Dividend notes: quality shines through - CTO, SPT, DPLM (13/07/23)

In these notes I review the latest updates from small-cap T Clarke and FTSE 250 firms Diploma and Spirent Communications.

Welcome back to my dividend notes. Today I'm revisiting two FTSE 250 shares I covered in May and looking at a popular small cap I haven't written about here before (but have owned in the past - no position now).

Before I get started, I'd just like to mention a new podcast recording I took part in recently.

In the latest episode of the Investor's Roundtable, I joined well-known private investors Maynard Paton, Bruce Packard and Mark Simpson to discuss Tristel (TSTL), Ocean Wilsons (OCN) and micro-cap software firm Arcontech (ARC). There was lots of good insight (and debate!). Find out what we thought here or listen below:

Companies covered in today's dividend notes:

- T Clarke (LON:CTO) - a solid set of results from a respected business, with the promise of a stronger second half. But slim margins, dilution and high levels of boardroom pay deter me, even though CTO scores well in my screen.

- Spirent Communications (LON:SPT) - this FTSE 250 network testing specialist remains temptingly priced in my view, but the heavy H2 weighting and inconsistent track record of the group leave me unsure.

- Diploma (LON:DPLM) - I'm a fan of this specialist distribution group, but I'm continuing to baulk at the price (perhaps mistakenly). A quality business that's trading well, in my opinion.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

T Clarke (CTO)

"Forward order book at record level"

This London-focused electrical engineering contractor is one of the highest-ranked stocks in my dividend screen at the moment. Today's interim results appear solid, if not spectacular, with this small cap (£58m) business reporting a record £781m order book.

However, despite these apparent attractions, I don't expect to find myself owning the shares in my dividend portfolio. There are a couple of reasons for this. Let's take a look at the results and then I'll explain why I'm not interested.

Financial highlights: today's half-year numbers cover the six months to 30 June 2023. In my view, they highlight both the risk and attractions of this business.

Revenue was almost unchanged at £207m (H1 22: £206m), but pre-tax profit fell by 13% to £4.8m due to an increase in overheads and finance costs.

Earnings per share fell by 15% to 8.7p, but dilution from the £10.7m equity placing on 6 July means that if this figure was calculated today, it would be lower. This cash has been raised to support future growth, but will result in a hit to earnings per share this year.

T Clarke's operating margin fell from 2.9% to 2.8% during the period, reflecting higher costs.

Cash flow also suffered, with net cash from operating activities falling from £5.3m to just £1.0m. As a result, the group's net cash balance fell from £7.2m at the end of June 2022, to £4.5m at the end of last month.

In fairness, underlying operating cash generation was unchanged from the same period last year, at £7.3m. But a £5.2m working capital outflow combined with higher tax and interest charges to reduce net cash flow from operations.

Outlook: the company expects to report significant revenue growth during the second half of the year, allowing it to meet its target of £500m in annual revenue.

An updated note today from house broker Cenkos (available on Research Tree) suggests adjusted earnings will fall by 11% to 17.4p per share in 2023, before rising to a forecast figure of 24p per share in 2024.

This reflects higher costs and the dilution from the recent placing in 2023, followed by expected gains from new growth in FY24 onwards.

Dividend growth is expected to be maintained despite the increased sharecount. Cenkos expects the payout to rise by 11% to 5.9p per share this year, giving a prospective yield of 4.5%.

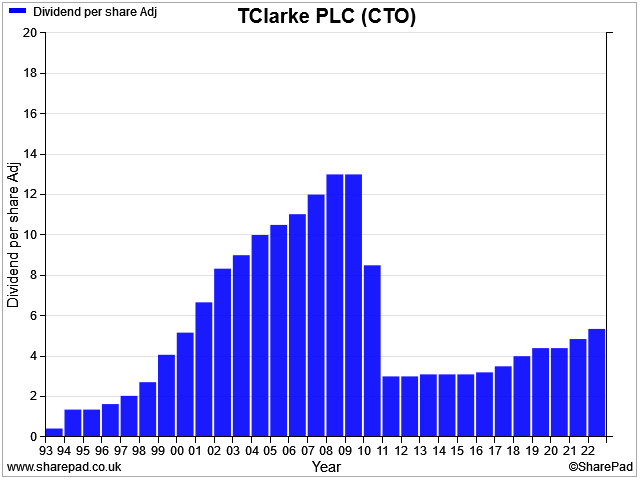

T Clarke has paid a dividend for the last 31 years, but this has included a number of cuts and the current payout is well below historic highs:

Cash / recent placing: T Clarke's net cash balance looks reassuring, but I don't think this cash is really surplus to requirements. Contracting companies like this need to have plenty of cash to fund new contracts, and to convince customers of their financial strength. No one wants to risk having a key contractor fail mid-project.

T Clarke's balance sheet at the end of the half year showed £110m owing from customers and £99.5m owed to suppliers, in addition to £15m of bank debt. These are big numbers for a company that's generated revenue of £427m over the last 12 months. I think they highlight the need for cash – and the risk of a liquidity problem if anything unexpected happens.

Customer payment terms are pretty generous, too. My sums suggest that it took an average of 94 days for T Clarke to convert money owed into cash received over the last year.

That's slow, but not especially unusual in the construction sector.

My view

Slow payments and low profit margins are two of the reasons why construction and contracting firms have a reputation for being (financially) accident prone – and why I rarely invest in them.

If costs overrun or new work dries up, companies can rapidly run short of cash to pay their own bills.

T Clarke seems quite well managed to me and appears to offer a somewhat differentiated service. Its directly-employed workforce has a reputation for delivering complex commercial projects such as data centres and large office buildings. The group has been in business since 1889.

Even so, operating margins not risen above 3% since the 2008 crash, highlighting the slim profits in this sector. The must also remain susceptible to the impact of a broader economic or construction sector slowdown.

Pension black hole? T Clarke's long heritage means it has a sizeable finaly salary pension scheme. Although closed to accruals, this continues to absorb cash.

The scheme assets had a fair value of £28m at the end of June, giving rise to a £11m deficit when compared to future obligations of £39m.

A more useful measure I use to gauge whether a pension scheme will need regular cash injections is to compare the pension payments with the value of the scheme's assets.

T Clarke reported £2.8m of benefits paid last year. When compared to scheme assets of £28m, this implies a 10% rate of return would be needed to support future payouts without further company contributions. I think this is unlikely to be achievable.

Deficit reduction payments are currently set at £1.2m per year. I suspect that the pension scheme could remain something of a black hole for cash.

Generous director remuneration: one other factor that's caught my eye about this business is that the top directors appear to be quite generously paid. Total remuneration for CEO Mark Lawrence and the two other executive directors totalled £4.3m last year. Non-execs collected a further £278k.

Total boardroom remuneration of £4.6m represented nearly 45% of last year's pre-tax profit of £10.3m. I think that's quite high. By way of contrast, dividend payments totalled about £2.4m, or less than a quarter of pre-tax profit.

Final thoughts: I think T Clarke is probably a good business to work for and a reliable supplier to its customers. But I'm not convinced that it's likely to be a great investment, at least, not at this point in the cycle.

If the company was priced at distressed levels during a downturn, I might consider it as a cyclical turnaround play. But I don't see the shares as a good fit for my dividend portfolio.

Spirent Communications (SPT)

"Full year expectations unchanged although materially heavier weighting to second half"

I covered the previous trading update from FTSE 250 network test and assurance business Spirent in May, and then followed up with a more detailed dividend share review later that month (Is Spirent Communications a quality compounder?)

Check out these pieces (free to read) for more background on my view of this business.

Q2 trading highlights: after a slow start to the year, trading is said to have improved during the second quarter.

Even so, Spirent's half-year numbers are still expected to be down sharply compared to the same period last year:

- Half-year revenue down 20% to $224m

- H1 order intake down 19% to $239m, compared to the same period last year

- Improved performance in Q2: "order intake in the second quarter broadly similar to same period last year"

- Order book up 6% since December 2022 to $304m

- "Increasing order pipeline and conversion rate with important 5G and Positioning wins"

- "Near to closing a significant lab and test automation opportunity for a brand new strategic customer segment, Financial Services"

Outlook: full-year expectations are unchanged, but management stress again that there will be a "materially heavier weighting to the second half".

Interestingly enough, T Clarke (above) also expects an H2 weighting. So is economic activity picking up, or are these companies likely to issue profit warnings later this year?

My feeling is that it's about 50/50 – I continue to think there's a risk of a profit warning from Spirent later in 2023, but it's certainly not a foregone conclusion.

Consensus forecasts today price suggest earnings of 15.9 per share for 2023, with a dividend of 7.6p. That prices the stock on 14 times earnings, with a 3.4% yield. That doesn't look unreasonable to me, for a cash-rich business that generated a 22% return on capital employed last year.

My view

I continue to think that Spirent Communications shares could offer decent value at current levels. I think it does have many of the characteristics I look for in a quality business.

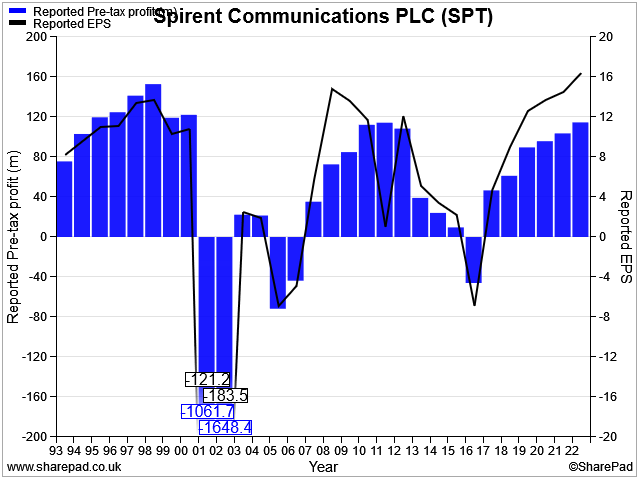

However, as I explained in May, I have reservations about the inconsistent track record of this business and its history of regular strategy updates.

Things may be different this time – if so, I may be missing out. But for now, I'm going to remain on the sidelines.

Diploma (DPLM)

"The first nine months of FY 2023 have increased our confidence in our full year guidance"

I would argue that distribution group Diploma is probably a better quality business than Spirent (above), due to its historic ability to generate compound growth.

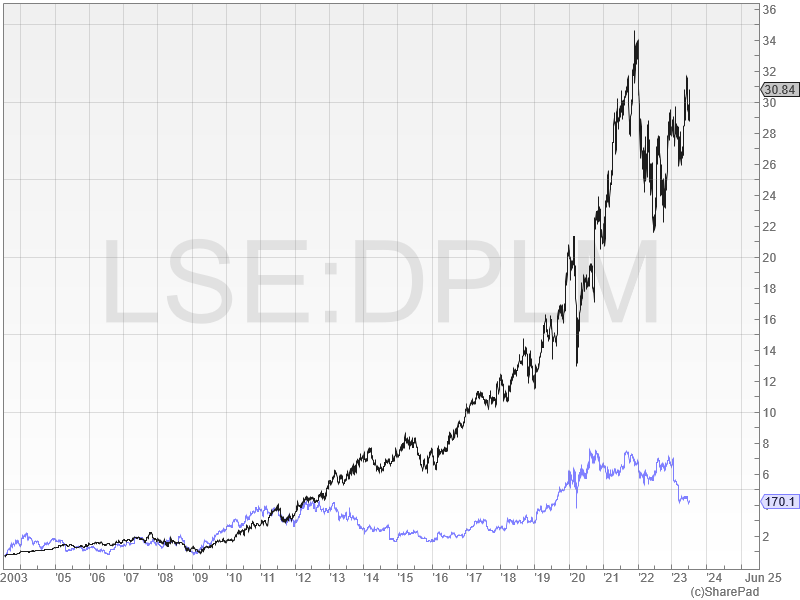

This share price chart comparing the two over the last 20 years tells the story, in my view. Changing the timeframe to one, five or 10 years still shows Diploma outperforming:

Naturally this kind of success doesn't come cheap. But Diploma's latest quarterly update suggests the company is continuing to perform well and is avoiding the revenue slumps reported by some other industrial businesses (including Spirent).

(For more background on Diploma, I covered the firm's half-year results in May)

Q3 update: today's update covers the nine months to 30 June. It's short, but fairly sweet, reiterating May's guidance with additional confidence.

- Reported revenue growth of 21%; this is split out into 9% organic, 8% acquisitions and 4% from foreign exchange gains

- Sales growth was said to be "broad-based" across Controls, Seals and Life Sciences divisions

- Today's acquisition of fluid power solutions business DICSA for £170m will be integrated into the European Seals business and is expected to contribute 5% earnings per share growth in its first full year. This seems a reasonable price, at first glance.

- Diploma has made eight bolt-on acquisitions for £26m since the end of the half year

Outlook: with nine months of the financial year complete, management has "increased confidence" in the full-year guidance issued in May, which is unchanged in this update:

- Organic revenue growth of c.7%, with a further 7% contribition from acquisitions

- Adjusted operating margin is expected to be around 19%.

- Free cash flow conversion of c.90%

These are excellent metrics, in my view.

Broker consensus estimates for Diploma price the stock on a FY23 forecast P/E of 25, with a prospective dividend yield of 1.9%.

My view

This update strengthens my previous view that Diploma is a quality business I would quite like to own share in.

The question, of course, is how much should I pay?

Diploma currently scores 60/100 in my dividend screen, reflecting its quality metrics but relatively steep valuation and low yield.

Checking two of my preferred valuation measures, the shares do indeed look quite fully priced on a trailing 12-month view:

- EBIT/EV yield: 4.3%

- Free cash flow yield: 3.8%

A business that earns 15%-20% returns on equity and has a 20+ year record of dividend growth probably deserves some kind of valuation premium, but for me, this is still a stretch.

Mind you, I might be wrong to refuse to pay up.

Genuine quality compounders are quite rare and almost always expensive. But the current share price of almost £31 looks quite full to me. For now, I'm going to continue watching and hope that a better buying opportunity arises at some point.

After all, Diploma's share price traded at £26 as recently as April and hit a 52-week low of £22 in September last year.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.