Dividend notes: do these FTSE 100 shares offer value? ADM, AV, BA (17/08/23)

I give my view on recent results and acquisition news from BAE Systems, Admiral and Aviva.

Welcome back to my dividend notes. Today I'm looking at a trio of FTSE 100 firms that have reported recently. These include:

- a seven-bagger;

- a business that's just announced its biggest ever acquisition;

- and a company whose share price is lower than it was 20 years ago!

Companies covered:

- Admiral (LON:ADM) - solid half-year results confirm my view this firm is the class of the field in the UK motor insurance sector, but I'm less convinced by Admiral's international diversification efforts.

- Aviva (LON:AV) - solid half-year results show continued cash generation and delivery to plan. I don't think the quality of this business justifies a high rating, but at current levels the 8.7% dividend yield looks attractive to me.

- BAE Systems (LON:BA) - defence giant BAE looks in good shape at the moment and has a record order book. But the company has just announced its largest ever acquisition. BAE shares are also trading at a near-record valuation. I'm not sure how much value is on offer at this point.

Tip: to search for my previous coverage of a company, enter its ticker code into the search tool at the top of this page.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Admiral (ADM)

"we believe that the cycle is turning"

Admiral has issued a solid set of half-year results and a confident outlook for the year ahead. The company believes the cycle could be turning for UK motor insurers, after a difficult year in 2022 when claims costs soared.

These challenging conditions exposed some weaknesses in rival Direct Line's business and DLG reported a loss for 2022. I subsequently decided to sell DLG from my model dividend portfolio and my own holdings.

However, FTSE 100-listed rival Admiral fared much better in 2022, reporting a pre-tax profit just 7% below pre-pandemic levels.

In truth, I think Admiral has always been a superior business to Direct Line. My original decision to purchase Direct Line was based on valuation rather than quality grounds. With hindsight, this may have been short sighted.

This week's half-year results from Admiral showed a further drop in earnings and a reduction in the interim dividend – but these numbers still seemed pretty respectable to me, given the improving outlook.

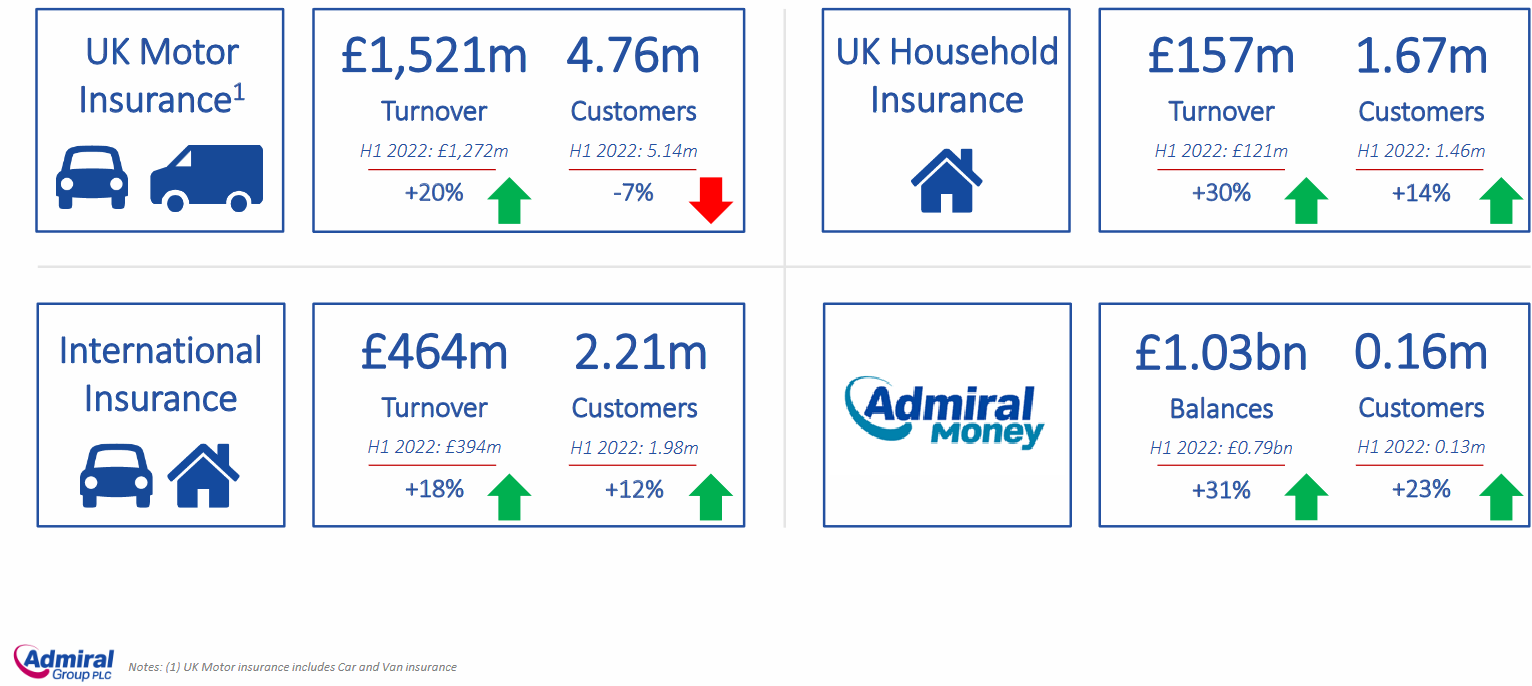

Half-year highlights: Admiral says its group revenue rose by 21% to £2.24bn during the six months to 30 June, as insurance premiums were increased to reflect continued inflation.

The company says that new business quotes for UK motor insurance rose by 20% during the half year, compared to the same period last year.

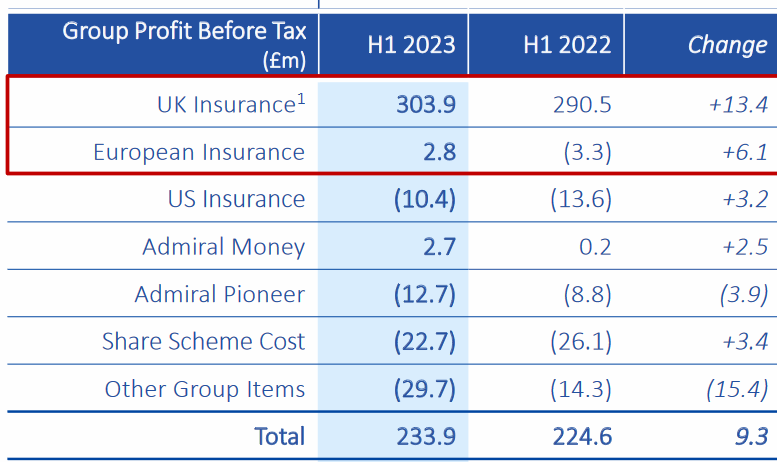

While this is painful for consumers, Admiral doesn't appear to be profiteering. Pre-tax profit rose by just 4% to £233.9m, while after-tax earnings per share fell 5% to 57.6p.

The group's financial health remained good, though. Admiral's solvency ratio was 182% at the end of the half year (H1 22: 185%) reflecting a comfortable cushion of surplus capital to support dividends.

Profitability was also strong, with a return on equity of 39% (H1 22: 36%). Admiral's heavy use of reinsurance has long supported high returns on equity.

I'm not sure if the business will return to its long-run average of c.50% ROE, but these results suggest to me that Admiral's business model is continuing to work well in more difficult circumstances.

Dividend: the interim dividend fell by 15% to 51p per share, as the company maintained its payout ratio of c.90% of earnings. Current forecasts suggest a full-year payout of 116p, giving a prospective yield of 5%.

Operating commentary: the total number of group customers rose by 4% to 9.4m last year, but the company says its UK motor customer base fell by 7% to 4.76m customers, as it prioritised margins over growth.

Customer numbers in the firm's other UK operations rose, as these operations were less affected by inflation and presumably remained more competitive on price.

The group's underwriting remained profitable, with a combined ratio at group level of 89.8%.

The combined ratio represents the sum of claims costs and operating expenses, compared to premium income. So a figure under 100% represents profitable insurance underwriting.

In addition to underwriting profits, insurers may generate investment income by investing customers' premiums. In the UK motor business, higher interest rates drove an investment income of £50.9m during the half year, compared to £20.9m during the same period last year. This helped to offset a slight reduction in underwriting profits, which fell from £198.5m to £189.5m for the half year.

There are lots of moving parts here, but performance in the core UK business during the first half of this year looks good to me and was also fairly consistent with past years. It's hard to find serious fault with this business, in my view.

International operations/diversification: Admiral is already the largest motor insurer in the UK and has limited room to expand.

It's addressing this challenge in two ways:

- the UK business is expanded into adjacent areas such as home and travel insurance and personal loans

- the group has several interational insurance operations in Europe and the US

These secondary businesses all generated revenue and customer growth during the half year:

However, several of them remain loss-making. None of them make a material contribution to the profitability of the group:

Admiral's international insurance operations now have 2.2m customers and generated £464m of revenue during the first half of the year. So these businesses are not trivial – but their customers are spread across multiple operating subsidiaries in the US, France, Spain and Italy.

International insurance growth has been underway for well over a decade:

- Spain (2006)

- Italy (2008)

- USA (2009)

- France (2010)

Yet collectively, these operations generated a pre-tax loss of £7.6m in H1.

In contrast, Admiral's UK insurance business was launched in 1993. In 2003, it generated a pre-tax profit of £57m.

The group's UK loan business, Admiral Money, has also delivered a quicker journey to profitability. It was launched in 2017 and turned profitable in 2022.

I wonder if the overseas insurance businesses lack the kind of disruptive innovation that characterised Admiral's strong early growth. Presumably they all face large, established incumbent competitors. Each market will also have different cultural and market characteristics. Insurance is not exactly the same everywhere.

It's not clear to me if Admiral's overseas insurance businesses will ever reach the kind of attractive scale and profitability enjoyed by its UK operations.

I'm also slightly unsure about the Admiral Pioneer business, which appears to be an in-house venture capital division:

"Admiral Pioneer is a new entity within Admiral Group with the aim of seeding, launching and scaling new businesses to grow and diversify Admiral in the future."

Admiral Pioneer generated an increased pre-tax loss of £12.4m during the first half (H1 2022: £8.8m loss).

I think it's possible to argue that Admiral and its shareholders would be better served by the firm focusing on its UK business and returning any additional surplus capital to shareholders, perhaps through buybacks as well as dividends.

In reality, only time will tell. I accept that all of these efforts could go either way. One (or more) of them may yet become a standout success, justifying all the others.

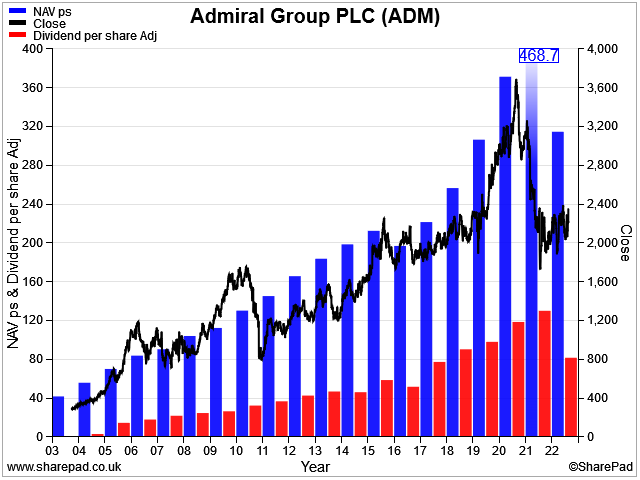

Although I'm a little sceptical about these diversification efforts, the company's track record of creating shareholder value does perhaps justify giving management the benefit of the doubt. Admiral shares have seven-bagged in 20 years, backed by steady dividend and NAV growth:

My view

Despite my concerns about diversification (diworsification?) I think Admiral remains an excellent and very profitable business.

Broker consensus forecasts currently price the shares on 19 times forecast earnings, with a dividend yield of around 5%. This P/E rating is slightly above the long-run average according to SharePad data, but I think it could still represent fair value for this business, given Admiral's high returns on equity.

I remain interested in Admiral, which also scores well in my dividend screen for financial stocks.

I'll continue to follow the business, but I'm aware that inflation has been more persistent than expected. Even if price rises ease, I wonder if they may continue to weigh on Admiral's ability to take market share and grow profits, given competitive pressures.

For now, I'm on the sidelines. But Admiral is certainly a stock I could see myself owning in my dividend portfolio.

Aviva (AV)

"Confident outlook for 2023, expect to exceed Group medium-term targets"

I last looked at this FTSE 100 insurer in May, when I thought that the shares were reasonably valued and potentially attractive to me from an income perspective.

Half-year results highlights: this week's interim results don't change that view. Aviva's operating profit rose by 8% to £715m during the first half of this year, while Solvency II own funds generation (a measure of surplus cash generated) climbed 26% to £648m.

Aviva's Solvency II coverage ratio remained very comfortable, at 202%, while the group's combined operating ratio of 94.8% confirmed that it general insurance underwriting remains profitable.

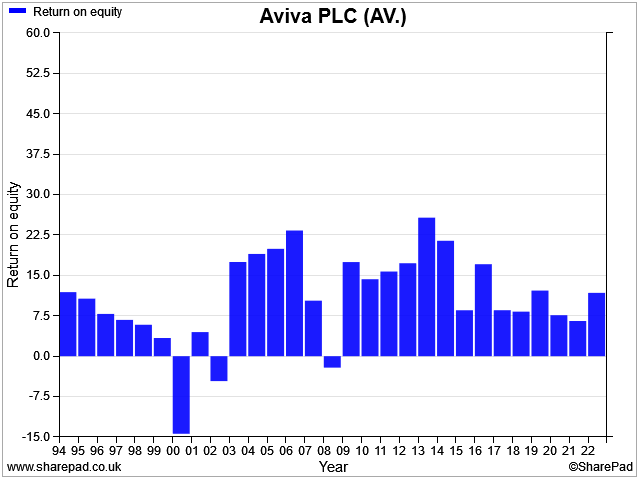

Profitability improved on the same period last year, with a return on equity of 10.8% (H1 2022: 6.7%).

Dividend: the interim dividend will rise by 8% to 11.1p per share and the company confirmed previous guidance for a payout of c.33.4p per share this year. That gives Aviva shares a prospective yield of 8.7% at current levels.

However, management say that dividend growth from next year is likely to be at "low-to-mid single digit" levels.

Operating commentary: Aviva said gross written premium rose by 12% to £5,274m in its general insurance business, primarily driven by price increases.

Sales of health insurance rose by 58%, presumably driven by buyers seeking to circumvent long NHS waiting lists.

Annuity sales (bulk and individual) rose by 17% to £3,223m, while the Aviva Investors asset management business maintained net inflows of £0.2bn, unchanged from the same period last year.

Outlook: CEO Amanda Blanc believes that profitability should continue to improve in the general insurance business as inflation eases and the benefits of previous price increases feeds through.

Ms Blanc expects to report a group operating profit up by 5%-7% in 2023, from a figure of £1,350m in 2022.

Note: Anyone looking at last year's results for a comparison may be confused - operating profit last year was reported as £2,213m. The reason for the discrepancy is that the firm's 2022 results have now been restated to reflect the new IFRS 17 accounting rules for insurers. This shouldn't have any impact on dividend-paying capacity, but results in some reporting and measurement changes - details available here.

Aviva says it remains on track to generate £1.5bn of own funds per annum by 2024 and return a total of £5.4bn to shareholders between 2022 and 2024.

Targeted cost savings of £750m are expected to be delivered "by 2024", one year early.

Broker forecasts suggest earnings of 41.6 per share this year, pricing the stock on just nine times forecast earnings – with a near-9% dividend yield.

My view

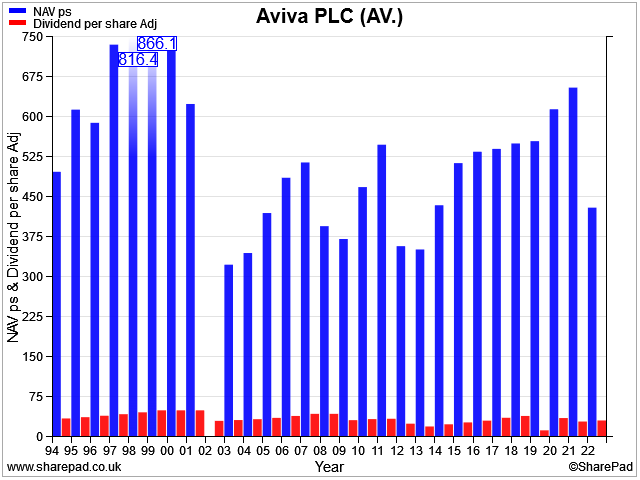

As I discussed in my dividend share review of Aviva in January, Aviva's profitability has always been somewhat average – sometimes below average:

Although I believe CEO Amanda Blanc has made some sustainable improvements to performance, I think it's worth remembering the company's poor record of shareholder value creation:

This may be one reason why Aviva's share price has essentially made no progress over the last 25 years:

I suspect Aviva's large, mature operations in developed markets will always struggle to generate much sustainable growth. But the group's improved cash generation and stronger balance sheet suggest to me it could remain a decent cash cow for income seekers.

Everything has its price, in my view, and with a covered forecast dividend yield of 8.7%, I would consider Aviva for a high-yield portfolio.

BAE Systems (BA)

"secured £21.1bn of orders to set a record order backlog of £66.2bn"

The war in Ukraine has triggered a widespread increase in defence spending by western governments.

FTSE 100 defence group BAE Systems upgraded its profit guidance earlier this month after publishing half-year results showing operating profit up by 20% to £1,233m for the six-month period.

Underlying earnings per share are now expected to rise by 10%-12% this year, compared to 5%-7% previously.

Free cash flow is expected to top £1.8bn, versus previous guidance of £1.2bn.

Debt levels are down and the group has a record order book of £66.2bn. The outlook appears strong, with high single-digit percentage earnings growth forecast through to 2025.

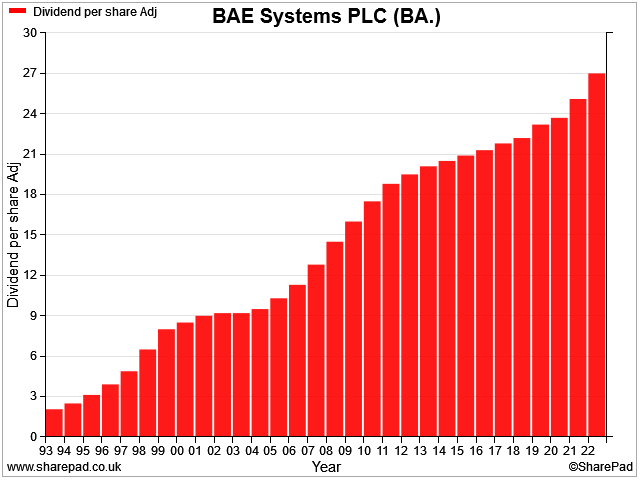

BAE has an impressive 20-year record of dividend growth and the firm's interim payout has just been lifted by 11%. That's well above the 4% average growth rate of recent years. Should I be considering this stock for my dividend portfolio?

My view

I have followed BAE Systems for several years but do not currently own the shares. I think the business is in good shape at the moment and appears to be well positioned to benefit from the external environment.

The shares currently score fairly well in my dividend screen, earning a score of 68 out of a possible 100. However, while the group's dividend record naturally appeals to me, there are several reasons why I'm not considering buying the shares at the moment.

Acquisition: chief executive Charles Woodburn appears to be feeling confident. He's just agreed a $5.5bn deal to acquire the Ball Aerospace business from its parent company, US packaging group Ball Corporation.

Ball Aerospace is described as a "space and defence technology leader":

"Ball Aerospace is a leading provider of spacecraft, mission payloads, optical systems, and antenna systems"

The deal will be BAE's largest ever and is expected to help BAE gain scale in this fast-growing segment of the market.

Woodburn says he "couldn't be more pleased" to have secured this deal and believes the "strategic and financial rationale is compelling". However, the value – or not – of this acquisition appears to be highly dependent on continued growth hopes.

- BAE has agreed to pay $5.55bn for Ball Aerospace

- Management say that this includes tax benefits with a net present value of $750m, reducing the effective cost to around $4.8bn

- Including this tax benefit, BAE says the deal is valued at 13 times Ball's 2024 forecast EBITDA, suggesting an EBITDA figure of about $370m

- However, Ball's 2023 forecast EBITDA is said to be $310m, increasing the valuation multiple to 15.5x EBITDA

- Moreover, EBITDA includes depreciation and amortisation costs that are very real for engineering and manufacturing businesses.

- I prefer to consider acquisitions based on historic operating profit

- The mandatory disclosures reveal that Ball generated revenue of c.$2bn and EBIT of $170m in 2022

- These numbers imply BAE is paying a multiple of 28 times trailing operating profit, including the expected tax benefit

- For contrast, BAE itself currently trades on a trailing EV/EBIT multiple of 13x – as we will see, this is somewhat above average for this business.

I suspect that the Ball acquisition will probably be a reasonable deal for BAE over the medium term, expanding its capabilities in key areas. But my feeling is that BAE is probably paying quite a full price.

More generally, my experience suggests that when companies have the confidence to make record-sized acquisitions, market conditions are often quite bullish, limiting the value on offer.

This leads me to my next concern.

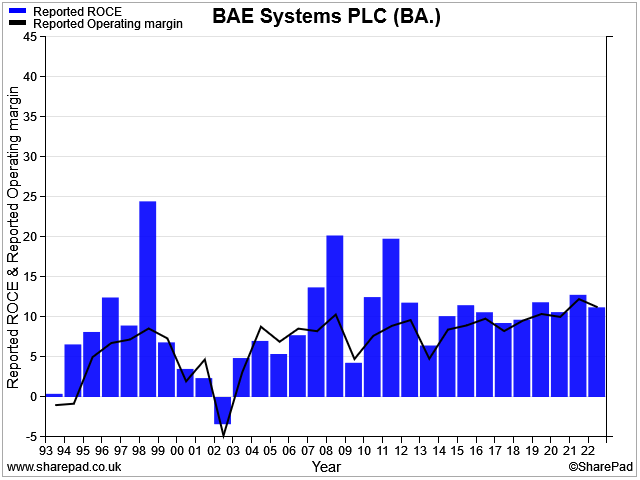

Profitability: I really want to own businesses with above-average profitability and the ability to deliver compound growth over long periods. BAE's return on capital employed has averaged just over 10% in recent years. Margins are also somewhat unexciting, averaging around 10%.

These numbers are okay for a large and somewhat capital-intensive engineering business. But they're at the lower end of the range I target, especially given the rising cost of capital (interest rates):

I wouldn't rule out investing in BAE, based on this historic profitability. But I'd want to do so when I felt that the valuation provided a comfortable margin of safety. I'm not sure that's true at the moment.

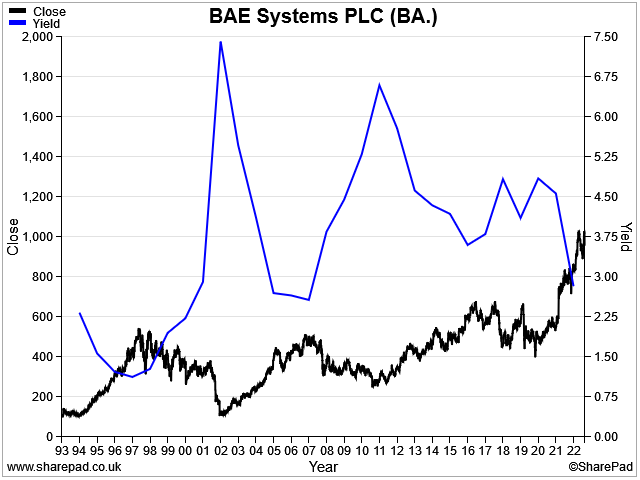

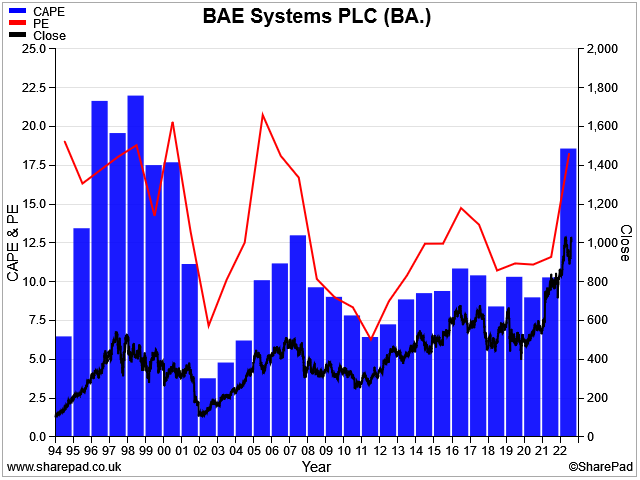

Valuation: BAE shares are currently trading on about 16 times forecast earnings. The dividend yield has dropped to about 3%. Historically, such a low yield has been unusual and signalled the start of a period of share price weakness:

Of course, past performance is not a guarantee of future returns. But the stock's P/E is also unusually high at the moment:

In my view, the current valuation reflects two possibilities:

- BAE's earning power will be significantly improved for the foreseeable future, due to a resurgence in government defence spending

- Market exuberance for defence stocks means that BAE shares are trading above the level I would normally expect for this business, which I'd characterise as mature, of average profitability, and relatively slow growing.

In situations like this, we all have to do our own research and form our own view.

My personal view is that BAE shares look relatively expensive at the moment. To be interested in buying, I'd be looking for a dividend yield of 4%-5%, which would be equivalent to a share price of 600p - 750p.

I may be wrong, of course! Time will tell. Please let me know what you think in the comments below.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.