Dividend notes: markets shrug despite stable outlook - INCH, BMY (26/10/23)

I review the latest updates from Harry Potter publisher Bloomsbury Publishing and FTSE 250 automotive group Inchcape.

Welcome back to my dividend notes, which are now resuming after a short break.

In this update I'm looking at two companies that have published solid updates and reiterated guidance – but failed to excite investors.

Companies covered:

Update: this article was amended on 31 October 2023 to add correct disclosure information.

- Inchcape (LON:INCH) - the shares have been falling recently but this solid Q3 update reiterates 2023 guidance and highlights continued organic growth.

- Bloomsbury Publishing (LON:BMY) - a solid set of H1 results from the Harry Potter publisher, which scores very well in my dividend screen at the moment. However, I have some slight concerns about the non-consumer business.

Disclosure: at the time of publication, Roland owned shares in Inchcape and Bloomsbury Publishing.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Inchcape (INCH)

"expectations for the Group's results for FY 2023 remain unchanged"

Shares in this FTSE 250-listed international automotive distribution group have fallen sharply this year and are now trading at levels first seen 10 years ago.

Although the firm's third-quarter statement showed continued revenue growth and reiterated full-year guidance, investors remain wary.

Depending on your viewpoint, Inchcape's share price weakness may highlight the cyclicality of this business – or it might suggest a buying opportunity.

I'm fairly positive, although I recognise some risks to the outlook (I hold Inchape shares in my systematic SIF model portfolio at Stockopedia).

Investment case: in my view, the key point about Inchcape is that it is now primarily a distribution group, not a retailer. Car retail generated less than 10% of group operating profit during the first half of this year – the remainder came from the faster-growing distribution business.

Inchcape's distribution business effectively provides an outsourced service to handle manufacturers' operations in countries where they don't wish to establish a full operating infrastructure. This can include marketing, parts, localisation and managing franchised dealer networks.

The company has been rolling out this strategy since 2016 and has accelerated growth through a number of acquisitions, including a £1.3bn deal in 2022 to acquire Derco, the largest independent automotive distributor in Latin America.

I believe this focus on distribution should reduce the cyclicality of this business and support higher margins and returns on capital. However, the market doesn't seem convinced and I would admit that this strategy is not yet fully proven.

Let's take a look at today's Q3 update.

Q3 update: today's update is fairly short but highlights continued organic growth and progress with the integration of Derco.

- Q3 total revenue up 35% to £2.8bn (+10% organic growth)

- Q3 distribution revenue up 47% (+13% organic growth)

- Q3 retail revenue up 2% (+1% organic)

Geographically, the company's broad footprint appears to have helped offset the impact of weaker conditions in some countries:

- Americas: "growth in the majority of markets, market share gains", but "softer markets in Chile and Colombia"

- APAC: "broad-based growth accross our markets", supported by three acquisitions during the quarter

- Europe and Africa: revenue was supported by order-book unwind in Europe, but "new consumer demand remains muted across the region". This seems to suggest that the outlook may be weaker when backlogs have been cleared.

Outlook: Inchcape reiterated its full-year guidance, as previously stated with this year's interim results:

"we expect full year results for FY 2023 to be towards the top end of the range of published market consensus"

According to the company, this is based on a range of analyst estimates for adjusted pre-tax profit of between £470m and £506m.

For what it's worth, consensus estimates for pre-tax profit in SharePad suggest a figure of £503m. This would represent a 35% increase from 2022, albeit boosted by the Derco acquisition, which was partly funded by new shares.

Including the impact of dilution, forecasts suggest adjusted earnings of 84p per share this year, a 16% increase from 72p in 2022.

My view: These FY23 forecasts suggest Inchcape stock is currently trading on around eight times forecast earnings, with a possible 5% dividend yield.

Given the group's historically strong cash conversion, I think this could be an attractive entry point.

My main concern is the lack of guidance for 2024. I think there's a risk that as the supply chain backlog unwinds, underlying demand for new cars might be weaker next year. This could hit Inchcape's earnings.

The integration of Derco is another potential concern – it was a big acquisition. However, progress is said to be good so far and has included a 50% reduction in excess inventory, reducing working capital (and freeing up cash).

Based on the information available today, I think Inchcape could be attractive at current levels.

Bloomsbury Publishing (BMY)

"our highest ever first half results, with year-on-year revenue growth of 11% to£136.7 millionand profit growth of 11% to£17.7 million"

Independent publishing house Bloomsbury is best known as the publisher of Harry Potter, but also has much broader consumer and academic publishing businesses.

I last covered this business – which is still led by founder Nigel Newton – following May's full-year results.

Today's half-year results also look fairly reassuring to me, with a strong set of figures from the consumer business. However, I do have some concerns about the weaker growth of the non-consumer business, which I discuss below.

H1 results summary: the headline numbers from these results showed continued growth, with revenue up 11% to £136.7m and pre-tax profit up 8% to £14.0m.

Consumer division: sales in the consumer division rose by 17% to £89.4m, supporting a 26% rise in pre-tax profit to £11.0m and a 12% pre-tax margin. That seems respectable, based on this commentary from a rival UK independent publisher, which suggests an industry-standard target of 10%.

In addition to the continued strength of Harry Potter sales, sales of fantasy author Sarah J. Maas rose by 79% due to strong demand for her backlist. All 15 of Maas' titles have been published by Bloomsbury.

Non-consumer division: Growth was slower in the non-consumer division, which publishes academic and professional material.

Sales in this division rose by just 2% to £47.3m, while pre-tax profit fell by 21% to £3.6m. This gives a pre-tax margin of 7.6%, somewhat lower than the consumer business.

Management say the fall in profits reflects normalised (higher) staffing costs and exchange rate movements. The company also seems to suggest that the somewhat flat sales performance may be linked to a normalisation of US sales after a "one-off" boost provided by government funding to encourage digital learning.

However, I remain slightly concerned about the strength of organic growth in this business, which has been heavily acquisitive over the last 17 years:

Last year, Bloomsbury reported organic growth of 3% in non-consumer, with the 19% rise in total revenue driven by acquisition contributions.

There have been no acquisitions during the current year or the comparative period in 2022 and these interim results show organic revenue growth of just 2%.

This lack of organic growth suggests to me that Bloomsbury may be purchasing mature products with limited growth potential. Thus the continued growth of this division may rely on further acquisition spend.

Free cash flow: Free cash flow for the half year was £0.85m (H1 2023: £4.4m) reflecting some lumpy working capital movement. However, operating cash flow before working capital was up slightly to £20.7m; I do not see anything to worry about here.

On a trailing 12-month basis, I estimate free cash flow at £17.4m, reflecting the company's traditional H2 weighting to sales, due to festive shopping.

My sums suggest a free cash flow/EV yield of 6.0%, which looks quite reasonable to me.

Balance sheet: net cash fell by 6% to £39.1m (H1 2023: £42.5m) but given the underlying strength in cash generation, I don't see this as a concern. Bloomsbury's balance sheet looks very strong to me.

Dividend: Bloomsbury's free cash flow certainly appears to provide comfortable cover for the stock's forecast dividend yield of 3%.

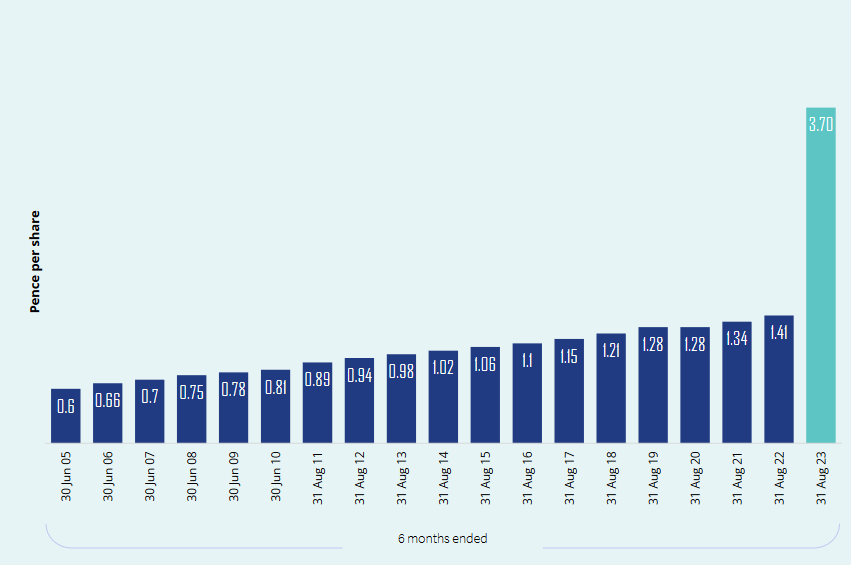

The interim dividend was increased by 162% to 3.7p per share, but this is not an outright increase. Management says that to reflect a reduction in seasonality in the group's cash flow, the proportion of the dividend paid following the half-year results has been increased.

However, overall dividend guidance for the full year is unchanged. Consensus forecasts suggest a total dividend of 12.3p per share for the full year, giving a prospective yield of 3.0%.

Outlook: guidance for the current year is unchanged:

"we are confident of achieving the Board's expectations for the year ending 29 February 2024"

Broker consensus forecasts I can see suggest earnings of 29.4p per share, pricing the shares on less than 14 times forecast earnings.

My view: on balance, I think this is a decent business with an attractive list and some very attractive star authors, such as J.K. Rowling and Maas.

However, I'm not yet completely convinced about the quality of the non-consumer business. At present, this appears to be lower margin and much slower-growing than the consumer business.

I accept that the non-consumer offer may in time lead to a high level of recurring subscription revenue and other attractive outcomes. But right now, it seems to be dilutive to the profitability of the wider group.

Return on capital employed is not especially high, either. On a trailing 12-month basis, my sums suggest a figure of 13.4%. That's above average, but well below the 22% average of existing dividend portfolio.

In all honesty, I'm not sure how heavily I should weight my concerns about Bloomsbury.

I currently hold Bloomsbury shares in my systematic SIF portfolio at Stockopedia, but not in my long-term dividend portfolio. I can't shake off a suspicion that the group's profits are reliant on a relatively small number of publications, but I do admire the its long-term growth record and strong dividend history.

Disclosure: at the time of publication, Roland owned shares in Inchcape and Bloomsbury Publishing.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.