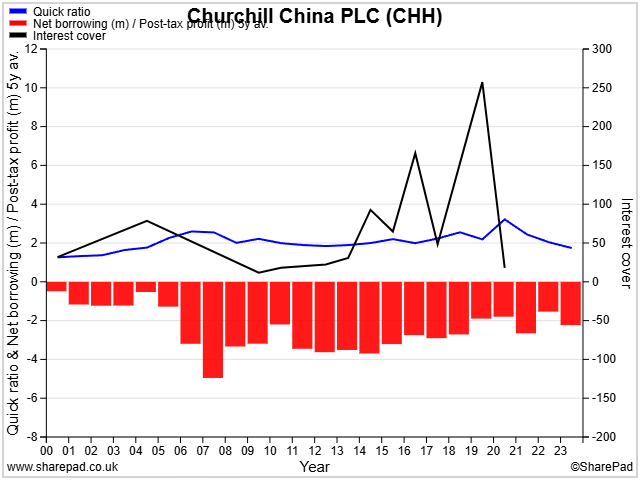

In terms of scoring, I rate stocks for fundamental health based on a combination of interest cover (I previously used fixed charge cover) and leverage.

For a company with no debt these metrics are not always that meaningful, so I've also added in the quick ratio to the chart below:

The quick ratio compares a company's current assets and current liabilities, but excludes inventory. For a manufacturer I think this can be useful, as inventory is not always especially liquid, particularly if times are troubled.

Churchill's quick ratio of c.2x looks reassuring to me, especially given its long-term stability.

Churchill China scores 5/5 for fundamental health in my screening system.

Conclusion: a watchlist stock

My dividend screening system awards Churchill China an overall score of 64/100 at the time of writing (November 2024).

I think Churchill deserves some credit for navigating the last few years while maintaining a strong balance sheet and protecting its profitability.

However, the near-term outlook still looks difficult to me. In the UK, rising national insurance and minimum wage costs are likely to hit hospitality operators relatively hard. I'm not sure there's much evidence yet of a recovery in consumer spending, either.

In its interim results Churchill commented that smaller operators in the hospitality sector were having particular problems. I'd imagine this will continue into 2025, although larger operators such as JD Wetherspoon (a Churchill customer!) are likely to be more resilient.

Here's a summary of the main points, as I see them:

Pros:

- Churchill China is a market leader in the UK with a growing presence in Europe

- Mid-teens ROCE is respectable and supports growth and an attractive dividend

- Good cash generation and a very strong balance sheet

- Valuation is at a 10-year low, shares could be cheap

Cons:

- Long-term growth potential is unclear, track record of growth is mixed

- Cyclical conditions are difficult and might worsen

- Higher interest rates may mean that Churchill will remain more modestly valued unless growth accelerates

- Capital intensity of business likely to limit any improvement in profitability

My view: although I have some reservations about the maturity and growth potential of this business, I can see plenty to like at current levels.

Churchill's valuation and 4.6% yield look increasingly attractive to me, especially when paired with its very strong balance sheet.

There's a decent chance I'll decide to replace one of the stocks in my portfolio at the end of this year. If I do, Churchill China will be on the shortlist of stocks I consider as a potential replacement.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.