The Dividend Note - quality small-cap dividends? BOOT, FNX, PGH (26/01/24)

Hunting for good dividend shares among small caps. I review this week's updates from Henry Boot, Fonix Mobile and Personal Group.

Welcome back to The Dividend Note, my weekly review of results from dividend stocks that look interesting to me.

This week's note has a small-cap theme, as I consider the latest updates from a property business, a mobile payments operator, and a company that sells insurance.

These smaller companies are all very different. I've selected them because I think they may all have the potential to provide a good quality income.

Companies covered:

- Henry Boot (LON:BOOT) - 2023 results are expected to be in line with expectations, but this property group has issued a profit warning for 2024. That's a slight disappointment, in my view, but I still think there's probably value (and income) on offer here for patient investors.

- Fonix Mobile (LON:FNX) - a strong half-year update includes a further upgrade to guidance for the full year. I admire Fonix's cash conversion and growth and suggest the business could remain reasonably valued, albeit slightly above my target price range.

- Personal Group (LON:PGH) - I think this workplace benefits group might be turning the corner after a difficult few years. This week's 2023 trading update shows improved margins and a double-digit increase in recurring revenue. There's also a 6% yield.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Henry Boot (BOOT)

"the Board now expects profitability for 2024 to be significantly below current market consensus"

Full-year trading update / Mkt cap: £250m

This week's trading update from small-cap property Henry Boot included a profit warning for 2024.

Despite this setback, I remain interested in this venerable business, which has been trading for over 100 years. I think there's a good chance that BOOT shares offer value at current levels.

Let's take a look.

Previous coverage: I last covered Henry Boot in September, when the company's interim results were published and full-year guidance was left unchanged.

The company says that "robust sales" in its property development and land management business have helped to support profits, offsetting weaker conditions in housebuilding and construction.

Chief executive Tim Roberts reassures investors that 2023 results should be in line with forecasts:

"Despite challenging market conditions for our three key markets, our ongoing focus on high quality land and development in prime locations resulted in a resilient performance in 2023. We therefore expect profit before tax for the year to be in line with current market consensus."

Consensus estimates are helpfully included in the footnotes and indicate expectations for a 2023 pre-tax profit of £37.2m. That's in line with estimates I can see in SharePad which show earnings per share of 18.8p, pricing the shares on 10 times earnings.

At this level, the expected dividend of 7.3p per share looks safe enough to me, giving a prospective yield of 3.9%.

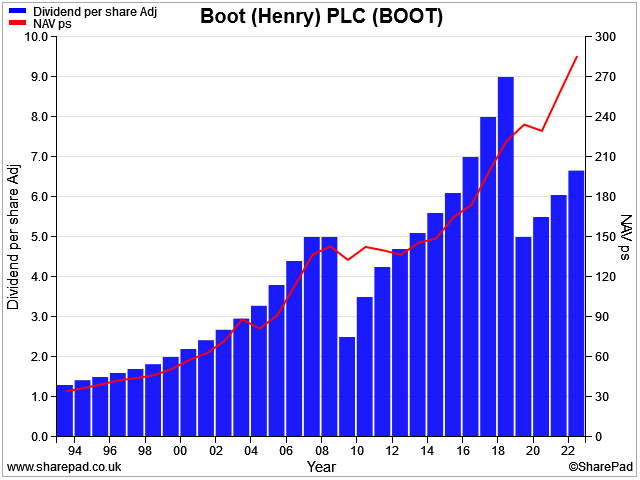

Henry Boot has a fairly decent dividend history in my view, for a property business:

The segmental results demonstrate that some parts of the UK property market continued to function well last year.

Hallam Land Management: the group's land development arm "traded well" in 2023, selling 1,944 plots to housebuilders (2022: 3,869). Average gross profit per plot is said to have increased, due to a significant freehold sale in Kent.

HLM also continued to replenish its pipeline last year, acquiring 18 new sites with the potential to deliver 7,212 plots. This increased the land portfolio to 100,972 plots (2022: 95,740 plots), of which 8,501 plots have planning permission.

Henry Boot Developments: the group's property development business is said to have performed ahead of expectations, completing schemes with a gross development value (HBD share) of £111m (2022: £83m).

The committed development pipeline is now valued at £299m (HBD share: £159m). HBD "has optionality" on a significant number of other schemes that could start within 12 months, subject to market conditions.

Stonebridge Homes: Boot's premium housebuilder managed to increase the number of homes sold last year by 43% to 251. Management say that Stonebridge's premium focus has helped protect it from the slump in new home sales reported by most larger housebuilders.

That seems quite positive to me, given that other housebuilders at similar price points such as Redrow and Bellway (I hold) have reported lower volumes.

Henry Boot Construction: trading conditions were difficult and overall results were below expectations, albeit still profitable. At this early stage in the year, 46% of the 2024 order book has been secured and the business is seeing "an encouraging number of new opportunities".

Outlook

Problems start to emerge when Henry Boot talks about the outlook for 2024. The main issues seem to relate to the housing market:

Land sales to housebuilders have been agreed on "extended payment profiles". These are now expected to take longer than expected to complete. As a result, net debt is likely to remain at the top end of the group's target range. This will mean that interest charges are higher than expected, impacting profits.

Flipping this situation around, these sales show up in housebuilders' accounts as land creditor liabilities. We might wonder why they now appear to be taking longer than expected to be settled.

Apparently (e.g. here and here), it's quite common for land payments to be linked to development milestones, such as planning permission or site infrastructure completion.

I suspect that what may be happening is that housebuilders are slowing down their progress towards these payment milestones in order to preserve cash flow until housing market conditions improve.

I should stress this is only guesswork on my part, and may not be correct. But it might explain why Henry Boot is now having to accept longer payment timeframes than originally expected – the company is hugely experienced in this market, after all.

The other factor contributing to the cut to 2024 guidance is Stonebridge Homes. Although this builder seems to have performed well last year, management has now become "more conservative" in estimating likely completions for 2024 and 2025.

As a result, a further recovery in sales is now expected to "be more weighted to 2025".

2024 profit "significantly" below expectations: Henry Boot's management say that 2024 pre-tax profit is now expected to be lower than previously expected.

Helpfully management specify previous consensus of £37.2m, so we know that the new figure will be lower than this.

From what I can see, consensus forecasts for 2024 have been cut by c.20%, giving a 2024 earnings estimate of 14.9p per share.

Analysts appear to expect the dividend to remain safe and are pencilling in a 7% increase to 7.8p.

At the time of writing, these forecasts imply a P/E of 13 and a dividend yield of 4.1%.

My view

Mr Roberts says that he believes the "the [UK] economy and our markets have turned a corner". Unfortunately, Henry Boot hasn't quite made it round the bend yet.

Joking aside, I don't think this is a major disaster. Although I'm a little disappointed that these headwinds weren't evident to management in September, I think the value case here remains intact.

One reason for my optimism is the long-term focus of the group's core land development business. This week's update highlights an example of this.

"Over 20 years ago", Henry Boot secured an option to acquire land in Swindon, in partnership with housebuider Taylor Wimpey.

In August 2021, outline planning consent was secured for 2,380 plots.

In December 2023, Henry Boot agreed to acquire the land and also agreed to sell 759 plots to housebuilder Vistry. This deal is expected to generate an annualised internal rate of return of 10% – after more than 20 years.

This may be an exceptional case, I don't know. But I feel confident that the group's land assets will remain valuable in the future and will generate further profits when market conditions improve.

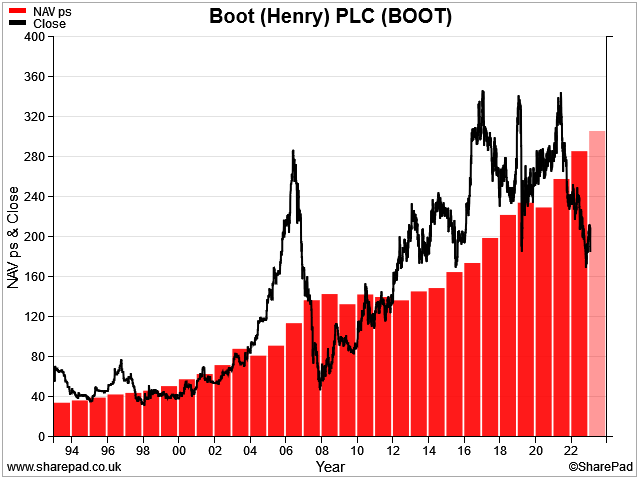

Henry Boot reported a net asset value of 303p per share in its interim results. As I write, the shares are trading under 200p, leaving the stock trading at a 35% discount to its book value.

Historically, this is unusual. And although past performance is no guarantee of future returns, similar discounts have previously provided buying opportunities:

As such, the opportunity to buy the shares significantly below book value – and with a 4% dividend yield – looks interesting to me.

Fonix Mobile (FNX)

"Fonix continues to generate strong underlying cash flows and intends to pay an increased interim dividend in March 2024"

Half-year trading update / Mkt cap: £235m

Fonix is a mobile payments specialist that allows clients in sectors such as television, gaming and charity to take payments from consumers via text messages. These are then charged to the consumer's mobile phone bill.

Usage cases include donations, competitions, ticketing and cash deposits. Clients include ITV (I hold), Comic Relief and Children in Need.

When this business appeared on the market in 2020 I initially discounted as a growth business that didn't fit into my quality dividend universe.

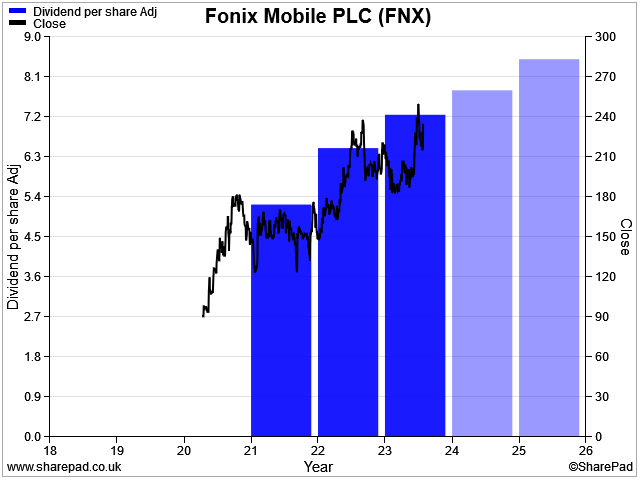

So far, that has poved to be a mistake – Fonix shares have more than doubled since then and the business has proved to be highly profitable and cash-generative, with an attractive dividend record:

Of course, Fonix's record as a listed business is still a little too short to score well in my screening system. But I can certainly see some attractions.

This week's trading update covered the six months to 31 December 2023. Gross profit for the period rose by 17.9% to £9.2m, while adjusted EBITDA for the half year was 17.7% higher, at £7.3m. These figures were ahead of expectations.

H2 performance is expected to be relatively weaker, as H1 included some one-off catch-up trading relating to the Queen's death in 2022.

Even so, management now expects Fonix's full-year adjusted EBITDA to be "marginally" ahead of previous expectations.

Adjusted EBITDA isn't my favourite measure of profit. But in fairness, past years' results have shown at least 75% conversion from adjusted EBITDA to underlying free cash flow (excluding movements in client cash):

- FY23: Adj. EBITDA £11.6m / Underlying FCF: £9.4m

- FY22: Adj. EBITDA £10.3m / Underlying FCF: £7.8m

Given this record, I'm going to assume a similar rate of conversion in FY24.

With thanks to Research Tree, an updated note from broker Cavendish Financial is available, upgrading FY24 adjusted EBITDA forecasts to £13.1m.

Assuming a 75% conversion from EBITDA to underlying free cash flow gives a figure of £9.8m, leaving Fonix trading with a forecast free cash flow yield of 4.2%.

That's equivalent to a P/FCF multiple of 24, which is also the stock's forecast P/E ratio. Not cheap, but not necessarily expensive for a growing business that generated a 100% return on equity last year.

Dividend: a dividend of around £7.8m (7.8p per share) is expected to be paid from this free cash flow, in line with the company's progressive dividend policy.

This gives Fonix shares a possible dividend yield of 3.3% at 235p.

Trading commentary: Fonix reports a 15.3% increase in total payment volumes to £158m during the half year, with a record month in December.

The company has released a new Subscription Manager product for charity customers and says it achieved 100% platform uptime during the period – important when many payments are timely and take place in surges (e.g. live TV voting and charity donations).

Management also report significant gross profit growth in Ireland. Key client relationships in this growth market have been strengthened by Fonix's decision to coordinate industry discussion on a proposed new Gambling Regulations Bill.

Apparently, this regulation could affect some of the services offered by Fonix's clients – so there's a degree of regulatory risk implied here.

I don't know what proportion of Fonix's revenue might be exposed to gambling regulation in Ireland or indeed the UK. It is something I would try to find out if I was considering an investment.

Outlook: chief executive Rob Weisz sounds confident and believes the growth outlook for the UK and Ireland "remains strong".

Weisz also says that Fonix is making "good progress on further international expansion" and hopes to make announcements on this later this year.

My view

I don't see too much to dislike here, except perhaps the potential exposure to gambling regulation.

Fonix's capital-light model supports very high returns on equity and strong cash generation. If the business can enter new markets successfully and continue to expand, then I think it could be worth significantly more in the future.

For me personally, the combination of a recent flotation and 4% free cash flow yield means that I'm going to stay on the sidelines for now.

However, barring any bad news, I might consider any pullback as a possible buying opportunity.

Personal Group (PGH)

"Continued growth in recurring revenues and a record year for new insurance sales"

FY23 trading update / Mkt cap: £56m

Personal Group Holdings provides workforce benefits and services for employers. Its main services are affordable health insurance and a benefits platform that provides discounts on third-party services.

This is the first time I've written about this AIM-listed business here, but I've kept an eye on it in recent years. Historically, Personal Group has been strongly cash generative and paid generous and reliable dividends.

The last few years have been a little more difficult. But my initial impression is that this business may now be regaining momentum under new CEO Paula Constant, who took up the role in August 2023.

I'm going to take a quick look at the 2023 highlights here, but I'm planning to take a more detailed look at the business when its final results are published in March.

2023 trading summary: Personal Group reported flat underlying revenue, but saw improved margins and continued growth in recurring revenue.

- Total revenue rose by 18.8% to £103m, but this included £54m of pass-through revenue related to voucher resales (2022: £37.4m). I guess there may have been some inflationary increase in voucher values, in addition to any volume growth.

- Underying revenue was flat at £49m (2022: £49.3m)

- Adjusted EBITDA rose by 33% to £8m, lifting EBITDA margin from c.12% to c.16%

- This performance is said to be in line with expectations; consensus forecasts indicate 2023 adjusted earnings of 14.3p per share, pricing the shares on a 2023 P/E of 12.7.

Initial efforts by the new CEO to improve profitability by focusing on insurance and the benefits platform appear to be paying off. Last year saw double-digit growth in recurring revenue streams:

- Total recurring revenue up 14% to £38.3m – 78% of underlying revenue (excluding voucher sales)

- Affordable insurance (employee-paid health insurance): annualised insurance premium income rose by 13% to £31.6m, with new annualised insuance sales up 24% to £11.8m - a record year.

- Benefits platform ('Hapi'): annual recurring revenue up by 22% to £6.1m; a big part of this comes through white-label sales, most significantly through a partnership with Sage Employee Benefits. This is providing Personal Group with an effective way to target the UK's large, fragmented SME market (disc: I hold Sage in my dividend portfolio)

- Pay & Reward (remuneration consulting): annualised recurring revenue up by 6% to £0.57m

Personal Group has historically reported net cash at the end of each financial year and this appears to remain the case. The company says it had more than £20m in cash and no debt at the end of the year.

Outlook: further detail on expectations for 2024 will be provided with the full-year results in March. This will also include the outcome of the new CEO's strategy review.

For now, the commentary sounds confident:

"Trading in the first few weeks of 2024 has been positive, reinforcing confidence in ongoing delivery moving forward."

"Confidence across the Company is high for 2024 and the Group is well-placed to deliver ongoing growth acceleration."

Current consensus forecasts on Stockopedia price the stock on 12 times 2024 forecast earnings, with a 6.8% dividend yield. That seems undemanding to me, if the recent momentum continues.

My view

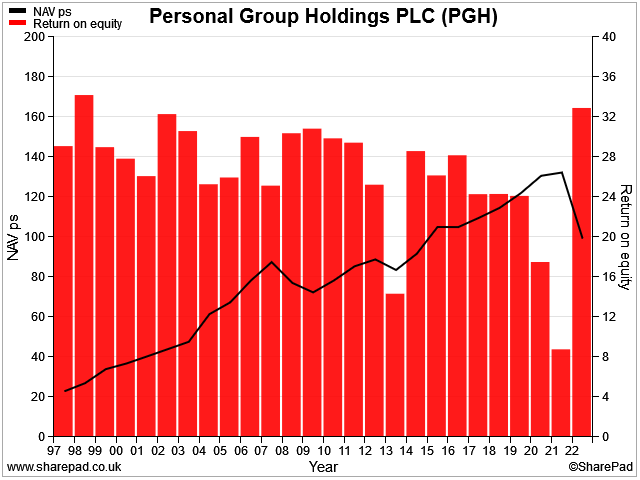

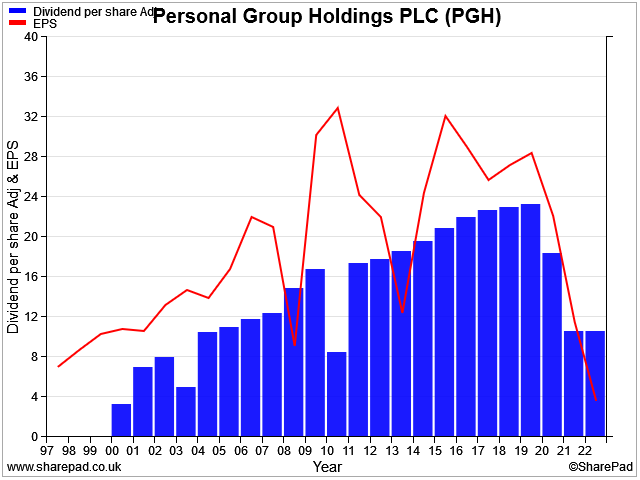

Historically, Personal Group has delivered the high returns on equity and consistent NAV growth that I look for in financial business:

Dividend payments have also been generous in the past:

My initial impression is that the group's 2023 results look positive and suggest that it may be regaining momentum.

The shares don't look too expensive to me at current levels.

I plan to take a closer look when the full-year results are published in March.

Disclosure: At the time of publication, Roland owned shares of ITV, Sage, and Bellway.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.