Dividend notes: buying £1 for 70p? BOOT (19/09/23)

I review interim results from small-cap property group Henry Boot (LON:BOOT). With the shares trading at a discount to NAV, is this a buying opportunity?

Welcome back to my dividend notes.

Today I've taken a look at the latest numbers from a small-cap property company that I think could offer value at current levels.

Companies covered:

- Henry Boot (LON:BOOT) - this family-owned property group has an impressive 135-year track record and looks fairly safe and reasonably valued to me.

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

As always, my comments represent my views and are provided solely for information and education purposes. They are not advice or recommendations.

Henry Boot (BOOT)

"an increase in NAV of 3%, plus the confidence to grow our interim dividend by 10%"

This quote sums up some of the appeal for me of this family-owned property group.

With a £270m market cap, Henry Boot is one of the smaller listed players in this market. But it's been in business for 135 years, and I think it has an impressive record of value creation for long-term shareholders.

Henry Boot's business is divided into three core divisions:

- Land Promotion: the company buys land, gains permitting and then sells it on for a profit, mostly to housebuilders. The current land bank is sizeable, with 97k plots, of which 8.3k are permitted;

- Property Investment & Development: commercial property and housebuilding projects, including sales and lettings;

- Construction: property construction, plant hire and road building.

Boot's half-year results cover the six months to 30 June 2023 and seem quite respectable to me, given current market conditions.

Revenue for the half year rose by 24.5% to £179.8m, driven by land sales and housing completions.

However, a sharp rise in input cost inflation appears to have contributed to a slump in profit. The group's gross margin fell from to 22.7% (H1 2022: 30.4%).

When paired with a 12% increase in operating costs (presumably energy and wages), this caused Boot's pre-tax profit to fall by 36% to £25.0m (H1 2022: £38.8m).

Management says that "build cost inflation started to moderate" during the first half, falling from 10% in 2022 to 8%. Hopefully this means margins will stablise in H2.

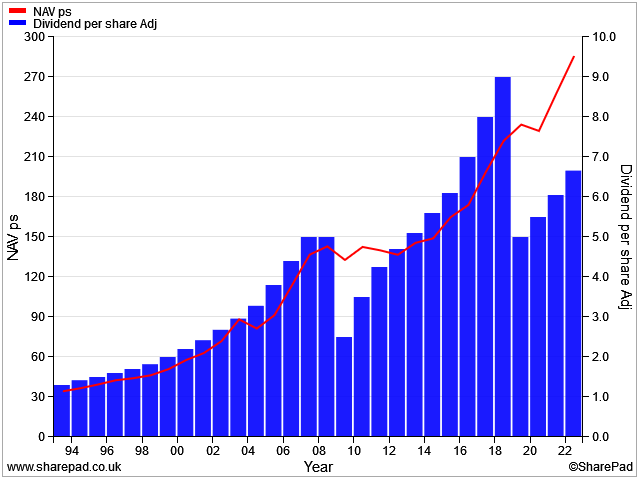

NAV/debt: Net asset value rose by 2.6% to 303p during the half year. This was achieved despite an increase in net debt to £70.8m (Dec 2022: £48.6m), reflecting spending on committed developments.

Boot shares are trading at 203p at the time of writing, giving a potential discount of 33% to NAV of 303p.

Dividend: the interim dividend was increased by 10% to 2.93p per share. This is consistent with broker forecasts for a full-year payout of 7.3p, covered 2.5 times by earnings.

At the time of writing, this gives Boot shares a forecast dividend yield of 3.6%.

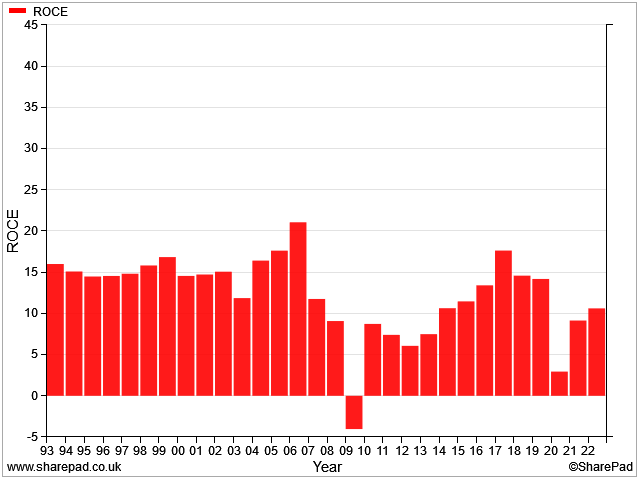

Profitability: I was pleased to see return on capital employed mentioned frequently and conspicuously in the results. ROCE in H1 2023 was 6.3%, but the full-year figure for 2023 is expected to be at the lower end of the group's medium-term target range of 10%-15%.

ROCE of 6% is obviously not that impressive. But the fact this metric is used publicly as a KPI reflects well on management, in my view. Moreover, I think the group's medium-term target looks credible, based on past performance:

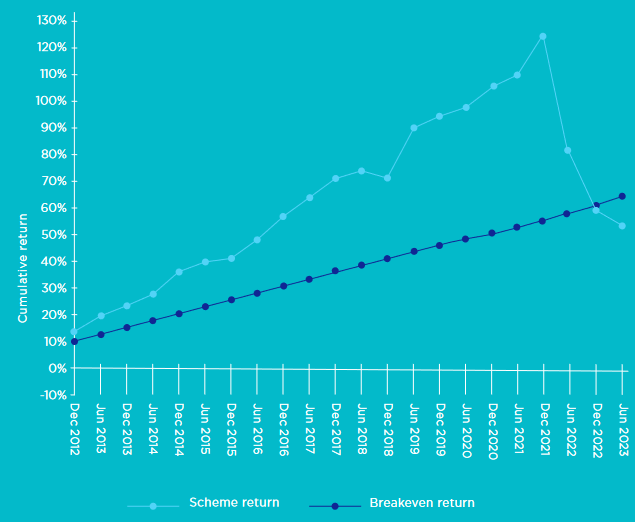

Pension: Boot appears to have a substantial final salary scheme, as might be expected. Recovery contributions have fallen to £1.2m annually, but the scheme seems to have suffered badly from rising interest rates.

I'd want to understand a little more before investing, although I don't think there's a problem here.

Outlook: chief executive Tim Roberts paints a mixed picture of the outlook:

"our focus on prime strategic sites, high quality development and premium homes has provided us with a degree of resilience."

However, the outlook remains uncertain:

"Whilst uncertainty in our markets has increased, we believe we have enough momentum to carry us through the year, although the outlook for 2024 for the time being is not so clear."

There's no change to guidance for the full year, suggesting that Henry Boot could report earnings of 18p per share and pay a 7.3p dividend this year. That's equivalent to a forecast P/E of 11, with a 3.6% yield.

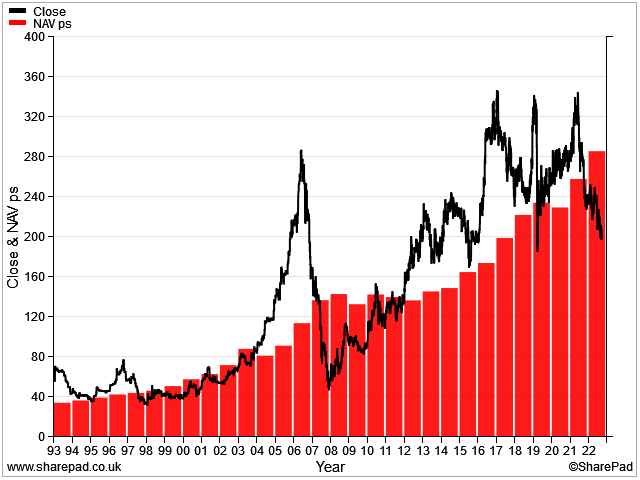

When paired with the stock's c.30% discount to NAV, this rating does not look expensive to me – see below.

My view

The short version of this update is that over the last 20 years, this family-owned property group has tended to be a good buy when its share price has fallen below net asset value:

Of course, past performance is not a guide to future returns. Even if I'm right, market conditions may get worse before they start to improve.

I'd want to dig a little deeper before considering this share as an investment, but given Boot's long track record of profitability and value creation for shareholders, I can see plenty to like at current levels.

Disclaimer: This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.