Dividend notes: the same but different - IPX, PMI

I review the latest results from AIM-listed fund managers Impax Asset Management and Premier Miton and give my view on these stocks. Do they offer opportunity?

In this edition of dividend notes I'm taking a look at the latest results from two fund managers that are among the highest-ranked stocks in my dividend screening results.

Both offer attractive dividend yields, but they have very different valuations and profiles. Asset managers remain under pressure for a variety of cyclical and structural reasons, as these numbers show.

But I think there could be some value in this sector at the moment.

Companies covered:

- Impax Asset Management (LON:IPX) - this sustainability specialist has de-rated sharply, but remains highly profitable and continues to attract new money. I think it's an interesting business.

- Premier Miton (LON:PMI) - falling AUM has combined with a reduction in fee margins to trigger a collapse in profits. A dividend cut has become necessary, but this situation might reverse quickly when market improve.

This is a review of the latest results from UK dividend shares that are in my investable universe and may appear in my screening results.

Impax Asset Management (IPX)

"Positive net inflows of £1.1 billion during the Period, well diversified by channel and geography."

Last week's half-year results from sustainable investment specialist Impax Asset Management triggered a sharp sell off:

Were the numbers (or the outlook) really that bad? I've admired this group's progress and exceptional profitability for years, but have generally felt priced out. But at current levels, I can see some possible attractions, including a 4%+ dividend yield.

Let's take a look.

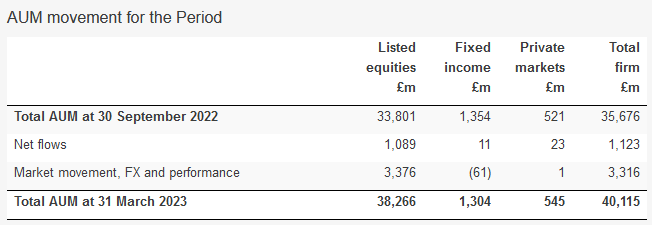

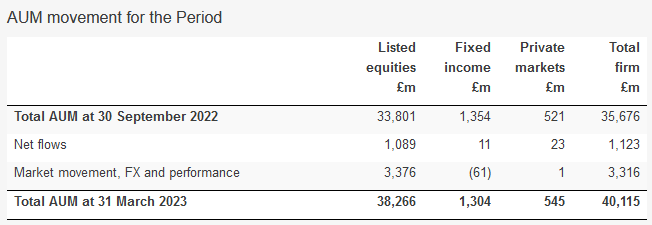

Results summary: Impax saw positive net inflows to its funds of £1.1bn during the half-year to 31 March 2023. Investment gains and currency effects added a further £3.3bn.

As a result, total assets under management to £40.1bn, up from £35.7bn at the end of September. These inflows were almost entirely into listed equity products:

Despite this steady performance, revenue was broadly flat and profits fell sharply:

- Revenue of £88m (H2 2022: £86.8m)

- Adjusted operating profit down 19.7% to £27.3m

- Reported pre-tax profit down 34.5% to £21.4m

- Adjusted earnings down 18.4% to 17.2p per share

- Interim dividend unchanged at 4.7p per share

The fall in profits was driven by two factors:

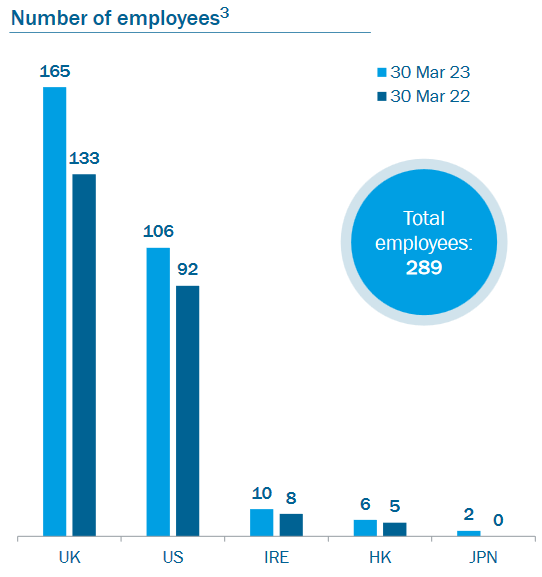

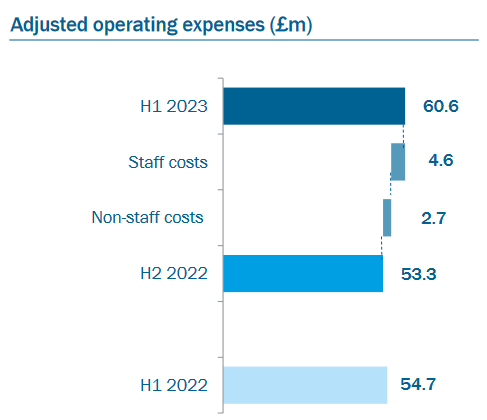

Operating costs: Impax is adding headcount and investing in its operations to support future growth.

Adjusted operating costs rose from £54.7m to £60.6m, with the increase including £4.6m of additional staff costs:

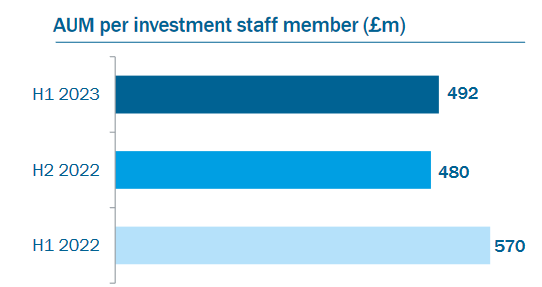

This extra headcount has contributed to a reduction in staff productivity, at least temporarily:

Finance costs: the other factor that depressed profits was listed as finance costs. However, the accounting footnotes show that this relates to foreign exchange translation losses on intercompany loans and cash balances. I'd guess that the majority of these may have been non-cash accounting entries only:

Profitability: I think it's fair to say that many of the factors that held back profits during the first half were temporary external factors or else a result of the company investing in its continued growth.

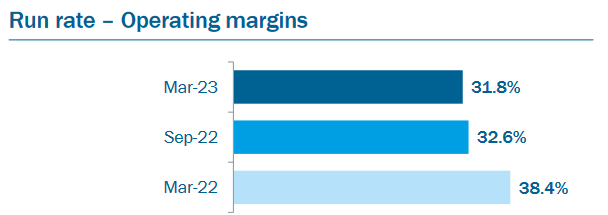

However, they have had a big impact on operating margins over the last year:

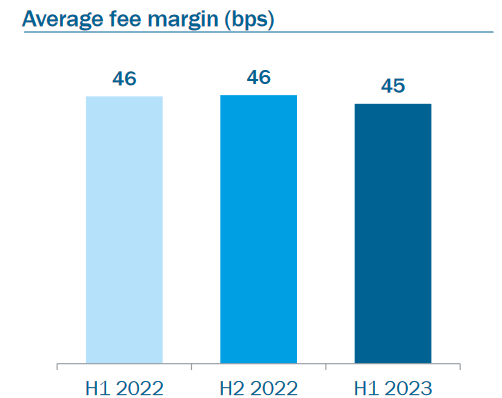

Even so, this business remains far more profitable than most other UK-listed asset managers. Fee margins have also remained stable and competitive (see PMI below), suggesting profits could rebound when markets become more supportive:

My sums suggest a trailing 12-month operating margin of 33.2%, with a TTM return on equity of 42.8%. Still pretty good.

Outlook: CEO (and 7.2% shareholder) Ian Simms says that despite a challenging macro background, pressures such as cost inflation, supply chain issues and energy prices are all easing. This could bring some relief for businesses "in the near term", he says.

Simms believes that company is well positioned to benefit from policy and regulatory factors such as the US Inflation Reduction Act and similar measures in Europe and Asia.

No new financial guidance was provided, but consensus forecasts have been tweaked slightly lower. The latest broker estimates I can see suggest earnings of 37p per share this year, with a dividend of 27.3p.

Those numbers price Impax shares on 18 times forecast earnings, with a 4.2% yield.

My view

I remain impressed by Impax's performance and profitability. The company's investment focus on sustainability is not just an ESG tick-box exercise – rather, my impression is that it focuses on investments with the ability to make a positive contribution to modern, sustainable infrastructure and societies.

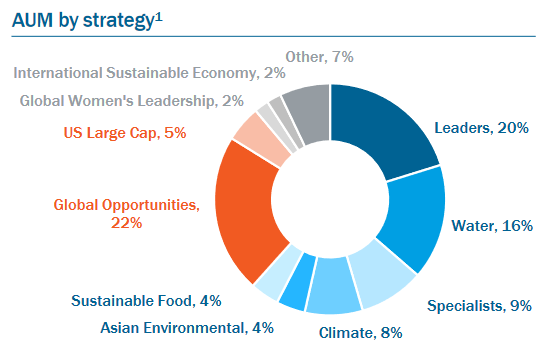

Here's how AUM was split across different strategies at the end of H1:

One shortcut to understand the type of companies held by Impax is to look at the top portfolio positions for listed investment trust Impax Environmental Markets (LON:IEM).

At present, these include FTSE 100 firms Croda International (chemicals) and Spirax-Sarco Engineering (steam management systems).

Impax shares remain relatively expensive, on 18 times forecast earnings or 2.2% of AUM.

However, I think a pricier rating could be justified here. This group is highly profitable and continuing to attract meaningful inflows, unlike some rivals.

I'm inclined to see this as a differentiated business with good long-term potential. Although I can see some near-term downside risk, I don't think the current valuation is unreasonable.

Premier Miton (PMI)

"As confidence returns to markets and to investors, we are well placed to return to growth."

Like Impax, Premier Miton's results last week were also met with a share price slump. But in this case, I think the reasons are more obvious – and perhaps more justified.

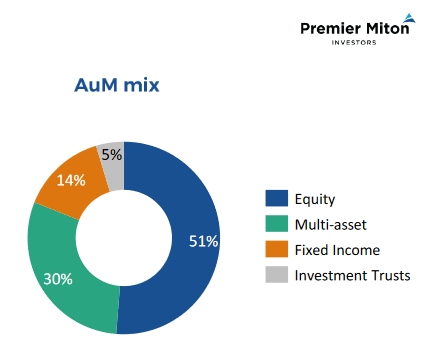

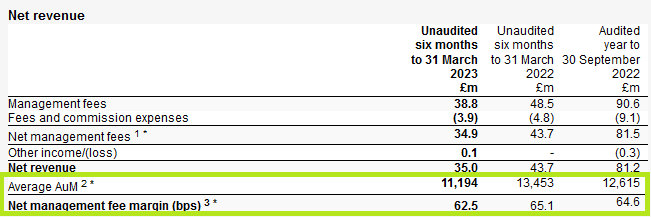

This generalist fund manager had £11.0bn of assets under management at the end of March, up by 4% from £10.5bn at the end of September. However, this level of AUM is well below the £12.8bn seen one year earlier.

Fortunately, net outflows have slowed, dropping to just £32m during the period, compared to £400m during H1 last year (and £1bn during FY22).

This performance translated into a sharp fall in profits, with adjusted pre-tax profit for the half year dropping 46% to £7.9m.

Interestingly, profits didn't fall because of higher costs. Whereas Impax is hiring and investing for the future, Premier managed to cut its operating costs during the period.

Profitability slump: Premier Miton's profits fell because of a sharp fall in net revenue, which fell by 20% from £43.7m to £35.0m during the period. This table shows the breakdown of the numbers and highlights the two reasons for this revenue slump:

This is a classic example of (reverse) operating leverage in action; a double whammy of lower AUM and lower fee margins.

My sums suggest the £8.7m fall in net revenue would have been reduced to £7.4m if fee margins had remained unchanged. That extra £1.3m could have lifted adjusted pre-tax profit to more than £9m and might have prevented a dividend cut.

This kind of situation is not unusual for fund managers in a downturn (although Impax's fee margins have remained far more stable). I think the question for investors is whether the reduction in fee margins will persist or if pricing power will return in stronger markets.

Given the competitive pressure on generalist fund managers, I'm not sure we'll see fee margins rising anytime soon.

It's also interesting to note that Premier Miton's fee margins of 0.625% is still significantly higher than Impax's figure of 0.45%.

Dividend: PMI's profit slump prompted a dividend cut that was needed to keep the payout with its targeted range of 50%-65% of adjusted earnings.

The interim dividend was cut by 19% to 3.0p per share, representing 68% of adjusted half-year earnings of 4.4p per share.

Outlook: Broker forecasts suggest a full-year earnings of 7.3p per share, with a dividend of 7p per share. This would represent 95% of forecast earnings, so I'm not sure how likely it is, but I can see that it might be possible.

These estimates price PMI shares on 11 times forecast earnings, with an 8.2% yield.

My view

Like Impax, Premier Miton faces short-term headwinds that are largely outside its control. But as a small-cap and generalist fund manager in a competitive market, I can't help feeling that this group lacks differentiation – and perhaps scale.

On the other hand, Premier Miton shares certainly look cheap to me at the moment. The shares currently trade on 11 times forecast earnings, or 1.1% of AUM – half Impax's valuation.

PMI's forecast dividend yield of 8% is also tempting, assuming it's sustainable.

My inclination at the moment is that Impax represents a more attractive long-term investment than Premier Miton. But I could be wrong.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.