Dividend notes: quality in specialist niches - PAG, RNWH (13/12/23)

I review recent results from specialist infrastructure group Renew Holdings and buy-to-let mortgage lender Paragon Banking.

Welcome back to my dividend notes.

This time I'm looking at two sets of company results that caught have caught my eye recently, thanks to positive performances and apparently reassuring outlooks.

Companies covered:

- Paragon Banking (LON:PAG) - this buy-to-let lender specialises in professional landlords and appears to be performing well, with only a limited rise in arrears. I think the shares could be reasonably priced.

- Renew Holdings (LON:RNWH) - another solid set of results. This infrastructure specialist continues to justify its claims of differentiation and superior quality, but I think the share price may be up with events.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Paragon Banking (PAG)

"The Group’s performance for 2023 again demonstrates the strength of our business model"

Final results y/e 30 September 2023

Paragon Banking specialises in lending to professional buy-to-let landlords and SME businesses. The group's UK banking licence gives it access to retail deposits, meaning that it isn't dependent on wholesale markets for funding.

I covered this FTSE 250 dividend share earlier this year and was left with a favourable view.

Paragon's latest results cover the financial year to 30 September and also look fairly positive to me.

Underlying pre-tax profit for the full year rose by 25.4% to £277.6m, with underlying earnings per share up 34.8% to 94.2p. Both figures exclude non-cash fair value gains, which I think is reasonable in this context.

Paragon agreed £3.01bn of new loans last year, down slightly from £3.21bn in 2022. Of this, £1.88bn was for mortgage lending, with the remaining £1.13bn offered as commercial lending.

Net lending increased by 4.7% to £14.9bn and the bank says it achieved a customer retention rate of 80% at loan maturity. In mortgage lending, this represents an increase from 70% in 2022 – the bank says this improvement has been helped by a new web portal allowing for easier refinancing. A similar service has now been launched for SME borrowers.

This high retention rate seems to suggest that the majority of borrowers retain both the appetite and the creditworthiness needed to secure Paragon loans. According to Paragon, professional landlords are not fleeing the market in the way that amateur landlords are:

While it is clear that the changing economic environment and regulatory landscape has caused some landlords to step away from the PRS, the Group’s experience is that this reaction is concentrated amongst some smaller non-specialist amateur landlords, while its specialist customers remain committed to the sector.

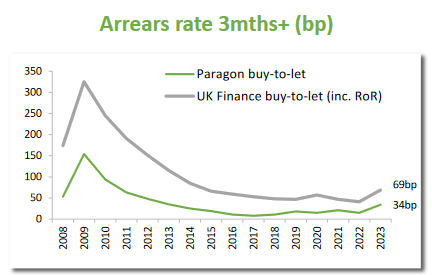

Despite this, bad debt levels did rise during the year. Three-month plus arrears now represent 0.34% of the loan book, compared to 0.15% one year earlier. Actual impairments rose by 28.6% to £18m (FY22: £14m).

Paragon says its arrears rate is still "significantly below the industry average":

The bank also points out that the average loan-to-value ratio on its buy-to-let portfolio is 62.8%. Assuming house prices don't collapse, I think this should provide sufficient equity headroom in the event of loan defaults.

For retail savers, rising interest rates have provided some attractive new opportunities. Paragon's cash savings products appear to have been well-positioned in this market; the bank's retail deposits rose by 24.3% to £13.3bn during the year.

For a lender like Paragon, retail deposits are often cheaper than wholesale market funding, helping to support margins and competitive positioning.

Paragon's financial situation looks robust to me at the end of the year. The bank's CET1 ratio fell to 15.5% last year (FY22: 16.3%), but this is still a quite high in a historic context and when compared to rivals. It's also significantly above regulatory requirements.

Capital generation was aided by a 0.4% increase in net interest margin to 3.09%. Costs also fell as a proportion of income, with a cost:income ratio of 36.6% (FY22: 39.4%).

Improved profitability helped to deliver increated returns, with the bank's measure of underlying return on tangible equity rising to 20.2% (FY22: 16.0%).

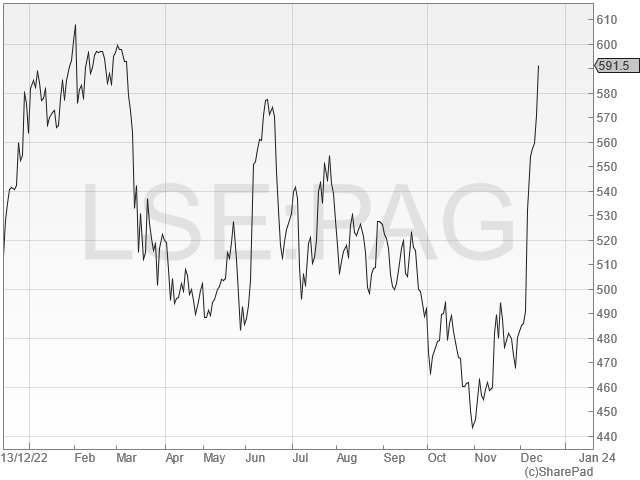

Paragon ended the year with tangible net asset value of 579p per share (FY22: 533p). These results seem to have given the market a renewed confidence in the quality of the bank's loan assets – Paragon shares have now re-rated to trade in line with book value, after trading at a discount for much of the autumn.

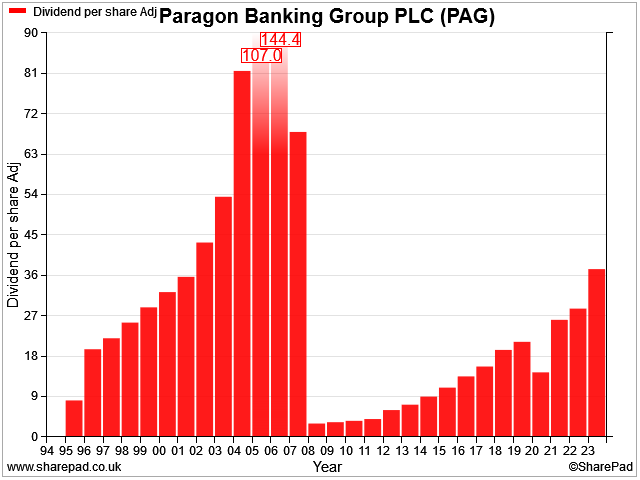

Dividend: the total dividend was increased by 30.8% to 37.4p per share for the year, in line with the bank's policy of distributing 40% of underlying earnings to shareholders.

This gives a dividend cover ratio of c.2.5x, which should be safe as long as earnings remain relatively stable. This payout has grown steadily since 2008 and currently offers a 6.5% yield.

Outlook: Paragon believes that its specialist focus on professional landlords in particular should continue to support its performance, even given broader market weakness:

"In this environment the Group’s focus on specialist products, a robust credit approach, high levels of customer retention and margin maintenance has delivered strong results in 2023 and these strategies will continue into 2024 and beyond."

Broker forecasts suggest underlying earnings per share will be broadly flat in 2023/24, pricing the shares on six times forecast earnings, with the 6.5% dividend yield unchanged.

My view

Investors sometimes find themselves fighting the last battle and missing good opportunities. I think that Paragon might fall into this category. I don't see too much to worry about in these results.

The obvious caveat to this view is that it is still too soon to be sure of the magnitude of the housing market slowdown.

Paragon suffered badly in the 2008 crash because as a (then) non-bank lender, it was locked out of the wholesale funding market. Bank balance sheets were also much weaker back then.

In my view, the situation is different today. Paragon obtained a banking licence in 2014, allowing it to diversify its funding with retail deposits. Its balance sheet also looks sufficiently strong to me for any reasonably likely scenario.

I would have preferred to buy Paragon shares when they were trading below book value. But on balance I think the shares are probably still quite reasonably valued today.

There's too much overlap with one of my portfolio stocks for me to consider investing, but I do continue to have a positive impression of this business.

Renew Holdings (RNWH)

"Record financial performance demonstrates the differentiated qualities and resilient nature of the Group"

Final results y/e 30 September 2023

Renew Holdings is a construction and engineering group that specialises in infrastructure work, including nuclear, rail, water and highways.

The overriding attraction of these markets for me is that they're generally far less cyclical than conventional construction. Projects are also often underwritten by long-term government-backed spending commitments.

Renew's long-term share price history certainly seems to suggest that it has skilled management and some kind of competitive advantage:

I last covered this business in May. I reckon Renew's latest results continue to support my (reluctant) view that this is a rare quality company in a sector that's known for being accident prone and low margin.

Revenue rose by 13% to £960.9m last year, while Renew's operating profit was 18% higher, at £59m. Although the resultant 6.1% operating margin is not high in absolute terms, it is high for this sector.

The order book increased by 11% to £860m – a rate of growth that broadly matched the increase in revenue, which seems reassuring to me.

One of Renew's attractions for me is that it generates high returns on capital employed. This is my preferred measure of 'real' profitability for non-financial businesses.

Renew generated ROCE of just under 30% last year, consistent with the previous year and above the five-year average of c.27%.

My sums suggest the group's reported net profit of £43.4m was converted into free cash flow of £42.3m excluding acquisitions (FY22: £47.2m).

Net cash was £35.6m at the end of the year, excluding lease liabilities.

Renew's free cash flow ticks another box for me – excellent cash conversion. FY22 free cash flow was boosted by more favourable working capital movements; the FY23 performance looks okay to me on an underlying basis.

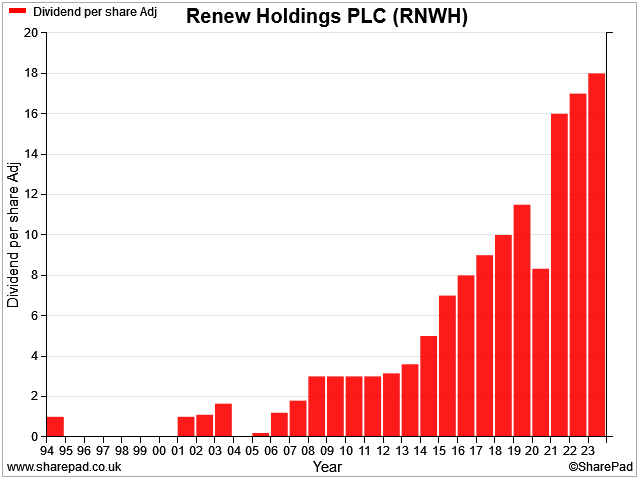

Dividend: the full-year dividend was increased by 5.8% to 18p per share, giving the stock a rather modest 2.2% yield at current levels.

Renew's dividend has risen fairly steadily ever since 2006:

Outlook: CEO Paul Scott says that the group is "well placed" to benefit from UK government spending on existing infrastructure and sees "exciting growth prospects in Water".

"Trading momentum has continued" into the new financial year and Scott is confident the group can build on its record of "long-term value creation".

Broker forecasts are slightly more measured and suggest adjusted earnings will be broadly flat this year, at about 64p per share. That puts Renew on 13x forecast earnings, with an expected 7% dividend increase giving a yield of 2.3%.

My view

Renew's dividend yield is low due to the company's prudent dividend cover of three times earnings. But my preferred measure of EBIT/EV gives an earnings yield of 9%, which I think could be decent value.

A free cash flow yield of over 6% also looks reasonable to me.

I'm not likely to buy Renew Holdings while the dividend yield is so low. But I remain impressed by this business and believe it probably does have some degree of competitive advantage in its specialist niches – notably nuclear energy.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.