The Dividend Note - decades of dividends - GSK, NWF, WYN, JHD (02/02/24)

I take a look at the latest updates from four companies with at least 20 years of consecutive dividend payouts - GSK, NWF, Wynnstay and James Halstead.

Welcome back to The Dividend Note, my weekly review of results from dividend stocks that look interesting to me.

Today's note covers companies that have issued results or updates over the last week and which boast at least 20 years of unbroken dividend payouts.

Companies covered:

- GSK (LON:GSK) - stronger free cash flow, falling debt, and a well-supported dividend that's returning to growth (after a cut). I don't understand much about pharma, but GSK's financials look much improved to me.

- NWF Group (LON:NWF) - profits were down after a more challenging H1. I remain positive about the medium-term outlook and valuation, with the caveat that I think there is still some risk that H2 might also disappoint.

- Wynnstay Group (LON:WYN) - a tough year that appears to have been made worse by the reversal of exceptional fertiliser profits in 2022. The shares trade at an sizeable discount to book value and now look good value to me.

- James Halstead (LON:JHD) - a brief but positive update from this flooring group, guiding for H1 profits to be 15%-20% above last year. Not cheap, but high quality with a 30-year dividend record and 4% yield.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

GSK (GSK)

"Broad-based performance drives sales, profits and earnings growth"

Final results / Mkt cap: £65bn

Forecast dividend yield: 3.8%

I don't really follow the pharmaceutical sector, as even the largest companies appear to be dependent on a regular supply of blockbuster drugs to support their profits.

Developing new medicines appears to be an expensive and somewhat hit-and-miss business, and I don't feel that I have the ability to understand or grade different companies' prospects.

Having said that, the largest companies in the market do appear to be sufficiently diversified to be plausible investments for me, as a non-expert. In the UK, the companies I keep an eye on are AstraZeneca, GSK and generic specialist Hikma Pharmaceuticals, which has lower drug development risk (I think!).

This week it was GSK's turn to report. I don't intend to dig very deep here, but I do want to highlight the group's improving financial performance and cash generation.

If this continues – and GSK hits forecasts – I think the shares could still be quite reasonably valued at current levels.

2023 results summary: GSK's headline results look strong to me and suggest the group may still be benefiting from the post-pandemic normalisation of vaccination programmes (many of which were paused).

Vaccine sales rose by 25% last year, including a 17% increase to £3.4bn in sales of Shingrix, its shingles vaccine.

The new Arexvy RSV vaccine generated £1.2bn of sales, making it the group's newest blockbuster (sales >£1bn).

Sales of HIV medicines rose by 13%, with general medicine sales up by 5%.

One bugbear of mine with GSK and AstraZeneca is the very high level of adjustment both companies like to apply to their profit calculations.

GSK's 2023 results show reveunue rising by 3% to £30.3bn last year.

The company then applies £2.1bn of adjustments to £6.1bn of reported pre-tax profit to arrive at an adjusted PBT figure of £8.1bn!

I prefer to stick with the statutory figures. Last year's pre-tax profit of £6.1bn represented a useful 7.7% increase on the £5.6bn reported in 2022.

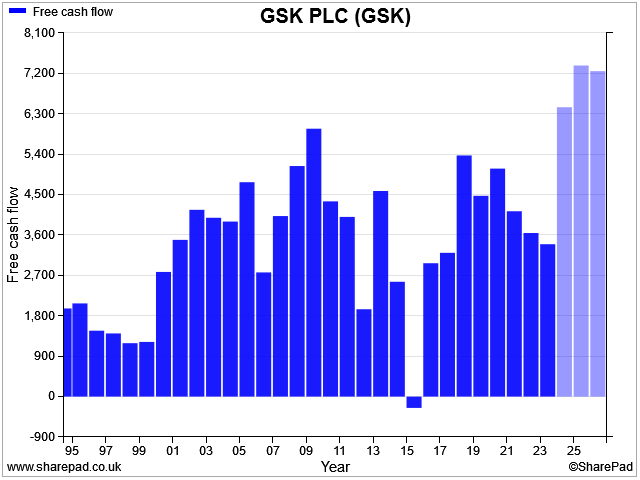

Where it gets more interesting, for me at least, is the cash flow statement.

My sums suggest 2023 free cash flow of about £3.8bn last year, excluding new acquisitions and the sale of equity investments.

Net profit attributable to shareholders was £4.9bn, so this represents free cash conversion of around 78%. Not a terrible result.

Net debt has also fallen further and was £15.0bn at the end of 2023 (FY22: £17.2bn). That's within my comfort zone, based on a net profit of c.£5bn.

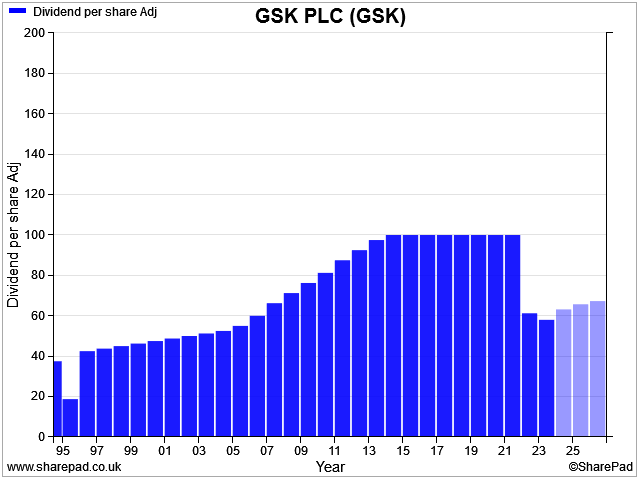

Dividend: GSK cut its payout following the spinout of its consumer goods business, Haleon.

The 2023 payout of 58p is expected to be a low point. Management are guiding for a dividend of 60p in 2024, giving a prospective yield of 3.8%.

GSK's dividend was flat for nearly a decade before the Haleon spinout and often looked under pressure to me.

But the company has not skipped a payout for 32 years, according to SharePad data, earning it inclusion in this decades of dividends newsletter!

Outlook: broker forecasts suggest GSK's growing sales of new products will continue to support stronger cash generation.

Consensus forecasts in SharePad suggest free cash flow could rise to £6.5bn in 2024 and might reach £7.4bn in 2025.

Based on the current market cap of £65bn, these estimates suggest GSK shares could offer a free cash flow yield of c.10% if forecasts are met.

I'm not sure how likely this is, but I think it could potentially be an attractive valuation for a leading FTSE 100 business.

My view

After a long period of fairly lacklustre performance, GSK seems to be turning a corner. I don't know if this will be sustainable, or if the company's pipeline will continue to deliver more blockbuster vaccines.

However, with the shares trading on 10 times FY24 earnings and offering a 3.8% dividend yield supported by free cash flow, the shares look more interesting to me than they have done for a while.

NWF Group (NWF)

"We have experienced a more challenging first half than in recent years, but our underlying expectations for the full year remain unchanged"

Half-year results / Mkt cap: £99m

Forecast dividend yield: 4.1%

NWF is a distribution group operating in three sectors – fuel, agricultural feed and ambient groceries. There's (much) more detail about this business in the in-depth share review I published in December last year.

January's half-year results revealed an (expected) slump in profits and were not well received by investors. However, the company says full-year expectations are unchanged and these results do not flag up any major concerns for me.

Half-year summary: NWF's headline numbers may look bad at first sight, but I think we need to remember that the comparative period was May-November 2022, when energy markets were disrupted significantly by the Ukraine war. This led to opportunities for larger-than-normal margins for companies such as NWF.

Here are some key H1 numbers:

- Revenue down 12.7% to £472.9m

- Pre-tax profit down 35.6% to £3.8m

- Diluted earnings per share down 40.9% to 5.5p

- Net cash (exc. lease liabilities): £13.3m (H1 2022: £1.2m)

I don't think there's much value in calculating profitability metrics from these half-year results. NWF's profitability is seasonal, with the majority generated in H2 (winter heating/farm feed season).

However, I think it is worth taking a look at each of the group's three operating divisions.

Fuels: the main products sold by this business are road fuels and heating oil. It's very much a consolidator, regularly acquiring small local suppliers.

Revenue fell by 14.2% to £344.8m in H1, while operating profit dropped 73% to just £0.7m.

"Expected normalisation of margins as supply conditions remained stable throughout the period"

NWF says that stronger commercial demand and the benefit of acquisitions offset weaker demand for heating oil. Overall, H1 volumes rose by 9.3% to 328m litres.

However, this remains well below the 347m litres sold in H1 2021, when NWF Fuels generated an operating profit of £3.6m.

Scrolling back to check, NWF says that there were UK fuel shortages in autumn 2021 and the company was able to benefit from this by maintaining supplies for its customers.

I see that oil and fuel prices also rose during H1 2021, potentially supporting bumper margins for companies such as NWF, who were able to sell into a rising market.

I don't want to draw too many conclusions without seeing the full-year results. But I wonder if the profitability of the fuels division is suffering a reset after the unusual events of recent years. If I'm right, then any weakness in volumes could become more significant again.

Food: in contrast to fuel, volumes are surging in the Food business. The company is currently using overflow storage facilities, in addition to its two permanent warehouses in Crewe and Wardle.

To address this, NWF's Food business, Boughey Distribution, has recently leased a new warehouse in Newcastle-under-Lyme. The new warehouse will add storage for a further 52,000 pallets, taking the group's total storage capacity to 187,000 pallets.

"The work on the fit out of Lymedale has already commenced and the site is expected to be fully operational by early autumn of this year. This is in line with our stated strategy for the Food business of targeting warehouse expansion, where it is backed by customer and retailer demand..."

The new property is expected to result in an annualised increase in headline pre-tax profit of c.£1.2m in the 2025/26 financial year.

Reading further down the notes reveals that pre-tax profit will be hit by £1.7m of set-up costs this year, but this seems a sensible investment to me.

The financial performance of the Food business was significantly stronger in H1, in contrast to Fuels. Revenue rose by 9.7% to £39.5m, supporting a 38% increase in operating profit to £2.9m.

The number of pallets stored rose by 10.7% to 135,000 in H1, and management say the business benefited from an 8.8% increase in throughput. They also confirm that NWF was able to pass through inflationary cost increases – essential to protect margins in a business of this kind.

The company reports a "high level of demand from both existing and new customers".

Feeds: revenue in the feeds business fell by 14.8% to £88.6m during the half year, resulting in a sharp fall in operating profit to just £0.4m (H1 2022: £2.1m).

Last year, NWF Feeds benefited from volatile commodity prices and a "record high milk price". These supported higher margins and stronger demand, respectively.

However, mild weather during the autumn last year meant that animals could graze outside for longer, reducing feed demand.

NWF's feed volumes fell by 5.5% to 225,000 tonnes in H1, seemingly underperforming the wider ruminant feed market, which DEFRA figures suggest fell by 1.4%.

The company says it also chose to forego some lower-margin merchant business and is focusing on higher margin direct-to-farm sales.

This volume drop seems to suggest a slight loss of market share, but peer Wynnstay (see below) reported a near-identical drop in feed volumes. So perhaps the DEFRA figure isn't a useful guide.

Milk production is also said to have fallen by 1% compared the prior half year, with the average milk price down by 22%.

NWF says average feed costs fell by 20%, "maintaining farmers' margins", but I would imagine dairy farmers might be slightly more cautious about spending in the face of falling milk prices.

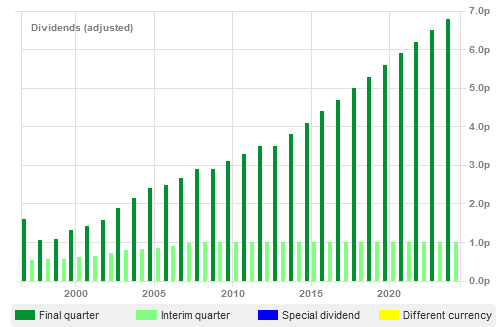

Dividend: the interim dividend has been left unchanged at 1.0p per share, in line with policy.

NWF pays the bulk of its dividend via the final payout each year. This is set when the cash-generative second half of the year has completed.

This chart from SharePad shows how NWF's payout has grown without a break for 28 years:

Consensus forecasts suggest a payout of 8.1p per share this year, maintaining the c.4% growth rate seen in recent years. This gives NWF shares a prospective yield of 4.1%.

Outlook

The company says its full-year expectations are unchanged, on an underlying basis:

"We have experienced a more challenging first half than in recent years, but our underlying expectations for the full year remain unchanged"

However, ramping up the new warehouse will result in a £1.7m hit to pre-tax profit and a cash outflow of approximately £8.5m.

When taking together with the weaker H1 performance of the Fuel and Feeds divisions, I'm not entirely convinced this constitutes an unchanged outlook.

Analysts covering the stock seem to agree; consensus earnings forecasts for 2023/24 have been cut by 2.6p to 19.4p per share since the warehouse acquisition was announced.

This leaves NWF shares trading on 10 times forecast earnings, with a 4.1% dividend yield.

My view

I don't see any serious concerns in these H1 results, but I think much will depend on how strong the company's second-half performance is. I think there's still some scope for disappointment.

I can't help feeling that long-time CEO Richard Whiting may have chosen the perfect time to retire (in March 2024), after 15 years in the role.

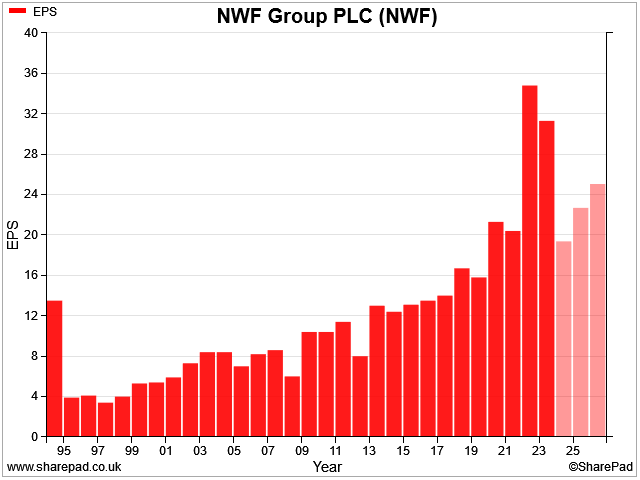

Despite this, I think the broader picture remains attractive. Based on current broker forecasts, NWF's profits are simply returning to the growth trend that was in place prior to 2021:

While long-term demand for road fuel and heating oil usage may trend lower, I'm not sure this will be a quick process.

Home owners don't change boilers that often, and there are not yet any mass-market alternatives to diesel for lorries and other heavy vehicles. I think the company's consolidation model should be able to offset this structural decline for some time yet to come.

If NWF can hit operating profit forecasts of £14.6m for the current year, then the shares could be trading on a tempting EBIT yield of nearly 15%.

The balance sheet looks fine to me and I don't see any obvious risk to the dividend.

I probably won't buy NWF for my portfolio, because it overlaps too heavily with another stock that I already own. But if it wasn't for this factor, NWF would probably remain on my watch list as a possible purchase.

Wynnstay Group (WYN)

"Much softer trading conditions compared to FY22"

Final results / Mkt cap: £80m

Forecast dividend yield: 4.8%

Wynnstay is an agricultural group with sizeable businesses in feeds, seeds, fertiliser and agronomy and agricultural merchanting.

In this sense, it competes in some of the same markets as NWF (see above), albeit the group's sole focus is agriculture and it has a broader presence in this sector than NWF.

I almost titled today's note "the great normalisation". Both NWF and Wynnstay appear to be in the middle of a return to normal levels of margin and earnings. This is taking place after a couple of years of exceptional performance, driven by external conditions in commodity markets and supply chains.

Shareholders have subjected the stock to a fairly brutal sell off – Wynnstay's share price is down by more than 40% from the highs seen at the end of 2022.

After such a big fall, the company's latest results suggest to me that this AIM-listed business could offer an attractive mix of income and value at current levels. Let's take a look.

Full-year results summary: Wynnstay's latest accounts cover the year to 31 October 2023.

Group revenue rose by 3% to £735.9m last year, thanks to record grain volumes and a contribution from two acquisitions.

However, pre-tax profit fell by 59% to £8.7m as margins on products – fertiliser, in particular – returned to more normal levels.

My sums suggest the group's operating margin fell from 2.9% to 1.2% last year. This translated into a return on capital employed of 5.8%, down from 14.6% in the prior year.

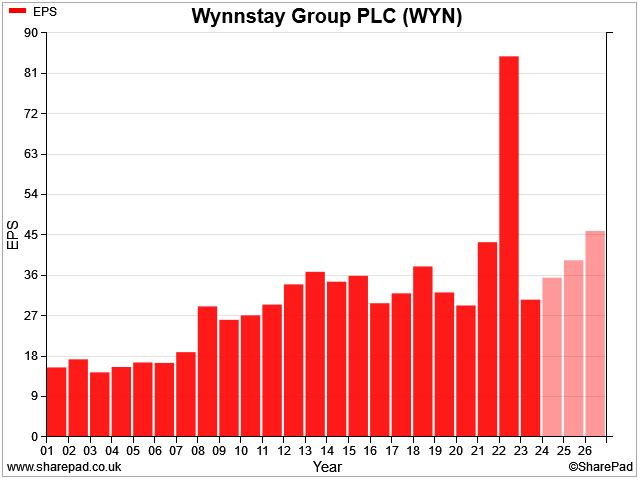

As with NWF, the trajectory of Wynnstay's profit growth seems to be returning to its past level:

Balance sheet/cash flow: a reduction in working capital last year provided a tailwind for Wynnstay's cash flow, leading to a net inflow of £4.3m.

This broadly maps onto my estimate of free cash flow of £4.6m, suggesting that the underlying business did not generate much additional surplus cash last year.

Despite this, the balance sheet looks strong to me, with a net cash position of £23.7m excluding lease liabilities (FY22: £21.5m).

Wynnstay ended the year with a net asset value of £135m, or 588p per share.

If I strip out intangibles, I still get a NTAV of 521p per share.

£55m of Wynnstay's NAV is held in inventories, the value of which is linked to commodity prices. Even so, the current share price of 374p reflects a 28% discount to tangible book value. That seems likely to offer value, in my view.

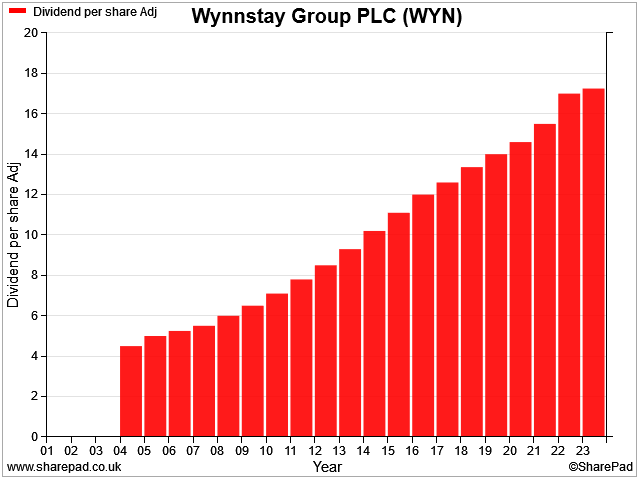

Dividend: prudent payouts over the last couple of years mean that Wynnstay has been able to maintain its record of dividend growth (just).

The company increased its full-year payout by 1.5% to 17.25p per share, marking its 20th consecutive year of growth.

Agriculture division: Wynnstay's core agriculture division generated revenue of £584.3m last year, down from £564.3m one year earlier.

Segmental profit dropped to £3.7m, from £14.7m in 2022. This swing appears to have been exaggerated by large movements the value of fertiliser inventories:

"segmental profit contribution of £3.7m, including one-off adverse Glasson fertiliser stock realisations (2022: £14.7m including significant Glasson fertiliser stock gains)"

My reading of this is that the company made a lot of money in 2022 when fertiliser prices surged, but was forced to sell some of its stock at a loss last year as fertiliser prices fell to more normal levels.

Interestingly, the company says that like-for-like feed volumes fell by 5.3% last year, reflecting lower demand from dairy and poultry farmers.

NWF also reported a 5% fall in feed volumes, so perhaps this is a truer reflection of the underlying market than the DEFRA figure of -1.4% cited by NWF.

Grain and fertiliser volumes were said to be strong, but a return to more normal pricing meant that margins were reduced.

Agricultural merchanting division: this smaller business provided a more stable performance. Revenue rose by 1.8% to £151.5m, while segmental profit fell 14% to £6.1m.

Management say that "lower farmer sentiment affected spending patterns", with a reduction in higher-margin sales.

Outlook

"Market conditions expected to remain challenging in the short-term"

Consensus forecasts in SharePad and Stockopedia suggest that earnings could rise by 15% to 35.5p per share this year. However, the management commentary above seems to be slightly at odds with this relatively positive view.

Last year's minimal dividend increase also suggests to me that management are taking a cautious view of the near-term outlook.

However, the medium view appears to be stronger:

"Strong balance sheet and good cash generation leaves Group well-placed to continue with its strategic growth plans and to consider suitable acquisition opportunities"

My view

Wynnstay looks to be trading on around 10 times forecast earnings, with a twice-covered 4.8% yield. Its business is well established and I would guess it enjoys good market share in its main geographical territories.

Given the strength of the balance sheet and the discount to book value, the risk/reward balance looks favourable to me at current levels.

James Halstead (JHD)

"The Board's expectations for the full year remain positive and for continued progress on dividend distributions."

AGM trading update / Mkt cap: £859m

Forecast dividend yield: 4.1%

This family-controlled flooring group is one of AIM's larger companies. Its main product is the Polyflor brand of vinyl flooring.

James Halstead's January AGM update was very short but made for positive reading.

Half-year profits for the period to 31 December are expected to be "in the region of 15-20% ahead" of the same period last year.

This positive result is expected despite "strong competition" and "softening of sales in some European markets".

My sums suggest this guidance is equivalent to pre-tax profit of at least £26.7m, which would be above the previous H1 high of £26.0m achieved in 2020/21.

The board expects to report "a robust cash balance", presumably as inventory levels return to more normal levels, freeing up cash.

It's worth noting that cash levels were already pretty robust – the company reported net cash of £63m at the end of June 2023.

My view

When I reviewed James Halstead's results in October, I said the share was on my watch list. This remains true.

The share price is currently at levels first seen eight years ago. My sums suggest an EBIT/EV yield of around 6.5% at current levels.

For a business that generates c.30% returns on capital and has a 30-year dividend growth record, I don't think that's too expensive.

I would consider buying the shares for my portfolio at this level.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.