Dividend notes: navigating uncertain markets - CRDA, HWDN, AJB (25/07/23)

I look at the latest results from Croda International, Howden Joinery and AJ Bell. These businesses all have a track record of super profitability but are facing weaker market conditions. I'm hunting for potential buying opportunities.

Welcome back to my dividend notes. These quality firms have all seen their share prices bounce back somewhat from recent falls. Do they tick the boxes as possible members of my dividend portfolio?

Companies covered:

- Croda International (LON:CRDA) - half-year results from the FTSE 100 group are in line with June's revised guidance. I remain interested but cautious, given the continuing weakness in volumes reported by the company.

- Howden Joinery (LON:HWDN) - the market has slowed from its pandemic peak, but I don't see any serious concerns in the kitchen company's latest accounts. I'm neutral on valuation, but remain positive on the business.

- AJ Bell (LON:AJB) - a solid Q3 update reiterates the appeal of this business, for me. The shares remain on my watch list.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Croda International (CRDA)

"Group performance in line with revised June 2023 expectations; full year 2023 guidance reaffirmed"

FTSE 100 chemicals group Croda issued a profit warning in June, but today's half-year results are in line with (reduced) expectations. With the stock down by 40% from its pandemic peak, is this a buying opportunity?

These half-year results appear to show a mixed picture. On the one hand, it's reassuring to see that there has been no further downgrade to expectations.

On the other hand, the half-year numbers do show a fairly dramatical drop in sales and profits compared to last year. On an adjusted, pro forma basis (reflecting the sale of the group's PTIC industrial business), revenue fell by 6% to £880.9m, while pre-tax profit was down 32% to £174.3m.

Sales were down in all three divisions, but I think there were some signs of hope in the core consumer care and life sciences businesses:

- Consumer care: this business produces products such as minerals for sunscreen and hair care ingredients. Volumes rose by 8% compared to the second half of 2022, but were 14% below the first half of last year. Croda reports continued destocking and says customers "have continued to reduce inventory levels". Price increases and a favourable mix meant that revenue was flat at £455.6m.

- Life sciences: sales were down 8% to £303m due to the loss of Covid-19 lipid sales to vaccine customers, which totalled $62m in in H1 2022. Excluding lipids, life sciences sales rose by 8%, due to "good sales growth in Pharma and Seed Enhancement".

- Industrial markets: the sales of the PTIC business on 30 June last year means that this division is now far smaller. According to the company, Industrials is "not a priority for capital allocation and strategic growth", but it plays a role in the group's manufacturing model. Excluding the impact of the PTIC sale, revenue fell by 20% to £122m in H1, due mainly to destocking and weak industrial demand. This has prompted a £21m impairment charge on the group's SIPO joint venture in China.

Cash flow and profitability: despite the fall in profit, Croda's free cash flow improved as inventories fell and the impact of last year's raw material cost increases started to unwind.

The company reports free cash flow of £76.4m for the half year, although my more inclusive measure suggests a figure of just £39.8m, excluding items relating to acquisitions and disposals.

Profitability took a hit from lower volumes. I calculate an operating margin for the half year of 14.8% (H1 22: 25.6%), while return on capital employed for the trailing 12-month period fell to 9% (FY22: 25.6%).

Outlook: chief executive Steve Foots expects customer destocking to continue into the second half of the year. Full-year adjusted pre-tax profit is expected to be between £370m and £400m.

This appears to be in line with consensus forecasts, so I guess we can assume that full-year adjusted earnings will be about 215p. That prices the shares on 26 times forecast earnings, while an unchanged dividend of 107p would give a yield of 1.9%.

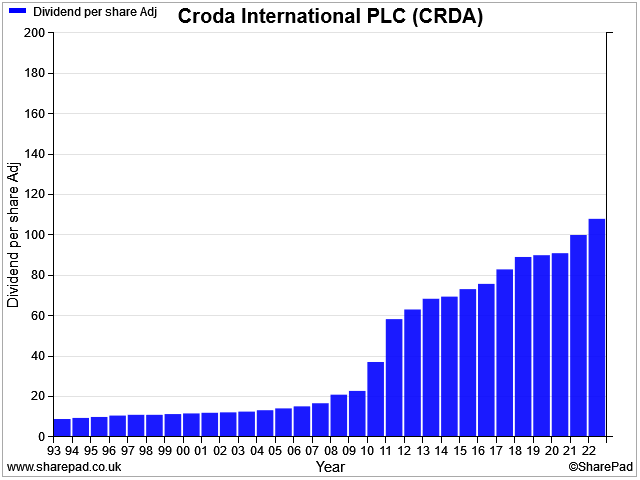

Croda's dividend yield tends to be low, but this business has an impressive dividend history that stretches back 30 years without a cut:

My view

These half-year numbers look broadly reassuring but leave some questions, in my view. We don't yet quite know how long it will be until volumes turn positive across the group's core businesses. I would guess there's still some risk that the second half of the year could disappoint.

However, Croda remains in good shape financially and I fully expect the group to return to growth and more typical profits margins over time.

I'm still learning about this business and will continue to monitor progress. The yield is a little lower than I look for and the valuation still seems relatively full to me. But it's a company I'd be happy to own, if a good buying opportunity arose.

Howden Joinery (HWDN)

(This is a catch-up item from last week - Howden's interim results were published on 20 July 2023.)

"Howdens performed well in the first half in a more challenging marketplace"

Kitchen specialist Howden Joinery supplies fitted kitchens to trade customers (e.g. kitchen fitters and builders) across an estate of 895 UK depots. The company is also expanding into France and now has 31 depots in this market, which is said to have a low penetration rate of fitted kitchens.

Howden has developed a track record of disciplined growth and double-digit profit margins in recent years. The stock has doubled since November 2014, but new kitchens seem unlikely to be a top priority for households facing cost-of-living pressures. I wonder if a slowdown might be on the horizon?

Results summary: these results cover the 24 weeks to 10 June 2023 - Howden has an unusual 24 December year end.

The company says that the half-year numbers show trading normalising, after the exceptional demand seen as the UK exited the pandemic last year.

Revenue for the half year rose by 1.5% to £926.9m, but operating profit fell by 21.5% to £117.0m (H1 2022: £149.1m). This drop reflected an additional £32m of operating costs. Management says underlying operating costs were stable and the increase reflected branch openings and refurbishments, plus investment in manufacturing, distribution and IT.

Earnings for the period fell 21.4% to 15.4p per share, but dividend growth was maintained, with the interim payout rising 2.1% to 4.8p per share.

Trading summary: management say that the firm's builder customers "remain busy", but that "activity levels [are] normalising" from the exceptional levels seen as we exited the pandemic.

Howden has launched 23 new kitchen ranges ahead of the Autumn peak trading period. The company says its placing more emphasis on entry and mid-range designs that account for the majority of cabinet volumes.

Improvements have been made to the group's supply chain and there's a renewed focus on ensuring that best-selling items have "the highest availability" in the group's UK depots.

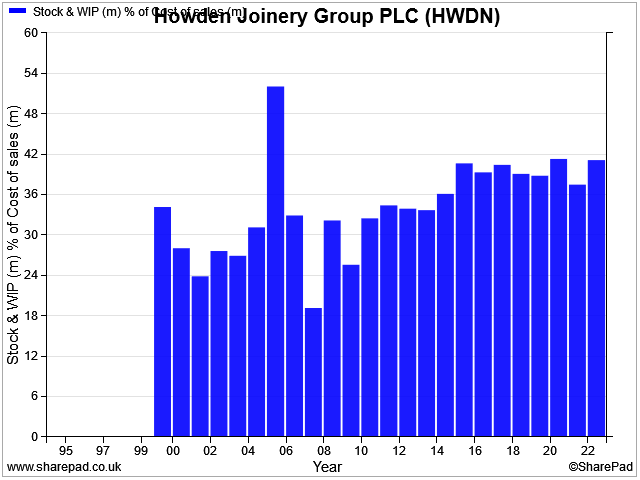

Financial performance: management says that inventory levels are being managed down from the peak "safety stock" levels maintained during the pandemic.

This is hard for us to assess from the numbers, as cost inflation over the last year may mean that a smaller volume of inventory is more highly valued. Certainly, the reported value of Howden's stock hasn't changed over the last year – inventories were held at £413.5m at the end of the period, compared to £415.6m one year earlier.

However, inventory as a percentage of cost of sales is in line with recent years' performance:

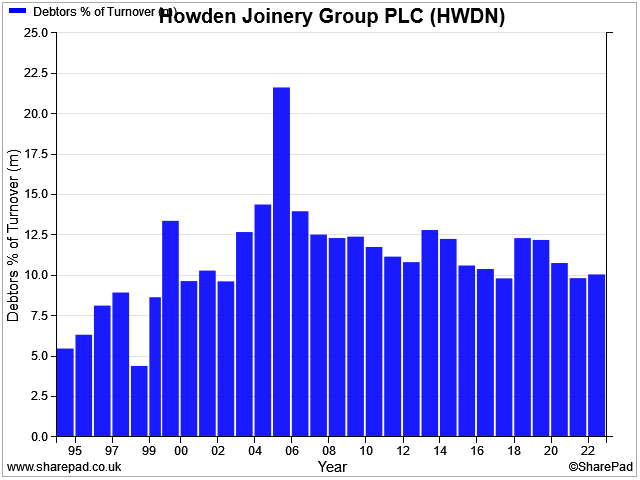

There's no sign yet of elevated receivables, either (a potential precursor of bad debt losses). Receivables as a percentage of revenue were just over 10% at the end of the half year, in line with the average of recent years:

Profitability & cash flow: sales in this business typically have a 40/60 weighting to the second half of the year. So it's probably unfair to assess performance based on H1 numbers alone.

On a trailing 12-month (TTM) basis, my sums suggest an operating margin of 16.4%, down from 17.9% last year.

Return on capital employed was more stable, dropping through at 26.5% for the 12 months to 10 June, compared to 27.8% for the year to 24 December 2022.

Net cash from operating activities fell to £182.3m (H1 2022: £209.2m). However, a £108.9m working capital outflow combined with £46.7m of capex and £12.m of pension contributions to drive a £191.6m net cash outflow from the business during the half year.

This left Howden with a cash balance of £117.8m at the end of the period (H1 2022: £249.7m) and no debt. However, net debt on a statutory basis was £555m, reflecting nearly £700m of lease liabilities.

In fairness, I would expect some of the H1 cash outflow to reverse during the seasonally stronger second half, as stock unwinds. I don't have any particular concern's about Howden's balance sheet.

Outlook: the company says that its plans are on track and expectations for 2023 remain unchanged.

"We remain confident of delivering growth ahead of our markets, while generating strong cash flow, and attractive returns for shareholders over the medium-term."

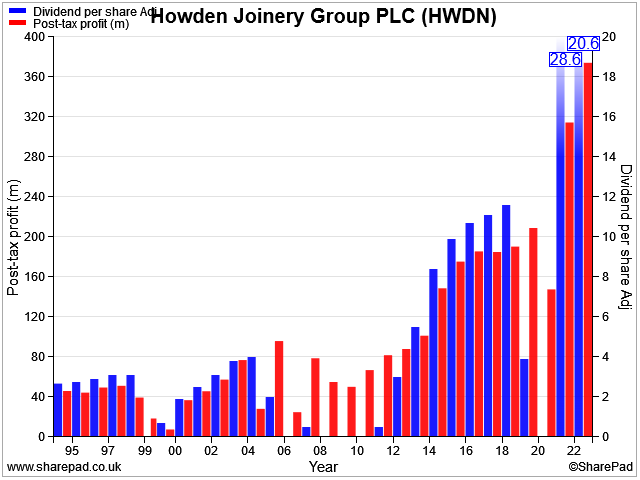

Broker consensus forecasts suggest earnings will fall by around 25% to 49p per share this year, with a flat dividend of c.20p per share. That puts Howden's shares on 15 times forecast earnings, with a 2.7% yield.

My view

I like this business and have admired the quality of the company's execution in recent years.

However, history suggests this business is very susceptible to economic downturns. Dividends have been interrupted with some regularity over the last three decades and profits have also suffered cyclical slumps:

If the UK experiences a recession in 2023/24, will Howden's profits and dividend be more resilient this time? I don't know.

Valuation: after touching a low of under 472p earlier this year, Howden's share price has bounced back strongly to nearly 750p at the time of writing.

Despite this, the stock appears to be quite attractively valued on my preferred measures, with trailing EBIT/EV yield of 8.4%. Although profits are expected to be lower this year, this valuation doesn't look unreasonable to me if the company can avoid a major profit slump.

I would have bought Howden shares at 500p, but I'm not yet sufficiently convinced to pay upwards of 700p. For now, I'm staying neutral, but I'll be monitoring progress with interest.

AJ Bell (AJB)

(This is a catch-up item from last week - AJ Bell's Q3 statement was published on 20 July 2023.)

"Continued growth in customer numbers and net inflows of over £1 billion onto our platform in the quarter"

AJ Bell is an investment platform that serves both DIY investors (D2C) and advised clients. This business only floated on the London market in 2018, but it already has many of the attributes I look for in a quality dividend stock.

I covered AJ Bell's half-year results in May – this update looks at the firm's Q3 update, which was issued last week.

Trading highlights: these latest numbers look fairly healthy to me:

- Total customers up by 10,6060 to 465,614 (+12% vs Q3 2022)

- Assets under administration up 2% to £69.8bn (+10% vs Q3 2022)

- Net inflows of £1.1bn (Q3 2022: £1.6bn)

As I discussed in my note last week on Hargreaves Lansdown, UK investors are flocking to the security of short-dated fixed-income products. AJ Bell reports that eight of the top 20 investment choices by traded value during the quarter were government bonds or money market funds.

Outlook: there was no change to full-year expectations, but chief executive Michael Summersgill remains confident about the growth potential of the business:

"We continue to see significant opportunities for growth in the platform market and believe we are well positioned to capitalise on these in both the advised and D2C segments."

Broker forecasts on SharePad suggest AJ Bell's earnings will rise by 35% to 15.3p per share for the year ending 30 September. The dividend is expected to rise by 31% to 9.7p per share.

As I've previously discussed, I expect much of this increase to come from increased interest earned on client cash.

These estimates price the stock on 20 times forecast earnings, with a 3.1% yield.

My view

AJ Bell's quarterly numbers look pretty solid to me. I continue to think that the shares look reasonably priced, for a business that generated a 35% return on equity last year.

AJ Bell remains on my watch list and is a stock I'd consider owning, if a suitable opportunity arose in my dividend portfolio.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.