Dividend notes: FTSE 250 shares that are too cheap? RDW, ASHM (14/09/23)

Cyclical conditions are tough for housebuilder Redow (LON:RDW) and asset manager Ashmore Group (LON:ASHM). I review the latest results from both companies and ask if they offer value.

Welcome back to my dividend notes.

Today I'm looking at two fairly unloved FTSE 250 shares. They're facing tough cyclical conditions at the moment, but I think there are good reasons to be more optimistic about the medium-term outlook.

Companies covered:

- Redrow (LON:RDW) - profits are expected to halve this year, but this upmarket housebuilder looks in good health and fairly cheap to me, on a cyclical view.

- Ashmore (LON:ASHM) - I think the 8.8% dividend yield may remain supportable, if the emerging markets asset manager can stem the tide of outflows. There are less risky options elsewhere, but the high yield looks tempting to me.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Redrow (RDW)

"as we go into 2024 the market remains challenging and uncertain"

Full-year results from this housebuilder appear reassuring at first sight, but the firm's management expect profits to halve over the coming year.

Full-year results highlights: as we've seen elsewhere, housebuilders have been running off their order books this year and converting these backlogs to cash. This has led to some surprisingly strong results.

Redrow is a good example of this. Revenue for the 52 week to 2 July 2023 was almost unchanged at £2.13bn, with underlying pre-tax profit down just 4% to £395m.

Price rises helped offset the impact of rising costs. The average selling price on private homes rose by 8%, with affordable home prices up by an average of 5%.

The company says the average price of its flagship Heritage Collection homes rose by 9% to £473,300. My sums suggest that the average price of one of the firm's affordable homes was c. £176k.

A "very selective" approach to land buying helped to boost cash conversion. I reckon Redrow generated £155m of free cash flow last year. That's equivalent to a free cash flow yield of about 9.5%.

Return on capital employed for the year was a creditable 18.2%.

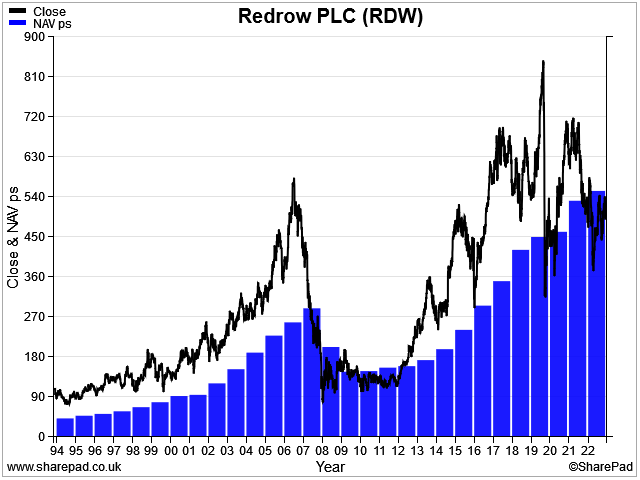

Redrow's year-end balance sheet shows net cash of £235m and a net asset value of £2,026m, or 612p per share (FY22: 554p). That's a discount of around 20% to the last-seen share price of 503p.

Dividend: a final dividend of 20p per share takes the total FY23 dividend to 30p. However, this payout is expected to fall in FY24.

FY24 guidance/outlook: last year's strong performance is not likely to be repeated during the current year.

Redrow's order book fell by 41% to £0.85bn last year.

Profits are expected to halve this year, "based on a sales rate in line with FY23 of 0.46 [homes] per outlet per week".

Sales during the first 10 weeks of the financial year have only averaged 0.34 per outlet per week, but this figure is presumably expected to improve.

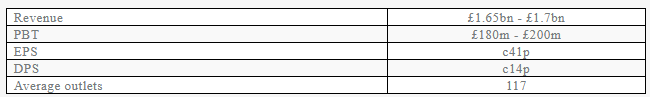

Management guidance for the 2024 financial year is as follows:

On this basis, Redrow shares are trading on 12 times forecast earnings, with a 2.8% dividend yield.

My view

I think Redrow's net cash position and discount to book value are probably a more meaningful guide to its valuation than cyclically-depressed annual earnings.

Historically, buying Redrow shares at a discount to book value has worked well:

Although I can't rule out the possibility that market conditions will worsen – especially in terms of volumes – the shares look decent value to me at the moment, given the strength of the balance sheet.

Founder Steve Morgan remains a 17% shareholder, so I imagine he'll ensure that management remain careful stewards of the business he built.

However, Redrow's depressed dividend yield means that for me, there are better options elsewhere in this sector. For example, the housebuilder I own in my dividend portfolio is expected to deliver a 5%+ yield over the coming year.

Ashmore (ASHM)

"Ashmore has delivered meaningful investment outperformance for clients this year and momentum is building as the recovery in Emerging Markets continues."

How should active asset managers compete against the rising tide of passive investing? Specialisiation seems the obvious answer to me, and emerging markets specialist Ashmore has always followed this path.

The company is still led by founder Mark Coombs, who also has a 31% shareholding.

Results for the year to 30 June 2023 show that Ashmore's investments outperformed the market last year, with a "positive performance of $3.4bn" on year-end assets under management (AuM) of $55.9bn (FY22: $64.0bn).

Unfortunately, "de-risking" by clients resulted in net outflows of $11.5bn, limiting Ashmore's ability to deliver a recovery in earnings.

Net outflows means lower fees, which are usually charged as a percentage of AuM. Given this backdrop, last year's results do not seem especially bad to me.

Revenue fell by 24% to £195.4m, reflecting a 23% fall in AuM. However, pre-tax profit of £111.8m was only 6% lower than the prior year, thanks mainly to a rise in interest income and a reduction in bonus costs.

Cash generation remained good, albeit down on the prior year. The company says an operating profit of £77.4m was converted into £111.6m of cash from operations. The equivalent figures for FY22 were £119.2m and £182.1m.

The group's year-end cash balance was £478.6m (FY22: £552.0m). Although I'd imagine that some of this cash is required for regulatory purposes, Ashmore's cash generation suggests to me that a dividend cut may yet be avoided.

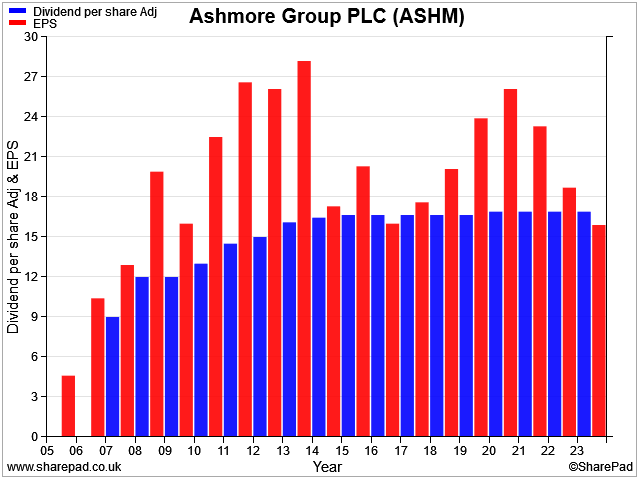

Dividend: Ashmore's dividend was maintained at 16.9p per share last year, giving the stock a dividend yield of 8.8%. My sums suggest the payout will cost around £120m, so it should largely be covered by last year's cash generation.

I estimate that Mr Coombs' share of the dividend is c.£37m per year, so I imagine he'll be reluctant to cut the payout while it remains supportable.

Ashmore's dividend has not been cut since its flotation in 2006, but growth has been minimal since 2015, as earnings have stagnated:

Outlook: Ashmore's results commentary each year generally includes a bullish outlook statement from Mr Coombs.

Even so, I think Ashmore's outperformance against its benchmarks last year may provide some justification for his confidence about the outlook for the year ahead:

"Some investors remain cautious, but client activity levels are increasing and the combination of positive performance and attractive valuations available across Emerging Markets should drive capital flows over the medium term, as has occurred after previous down cycles."

Broker forecasts suggest a 6% increase in earnings to 13.1p per share this year, with an unchanged dividend. That puts Ashmore on a P/E of 15, with a chunky 8.8% dividend yield.

My view

I don't know whether Ashmore will be able to attract new client inflows and stage a recovery in AuM this year. But my general impression of this business is that it's fairly good at what it does.

For much of the last decade, Ashmore generated 20%+ returns on equity and operating margins in excess of 60%. So a return on equity of c.10% in each of the last two years is a disappointment.

However, this business remains profitable and appears to be well capitalised. In my view, the dividend is only slightly stretched at present.

With the shares trading at post-2009 lows, I can't help feeling that Ashmore shares are probably cheap at current levels.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.