The Dividend Note - 40-bagger | 8% yields | 2017 IPOs | TIFS, ALFA, FOUR , FSFL, SUPR (15/03/24)

I review results from five stocks that are relatively new to me - Alfa Financial, TI Fluid Systems, 4imprint, Foresight Solar and Supermarket Income REIT.

In this edition of The Dividend Note, I've taken a look at five shares that issued results last week but which I haven't really looked at before.

Three of these companies floated on the London market in 2017. I avoided these IPOs at the time, but can see some potential attractions now.

Elsewhere, I've looked at a classy, market-leading business that's been a 40-bagger over the last 20 years – and a renewable energy play with an 8% dividend yield.

Let's take a closer look.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- TI Fluid Systems (LON:TIFS) - this automotive parts specialist appears to be undergoing a successful turnaround. While risks remain, I think it could offer value and attractive cash generation.

- Alfa Financial Sofware Holdings (LON:ALFA) - a financial software business with wonderful margins and cash generation, but growth seems lacking. Although regular special dividends boost the yield, I wonder if the valuation is up with events.

- 4imprint Group (LON:FOUR) - selling promotional products to US business clients has made this stock a 40-bagger. Scope for future growth suggests I should watch for a buying opportunity.

- Foresight Solar Fund (LON:FSFL) - I'm not an expert on renewable energy funds, but these results look solid to me and suggest that FSFL shares could offer value and maintain an attractive 8%+ dividend yield.

- Supermarket Income REIT (LON:SUPR) - it does what it says on the tin... SUPR shares curently trade at a discount to book value, with a tempting 8% dividend yield. I don't see any serious risks.

TI Fluid Systems (TIFS)

"Double-digit revenue growth and Adjusted EPS up 57%"

2023 full-year results / Mkt cap: £786m

FY24 forecast dividend yield: 4.5%

TI Fluid Systems is an automotive parts company specialising in "thermal management and fluid handling solutions" for automotive companies. The company's products include brake lines and connectors, coolant and refrigerant assemblies and fuel tanks and related items.

TIFS' history stretches back to 1922 but the business has been through various guises and ownerships since then. Most recently, it was owned by private equity group Bain Capital before being floated in London in 2017.

As often happens, investors who bought shares in a private equity float have suffered from the experience. TIFS' share price is still well below its IPO level:

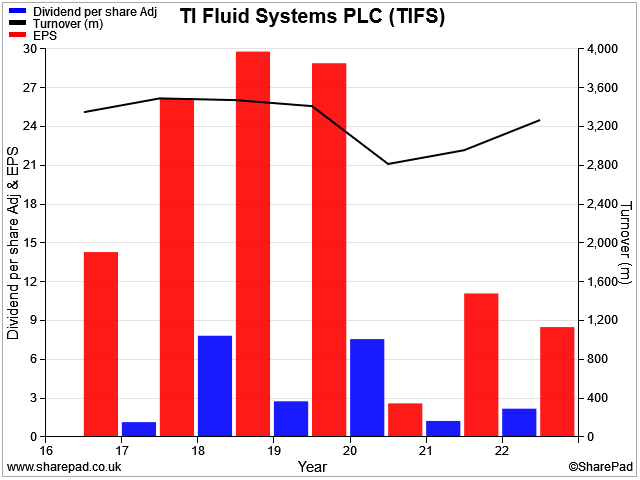

TIFS' financial performance was badly derailed during the pandemic but may now be getting back on track, following the appointment of CEO Hans Dieltjens in late 2021:

I haven't looked into the company's past performance in any detail, but my feeling is that it may have been suffering other problems in addition to the disruption caused by the pandemic.

2023 results summary: the last couple of years have seen significant restructuring costs and headcount reductions, but things now seem to be moving in the right direction:

- Revenue up 7.6% to €3,516.2m (11.1% constant currency)

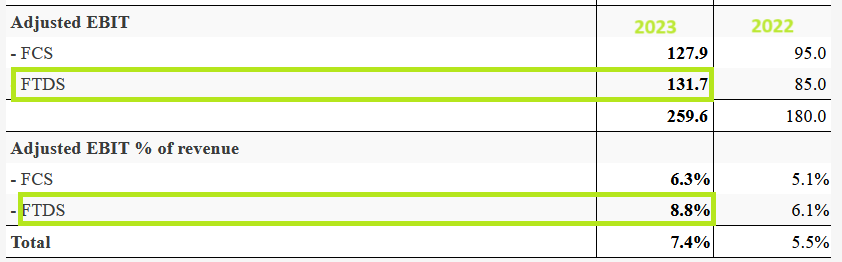

- Adjusted EBIT up 44% to €259.6m

- Adjusted EBIT margin 7.4% (2022: 5.5%)

- Reported net profit: €83.6m (2022: loss of €279m)

- Free cash flow of €91.1m (2022: €18.0m)

- Dividend per share: 6.83 euro cents (2022: 2.54 euro cents)

Part of CEO Dieltjens' strategy involves increasing the company's focus on opportunities in electric vehicles, to begin the process of evolving away from ICE components such as fuel tanks.

This new focus appears to be gaining momentum. New bookings (orders) last year totalled €3.0bn, of which €1.3bn related to battery electric vehicles (BEV). New products are being developed to complete the company's product set for EVs.

However, at present, fuel systems (FTDS below) continue to generate around half the group's profits, at slightly higher margins than fluid control systems (FCS), which includes EV products:

While cash generation improved last year, debt levels remain a little high for me. Net debt excluding lease liabilities fell by €30m to €595m in 2023. While this equates to a comfortable-sounding 1.5x EBITDA (2022: 1.9x EBITDA), it's still nearly five times TIFS' net profit. That's a little higher than I'd like to see.

However, profits and cash generation could improve significantly if TIFS can achieve targeted improvements in profit margins.

Outlook: management expectations for the year ahead suggests self-help measures will be the main driver of progress:

- Planning assumptions based on "a modest year-on-year industry volume decline"

- Flat-to-low single digit revenue growth, at constant currency

- Adjusted EBIT margin to rise above 7.3%, thanks to "productivity and efficiency initiatives"

- Targeting adjusted free cash flow of 30% of EBITDA – consensus figures suggest a FCF figure of around €125m, implying a c.15% forecast FCF yield.

My view

TIFS shares currently trading on 6.6 times 2024 forecast earnings and offer a dividend yield over 4%.

Last year's free cash flow of €91m (my calculation) gives an attractive trailing free cash flow yield of over 11%.

Debt levels and the cyclicality of the automotive industry mean this isn't without risk. But if TIFS can continue to make progress with its strategy, I think the shares could be cheap at this level.

Alfa Financial Software Holdings (ALFA)

"Record year for software delivery with seven customer go-lives in the year along with 28 other deliveries"

2023 full-year results / Mkt cap: £500m

FY24 forecast dividend yield: 1.1% (+regular special dividends)

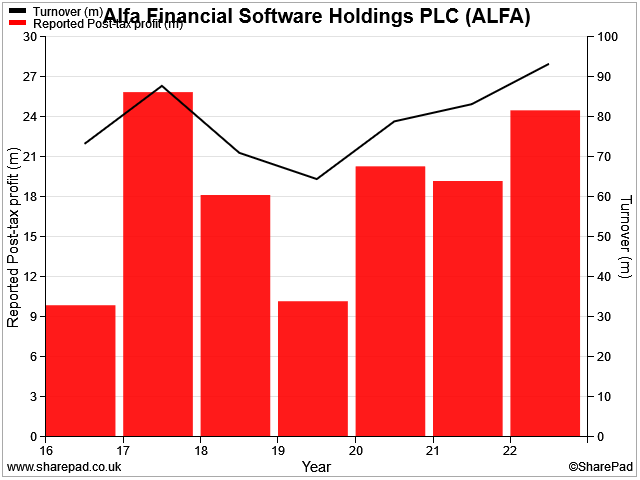

This financial software business is also a member of the IPO class of 2017. Like TI Fluid Systems (above), Alfa has also disappointed shareholders who bought into the float:

However, I think there are signs that a more attractive opportunity may be emerging.

Alfa describes itself as "a leading developer of software for the asset finance industry". Its two main customer markets appear to be automotive finance and equipment finance – for example, construction plant.

Alfa's sofware appears to support the complete lifecycle of lending on such assets:

Customers include some blue chip institutions, such as Lloyds Bank and Santander.

Alfa is effectively controlled by CHP Software and Consulting, which controls c.60% of the stock.

CHP is the investment vehicle of chairman Andrew Page and CEO Andrew Dalton. Both men apparently receive minimum wage salaries only, in order to align their interests with shareholders and reflect their significant shareholdings.

The story so far: Alfa appears to have all the desirable characteristics of a good quality software business – high margins, recurring revenue and strong cash generation.

However, progress stumbled in 2019. At the time, the company said this was due to "delays in implementation projects and reduced discretionary spend by customers".

Profits are only now returning to 2017 levels:

With that introduction, let's take a look at the 2023 results.

2023 results summary: the company claims record software deliveries last year, with seven customers going live. This supported 16% growth in subscription revenue and a 28% increase in total contract value, to £165.3m (2022: £143m).

However, management says that investment in product development put pressure on profit margins in 2023:

- Revenue up 9% to £102m, with subscription revenue up 16%

- Operating profit up 2% to £30.1m

- Operating margin: 29.5% (2022: 31.7%)

- Diluted earnings down 2% to 7.9p per share

- Net cash up 17% to £21.8m

Profitability: although margins fell last year, profitability remained excellent. My sums suggest a return on capital employed of 60.8% (2022: 58.2%).

Free cash flow: cash generation was also impeccable. My sums suggest free cash flow of £27.8m, representing 119% conversion from net profit of £23.3m.

Dividends: Alfa declared two dividends with its 2023 results:

- Ordinary dividend of 1.3p per share

- Special dividend of 2p per share

Together, these give a payout of 3.3p, equivalent to a 1.9% yield at 171p per share.

However, the company's comments indicate that special dividends are its preferred method of returning surplus capital. My reading of the results suggests Alfa has the capacity for further payouts in calendar 2024.

This view seems to be supported by performance over the last couple of years:

If I've read this correctly, in calendar 2023, shareholders will have received a 1.2p ordinary dividend and 5.5p per share of specials, giving a total of 6.7p per share.

That's equivalent to a yield of 3.9% at the last-seen share price of 171p.

In my view, that's potentially attractive, for a high-margin, cash-generative business – assuming a return to sustainable earnings growth.

Outlook: market conditions are expected to remain broadly stable, with continued revenue growth. However, there's no guidance on expected profits:

"We expect 2024 revenue growth to be mid to high single digits driven by continuing strong growth in subscription. Within this performance, we anticipate a greater weighting in the second half of the year as new sales come fully on stream."

Turning to broker forecasts, consensus estimates prior to the 2023 results suggested that Alfa's 2024 earnings could fall slightly to c.7.5p per share.

That would value the stock on around 23 times FY24 forecast earnings.

If I assume that at least 5p of this can be returned to shareholders, I get a possible dividend yield of just under 3%.

My view

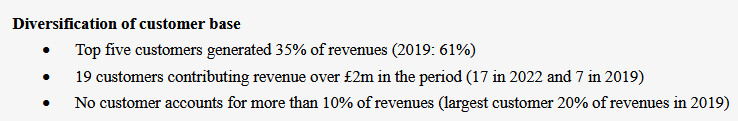

I haven't research Alfa's past performance in any detail. But my inference from the 2023 results commentary is that customer concentration may have contributed to the 2019 slump, but is less likely today:

In terms of valuation and outlook, Alfa's 2023 operating profit of £30m implies an EBIT/EV yield of just over 6%. That's not outrageously expensive, for me, but I'd probably want to see a slightly stronger outlook for growth, too.

I hope some updated broker guidance will become visible to private investors like me over the coming days.

I think Alfa Financial has some attractive qualities, but feel the shares may be up with events at current levels.

4imprint Group (FOUR)

"Continued market share gains driving very strong financial results"

2023 full-year results / Mkt cap: £1.7bn

FY24 forecast dividend yield: 2.9%

This business describes itself as a "direct marketer of promotional products". In other words, it makes branded items that companies give away to their customers.

For a cynic like me, it might be tempting to view this as a low-quality business making products that are often carelessly discarded or unused. But the reality seems otherwise.

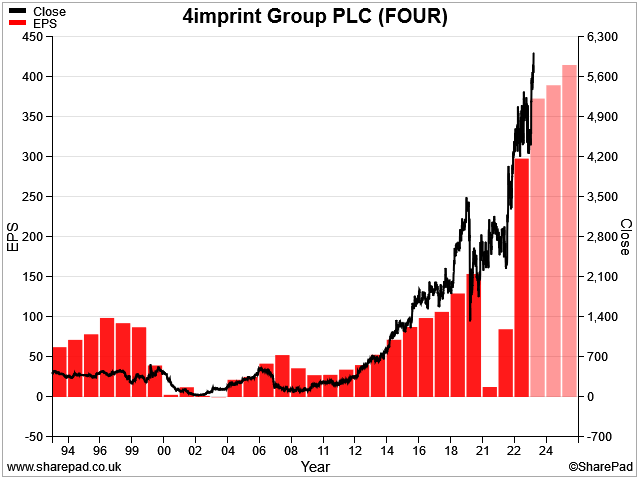

4imprint's customers clearly value its services. They spent $1.3bn with the company last year, extending a fantastic record of growth and profitability:

With the shares trading at a record high of £60, shareholders who picked up the stock at its pre-pandemic peak of £32 in January 2020 have now almost doubled their money. It's an impressive result, but are the shares now up with events?

2023 results summary: 4imprint says it gained market share last year, with order numbers up by 12% to 2,090,000. This translated into a strong financial performance:

- Revenue up 16% to $1,326.5m

- Operating profit up 32% to $136.2m

- Operating margin: 10.3% (2022: 9.0%)

- Earnings up 32% to 377.9 cents per share

- Dividend up 34% to 215 cent per share

- Net cash up 20% to $104.5m

4imprint is technically a UK business, but generates 98% of its revenue in North America, so it makes sense to report results in US dollars.

Profitability: operating margins topped 10% last year, thanks to a 2% improvement in gross margins and more stable supply chain conditions. My sums suggest the capital-light business model generated an impressive 93% return on capital employed.

One other reason for this increase in profitability is the improved productivity of the company's marketing activities since the pandemic. 4imprint generated $8.30 of revenue for each $1 spent on marketing last year, compared to less than $6 in 2019.

However, last year's result was lower than the $8.86/$1 achieved in 2022. To me, this suggests that the benefits of the changes made to 4imprint's marketing strategy may now have been fully realised. I suspect margins may now level out.

Free cash flow: unsurprisingly, this business is highly cash generative. My sums suggest net profit of $106.2m was converted into free cash flow of $125.9m in 2023.

Dividend: the 2023 dividend of 215 cents per share is equivalent to a payout of around $61m, representing about half last year's free cash flow.

The company says that its capital return policy is under review, given the strength of the balance sheet. A special dividend looks potentially affordable to me.

Outlook: Chairman Paul Moody says that trading results so far in 2024 have been in line with internal expectations and consensus forecasts.

"We are confident that we will continue to take market share."

Broker estimates suggest profit growth will level out this year. Consensus numbers suggest a 5% increase in earnings to 396 cents per share, with a matching dividend increase to 226 cents per share.

These numbers imply a forecast P/E of 19, with a 2.9% yield.

My view

4imprint appears to be a good quality, cash-generative business. Market share in the US is said to be around 5%, according to a note available on Research Tree from broker WH Ireland.

In a market that's said to be quite fragmented, I think it's reasonable to think that a strong player could gain a 10% share. That could mean that 4imprint's business has the potential to double in size again.

4imprint shares don't necessarily seem too expensive to me at current levels, given the group's strong profitability and cash generation.

However, forecasts for slowing growth give me hope that a better buying opportunity may emerge. For now, 4imprint goes on my watch list.

Foresight Solar Fund (FSFL)

"Record cash distribution from the underlying assets of£120 million"

2023 full-year results / Mkt cap: £521m

FY24 forecast dividend yield: 8.8%

The last 10 years have seen something of a boom in REITs and listed infrastructure investment trusts. However, the return of more normal interest rates over the last couple of years has triggered a sell-off across the sector.

Having allowed some time for the dust to settle, my feeling is that several high-yield opportunities are now emerging. I think Foresight Solar Fund could be an example of this.

As its name suggests, FSFL owns a portfolio of solar farms and battery assets, primarily in the UK, but also in Australia and Spain. It's managed by well-regarded alternative asset specialist Foresight Group (LON:FSG).

FSFL floated in 2013, making it one of the older listed contenders in this sector. Unlike some newer funds, it has delivered a positive total return (share price + dividends) to shareholders since its listing, despite the challenge of adapting to higher interest rates:

My sums suggest this rate of total return only equates to an annualised figure of around 4.3%. However, I think that the current discounted valuation and 8%+ dividend yield could mean that future returns will be higher than this.

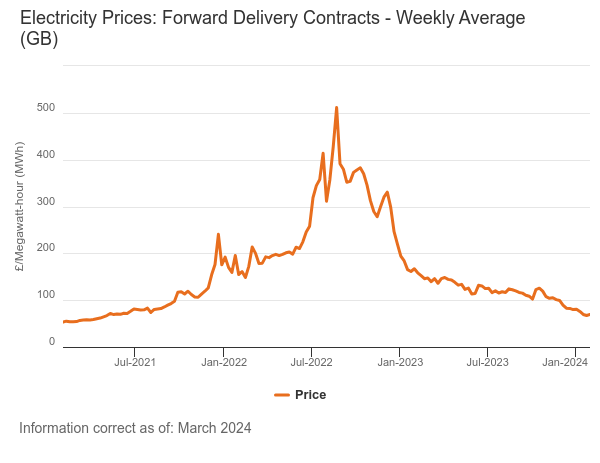

2023 results summary: the main risks for investors in FSFL and other renewable energy investment trusts seem to relate to future power prices and the impact of higher interest rates on valuations (i.e. assets will be worth less/cost more to finance).

Ultimately, there's a risk that future cash flows might not support the current level of dividend income.

FSFL's 2023 results reflect these risks:

- Net asset value down 9.5% to £697.9m (118.4p per share)

- 2023 dividend cover of 1.61x is expected to fall to 1.5x in 2024, and 1.35x in 2025, based on current revenue (i.e. power price) forecasts

It's worth noting that in general, a growing proportion of renewable assets are taking market prices for electricity, rather than being protected by subsidy regimes.

FSFL says that average UK wholesale electricity prices fell from around £200/MWh at the start of 2023 to £90/MWh in the fourth quarter. Management describe this as prices returning to more normal levels. That seems fair, based on this Ofgem price chart:

Fortunately, results from asset sales during the year suggest to me that FSFL's valuation methodology has remained sound and relatively conservative through this period of disruption:

- Sale of 50% of Lorca subsidy-free portfolio in Spain, priced at a 21% premium to Q3 holding value

- Recent sale of "several large ROC-backed solar portfolios in the UK" at a 15% premium to the UK portfolio valuation, which is based on a power price benchmark of £1.17m/MW.

Of course, these may be cherry-picked examples chosen because they were easier to sell – it's hard to be sure.

Gearing fell to 38.8% last year (2022: 40.5%), expressed as a percentage of gross asset value. This seems reasonable to me and I'm reassured by the recent focus on debt reduction.

The majority of FSFL's debt appears to be hedged and long-term. I don't think there's much near-term refinancing risk.

Dividends: FSFL has declared a total 2023 dividend of 7.55p per share, in line with its target for the year.

The 2024 dividend target has been set at 8p per share. This is expected to be covered 1.5x by 2024 operating cash flow.

Outlook/growth opportunities: FSFL bought the rights to six development-stage solar projects in Spain last year, totalling over 460MW. This has the potential to add around 50% to the existing portfolio capacity of 969MW.

The expected average life of the UK portfolio at the end of 2023 was 31 years, with an average of just over 22 years remaining. Management are pursuing lease extensions covering 260MW of installed capacity in the UK portfolio, which has the potential to support higher asset valuations (based on expected future cashflows).

My view

I'm not an expert on this sector, which relies on complex modelling involving power prices, financing costs and inflation estimates.

On balance though, my initial impression of FSFL is fairly favourable.

The shares currently trade nearly 25% below their book value and offer a forecast dividend yield of 8.8% for this year. This looks achievable to me, based on current information.

If I was investing for maximum dividend yield, I would be tempted to learn more about this sector and take a closer look at FSFL.

Supermarket Income REIT (SUPR)

"On track to deliver full-year 2024 dividend target of 6.06p"

2023/24 half-year results / Mkt cap: £925m

FY24 forecast dividend yield: 8.2%

This is another property/infrastructure investment trust that looks potentially attractive to me at the moment.

As its name suggests, Supermarket Income REIT owns a portfolio of 55 UK supermarkets. In total, 77% of rental income comes from Sainsbury's and Tesco, suggesting very minimal tenant credit risk.

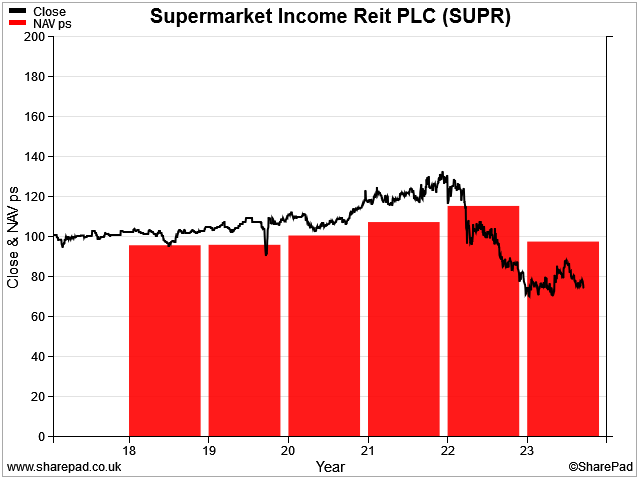

SUPR floated in 2017 and traded at a premium to NAV for much of its early life. However, rising interest rates triggered a sharp sell off that's left the stock trading at a discount to NAV:

As with TI Fluid Systems and Alfa Financial above, SUPR is another example of a 2017 IPO that has delivered poorly for early shareholders.

However, the market is in a different place now. I think there could be some value and income opportunity here.

2023/24 half-year results summary: SUPR's half-year results cover the six months to 31 December 2023. They show an improvement in earnings, driven by rent increases and acquisitions. Much of SUPR's rental income is inflation linked.

At the same time, net asset value fell, reflecting broader market trends and the impact of higher interest rates on valuations. Overall, the headline numbers look fairly reassuring to me, given the stock's current discount to NAV:

- Annualised passing rent up 10% to £104.7m

- EPRA net asset value down 5% to £1,094m (88p per share)

- Operating profit up 18% to £45.0m

- H1 adjusted earnings of 2.9p per share (unchanged)

- H1 dividend of 3.0p per share (unchanged)

A mix of acquisitions and disposals supported some debt reduction and improved the overall portfolio yield:

- Net loan to value 33%: (H1 23: 37%)

- Portfolio net initial yield: 5.8% (H1 23: 5.6%)

On this initial review, the main risk I can see is that SUPR is effectively borrowing short to lend long. In other words, its lease lengths are much longer than its loan maturities. This creates some refinancing risk, at least in theory:

- Weighted average unexpired lease term (WAULT): 13 years

- Average debt maturity: 4.1 years

The weighted average cost of debt has risen from 2.6% to 3.1% over the last year. While drawn debt is all hedged, further refinancing will be needed over the next few years. Average debt costs may still have further to rise.

I suspect that inflation-linked rental income will be sufficient to support higher finance costs. But in a negative scenario, higher interest rates could put pressure on the dividend.

Outlook: management see continued opportunities to add to the portfolio at attractive valuations and say that SUPR has enough debt capacity to fund this.

Chair Nick Hewson says the sector attracted a record £2.1bn of investment last year, supporting a positive outlook for valuations.

SUPR is maintaining its FY24 dividend target of 6.06p per share, giving a prospective 8.1% yield at the last-seen price of 75p.

My view

A 15% discount to book value and 8% dividend yield seem a more attractive basis for a REIT investment than the valuations that prevailed prior to 2022.

While I can see some risks, this initial review doesn't leave me with any serious concerns. As with FSFL, if I was investing to maximise my dividend income, SUPR is certainly a stock I would look at more closely.

Please let me know what you think about the stocks I've covered here, or anything else relating to UK dividends. You can drop a comment below, or reach me on Twitter/X @rolandhead.

Roland Head

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.