Dividend notes: value at the right price? BATS, AZN, SPT (02/08/23)

I find potential signs of value among half-year results from British American Tobacco, AstraZeneca and Spirent Communications.

Welcome back to my dividend notes. Today I'm looking for signs of value at two FTSE 100 firms following recent half-year results. I also consider the outlook for an unloved – but potentially cheap – FTSE 250 tech stock.

Companies covered:

- British American Tobacco (LON:BATS) - rising interest rates and legal costs are adding pressure to deleverage. I think there's a fair chance the 9% dividend yield will remain safe, but I don't think it's certain. Despite this, I reckon the shares are likely to offer a decent return from under £26.

- AstraZeneca (LON:AZN) - financial performance at this pharma group seems to be improving after a tough few years. The valuation is still too steep for me, but I can see the potential for a future investment here. I'll be watching more closely from now on.

- Spirent Communications (LON:SPT) - profits collapsed in H1 at this network testing specialist. But the order book is at record levels and the balance sheet carries net cash. A profit warning remains a risk, in my view, but I think the shares could offer decent value on a medium-term view.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

British American Tobacco (BATS)

"Commitment to dividend growth in sterling terms and our long-term 65% dividend pay-out ratio"

A 29% rise in sales of vapes and other non-combustible products provided a boost to revenue at FTSE 100 tobacco group BATS during the first half of this year.

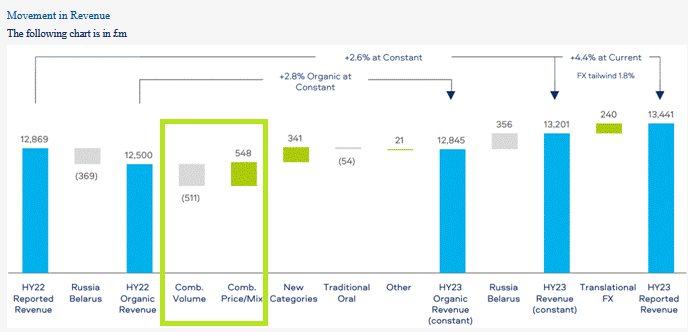

Revenue at the high-yield favourite rose by 4.4% to £13,441m during the first half of the year, despite a 0.5% fall in cigarette volumes by value.

New Categories – vapes, nicotine pouches and heated tobacco – generated £1,656m of revenue during the quarter, as customer numbers rose by 1.5m to 24m. Chief executive Tadeu Marroco says that this business is now "close to breakeven" and should make a profit contribution next year.

Adjusted operating profit for the half year rose by 3.6% to £6,020m, while free cash flow for the period was £2,467m, by my estimation.

It's worth pointing out that BATS' cash flow is always second-half weighted due to various timing issues. So full-year cash generation should be much stronger.

The group's trailing 12-month cash flow is about £8.1bn and a similar result is expected this year. That should provide sufficient cover for the dividend, which cost £4.9bn last year.

This FTSE 100 tobacco giant has been a reliable source of dividend income for many years, despite rising debt levels, legal settlements, declining tobacco volumes and now rising interest rates.

The dividend is declared annually but paid quarterly. The current payout of 230.9p (57.72p/qtr) was declared with the 2022 results and currently provides a yield of more than 9%.

However, commentary in these half-year results suggest to me the payout could be under greater pressure than previously.

Dividend vs net debt? BATS' net debt was £38,345m at the end of June, down from £39,281m at the end of December and £40,806m on 30 June 2022.

This reduction seems encouraging, but leverage remains high – net debt/EBITDA was 2.9x at the end of last year.

2023 guidance suggests only that BATS will make "progress towards the middle of our 2-3x" leverage corridor.

Indeed, the following management quote suggests to me there could be a growing tension between the need to deleverage and maintain dividends at current levels:

in 2023 the Board has taken a pragmatic approach to prioritise strengthening our balance sheet. At the same time, we understand the importance of cash returns to shareholders, and remain committed to our 65% dividend payout ratio over the long term.

I can see a couple of possible reasons for a renewed focus on debt reduction.

Legal woes: in April BATS reached a $635m settlement with US authorities relating to allegations the firm was selling cigarettes to North Korea in breach of sanctions.

The company has not yet settled this case in Canada, but its operations there are currently operating under bankruptcy protection (Canada's CCCA).

One consequence of this is that the £1,653m of cash and £302m of investments held by BATS' Canadian subsidiary (confusingly, this is Imperial Tobacco Canada) are not currently available to the wider group.

I don't have enough knowledge of these proceedings to predict what might happen next. But presumably there's a risk that at least some of this cash will be lost permanently or required for a settlement.

Rising debt costs: A second potential concern is the impact of rising interest rates.

The company says it has debt maturities of around £4bn per year over the next two years, and expects to report higher finance costs. Given the relatively small size of these maturities, the immediate impact of higher interest rates may be limited.

But from what I can see in recent RNS notices, BATS is refinancing notes with rates of 2%-4.5% with new notes at 6%-7%.

If average borrowing costs are rising by c.2.5% on refinancing. then each £1bn of debt refinanced could add c.£25m to annual interest payments.

Thus, refinancing £4bn per year might added £100m/yr to interest costs.

I should stress these are only my estimates and may be incorrect. But the direction of travel is clear and these extra costs will have to come out of free cash flow, before any debt repayments are made.

Outlook: full-year guidance is unchanged.

Global tobacco industry volumes are expected to fall by 3%, but BATS expects to achieve underlying revenue growth of 3%-5%, thanks to price increases and New Categories sales.

This graphic from the H1 numbers provides a neat illustration of how price increases are used to offset volume declines:

Operating cash flow conversion for the full year is expected to be over 90%.

The company is maintaining its "commitment to dividend growth in sterling terms" and its long-term target for a 65% dividend payout ratio.

Broker forecasts price the stock on less then seven times forecast earnings, with a 9.2% yield.

My view

Will British American be able to maintain its dividend while achieving the necessary deleveraging? Possibly, I think, but I don't think it's certain.

However, the continued growth of the New Categories business seems encouraging. If this business unit can turn profitable (and cash generative) next year, it will be a significant milestone.

BATS shares look cheap to me on pretty much any measure – for example, £8.1bn of free cash flow gives a trailing free cash flow yield of more than 8%, even when the company's debt burden is included in its valuation.

The long-term risks to this business are well-rehearsed and don't need repeating here. But at current levels, I think the odds are favourable that the shares can deliver an acceptable shareholder return on a medium-term view.

AstraZeneca (AZN)

"Strong revenue and EPS growth, reflecting momentum of recent launches and robust commercial execution"

Pharmaceutical group AstraZeneca has been on a journey since CEO Pascal Soriot took charge in 2012. The firm's recent half-year results suggest to me that his decision to ramp up debt to fund acquisitions and growth may be paying off.

Measuring progress objectively isn't always easy, though. AstraZeneca reported 'Core' earnings per share of $4.07 in H1, but statutory earnings of $2.34 per share. Which should I rely on?

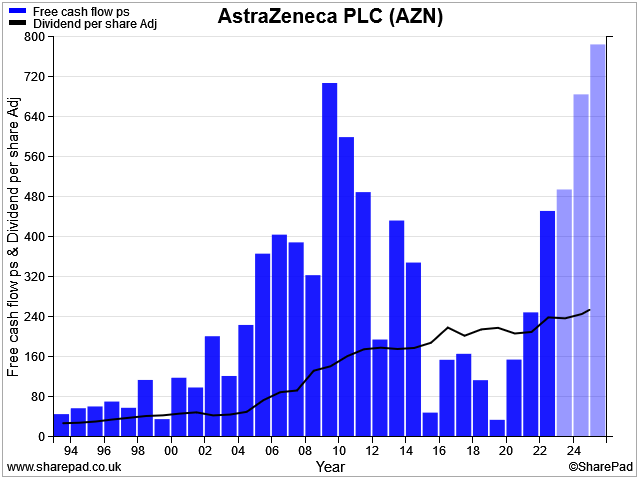

Rather than spending hours in the quagmire of adjustments that lie behind the core numbers, I've been monitoring AZN's free cash flow in recent years. After all, this is reality.

The results have been encouraging, I think, and forecasts suggest stronger results are coming down the line.

The good news is that Astra's dividend is now covered by free cash flow again, after six years without cover.

There are still a couple of potential sticking points for me, though.

Valuation: my sums suggest the shares are currently trading with a trailing 12-month free cash flow yield of about 3%. That's a little lower than I normally look for.

Consensus forecasts on SharePad suggest free cash flow will rise to $10.7bn in 2024 and $12.3bn in 2025. That would imply free cash flow yields of 4.8% and 6% respectively, based on current exchange rates.

That seems potentially attractive, especially as the group's rising profits have brought leverage down to a comfortable level, in my opinion.

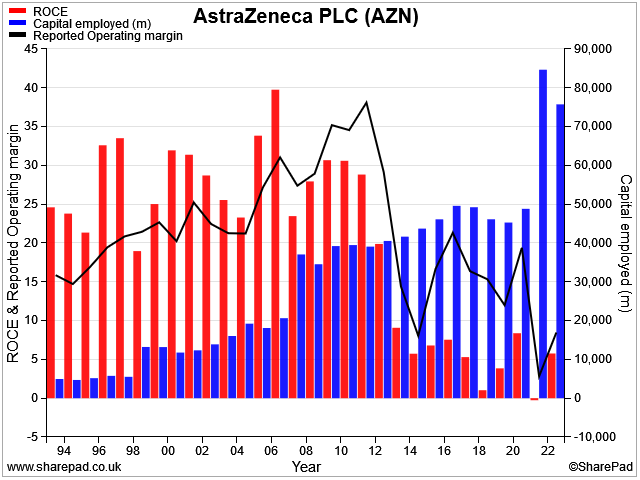

Profitability: AstraZeneca's balance sheet capital employed has risen from $41bn to $75bn since 2012. I think this mostly reflects spending on acquisitions and new products, which has lifted intangible assets from $26bn to $58bn over the same period.

As a result of this, the group's profitability has suffered. Return on capital employed has collapsed and operating margins have also taken a big hit:

However, if profits (and cash flow) continue to strengthen as forecast, then I can imagine that AstraZeneca may soon be reporting improved profitability.

My view

I think it's fair to say that a fair amount of growth is already priced into AstraZeneca shares. But to my surprise, this FTSE 100 stock doesn't look as expensive as I thought it would.

With a dividend yield of just 2.1% and such low historic profitability, AZN isn't in the buy zone for me at the moment. But I wouldn't rule out a possible investment in the future.

I will be paying closer attention to this stock going forwards.

Spirent Communications (SPT)

"Operating profit was materially impacted by negative operating leverage which we expect to meaningfully reverse in the second half of 2023."

Glass half full, or half empty? Half-year results from network testing specialist Spirent Communications could be read both ways.

A 10% share price slump on the day suggests the naysayers have the upper hand for now, but I think an opportunity could be emerging here.

H1 highlights: Spirent's revenue fell by 20% to $223.9m during the first half of the year, triggering a 96% drop in reported operating profit to just $1.6m. This appears to be an example of operating leverage in reverse. It can be painful.

However, the order book rose to a record $303.4m (H1 2022: $283.6m) and order intake remained healthy at $239.4m (H1 2022: $295.5m).

Spirent's balance sheet also appear to be in good health. Despite spending $34m on a share buyback, the group ended the half year with net cash of $148m (H1 2022: $189m).

The interim dividend rose has been lifted 5% to 2.76 cents per share, putting the stock on track to offer a 4% dividend yield this year.

What's the problem? Telecoms is a cyclical business and Spirent's customers – mainly mobile network operators – appear to be slowing their spending.

The popular argument that 5G spending is necessary and unavoidable appears not to be entirely true. The spending may be necessary, but it can still be delayed.

However, chief executive Eric Updyke says that performance improved in the second quarter:

"we have been encouraged by the strong uptick in orders in the second quarter, which will feed into second half revenue and beyond."

Updyke says the company secured some important wins in Q2:

"we saw good engagement for our service assurance solution with North American Tier 1 operators, closed strategically important deals for our 5G O-RAN services, maintained our 800G high-speed Ethernet testing leadership and continued aligning the capabilities of our sales organisation with our customers by focusing on ROI."

Efforts to diversify the group's customer base are also continuing:

"we are diversifying our customer base into new verticals and are currently finalising the detailed work scope for a significant lab and test assurance and services solution, worth over $15 million, with a major retail bank. This will establish a brand new customer segment that presents a significant opportunity for our solutions in a sizeable market."

Outlook: when I last looked at Spirent in July, I commented on the risk that the expects H2 profit weighting might end up leading to a profit warning later in the year.

Today's outlook commentary doesn't change my view that this remains a possibility.

The company warns that "order intake momentum has not yet fed into revenue", but says that Spirent does say that it's seeing increasing signs of customer confidence and order growth.

Management reiterate full year guidance, with the caveat that "trading performance will be materially more weighted to the second half of the year than usual."

Broker forecasts price the stock on about 12 times earnings, with a forecast yield of 4%. That seems decent value to me, for a company with net cash and a recent track record of 20% returns on capital employed.

My view

Spirent's share price fell after these figures were announced, rather suggesting that the market shares my fear that a profit warning remains likely.

I don't know how likely this is, but I can't help feeling that this business is probably cheap on a medium-term view, regardless of any short-term weakness.

I don't see any reason to think that the group's franchise strength or competitive advantages are about to erode.

My only concern about Spirent as a long-term investment is the group's lack of a consistent track record. This is something I discussed in my in-depth review of the company back in May.

If Spirent had the kind of consistent long-term record I'm looking for, I'd probably be lining the shares up as a potential purchase for my quality dividend portfolio.

As things stand – rightly or wrongly – I'm staying on the sidelines for now.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.