Dividend notes (28/04/23): peak profits? NWG, MGAM

I review the latest results from UK dividend shares NatWest and Morgan Advanced Materials.

Bank results continue to flow, with NatWest's Q1 numbers out today.

I'm also looking at a FTSE 250 industrial group that looks potentially interesting to me, but may carry some cyclical risk.

This is intended to be a brief review of the latest results from UK dividend shares that are in my investable universe and are likely to appear in my screening results at some point.

This is a new format I'm experimenting with, so any feedback would be particularly welcome - please feel free to comment below or contact me directly.

Companies covered:

(click links to scroll to the relevant section)

- NatWest Group (LON:NWG) - gains from higher interest rates are flattening out, but this UK-focused bank looks in good shape to me.

- Morgan Advanced Materials (LON:MGAM) - a solid set of numbers, but a cyber attack will hit 2023 profits and I wonder about cyclical risks.

NatWest Group (NWG)

Q1 2023 attributable profit of £1,279 million and a return on tangible equity of 19.8%

Disclosure: I own NatWest shares as part of my SIF portfolio at Stockopedia. NatWest is not part of the dividend portfolio I run on this website.

NatWest shares are not as cheap as those of Barclays, which I looked at yesterday. But I think the greater simplicity of the company's retail-only banking model has some attractions.

Today's Q1 results appear to confirm this. Profit attributable to ordinary shareholders rose by 52% to £1,279m, compared to the same period last year. Most other key metrics were also positive:

- Return on tangible equity (RoTE): 19.8% (Q1 2022: 11.3%)

- Net interest margin: 3.27% (Q1 2022: 2.45%)

- Total interest-earning assets: £360bn (Q1 2022: £335bn)

- Cost-to-income ratio: 49.8% (Q1 2022: 57.1%)

- Tangible net asset value per share: 278p (Q1 2022: 269p)

- CET1 ratio: 14.4% (Q4 2022: 14.2%)

Bad debts appear to remain minimal. The bank booked an impairment charge of just £70m for the period, half the £144m reported for the final quarter of 2022.

However, while NatWest's Q1 results were significantly ahead of the first quarter of 2022, they didn't show much improvement from the fourth quarter (i.e. the preceding period).

Profit and other performance metrics were broadly flat in Q1, when compared to Q4 2022. My feeling is that the easy money gains from rising interest rates are now in the bank's results – and perhaps also priced into its shares.

Outlook: the bank has left its 2023 guidance unchanged from the time of its 2022 results.

Broker consensus forecasts price the stock on about six times 2023 forecast earnings, with a dividend yield of 6.5%.

My view: as I mentioned in yesterday's review of Barclays' Q1 numbers, I think banks could come under some pressure to pass on higher interest rates to savers.

NatWest's instant access Cash ISA and Flexible Saver savings accounts both currently offer interest rates of just 1% on balances under £25,000. Fairly derisory, when 3%+ is easily available elsewhere.

I wonder whether the big banks could come under pressure to offer more competitive (fair!) rates to savers. This could mean that net interest margins – and perhaps profits – are approaching a peak.

We could also see a rise in bad debts if the UK economy slows further.

Even so, I think NatWest looks in good health and reasonably priced at current levels. As I write, the stock is trading at about 260p, just below its tangible book value of 278p.

This valuation seems fair to me, given the 6%+ dividend yield on offer and the bank's improving profitability.

NatWest shares probably aren't the bargain they were a year ago. But the stock still looks attractive to me, from an income perspective.

Morgan Advanced Materials (MGAM)

Customer demand remains robust.

This FTSE 250 industrial group can trace its roots back to 1865, when it started making crucibles – ceramic containers used for pouring molten metal in iron foundries.

The business was previously known as Morgan Crucible, but its current name more accurately reflects the diversified business of today. MGAM produces a wide range of specialist ceramics that are used in industrial, energy, transport and healthcare settings.

Let's take a look at today's results.

- 2022 highlights: today's final results cover the 2022 calendar year and appear to be in line with forecasts.

- Revenue up 17% to £1,112.1m (+11.2% at constant currency)

- Adjusted operating profit +21.3% to £151m (+14.7% at constant currency)

- Adjusted earnings per share up 24.3% to 33.8p

- Free cash outflow: £46.9m (2021: free cash flow of +£66.2m)

- Net debt: £200m (2021: £96.5m)

- Full-year dividend up 32% to 12.0p per share

Profitability: trading appears to have been positive across the group's operating divisions and it seems that the company has been able to pass on higher costs. MGAM's adjusted operating margin increased slightly to 13.6% last year.

The group cites a return on invested capital of 22.4% (2021: 20.5%), which is an adjusted metric. But my standard calculation of return on capital employed comes out at 19.8%, which is still very attractive, in my view.

Free cash flow & net debt: last year saw a free cash outflow of £46.9m, which sounds alarming at first glance. The outflow was explained by three items:

- £67m one-off contribution to UK pension scheme - no further payments due

- £35m increase in working capital to support inventory availability

- £29m capital expenditure

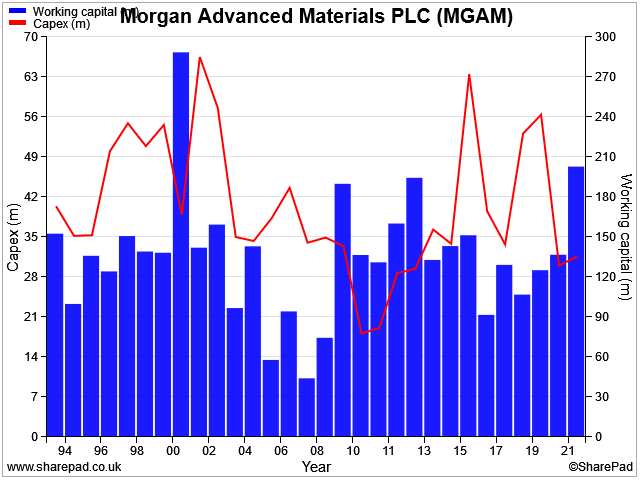

SharePad data suggests that annual capital expenditure of around £30m is fairly typical, so I'm not prepared to overlook this. But I do accept that the working capital and pension costs are probably unusual, if not exceptional.

Interestingly, the chart above suggests that working capital has only previously been this high ahead of a recession or slowdown (2000, 2009, 2012).

Excluding working capital changes and pension costs from last year gives me an estimated underlying free cash flow of £55m. That represents 57% cash conversion from last year's net profit of £96.7m. Not brilliant, but for a capital-intensive business with a £30m annual depreciation charge, perhaps not too bad either.

MGAM paid a £31.6m dividend last year. Combining this with the free cash outflow gives a total cost of £78.6m. This appears to have accounted for the majority of last year's £104m increase in net debt.

While I think leverage remains comfortable at 2x net profits, I'd prefer not to see any further increase this year.

2023 outlook: MGAM suffered a major cyber attack in January. The resulting disruption to production has now mostly been resolved, but the company expects to report a 10-15% hit to adjusted operating profit this year as a consequence.

Broker consensus forecasts ahead of today showed adjusted earnings falling by c.15% to 27.5p per share. The dividend is expected to be unchanged.

These estimates price MGAM shares on 11 times forecast earnings, with a 4% dividend yield.

My view: this business has exposure to many different industries and market sectors, with varying levels of cyclicality.

A positive spin on this would be to say that weakness in some areas will be offset by stronger demand elsewhere. For example, clean energy may continue growing, regardless of what might happen in the fossil fuel sector.

A more cautious view might be to suggest that the several of the group's major customer sectors are interdependent and might all suffer in a recession. For example, foundries and the automotive and aerospace industries.

I'm not sure which view is correct, but Morgan Advanced Materials does currently score quite well in my dividend screening results.

The shares don't look too expensive to me, either, given the above-average profitability of the business.

I'm not yet convinced that the shares are a long-term buy for me, but I think MGAM could be worth a closer look.

Disclaimer: This is a personal blog and I am not a financial adviser. The information provided is for information and interest. Nothing I say should be construed as investing advice or recommendations. The investing approach I discuss relates to the system I use to manage my personal portfolio. It is not intended to be suitable for anyone else.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.