The Dividend Note - what price for quality? EXPN, SPT, DPLM, AJB, IHP, CWK (19/01/24)

I review this week's updates from Experian, Spirent Communications, Diploma, AJ Bell, IntegraFin and Cranswick.

Welcome back to The Dividend Note. This week saw markets ease a little as a slight rise in inflation led investors to question whether interest rates will fall as soon as expected.

I don't think this is too significant in the scheme of things. Markets don't move up or down in straight lines. Nor is inflation likely to, in my view.

As this chart from SharePad shows, inflation has dipped twice over the last year before rising again.

I continue to believe that the worst of inflation is probably over, especially as UK unemployment has started to rise and is now above pre-pandemic levels:

Macro uncertainty is seems to be having varying levels of impact on the companies I follow. Most are performing reasonably well – and of course, many generate much of their revenue outside the UK.

This week's note has a quality theme as I look at updates from six companies on my quality dividend radar.

Companies covered:

Spirent Communications (LON:SPT) - this network testing specialist has suffered a series of profit warnings over the last year and its shares have de-rated sharply.

Although I have some reservations about the company's long-term track record, I think the worst is probably over for this cycle. I'm inclined to think the shares could be worth considering at current levels.

Experian (LON:EXPN) - a solid Q3 update provides a useful reminder of why I'd like to own this FTSE 100 information services business.

Experian scores highly on all my quality metrics. But a decade-long re-rating has left me priced out of the stock, for now at least.

Diploma (LON:DPLM) - a strong Q1 update from this specialist distributor suggests that Diploma remains on track for another decent years.

However, the shares look more expensive to me than at almost any time in history and I remain sceptical about buying in at this price.

AJ Bell (LON:AJB) vs Integrafin (LON:IHP) - I rate both of these investment platforms highly, as I've discussed before. Both issued Q1 updates last week - in this short section I compare and contrast some key metrics.

My tentative conclusion is that UK investor sentiment may have bottomed out and be starting to recover.

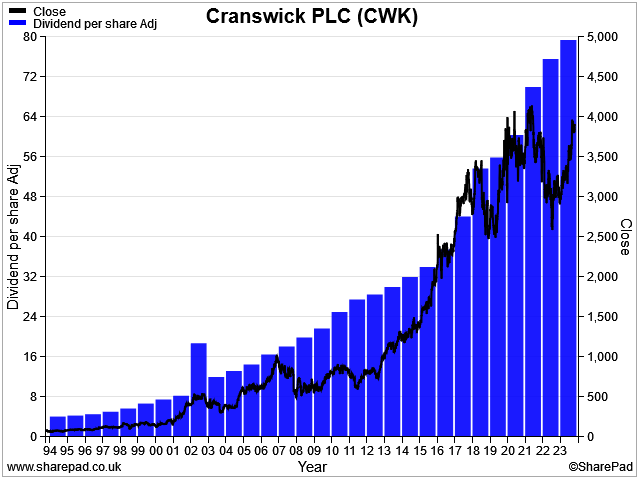

Cranswick (LON:CWK) - this FTSE 250 food producer may not seem an obvious choice for a quality dividend stock. But Cranswick has a 30-year dividend record, generates double-digit ROCE and has a decent balance sheet.

Management has just upgraded profit guidance for the current year, too.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Spirent Communications (SPT)

"Accelerating our focus on non-telco segments where market dynamics are currently more positive."

Spirent makes equipment and software that's used for network testing and quality assurance. The company is suffering from a spending slump in the telecoms sector at the moment, which is historically its main market segment.

I've covered this FTSE 250 network testing and assurance specialist in several updates last year (May, July & August 2023). I also took a broader look at the business in an in-depth dividend share review in May 2023.

After a series of profit warnings and downbeat statements, Spirent's full-year update for 2023 suggests to me that the worst may be past and the business could be worth considering as a turnaround.

Last week's update confirms that full-year results should be in line with revised expectations:

- Revenue down 22% at $474m, slightly below consensus figures I can see

- Adjusted operating profit "in line with the market consensus" – SharePad forecasts suggest a figure of $48.1m, down c.60% versus 2022.

- Cash balance closed at $103m, versus $148m at the end of H1 – it looks like Spirent still has a strong net cash position, albeit much reduced from earlier in the year

Market commentary: Management say telecoms remains "very challenging" but that efforts to diversify are paying off.

Chief executive Eric Updyke cites positioning, hyperscalers (cloud data centres) and financial services as areas where sales and order pipelines are improving.

Outlook: Spirent says it's started the new year with a growing order book and expects to continue expanding into new markets, while remaing well positioned to benefit when its core telecoms market recovers.

CEO Updyke says that technologies such as 5G, ORAN and 400G/800G high-speed Ethernet (for hyperscale data centres) will continue to drive demand for Spirent's services.

The tone of the outlook is positive, so I assume that existing consensus forecasts for 2024 remain unchanged for now. These suggest we could see a partial recovery in earnings this year and price the stock on a P/E of 19, with a 4% dividend yield.

My view

Although I have some reservations about the company's historic strategy shifts, the business as it stands today appears to benefit from attractive margins, good cash generation and continued growth opportunities.

The shares aren't quite as cheap as they were in October. But on balance, I think Spirent probably offers value at current levels and could prove a decent turnaround choice.

I'll aim to revisit Spirent when its 2023 results are published in March.

Experian (EXPN)

"We delivered good growth in Q3, at the upper end of our expectations."

I like to keep an eye on this credit rating and information services business, as it's the kind of high-quality compounder I would like to own, at the right price.

This update covers the three months to 31 December 2023, which is Experian's fiscal third quarter (y/e 31 March).

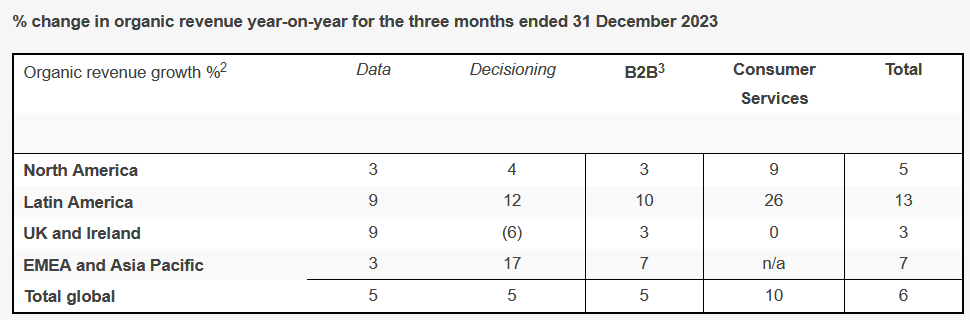

Revenue from continuing operations rose by 7% at constant exchange rates, with organic revenue growth of 6%.

Performance was positive in all regions, but appears to have been boost by a particularly strong performance in Latin America. The UK was notably the weakest:

Outlook: Chief executive Brian Cassin expects to report full-year organic revenue growth of between 5%-6%, with "modest margin accretion" at constant exchange rates.

My view

Experian ticks many of the boxes as a stock I'd like to hold in my dividend portfolio. Its services are widely used and scalable and generate an attractive level of repeat and subscription revenue.

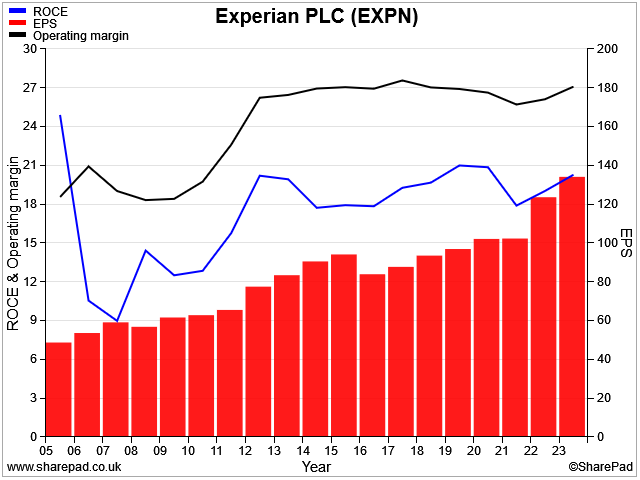

The business itself is high margin and cash generative, with a consistent history of growth:

However, despite earnings growth and profitability remaining broadly stable over the last decade, the business has become consistently more expensive by the measures I use:

This multiple expansion has been great for shareholders. While earnings have risen by about 2.5x since 2005, the share price has risen by more than six times.

This has left the stock with a free cash flow yield under 3% and a dividend yield of just 1.5%. Both are well below the level I'd look for to buy and leave the stock looking more expensive than it has been for at least 20 years.

This re-rating may have made sense during the zero interest rate era, but it doesn't add up for me now – especially as Experian has around $4bn of net debt.

I remain priced out, for now. But I'll keep watching and hope for an opportunity to add this business to my portfolio.

Diploma (DPLM)

"we remain confident in our unchanged full year guidance"

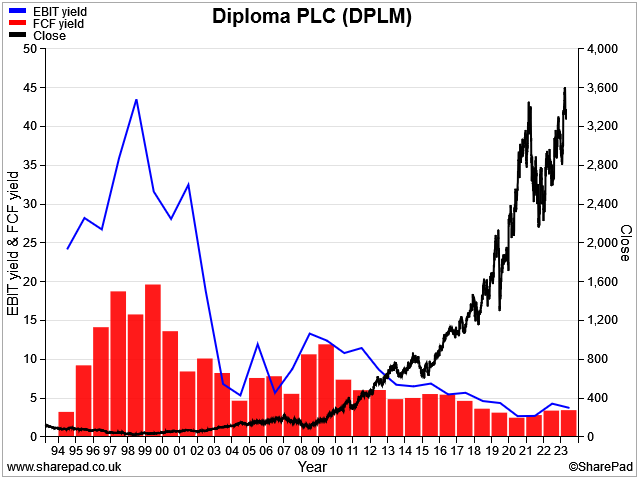

Many of the comments I made about Experian above also apply to Diploma, in my view. This business is a specialist distributor with a track record of high margins and bolt-on acquisitions for growth.

I covered Diploma's full-year results in November. Last week's update confirms progress in line with expectations. First-quarter organic revenue rose by 6%, with total revenue up 10% thanks to a contribution from acquisitions.

Three bolt-on acquisitions were made for a total of £9.5m in Q1, at average multiples of around 4x EBIT.

This appears to be a nice example of the valuation arbitrage that's possible by buying cheaper earnings privately and adding them to a highly-rated listed business – Diploma currently trades at around 25x trailing EBIT!

My view

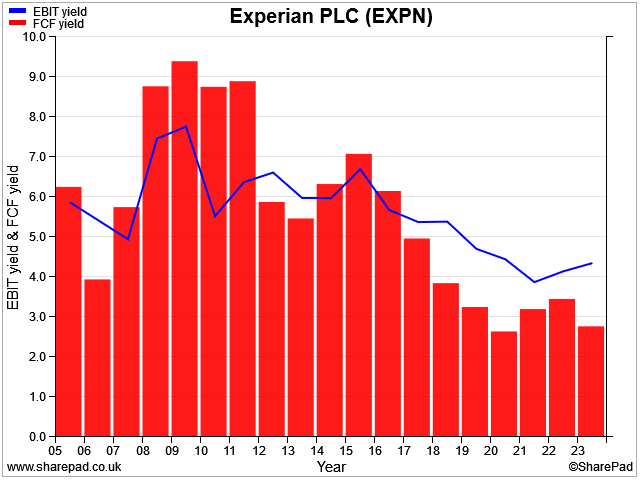

Unfortunately, Diploma shares look more expensive to me now than at virtually any point in the last 30 years, except during the 2020 crash:

Is there still value on offer? Perhaps, but it's not enough for me. Diploma's sub-2% dividend yield and 3.5% free cash flow yield suggest to me that much of the good news is already in the price, especially given the company's comments about the "uncertain economic outlook".

As I commented last week with regard to Games Workshop, I may be wrong to resist paying up for quality. But as investors, we all have to make our own decisions regarding risk and reward. Diploma isn't cheap enough for me.

I could be interested if Diploma shares revisit the mid-£20s levels seen in 2022. For now, I remain on the sidelines.

AJ Bell (AJB) vs IntegraFin (IHP)

"net inflows"

AJ Bell Q1 FY24 update / IntegraFin Q1 FY24 update

I've written about these two investment platforms several times before, most recently in December, when I covered both companies' full-year results.

IntegraFin and AJ Bell both issued Q1 updates last week, so rather than reviewing them in depth again so soon after my last comment, I thought I'd just compare some key operating metrics to see if any signs of life are emerging in the UK retail investor segment.

As a quick reminder, AJ Bell serves both DIY investors (D2C) and advised clients. IntegraFin only serves advised clients.

| Q1 24 performance | AJ Bell | IntegraFin |

| AUM (% chg) | £76.2bn (+7%) | £58.0bn (+6%) |

| Gross inflows | £2.7bn (Q4 23: £2.5bn) | £1.7bn (Q4 23: £1.6bn) |

| Net inflows | £1.3bn (Q4 23: £1.1bn) | £0.3bn (Q4 23: £0.4bn |

| # platform clients (% chg) | 484k (+2%) (161k advised, 323k D2C) | 231.4k (+0.5%) |

| Assets/client | £317k (advised) / £78k (D2C) | £251k |

Source: AJB and IHP Q1 FY24 updates

Broadly, both companies saw a modest uptake in gross inflows during the quarter, compared to the previous three months (Jun-Sept 2023). This suggests clients are becoming slightly more keen to add new cash.

Net inflows also improved for AJ Bell, but worsened slightly for IntegraFin. This suggests that IntegraFin's clients may have been slightly more keen to withdraw money during the period than those of AJ Bell.

AJ Bell also saw stronger growth in client numbers than IntegraFin. For better comparability, AJ Bell's advised client base grew by 1.3%, versus 0.5% for IntegraFin.

My view

Overall, I would say that AJ Bell's figures looked slightly stronger than those of IntegraFin, with the caveat that one quarter is too short to be really meaningful.

The main takeaways for me are that:

- we may be past the worst in terms of private investor sentiment in the UK.

- both of these companies remain in fairly good shape

According to consensus forecasts, AJ Bell currently trades on 19x FY24 forecasts, with a 4.3% dividend yield.

For IntegraFin, the FY24e P/E is 20, with a 3.5% dividend yield.

I continue to favour AJ Bell slightly over IntegraFin, but I think both remain potentially attractive, given their high margins and proven cash generation.

Cranswick (CWK)

"Adjusted Profit Before Tax for the year ending 30 March 2024 is now expected to be ahead of the Board's previous expectations."

Third-quarter trading statement

This business is one of the UK's largest food producers, with an emphasis on supplying fresh pork and chicken and cooked meat products. In addition to its own factories, Cranswick has a policy of vertical integration and also operates farms to produce its own 'raw materials'.

Notably, Cranswick produces 50% of its own pigs. According to a recent broker note from Shore Capital (available on Resarch Tree), this equates to 750k pigs "on the ground" at any time.

Cranswick is also said to have 10m chickens and some arable farming/milling capacity for feed production.

This model appears to work quite well, because it has supported a 30-year record of dividend growth and a 10-bagger share price performance over the same period.

Q3 trading summary: after a good start to the year, strong trading is said to have continued into fiscal Q3, which was Sept-December:

"Trading throughout quarter three and particularly during the key Christmas trading period was stronger than anticipated."

Cranswick says it saw volume growth across all four core UK food categories (Fresh Pork, Convenience, Gourmet Products & Poultry).

As a result, the company now expects adjusted pre-tax profit for the year ending 30 June to be higher than previously guided.

Outlook: consensus earnings forecasts have edged up by around 3% over the last month, suggesting that analysts are not expecting a massive earnings upgrade.

These estimates put the stock on a forecast P/E of 17, with a dividend yield of 2.2%.

My view

This business has expanded steadily over the years through a mix of organic and acquisitive growth. The business now employs nearly 15,000 people across 22 UK sites.

Cranswick now supplies all the major supermarkets, plus discounters, food-to-go chains and export markets.

I note that Cranswick's balance sheet shows almost £500m of fixed assets, c.£225m of intangible assets and £90m of biological assets (presumably live animals and crops).

From all of this, the business is able to generate c.£125m of net profit each year, supporting an average return on capital employed of c.15% in recent years.

Despite being quite capital intensive, Cranswick is able to generate quite attractive returns from its capital investments.

This level of profitability and the company's long history of growth suggest to me that it could be a good quality business.

I'm also encouraged by the relatively strong balance sheet – the half-year results showed net debt of just £51m, excluding lease liabilities. This looks modest compared to forecast net profit of £122m for FY24.

Meat production is not necessarily a sector I want to invest in, but I can't help admiring Cranswick's long-running success and quality metrics.

The shares look fully valued to me at current levels, but perhaps not wildly expensive. At a lower valuation, I might be tempted to take a closer look.

Roland Head

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.