The Dividend Note - should I invest with family shareholders? BOOT, LTHM, JHD, JIM, MBH (29/03/24)

I review recent results from five UK dividend shares with family ownership - Henry Boot, Michelmersh Brick Holdings, James Latham, James Halstead and Jarvis Securities.

Welcome back to The Dividend Note. To round out a busy month for corporate earnings I've decided to take a look at results issued this week by dividend-paying UK small caps with family ownership.

I tend to believe that such companies are likely to place a higher priority than usual on reliable dividends, given that many of their most influential shareholders may depend on these payouts to help fund their living expenses.

However, stocks such as these can also be illiquid and require patience when buying and selling. Reporting is not always as transparent or detailed as with larger firms.

For these reasons, I think that timing and prior research are even more important than usual with such businesses – but the rewards can be considerable.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Henry Boot (LON:BOOT) - this small-cap land and property group is a quality operator in my view, but appears to suffer from limited bargaining power with its much larger customers. Despite this, I see value with the stock at a 40% discount to NAV.

- James Latham (LON:LTHM) - shares in this well-run and cash-rich timber merchant look cheap to me on many metrics, although the low dividend yield is a downside. I remain interested, though.

- Jarvis Securities (LON:JIM) - this founder-led small-cap stockbroker currently offers a forecast dividend yield of 13.9%, but is also involved in a long-running FCA enquiry. The main regulatory risk, for me, is Jarvis's heavy dependence on interest earned from client cash.

- Michelmersh Brick Holdings (LON:MBH) - this week's full-year results reinforced my positive view of this business, but the outlook does seem to carry a measure of uncertainty – perhaps a little more than usual.

- James Halstead (LON:JHD) - no comment below, but this week's interim results from this family-run flooring group show profits up and confirm my excellent opinion of the business, which looks fairly valued to me and remains on my watch list as a possible buy.

Henry Boot (BOOT)

"we remain confident in achieving our medium term growth and return targets, as reflected in the 10% dividend increase we have announced today."

2023 full-year results / Mkt cap: £241m

FY24 forecast dividend yield: 4.4%

I've looked at this land promotion, property development and construction group a few times previously, most recently in January, but also in September last year. I also discussed Henry Boot with fellow private investors Graham Neary and Mark Simpson in this podcast.

My view is that this family-owned business is likely to offer good value if purchased at the current discount to NAV, given its disciplined long-term strategy and large portfolio of land and investment property.

2023 results summary: the group's 2023 results show progress on sales, but the company was unable to offset the impact of cost inflation and labour shortages during the year:

- Revenue up 5.3% to £359.4m

- Pre-tax profit down 18.2% to £37.3m

- Net asset value up 3.4% to 300p (excluding pension surplus)

- Net debt up 29% to £77.8m

- Full-year dividend up 10% to 7.33p per share

Is BOOT providing free credit for housebuilders? A 10% dividend increase against a backdrop of falling profits and rising debt suggests to me that management are confident future returns will recover.

Looking at the accounts, the increase in debt seems to relate to working capital outflows of £31m into land and ongoing developments:

"additional investment in housebuilder inventories, strategic land sales on deferred terms and the ongoing development of schemes in progress."

Elsewhere in the report, the company notes that land sales to housebuilders are being structured with deferred completions, to support housebuilders pared-back building schedules.

I am confident this increased working capital will turn into cash. But my feeling is that Henry Boot is being forced to borrow money in order to provide free credit to its housebuilder customers.

The company confirmed as much in its January update (my bold):

"Due to extended payment profiles with major housebuilders on strategic land sales, we anticipate gearing to remain towards the upper end of our optimum range of 10-20% through 2024, and given the higher interest rate environment, we anticipate this will also impact profit for the year ahead."

BOOT's net interest payments rose from £676k in 2022 to £3.6m last year – a material increase.

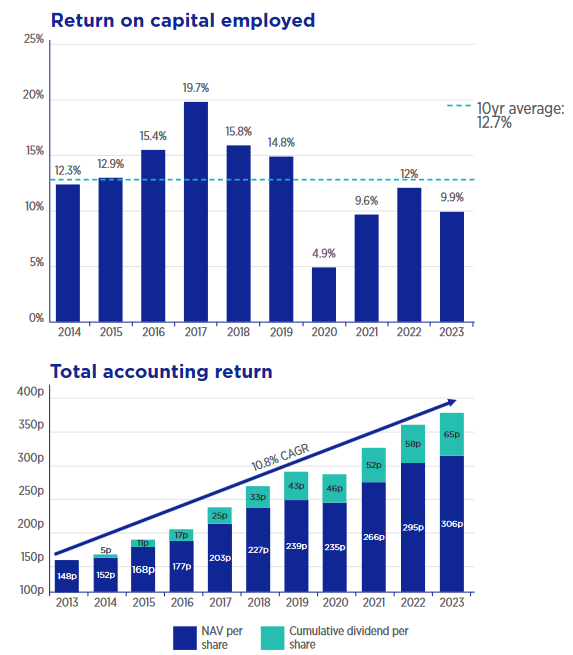

Profitability: To its credit, Henry Boot features return on capital employed (ROCE) and net asset value prominently in its reporting and corporate financial targets.

In 2023, the company reported ROCE of 9.9% and said that the capital employed in the business rose by 4.5% to £417m. I like the clarity of this reporting.

ROCE of 9.9% is nothing to write home about, but the company says that it's rolling 10-year average is 12.7%, within its target range of 10%-15%. I think this is high enough to be potentially attractive, given the stock's current deep discount to book value.

Trading commentary: while BOOT's construction and plant hire businesses suffered last year, headline operating metrics from the group's two largest divisions do not seem too bad to me.

Land promotion (2023 op profit: £21.4m): plots sold fell to 1,944 (2022: 3,869), but average profit per plot rose to £15.5k due to a high-value sale of land at Tonbridge Wells.

Using the company's planning average of £7k per plot, management estimate the current portfolio of 100,972 plots could deliver gross profit of c.£710m over time.

Planning delays contributed to a fall in the number of plots with planning permission to 8,501 (2022: 9,431).

Property development (2023 op profit: £22.2m): this division includes commerical property (mostly industrial) and housebuilding, through a JV called Stonebridge Homes.

Stonebridge – which is an upmarket offering – appears to have performed surprisingly well last year, increased the number of homes sold by 43% to 251. A more measured 10% increase to 275 is expected this year, en route to a medium-term target of 600.

The group's commercial development business (HBD), completed £111m of developments last year (sold/pre-let) and has a committed pipeline worth £159m for 2024 (50% sold/pre-let).

HBD's overall pipeline has a development value of £1.3bn, up from £1.25bn at the end of 2022.

Outlook: I don't think there was much change in the outlook guidance compared to BOOT's statement in January.

While the company believes that the housing market may be "turning a corner", 2024 profits are expected to be weighted to the second half. Management do not seem to expect a material recovery in housing until 2025.

Broker consensus forecasts suggest earnings could fall by a further 20% to c.15p per share this year. However, net asset value is expected to improve slightly and the dividend is expected to rise by c.7% to 7.8p per share, giving a prospective yield of 4.4%.

My view

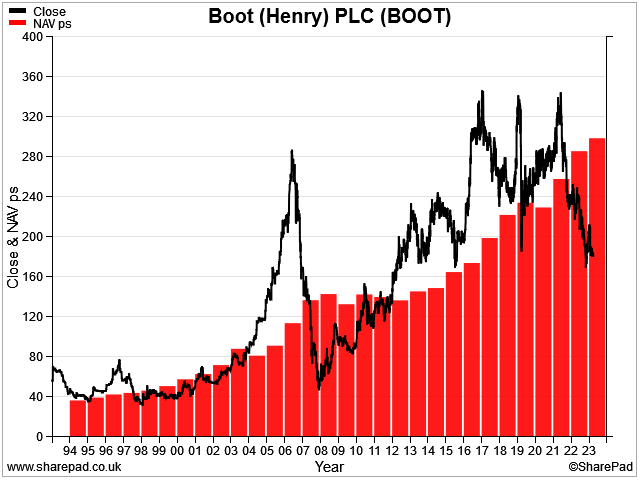

My feeling is that Henry Boot's 40% discount to book value is likely to represent at attractive entry point.

Past performance is no guide to future returns, but historically, buying BOOT shares at a discount to net asset value has worked well. However, anyone holding through the cycles has had to stomach some sharp drawdowns:

Looking ahead, I wonder if higher debt costs could continue to put pressure on profits for a while, slowing any recovery.

On balance I remain positive about the outlook here and would be comfortable buying BOOT at current levels. I think it's a well-run business with a strong franchise.

However, a caveat to this would be that I suspect the company's dependence on larger customers and the capital-intensive nature of its activities means that profitability will always remain relatively average.

For this reason, I'd only want to consider buying when the shares are depressed, as I believe they are at the moment.

James Latham (LTHM)

"We anticipate that our profit before tax will be in line with market expectations."

Trading update for y/e 31 March 2024 / Mkt cap £226m

FY24 forecast dividend yield: 2.5%

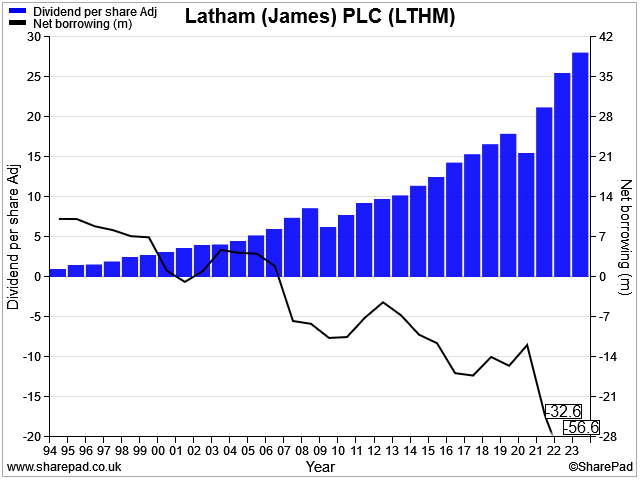

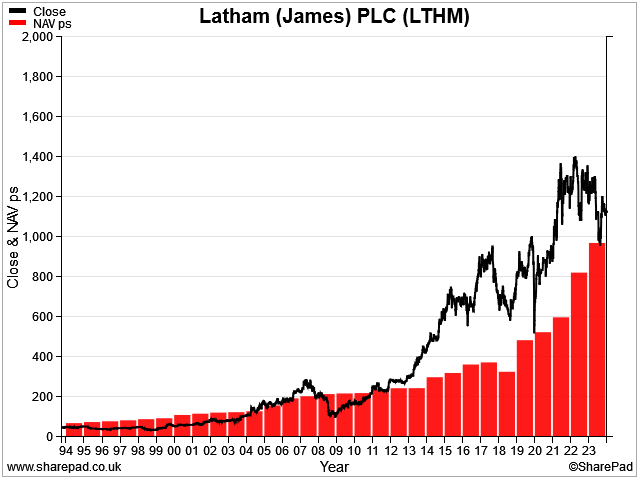

Latham's full-year update was brief but reassuring, suggesting that this timber merchant group will report results that value its shares on around 11.5x FY24 forecast earnings. For a cash-rich business that typically generates a mid-teens return on equity, I think this should be cheap.

I guess we'll have to wait for the full-year accounts to be published in June for any guidance on the outlook for the year ahead. But this statement did confirm that Latham's balance sheet and cash balances "remain strong".

This is potentially something of an understatement. Latham's half-year results showed net cash of £65m excluding lease liabilities.

Holding plenty of cash allows the company to take advantage of early settlement discounts with suppliers and flex it's stock levels when needed. But the half-year results show net cash almost equal to the value of Latham's entire inventory!

Cash levels have never been this high, so I have to wonder at what point the group's family management will decide to deploy some of this cash or return it to shareholders.

Special dividends have been paid in the past, while the company's dividend cover of more than three times earnings should also provide scope for an increase.

My view

On many metrics, James Latham looks very cheap to me at the moment. In addition to the P/E of 11.5, the stock's 2024 forecast EBIT/EV yield of 14% also looks very attractive.

The main risks I can see are that sales will be weaker than expected this year – or that the company will face greater price pressure than in the past, perhaps driven by some recent consolidation in this sector.

The low dividend yield of 2.5% is a little offputting for me, given that this looks like a fairly mature and slow-growing business. But a long record of strong profitability and steady dividend growth is tempting.

Historically, buying Latham shares when they've traded close to net asset value has been a good trade. We're not quite there at the moment, but this stock scores highly in my dividend screen and remains on my watch list.

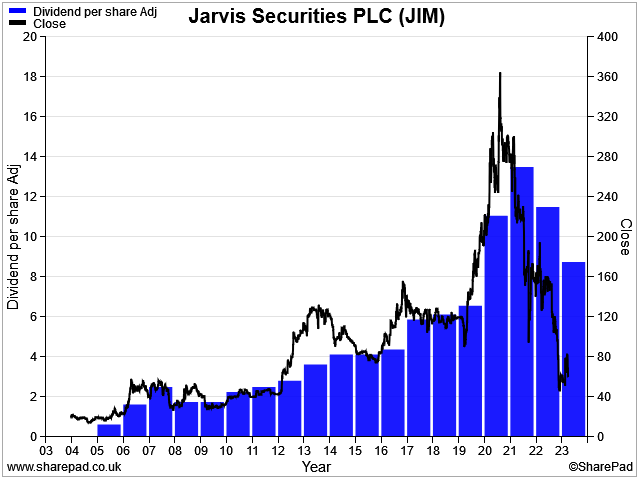

Jarvis Securities (JIM)

"Overall, we have traded in line with current expectations for the year."

2023 full-year results / Mkt cap £27m

FY24 forecast dividend yield: 13.9%

This small-cap stockbroker was a long-term favourite among AIM dividend investors, but has come unstuck somewhat over the last couple of years after attracting the attention of the FCA.

After a pause at the end of last year, dividends have now been resumed. And if the 2024 forecast payout of 8.4p per share is delivered and proves sustainable, Jarvis shares could offer a dividend yield of 13.9%.

Founder Andrew Grant remains both chairman and a 37% shareholder, satisfying my family-friendly dividend requirement.

FCA update: the FCA skilled person review into Jarvis initially led to the company accepting some voluntary restrictions on its Model B Corporate Client service.

However, the company says a lot of work has now been done to remediate any concerns and improve compliance. The FCA skilled person is due to begin a review of the company's remediation following the (delayed) publication of its draft report into the first stage of its enquiry.

However, my impression is that any impact from higher costs and/or lost clients is probably in the numbers already.

I'm a little more concerned about the current phase of the enquiry, which the company says includes:

"uninvested client cash, interest retention and term deposits."

This has become a hot topic generally among stockbrokers in recent months, but my impression is that Jarvis relies more heavily than most on interest from uninvested client cash. On this topic, the company says:

"Any potential impact on those income streams from reductions in funds held should become clearer in the coming months."

I think there's a lack of transparency here in the company's reporting, compared to big players such as Hargreaves Lansdown and AJ Bell. As far as I can see, Jarvis doesn't report assets under management, the amount of uninvested client cash, or the proportion of interest earned on this cash that's retained by the company.

For contrast, Hargreaves reports all of these measures and said recently that it retained 41% of interest earned on client cash during the first half of its current financial year.

2023 results summary: Jarvis's 2023 results were in line with forecasts. Broadly speaking, the benefit of higher interest rates helped to offset lower stock market trading voluumes and the loss of some clients as an indirect result of the FCA enquiry.

Revenue for the year rose by 3.8% to £13.1m, while pre-tax profit fell 15.1% to £5.2m. This fall reflected modest cost inflation, but the main reason for the decline was a £1.3m charge for exceptional costs relating to the FCA enquiry.

Despite this, cash generation was positive and the group's year-end net cash balance rose by 28% to £5.5m.

Profitability: despite the impact of the FCA-related costs, this remains an extremely profitable business. Jarvis's 2023 results imply an operating margin of 40% and a reported return on equity of 79%.

Dividend: Jarvis pays quarterly dividends. The company paid three interim dividends totalling 8.75p per share in 2023, but skipped its fourth-quarter payout.

In February, the company declared a Q1 dividend of 1.75p per share and broker forecasts suggest a full-year payout of 8.4p for 2024, giving the prospective 13.9% yield I mentioned earlier.

Interest earned: Jarvis reported gross interest earned of £7.6m last year, representing 58% of its total revenue of £13.3m (2022: 43%). I assume that substantially all of this interest was generated from uninvested client cash, highlighting the significance of this income stream.

Fees and trading commissions made up the remaining £5.5m of revenue, split fairly equally.

Outlook: no real comment on the outlook for 2024 was provided in the results, perhaps understandably.

House broker WH Ireland is forecasting adjusted earnings of 11.4p per share (2023: 11.9p) for the year, after excluding expected FCA-related costs.

That estimate prices Jarvis stock on five times earnings, with the previously-mentioned dividend yield of 13.9%.

My view

The valuation here is clearly intriguing, for a company with a long record of strong profitability and reliable shareholder returns.

For me, the downside is that the FCA Consumer Duty regime appears to have prompted the regulator to take a much closer look at how brokers are managing and profiting from uninvested client cash.

Although a pick-up in stock market volumes could help offset the impact of any reduction in retained interest income, I think it's fair to assume there's some downside risk here.

The question is whether it's severe enough to derail the investment case. I'm not sure. But in general, my experience is that a 14% yield is rarely sustainable.

Michelmersh Brick Holdings (MBH)

"Positive financial performance in 2023, with earnings for the year ahead of market expectations"

2023 full-year results / Mkt cap £95m

FY24 forecast dividend yield: 4.6%

Co-founders Martin Warner and Eric Gadsden continue to control around 28% of the shares in this premium brickmaker. I covered Michelmersh's interim results in September and was impressed by the quality and attractive valuation of the business, as I saw it.

Fast-forward six months and results for 2023 appear to be pretty sound, with earnings "slightly ahead" of expectations.

2023 results summary: Michelmersh's revenue rose by 13% to to £77.3m last year, including the benefit of an acquisition. On an organic basis, revenue rose by 1.3%, reflecting higher prices and lower volumes.

Gross margin was broadly stable at 38.9% (2022: 39.4%) suggesting the company was able to successfully pass through higher costs to customers. Pre-tax profit for the year rose by 8.8% to £12.5m, supporting earnings of 10.44p per share.

The full-year dividend was increased by 5.9% to 4.5p per share, giving a yield of 4.5%.

Michelmersh's balance sheet continues to look very strong to me. Good cash generation meant that net cash rose to £11m (2022: £10.6m). The company also has an undrawn £20m debt facility.

Trading commentary: management says that its diverse customer base and differentiated product lines supported demand in 2023, and that full production capacity was maintained.

However, the company also commented that stock levels across the brick sector in the UK are now well above five-year average levels, while 25% of UK production capacity has now been mothballed.

Depending on the timing of a recovery, this seems to suggest the next 12 months could see either a supply glut or a supply crunch. However, as I've discussed before, Michelmersh offers product choices not supplied by the volume UK brickmakers. This may provide some protection in an oversupplied market.

Outlook: Michelmersh says its focus for 2024 is on providing pricing stability and a balanced order book. The company expects to see "resilient order intake" from its diverse customer base.

In a change from last year, only 70% of energy costs have been hedged for 2024, reflecting management's hope that more favourable forward prices will become available.

The group's differentiated and premium products are a key element of its attraction for me. But I can't help feeling that the outlook for the year remains more uncertain than usual.

House broker Canaccord Genuity also seems to sense some uncertainty and has made modest cuts to its revenue forecasts for both 2024 and 2025, according to a note available on Research Tree.

However, Canaccord's analysts expect margins to strengthen and has left their earnings forecast for this year unchanged at 10.7p per share (2023: 11.5p), pricing the stock on 9.5 times forecast earnings.

My view

Michelmersh shares are trading close to book value and the group's net cash covers more than 10% of its market cap. Although I'm unsure about the near-term outlook, I think that the shares are probably attractive at under 100p on a long-term view.

I don't see too much risk to the 4.5% dividend yield, either.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.