The Dividend Note - quality operators - RS1, CWK + AJB, IHP, HL (24/05/24)

This week I've been taking a look at recent results from FTSE 250 dividend shares RS Group and Cranswick, plus news from investment platforms AJ Bell, Hargreaves Lansdown and IntegraFin.

Welcome back to The Dividend Note, my weekly look at UK dividend shares I might be interested in adding to my portfolio.

This week I've looked at electronic component distributor RS Group and meat producer Cranswick. But I want to start with a quick look at the latest news from three of the UK's largest listed investment platforms.

Market gains

AJ Bell (AJB) and IntegraFin Holdings (IHP) tend to report results close together. Both released half-year numbers this week.

These figures suggest to me that the downturn in the platform/asset management sector – and the opportunity to pick up some attractive dividend yields – may now be receding.

AJ Bell reported H1 pre-tax profit up 47% to £61.4m, while IntegraFin reported pre-tax profit up 16% to £32.4m.

AJ Bell's platform serves both retail customers and advisers, while IntegraFin only serves advisers.

Both companies generate a proportion of their fees from charges based on the value of assets under management. This means that rising markets provide a boost to profits, in addition to the benefit generated by net inflows.

I thought it was interesting to see how the balance between inflows and market movements has shifted over the last six months.

In its 22/23 financial year, AJ Bell's assets under administration (AUA) rose from £64.1bn to £70.9bn. 62% of this increase came from net inflows, with the remaining 38% from market movements.

During the first half of the current year, that split reversed. Between October and March, 69% of AJ Bell's AUA gains came from market movements, with only 31% from net inflows.

For IntegraFin, the split was 55%/45% in favour of inflows in FY23. This reversed sharply to an 82%/18% weighting in favour of market gains in H1 FY24.

IntegraFin was more dependent on market movements than AJ Bell because its net inflows slowed in H1, falling by 31% to £1.1bn when compared to H1 last year.

In contrast, AJ Bell's half-year net inflows rose to £2.9bn, versus £2.0bn last year. In both cases, however, the sharp rise in H1 profits was partly driven by rising markets.

When asset values rise, fee income as a percentage of assets increases without having any impact on platforms' fixed operating costs. This drives the positive operating leverage that causes profits to rise faster than revenue, as we saw in H1.

This effect – but in reverse – has weighed on UK fund managers' results over the last couple of years. I suspect this period is now over and expect to see stronger results from UK asset managers over the coming months.

My view

I've covered both AJ Bell and IntegraFin in these notes already this year, most recently here. This week's results do not change my views and I remain a fan of both businesses.

My feeling at the moment is that AJ Bell probably has superior growth prospects, due to its strong brand and dual focus on retail customers and advisers.

However, with shares in both firms up by 40%-50% from the lows seen in December last year, I'm not seeing the same kind of value that was there previously. For me, the shares are up with events for now. I would be looking for a better opportunity to buy.

I note that AJ Bell founder Andy Bell may agree – following this week's results he sold 7.5m shares at 375p, collecting £28m and reducing his holding by 1.8% to 18.7% (£310m).

Hargreaves Lansdown

We also learned last week that market leader Hargreaves Lansdown (HL) has received bid interest from a private equity-led consortium.

The company says it has rejected an offer at 985p, prompting the shares to levels last seen in 2022.

I have been positive on Hargreaves for a while due to its high margins, strong cash generation and 40% share of the UK retail investment market.

I covered the stock in a detailed review back in November 2022, shortly after the shares dropped to the 800p level.

More recently, in May, I published an in-depth piece on Hargreaves for Stockopedia subscribers. My valuation estimate of c.930p was based on a steady-state scenario, but I agree that for a private buyer (or in the event of a return to stronger growth), the business should be worth considerably more.

It will be interesting to see if Hargreaves manages to secure an offer that's acceptable to founders Peter Hargreaves and Stephen Lansdown, who still control around 25% of the stock.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend-paying companies that are of interest to me. In general, these are stocks that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- RS Group (LON:RS1) - this electronic component distributor is one of the largest in its sector. Although it's suffering from a post-pandemic demand slump, I think the fundamentals could support a strong recovery when market conditions improve.

- Cranswick (LON:CWK) - this meat producer has an outstanding record as a compounder and has delivered 34 years of unbroken dividend growth. The latest results look good enough to me but it looks like growth could slow this year. I wonder if a better buying opportunity might emerge as the 2% yield is too low for me to consider in my income portfolio.

RS Group (RS1)

"Results in line with market expectations, revenue down 1% with 8% like-for-like decline"

Results for y/e 31 March 2024 / Mkt cap: £3.6bn

FY25 forecast dividend yield: 3.0%

Electronic component supplier RS Group has been one of the higher-scoring stocks in my dividend screening results for a while. But the company has been battling a post-pandemic slowdown in demand and navigating the impact of cost inflation and supply chain disruptions.

I've looked at this business a number of times and been attracted by the historically strong quality metrics. When I reviewed RS Group's interim results in November I said I didn't see any reason to rush in, given the ongoing headwinds.

This week's full-year results cover the year to 31 March and suggest the company is still working through a difficult period.

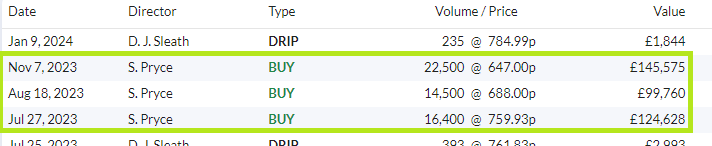

Even so, the full-year dividend for FY24 was lifted by 5% to 22p. I also note that CEO Simon Pryce has spent £370k buying shares over the last year, according to Stockopedia data.

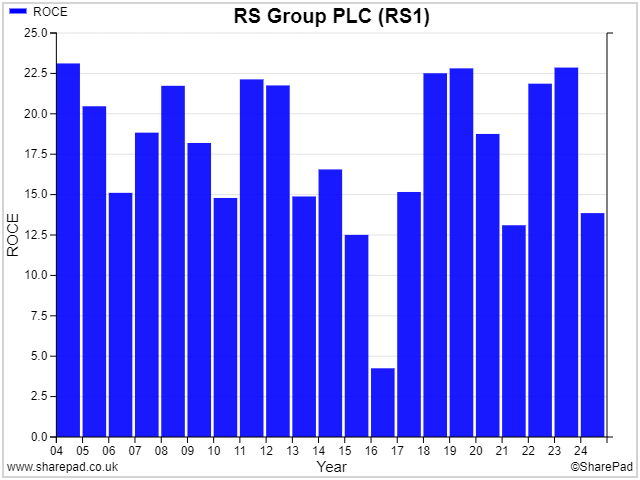

Both facts seem to suggest Pryce is confident in his ability to return the business to growth and rebuild returns on capital to the 20%+ levels enjoyed in the past.

2023/24 results summary: RS Group's headline numbers for last year highlight the drag on profits caused by lower volumes:

- Revenue down 1% to £2,942m

- Like-for-like revenue -8%, acquisition revenue +10%

- Operating margin down 3.3% to 9.5%

- Pre-tax profit down 33% to £249m

- Earnings down 36% to 38.8p per share

- Dividend up 5% to 22.0p per share

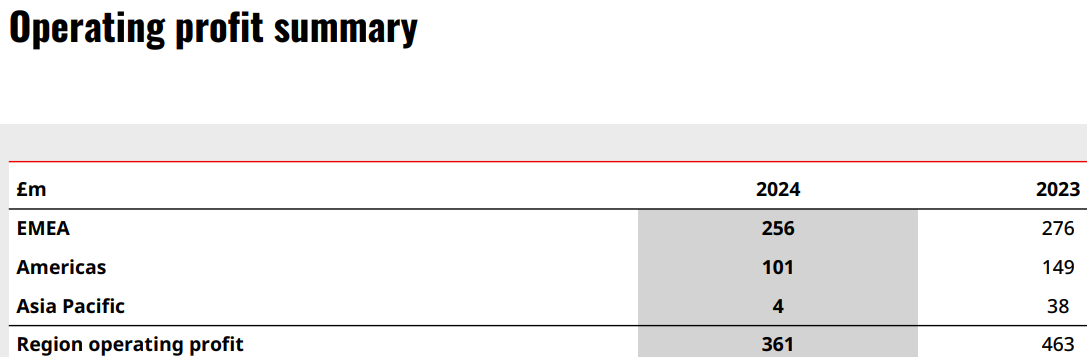

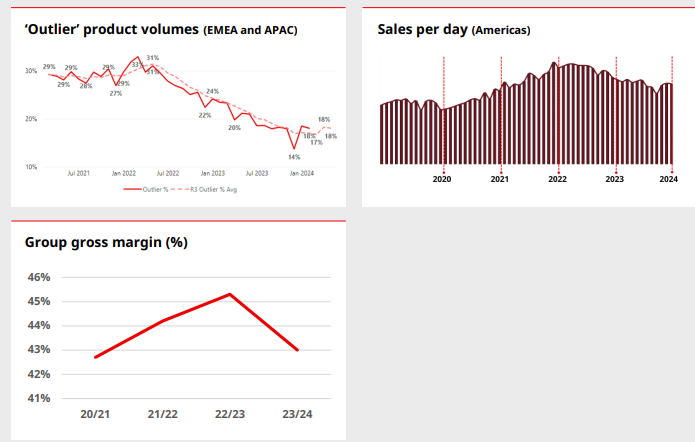

The business operates globally, but it's largest and most mature markets are in EMEA. Profit slowdown in these markets was less pronounced than elsewhere:

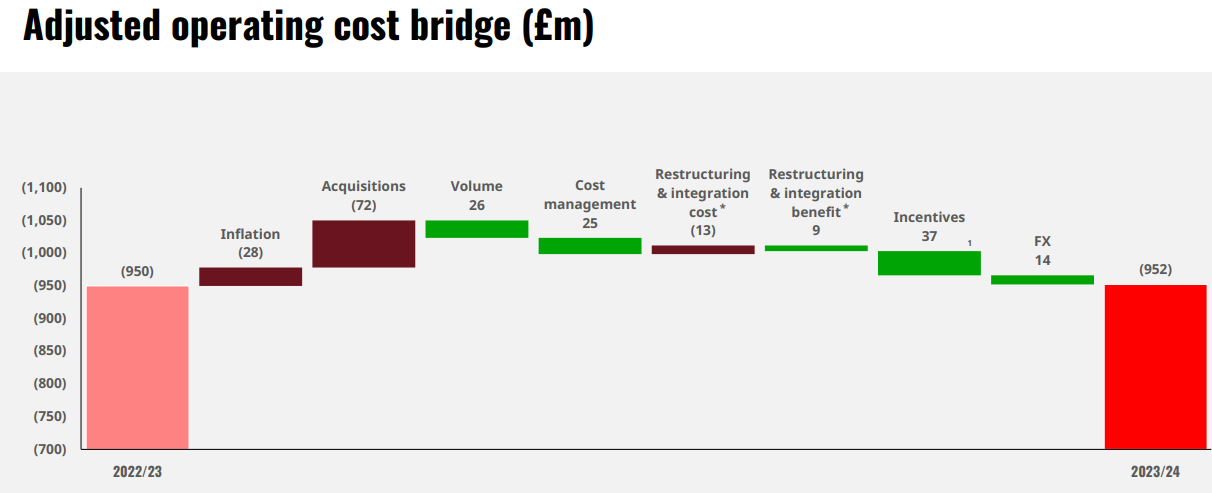

Lower volumes have depressed margins and profits as the group's cost base has remained broadly flat. This is a classic example of reverse operating leverage (see my comments on Victrex (VCT) last week):

However, I think the company does make a reasonable case when it argues that what's happening is at least partly the unwind of a significant boom in demand during the pandemic:

I'd hope to see these charts level out a little over the next year or so. Any failure to achieve this might suggest the group is losing market share, which would concern me.

Inventories: one point that caught my eye in November was a sharp increase in gross inventories during the first half of the year, from £660m to £799m. This was caused by a slowdown in demand, just at the same time as order backlogs from RS's suppliers were delivered.

Management guidance was for this situation to unwind in H2, and this does seem to have happened. Gross inventories fell from £799m to £725m during the second half of the year.

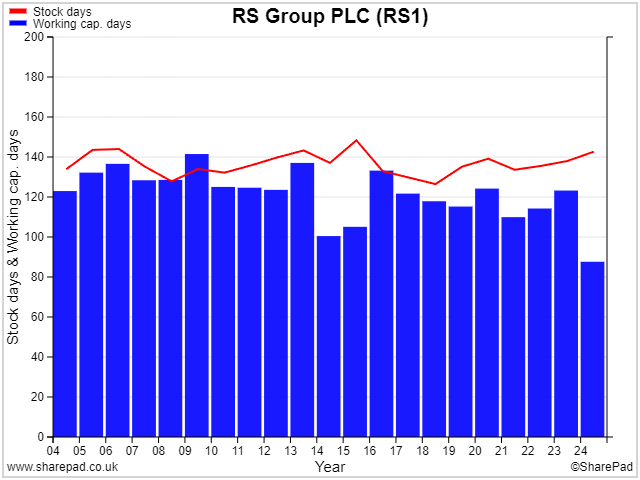

RS says that stock turnover for the full year was flat at 2.6x – equivalent to 140 days. This appears to be within the normal range for this business. Indeed, SharePad data suggests RS has become slightly quicker at converting stock to cash (working capital days) over the last 20 years:

However, stock that is held for an average of more than three months before being sold does highlight one of the characteristics of this business – RS carries a lot of stock so that it can fulfil orders quickly.

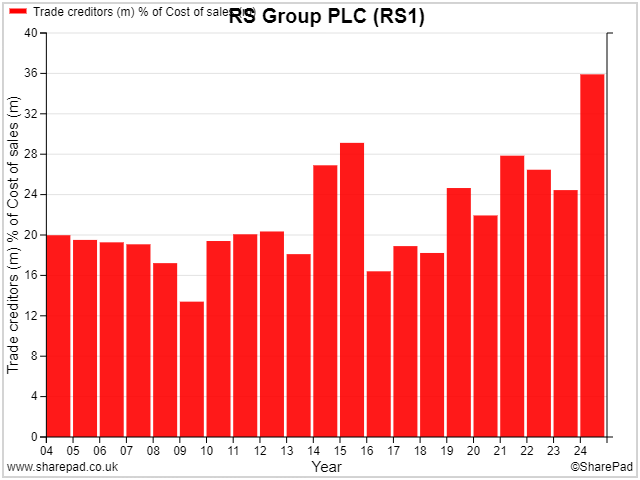

This could lead to a bloated balance sheet and low returns on capital. Fortunately, much of RS Group's stock appears to be funded by generous payments terms from its suppliers.

Based on the average payables figure for the year of £631m and cost of sales of £1,678.5m, my sums suggest RS waited an average of c.135 days last year before paying its suppliers.

The chart below suggests this may be an extreme result, perhaps linked to destocking, but the company's payment terms do seem to have become more generous as the business has grown:

In effect, suppliers provide free credit to fund the majority of RS's inventory. This is a characteristic that I've found to be common to this type of large distribution business.

What can go wrong? Sharp cash outflows can be required if payables need to be unwound to reflect a prolonged slowdown. But when well managed, I've found this model can support high returns on capital and strong cash generation, as the company does not need to use its own capital to buy stock.

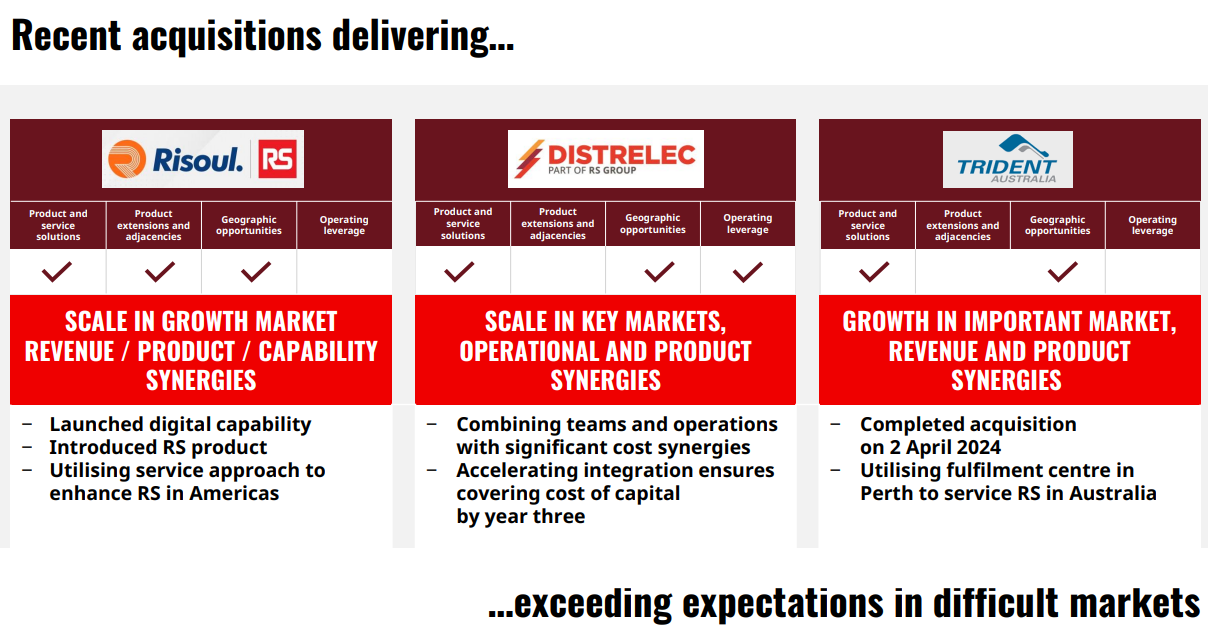

Strategy + acquisitions: RS Group's strategy is based on operating at scale with high levels of market share. In addition to organic growth, the company makes regular acquisitions. These are generally smaller firms that are either rivals or infill gaps in the company's coverage.

The acquisition of German firm Distrelec for £333m last year was a relatively large deal which pushed net debt up by £305m to £418m.

Outlook: CEO Pryce warns of limited visibility for the current year but says lead indicators suggest "some market improvement" during the second half.

However, his commentary suggests to me that conditions could remain weak and that his main focus will be on cost savings and positioning the business so its ready to benefit when growth returns.

Medium-term guidance is unchanged and sounds positive:

- Mid-teens adjusted operating margin

- High cash conversion

- Over 20% return on capital employed

Brokers have taken a fairly cautious view on the current year and appear to have trimmed their forecasts slightly following these results, suggesting earnings could be broadly flat this year at c.43p.

That prices the stock on a forecast P/E of 17 with a prospective yield of 3%.

My view

Based on these valuation metrics and the flat outlook, RS shares don't seem obviously cheap.

However, my sums suggest free cash flow of £126.5m last year, excluding acquisitions. This rises to £195.7m if working capital movements are excluded, giving an underlying FCF yield of c.5.5%.

When compared to reported net profit of £183.7m, this also highlights the strong underlying cash generation of this business – a core attraction for me.

Similarly, last year's return on capital employed of 13.5% (my calculation) was not a bad result for a down year.

In my view, these numbers highlight the sharp rise in profitability and cash generation that should be possible if sales volumes start to recover.

While risks remain around the timing and scale of a recovery, I don't see too much to concern me in RS Group's latest accounts.

I am not looking to add a new stock to my portfolio right now, but personally I would probably be happy to buy RS at under 750p. For now, I will keep the stock on my watch list along with other recent additions, as a possible future purchase.

Cranswick (CWK)

"Strong reported revenue growth of 11.9%, with like-for-like revenue growth of 11.6%"

Results for 53 weeks ended 30 March 2024 / Mkt cap: £2.4bn

FY25 forecast dividend yield: 2.1%

I looked at food producer Cranswick in January, when I provided an introduction to the company. I won't repeat those comments here. The TL;DR is that this FTSE 250 company is a vertically-integrated producer of pork and poultry products and is a big supplier to UK supermarkets.

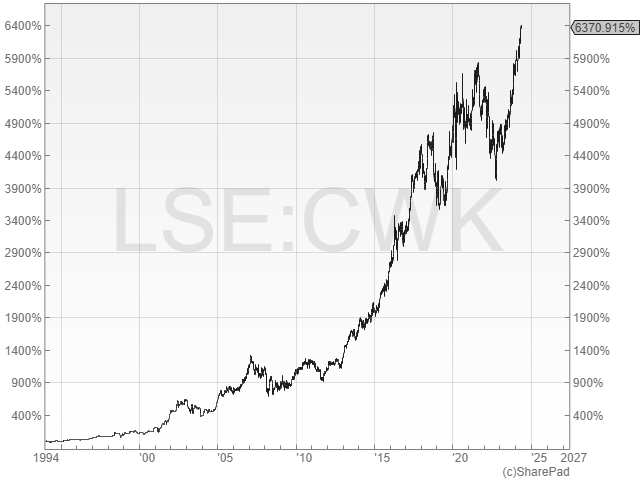

Cranswick is also a multibagger that's delivered a 6,370% total return for shareholders over the last 30 years – including 34 years of unbroken dividend growth.

Shareholders bought early and held have enjoyed a compound average return of 14.9% per year since 1994:

Cranswick's management upgraded full-year guidance in January's update and we can now see this come through in the full-year results.

- Revenue +11.9% to £2,599.3m

- Revenue +9.8% on a comparable 52-week basis with 4.5% volume growth

- Operating profit +14.4% to £166.9m

- Operating margin +0.1% to 6.4%

- Return on capital employed (ROCE) +1% to 15.9% (my calculation)

- Dividend +13.4% to 90p per share

Net debt excluding lease liabilities is just £20.2m and the balance sheet looks strong to me.

Trading commentary: Cranswick CEO Adam Couch says last year saw a more stable environment for farmers, leading to a recovery in pig prices and more stable results.

Customer service was said to be "excellent", with Cranswick achieving 98% fulfilment across the group's product portfolio.

However, export sales were lower due to a reduction in sales to China. This is the result of a key processing plant not having the required licence for exports – an issue the company says has been ongoing for four years.

Labour shortages also remain "a critical challenge" that has worsened following the recent salary threshold increase for UK Skilled Worker visas. To help solve its manpower shortages, Cranswick has now recruited 650 workers from the Philippines.

Growth: the company continued to invest in vertical integration, or self sufficiency, with capital expenditure of £91.4m. This included two acquisitions:

- the £46.1m acquisition of an indoor pig farming business in Lincolnshire with 18 sites and its own feed mill. This business produces 3,200 finished pigs per week

- the £13.3m acquisition of Froch Foods, a cooked meat and bacon processing facility

A further three projects totalling £112m remain in progress to expand the group's pork and chicken facilities in Hull and fit out a new hummus facility near Manchester.

Outlook: no new guidance was provided but Cranswick says trading so far this year has been in line with expectations.

"the outlook for the current financial year is unchanged"

Consensus forecasts on Stockopedia suggest adjusted earnings could rise by 3% to 250p per share this year supporting 2% dividend growth to 91.9p.

These estimates price the stock on a forward P/E of 17.7 with a 2.1% yield.

My view

My sums give Cranswick a trailing free cash flow yield of 4.5% and a EBIT/EV yield of 6.8%. Neither metric looks hugely expensive, given the company's track record.

However, paying 2.6x book value for a business with a five-year average return on equity of 14% suggests that I might only receive a return on invested equity of less than 6%.

The 2% dividend yield and modest growth forecasts for the current year also seem to support this view.

Such a low yield is also simply below the level at which I'd invest, given the income focus of my portfolio.

I am confident Cranswick remains a high quality business with a solid outlook. But I'd prefer to wait for a better buying opportunity before considering a purchase.

As always, please let me know what you think about the stocks I've discussed in the comments below – and signup to receive future updates.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.