The Dividend Note - light at the end of the tunnel? VCT, BT.A (17/05/24)

Victrex and BT shares have both fallen out of favour with investors in recent years. But I reckon this week's results may provide some reasons for optimism.

Welcome back to The Dividend Note, my weekly look at dividend shares I might consider adding to my portfolio. This time I'm looking at two FTSE 350 companies that have both been out of favour for a long time, BT and Victrex.

In both cases, management would like us to believe that their businesses are reaching inflection points.

In both cases, I think it they might be right. But as I'll discuss, significant uncertainties remain.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend-paying companies that are of interest to me. In general, these are stocks that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Victrex (LON:VCT) - this market-leading speciality polymers group has faced tough market conditions and is suffering from various financial headwinds. But I can't help feeling the bad news is in the price and that the shares could offer an opportunity.

- BT Group (LON:BT.A) - new CEO Allison Kirkby surprised the market with a dividend increase and confident new cash flow guidance. I can see reasons for optimism, but I remain concerned about pricing power and profitability.

Victrex (VCT)

"not expecting FY PBT progress"

2023/24 interim results / Mkt cap: £1.1bn

FY24 forecast dividend yield: 4.5%

Victrex produces high performance polymers, or plastics. Its main product is PEEK, which is a kind of high-end product that's strong and versatile enough to be used in a range of industrial and healthcare applications, sometimes replacing metal parts.

This is a business I've watched with interest in recent years. Historically it's benefited from strong profitability and good cash generation. I feel it should be the kind of good quality dividend growth stock that would fit in my portfolio.

Unfortunately, the company's performance (and its share price) have not lived up to this hope. Operating profit has fallen from a peak of £127m in 2018 to just £38m over the 12 months to 31 March.

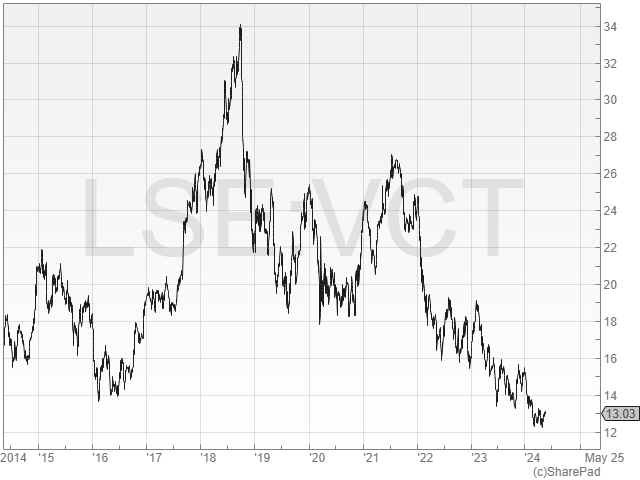

The Victrex share price has performed in a similar way. Long-term shareholders have suffered a 60% decline, from 2018's record high of 3,200p to around 1,300p today.

VCT shares are currently worth less than they were 10 years ago. But I can see some reasons to believe the business could be approaching a turning point, so I was interested to take a look at this week's half-year results.

Half-year results summary: there is no escaping the fact that this was another ugly set of numbers from Victrex.

Revenue fell by 10% to £139.3m on a constant currency basis, during the six months to 31 March 2024.

Underlying pre-tax profit fell by 34% to £28.0m, while reported pre-tax profit fell to just £3.3m due to £24.7m of exceptional costs.

The company says that while aerospace and automotive volumes rose by 18% and 14% respectively in Q1, medical revenue fell by 19% due to "industry destocking". Medical revenue last year reached a record of £65m, so customers appear to have overbought.

Victrex's balance sheet has also sacrificed its habitual net cash position in order to maintain its dividend. Net debt rose to £49.8m in H1 (H1 23: £5.3m). The company says this was largely due to a drawdown of the group's credit facility to fund the FY23 final dividend of £40m.

I'm not keen on using debt to fund dividends, but I think this should be an exception. Cash generation is expected to improve this year, as capex eases following the completion of a new plant in China.

Falling volumes: the underlying problem for Victrex at the moment is a fairly deep slump in customer demand.

The volume of PEEK sold fell by 11% to 1,737 tonnes during the first half of the year, compared to a "solid H1 23" last year. Weaker demand appears to have undercut pricing power and the average selling price fell by 4% to £80.2/kg.

One possible bright spot is that the volume trend may be improving. The company said Q2 volumes were 31% higher than in Q1 and were broadly flat with Q2 2023.

However, even if this continues, the benefits aren't expected to flow through to profits this year. Victrex is currently operating "much lower production rates" than usual in its factories, as it works through a two-year inventory reduction programme.

This is leading to reverse operating leverage, where fixed operating costs are being spread across smaller production volumes. To make matters worse, some of the inventory being sold was produced in FY23 when energy prices and material costs peaked. These costs are now passing through the cost of goods sold line in the P&L, depressing gross profits further.

These factors caused Victrex's gross margin to fall to 48% during the half year, from 53.5% in H1 2023.

Gross margins are expected to remain at similar levels in H2, leading to a full-year gross margin "lower than our [previous] guidance".

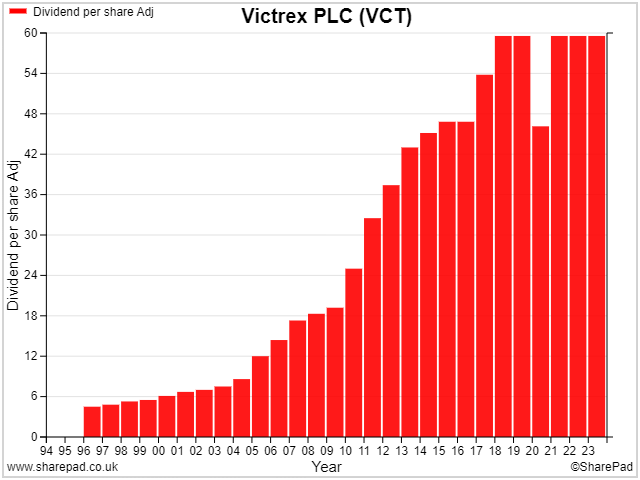

Dividend: the interim dividend was held unchanged at 13.4p per share. This gives a 4.5% yield and suggests management remain confident the payout will remain affordable.

The dividend has never been cut, but the recent period of flat payouts highlights Victrex's lack of growth in recent years:

Outlook: Victrex's outlook statement warns that management do not expect full-year pre-tax profit to improve this year.

The main reason for this seems to be the inventory reduction programme, which is not expected to complete until next year.

However, improving run-rates on volume are said to support the possibility of "low-to-mid single digit volume growth" this year with an improving outlook in FY25:

"If recent end-market improvement continues, growth prospects moving into FY 2025 look encouraging."

My reading of the company's comments is that the underlying demand situation may be stabilising or improving.

However, last year's capacity investment and excess inventory levels mean that any benefit from improving demand probably won't flow through to the accounts until at least next year.

Strategy update - 'Mega Programmes': most of Victrex's PEEK is sold in the form of resin, for manufacturing by the company's clients. The company is by far the largest producer of PEEK globally, but it does have some competition from (mainly) Chinese rivals producing an alternative grade of PEEK.

Perhaps partly to address the risk of commoditisation, Victrex launched an innovation programme in 2014 aimed at moving the business up the value chain.

The company wanted to reduce its dependency on selling PEEK resin and start producing more of its own finished parts. In theory this should be a higher margin, more differentiated business.

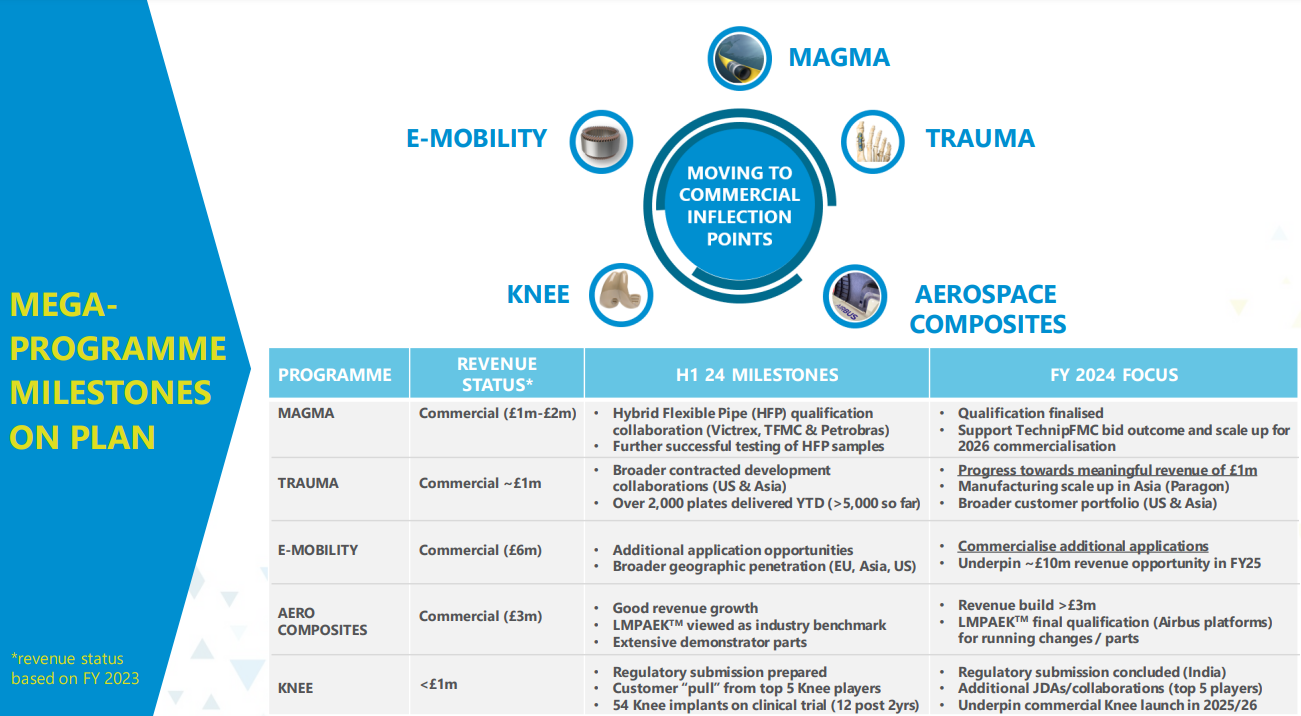

In 2014, Victrex launched five 'mega programmes' targeting specific product areas across its existing market segments.

Perhaps inevitably, these have taken longer to approach commercialisation than expected. But the latest commentary from the company does seem to suggest that revenue could soon start to flow (click to enlarge):

My view

Victrex is facing several headwinds at the moment. The combination of weaker demand and inventory reduction are causing a nasty dose of reverse operating leverage.

Last year's capex and this year's commissioning costs for the new China factory are also weighing on performance.

However, the business remains profitable and I think it's reasonable to expect that at some point, perhaps in FY25, Victrex may start to benefit from positive operating leverage.

On the assumption that volumes will stabilise and gradually recover, then capacity utilisation should start to improve. When paired with lower energy costs and savings elsewhere, this could result in a strong recovery in margins and cash generation.

Broker forecasts on SharePad suggest EBIT margins could return to 27% by FY26 – a level last seen in 2021/22. Historically this business has generated double-digit returns on equity, highlighting the potential for shareholder value creation.

The main risks I can see are that the company's volume business may have less pricing power than in the past, and that its mega programmes could still fail.

I can't rule out these possibilities. But on balance, my feeling is that Victrex shares may well offer decent value at the moment, on a medium-term view.

Chief executive Jakob Sigurdsson may also think so. According to Stockopedia data, Sigurdsson has spent £238k buying Victrex shares since the start of 2023.

Victrex is another stock for my watch list.

BT Group (BT.A)

"new guidance [...] to more than double our normalised free cash flow over the next five years"

Final results y/e 31 March 2024 / Mkt cap: £13.2bn

FY25 forecast dividend yield: 6.0%

BT has a reputation as a dividend stalwart among UK investors.

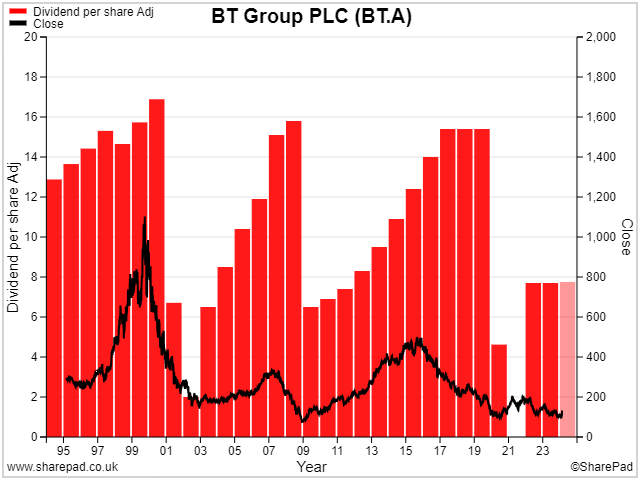

But when I look at the telecom incumbent's dividend and share price history, I find it slightly hard to understand why so many shareholders remain attached to the stock as an income play:

Including dividends, BT shares have delivered a total return -37% over the last decade, according to SharePad data.

Investors' long-running hope is that BT can leverage its dominant market share to help tame its burdensome debt load, capex bill and pension deficit.

Newish chief executive Allison Kirkby appears to have given fresh momentum to this hope. Unveiling this week's full-year results, she issued confident new guidance for improved cash flow and a further £3bn of cost savings.

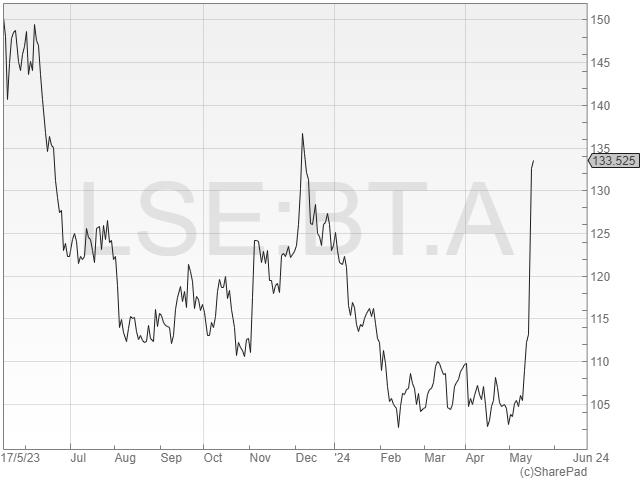

This guidance was paired with a surprise dividend increase that was well received by investors, leaving BT shares up around 25% on the week:

FY24 results summary: BT says it has now reached peak capex on its fibre rollout, which passed 1.0m premises during the final quarter of the year. The group's fibre footprint is now "over 14m premises" with a further 6m underway.

Management say the group is on track to reach 26m premises by December 2026. However, fibre take-up seems limited so far with retail FTTP customers totalling 2.6m at the end of March.

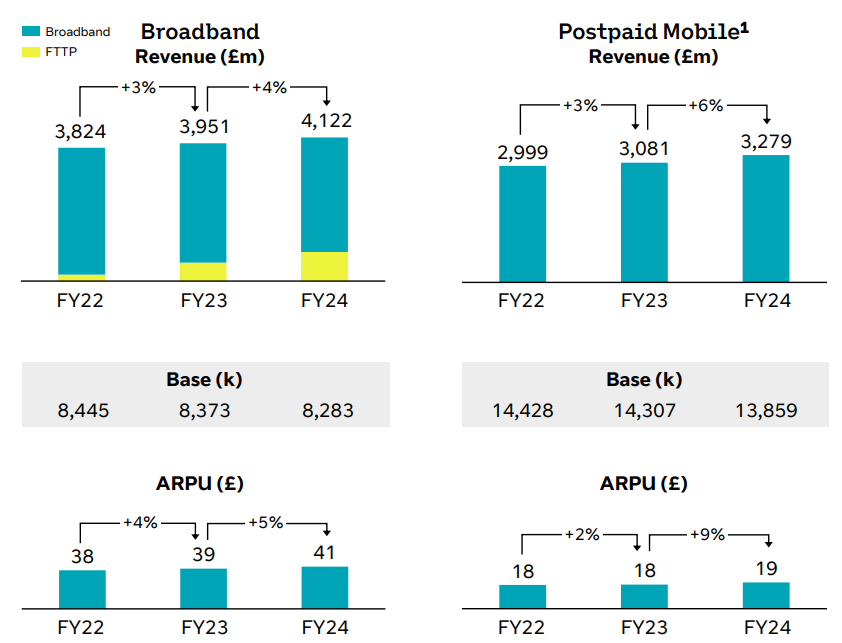

BT's Openreach unit is also continuing to lose customers – broadband line losses totalled 491k last year, equivalent to a fall of 2% in the customer base (see slide below).

Price rises helped to offset these losses. In consumer broadband, average revenue per user (ARPU) rose by 5% to £41.20 per month last year. This suggests the annualised revenue loss from last year's broadband line losses may have been £242m – just over 1% of group revenue.

Post-paid consumer mobile ARPU rose by 9% to £19.40, again offsetting losses in customer numbers.

Management say monthly consumer churn churn was stable at 1.1%.

Overall, I think it's a mixed picture, which is reflected in the financial results.

Group revenue rose by 1% to £20,797m last year. This finally arrests the run of annual declines seen since 2017, when BT's revenue peaked at £24,082m following the acquisition of mobile operator EE.

However, BT's pre-tax profit fell by 31% to £1,186m last year, while the group's operating cash flow fell by 11% to £5,953m.

BT's normalised free cash flow – a key adjusted measure – was 4% lower at £1,280m.

My more comprehensive calculation of free cash flow suggests BT suffered an actual cash outflow of just over £900m last year. This is reflected in the group's net financial debt balance (exc. lease liabilities), which rose by £1bn to £14.5bn. The company says this was mostly due to £800m of scheduled pension scheme contributions.

Dividend: the final dividend was increased to 5.69p per share, lifting the full-year payout by 3.9% to 8p per share.

Outlook & updated cash flow guidance: BT's decision to increase its dividend seems bold to me, but does appear to be underpinned by Ms Kirkby's updated cash flow guidance for the remainder of this decade.

Capex is said to have peaked at £4.9bn last year and should be "less than £4.8bn" from FY24-FY26.

From FY27 onwards, the intensity of the fibre rollout should ease. The company expects capex to fall by c.£1bn per year from 2026/27 onwards.

Together with further cost savings of £3bn, this is expected to support normalised free cash flow of £1.5bn in FY25, rising to £2.0bn in FY27, and c.£3.0bn by FY30.

For context BT's net cash interest payments and dividend payout totalled c.£1.5bn last year. On this basis, I'd say the increased dividend is probably affordable, albeit without much slack to allow for any increase in debt servicing costs.

Pension: I would be more relaxed about BT's debt levels if it didn't have a monster pension scheme with £40bn of liabilities and only £35bn of assets.

These numbers moved in the wrong direction last year, expanding the company's pension deficit increased to £4.8bn (FY23: £3.1bn) during the period. This sounds ominous, but this IAS 19 accounting measure is mostly reflecting the impact of rising interest rates on the market value of the bonds held by BT's pension scheme.

This is a quite different calculation from the triennial actuarial valuation, from which deficit reduction payments are calculated.

The last triennial valuation was in 2023 and committed the group to annual payments of £600m through to 2030.

The impact of higher interest rates might mean that the 2026 triennial valuation reaches a different conclusion and payments can be reduced. For now, however, I think it's prudent to view these annual payments as a fixed commitment.

My view

BT's current strategy is largely built around ramping up its fibre rollout and cutting up to 55,000 jobs from its 130,000 workforce by 2030.

10,000 jobs were cut last year and my understanding is that many of the cuts will be back-end loaded – engineers and service staff will be cut as the fibre rollout nears completion.

Capital expenditure is running at over 20% of revenue as the group tries to address a historic lack of investment in UK fibre infrastructure.

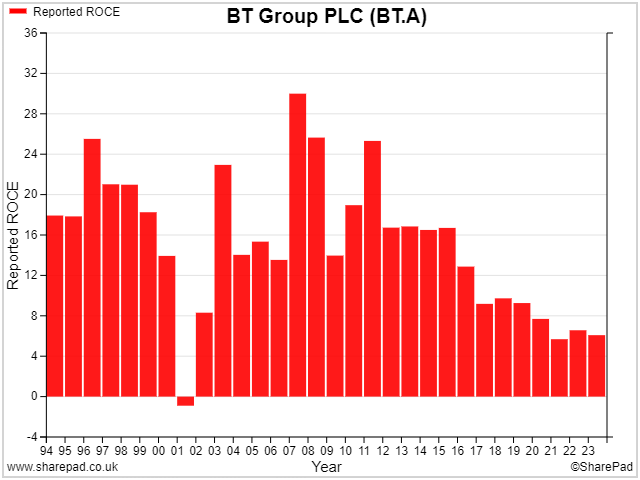

What we don't yet know is whether the group will be able to generate attractive returns on this massive capex. In a competitive market, does BT still have enough pricing power to generate returns above its cost of capital?

Return on capital employed has plunged over the last decade. I calculate a figure of 5.3% for last year, or 7.6% using management's adjusted measure of operating profit.

If BT can stem its market share losses and maintain the pricing power it needs to generate an economic return on its investment, then I think the shares could be reasonably priced at current levels.

The dividend now offers a 6% yield and consensus forecasts for £1.5bn of free cash flow this year imply an 11% free cash flow yield.

The trouble is that I have no idea how likely it is BT's profitability will improve. The added complications of BT's pension situation and political exposure are also discouraging, for me.

As an investor who is heavily led by the numbers, BT shares don't really appeal to me at current levels.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.