Dividend notes: cheap cyclical stocks? HFD, BKG

21/06/23: full-year results from housebuilder Berkeley Group and retailer Halfords suggest contrasting performances.

Welcome back to my dividend notes. Today I'm looking at contrasting sets of results from two cyclical UK businesses with exposure to consumer spending.

Companies covered:

- Halfords Group (LON:HFD) - profits have slumped and cash generation was poor last year. The 11% dividend increase looks unjustified to me. Although I think the firm's strategy is sensible, I'm not tempted by the shares.

- Berkeley Group Holdings (LON:BKG) - a reassuring set of results from one of the best quality housebuilders on the UK market, in my view. I think the shares probably offer value at current levels.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my view only and are not advice or recommendations.

Halfords (HFD)

"Final dividend of 7p per share proposed, to be paid in September 2023, resulting in a full year dividend of 10p, an increase of +11% vs FY22."

Full-year results from Halfords show that revenue rose by 15% to £1.6bn last year. However, the group's underlying pre-tax profit fell by 42.7% to £51.5m.

When Halfords warned on profits in January, pre-tax profit guidance was cut to £50m-£60m (from £65m-£75m previously). So these full-year results are in line with revised guidance, albeit at the bottom end.

Despite this, Halfords has lifted its full-year dividend by 11% to 10p per share, giving a yield of 5%. This increase is in line with the firm's dividend policy, but I'm not sure it's really affordable, as I'll explain.

The market appears to have taken a positive view of the numbers and the shares closed up by 8% on the day. However, I think it's worth putting this in context.

Halfords' share price has fallen by 50% over the last two years. The stock is currently trading at a level only previously seen during the 2020 crash and last year's mini-budget calamity:

Do today's results justify a more optimistic stance? Halfords currently appears in the results of my dividend screen, so I've been taking a closer look.

Results summary: Halfords' business is divided into two divisions for reporting purposes, Retail and Autocentres. Both divisions saw profits slump last year, but for different reasons.

Retail: underlying operating profit fell by 35% to £58.6m last year, giving a margin of 6.0% (FY22: 9.0%).

The retail business is split into cycling and motoring. The slump in profits (and margins) seems to have been caused by weakness in cycling sales, which fell by almost 11% on a like-for-like (LFL) basis.

Performance was stronger in motoring, where LFL sales were 4% higher. Halfords has made big strides in providing affordable drive-up parts and fitting services for common items like bulbs, wiper blades and batteries. The company is now focusing on brakes, another big consumables market.

I see this kind of consumer spending as relatively defensive, as it's needed to keep cars on the road and MOT-worthy.

Notably, retail operating costs were flat last year, suggesting inflationary pressures were managed well.

Autocentres: underlying operating profit fell by 28% to £10.4m, giving a margin of 1.7% (FY22: 3.8%).

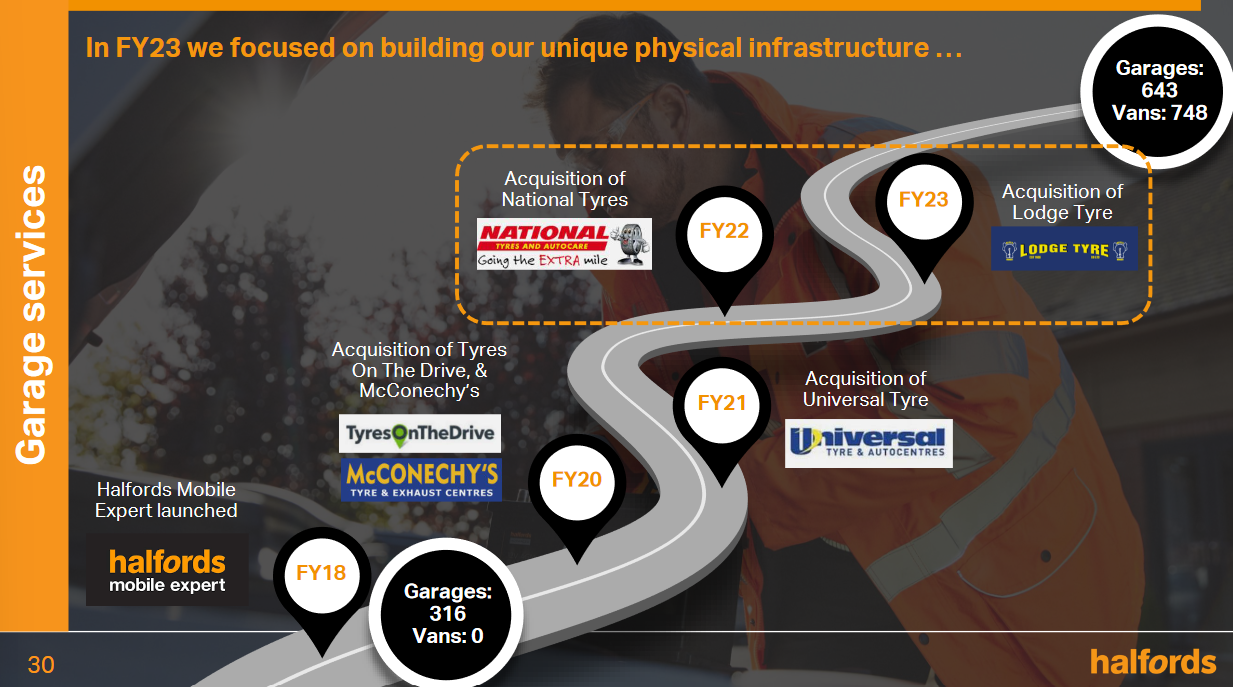

Halfords has been bulking up its Autocentres business with acquisitions of tyre chains. Lodge Tyres was acquired last year, adding 51 garages and 265 vans to the group's network.

This acquisitive growth put a positive spin on Autocentres revenue last year, which rose by 61% to £614m. But other metrics moved in the wrong direction. The expansion of the lower-margin tyre businesses pushed down gross profit margins, which fell by 5% to 50.4%.

Customers switching to cheaper tyre brands and replacing their tyres less often was also said to have added to margin pressure.

At the same time, operating costs surged, rising from just under £200m to almost £300m. The company says about two-thirds of this increase was driven by acquisitions. The remainder reflected wage inflation.

One of the problems that triggered Halfords' profit warning in January was that it was struggling to recruit enough experienced technicians to meet demand for higher-margin servicing and repair work.

The combined effect of last year's cost pressures and the increased weighting towards tyres was that the Autocentres division was barely profitable last year, generating an underlying operating profit of just £10.4m from £614m of sales. Statutory operating profit was even lower, at just £3.1m.

In fairness, the business may have faced a perfect storm of rising costs, recruitment problems, and customer cost-cutting.

Management expects "strong profit growth" from Autocentres in FY24, as cost pressures ease, acquisitions bed in, and garage utilisation improves.

Outlook: trading so far this year is said to have been "good", with positive LFL sales and increased market share "across all major categories". However, cost pressures are expected to continue.

Group profits are expected to rise and management "are comfortable" with current consensus forecasts for underlying pre-tax profit of £53.5m. That would represent a 4% increase on last year.

Consensus forecasts on SharePad suggest 2023/24 earnings of 18.2p per share, with a dividend of 8.5p per share.

If correct, that would represent a 15% cut from this year's dividend payout of 10p. I wouldn't completely rule out the risk of a cut, but at this stage I think this is probably just a quirk in the consensus numbers.

My view: I think chief executive Graham Stapleton is pursuing a sensible strategy and making reasonable progress. But Halfords' worsening profitability concerns me.

The group's statutory operating profit margin fell to just 3.5% last year (FY22: 7.8%), while return on capital employed fell to 6.3% (FY22: 12.3%). That's almost certainly below the group's cost of capital.

Free cash flow was also very poor. My sums suggest a figure of £4.9m, excluding the £32.6m spent on acquisitions. This clearly isn't enough to cover the c.£20m cost of the annual dividend, even before this year's increase.

Halfords started last year with net cash of £46m (excluding lease liabilities), but ended the period with net bank debt of £1.8m. This suggests £48m of cash outflows, reflecting both acquisition spending dividend payments.

While this level of debt shouldn't be a problem in itself, the group also has nearly £350m of lease liabilities. Lease payments totalled nearly £90m last year.

With profit margins under such pressure, I'd have preferred to see the dividend kept flat (at most) until free cash flow cover improves.

Given the cautious outlook for the year ahead and the company's poor cash performance, I think Halfords shares are probably up with events at current levels. While I can see scope for improvements, I suspect that cost pressures and weaker consumer spending could remain a concern in FY24.

Berkeley Group (BKG)

"Berkeley has delivered pre-tax profits in line with the guidance provided at the start of the financial year, maintained our shareholder returns programme and increased the net cash position."

Anyone who bought shares in this FTSE 100 housebuilder 20 years ago is now sitting on a near-10 bagger.

I rate this business highly. Although founder and long-time chairman Tony Pidgley sadly passed away in 2020, chief executive Rob Perrins has worked at the busines since 1994 and has been CEO since 2009.

I think Perrins is a pretty safe pair of hands and is unlikely to deviate too far from the long-term regeneration model developed by Pidgley.

This week's final results cover the year to 30 April 2023 and look reassuring to me. They've also been produced very punctually. That's a sign of good financial controls, in my view.

Financial summary: Berkeley's revenue rose by 8.6% to £2,550.2m last year, while pre-tax profit rose by 9.5% to £604m. Strong cash generation supported an improved year-end net cash position of £410m (FY22: £269m).

Berkeley ended the year with a net asset value of £31.01 per share, up from £28.18 at the end of April 2022.

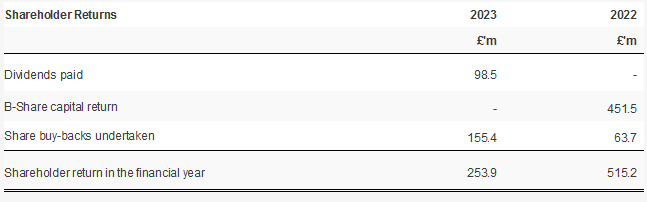

Shareholder returns totalled £254m during the period, split between buybacks (£155.4m) and dividends (£98.5m).

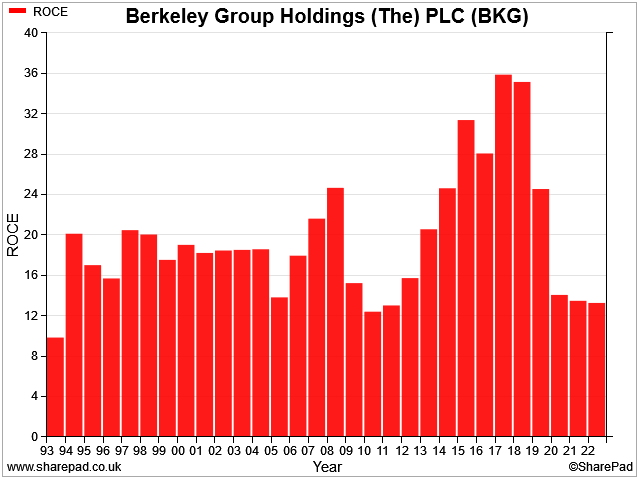

Profitability: My sums suggest an operating margin of 20% and a return on capital employed of 10.8% for the 2022/23 financial year. Both are solid figures in my view, given my assumption that we're at a fairly low point in the housing cycle.

According to SharePad data, Berkeley's ROCE has averaged 19% since 1987. I think this highlights the long-term value that's been created for shareholders by the company's careful capital allocation and long-term planning.

Operational performance: Berkeley completed 4,043 homes last year, plus 594 in joint ventures (FY22: 3,750, 872). Of these, 86% were on regenerated brownfield land – developing former industrial sites in London and the South East is a core competency of this business.

At the end of the year, the group had £2,136m of cash due on private exchanged sales over the next three years (FY22: £2,171m).

The company says that cancellation rates have remained within normal ranges, except during the period around last year's mini-budget. However, CEO Rob Perrins admits that interest rates are affecting buyer activity:

"... the market is likely to lack urgency until there is more certainty over the trajectory of interest rates."

Estimated gross margin on current land holdings fell to £7,629m (FY22: £8,258m). However, this is largely related to the reclassification of 5,500 plots from land holdings to the company's long-term pipeline.

This is effectively a move backwards in terms of the development status of these plots. Berkeley says this decision was prompted by planning delays – "the majority of these sites are at appeal or subject to a call-in".

Outlook: at current sales rates, the company expects sales in 2023/24 to be around 20% lower than 2022/23. This is at the upper end of peer group forecasts at the moment, from what I've seen so far.

The company says its slowed the pace of construction and new investment and has reiterated its profit guidance for the next two years:

"Berkeley reiterates its guidance of delivering pre-tax profits of at least £1.05 billion across its next two financial years (FY24 and FY25) combined, which is likely to be slightly weighted to the FY24, in line with market consensus"

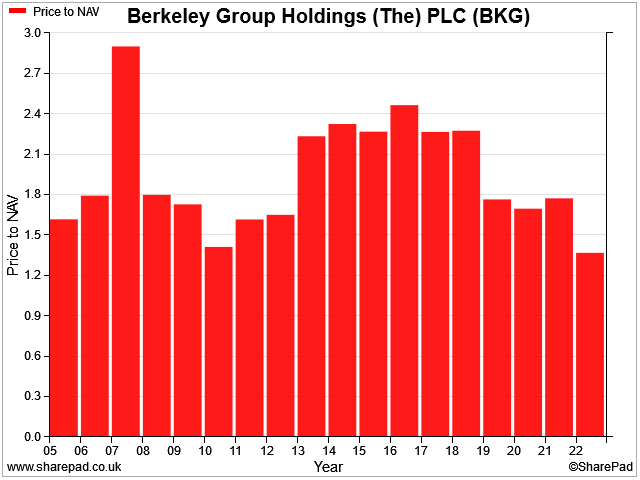

Guidance for shareholder returns is unchanged at £283m (£2.63 per share) per year up to 30 September 2025. This can be made through either dividends or share buybacks. Recent purchases have been weighted towards buybacks, reflecting the relatively low valuation.

My view: SharePad data suggests to me that Berkeley shares are probably cheap at current levels, on a cyclical view.

The shares are trading on about nine times 10-year average earnings and at less than 1.5x book value. That's the lowest price/book multiple since 2010, according to SharePad:

The near-term outlook looks uncertain and market conditions may yet worsen. But I think a fair amount of bad news is already priced in.

On a medium-term view, I think Berkeley Group shares look decent value at the moment. However, I already own shares in another high-quality housebuilder, so I'm not looking to buy any more right now.

Disclaimer: This is a personal blog and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.