The Dividend Note - unloved value opportunities? - SPT, RWA, INCH, NICL (08/03/24)

Welcome back to The Dividend Note. This is a weekly review of results from dividend stocks that look potentially interesting to me.

This week's theme is dividend stocks that are unloved and look potentially cheap to me.

I'll start with a quick mention for FTSE 250 telecoms equipment firm Spirent Communications (LON:SPT), which received a takeover offer from US peer Viavi this week.

I've covered Spirent a number of times over the last year, including this in-depth review and January's full-year trading update, when I thought Spirent "probably offers value".

(N.B. to search for company content, type the relevant ticker into the search tool at the top of the page.)

Spirent shares have scored highly in my dividend screen in recent months, but I've resisted the temptation to add them to the portfolio because I wasn't completely convinced by the company's long-term track record or quality pedigree.

As it turns out, this was a case where it would have been more profitable to focus on the short-term cyclical opportunity. Even without a bid, I think Spirent would probably have staged a reasonable recovery.

This week was a bumper week for corporate news and there's no way I can cover everything of interest. To narrow down the selection, I've focused on companies that interest me and also currently appear in the results of my dividend screen.

Companies covered:

These notes contain a review of my thoughts on recent results from UK dividend shares in my investable universe. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Robert Walters (LON:RWA) - 2023 is expected to be a low point for profits from this recruiter. The latest numbers highlight the strength of its balance sheet and the appeal of its 5.5% dividend yield, in my view. The company is maintaining bench strength and I expect a solid recovery at some point.

- Inchcape (LON:INCH) - final results from this automotive distributor look fine to me, albeit debt is a little high. A weaker outlook for 2024 is a concern, but on balance I think the shares could offer value at this level. The 5% yield looks safe enough to me, barring an unexpected slump in trading.

- Nichols (LON:NICL) - the soft drinks group has issued a much-improved set of 2023 results. Its quality credentials appear intact after a difficult few years and I'm tempted by the value – and cash – that's potentially on offer.

Robert Walters (RWA)

"Our collective experience trading through previous market cycles tells us that when conditions do improve, the inflection can be rapid"

2023 full-year results / Mkt cap: £305m

FY24 forecast dividend yield: 5.9%

I last covered specialist recruiter Robert Walters in August last year, when I also suggested this stock could be a cyclical opportunity...

Timing any kind of cycle exactly is nigh-on impossible. But I thought Robert Walters looked interesting in August and continue to think so today, following the group's latest annual results.

Although the shares have risen by around 15% from the lows seen in the autumn, the stock is still close to the long-term trend line that has previously provided support.

Of course, past performance is no guarantee of future returns. However, I think that Robert Walters also looks in good shape on a fundamental view, as I'll discuss below.

2023 results summary: Robert Walters' main focus is accounting and financial services, although the company also covers areas such as HR and law.

Last year's results highlighted the operating leverage that's inherent in this business model, with profits dropping much further than fee income:

- Revenue down 3% to £1,064.1m

- Group net fee income (gross profit) down 8% to £386.8m (this is the key top-line metric as it excludes pay for temporary positions and other pass-through costs)

- Operating profit down 55% to £26.3m

- Earnings per share down 64% to 20.1p

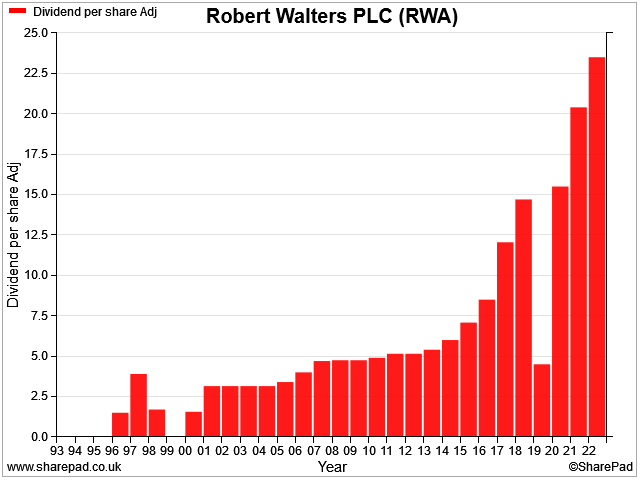

- Dividend unchanged at 23.5p per share

- Net cash exc. lease liabilities down 18% to £79.9m

The company's decision to maintain the dividend appears to be well-supported by the balance sheet and maintains its attractive record in this department:

The big drop in operating profit compared to fee income tells me that Robert Walters' operating costs have not fallen very much despite the slowdown in business.

This is a deliberate decision by the business. Robert Walters has only cut headcount by 9% over the last year, in order to "maintain core consultant capacity in most resilient markets".

CEO Toby Fowlston – who has been with the business 25 years and recently took over from founder Robert Walters – gave the following explanation for this decision:

"Our collective experience trading through previous market cycles tells us that when conditions do improve, the inflection can be rapid, and we therefore have strong conviction in our decision to maintain our core consultant capacity, whilst sensibly managing our cost base."

Given the strength of Robert Walters' balance sheet, which had a robust £80m net cash position at the end of last year, this seems logical to me. Having teams of experienced and well-networked employees in place should logically lead to a stronger recovery when conditions improve.

Geographic performance: the group's largest and most profitable business last year was in the Asia Pacific region, where net fee income of £168m (-13% vs 2022) converted into operating profit of £19.3m (-48% vs 2022).

Europe also performed well, but the group's UK and RoW businesses (mainly USA) reported operating losses for the year. Net fee income fell by 40% in North America as the pandemic tech hiring boom was reversed.

Cash flow & profitability: despite the slump in profits, a reduction in working capital supported free cash flow of £14.0m last year, covering the majority of the c.£17m cost of the dividend.

Profitability also remained respectable, with a return on average capital employed of 11%. This figure has reached more than 30% in the past, highlighting the profitability of this business model during strong markets.

Outlook: the company says trading conditions have remained "muted" in the early weeks of 2024, "albeit with some isolated pockets of growth".

Unspecified initiatives are now underway to strengthen the business over the medium termn. These will be discussed at a Capital Markets Day in the autumn.

For now, broker consensus estimates suggest that earnings could start to recover in 2024. SharePad forecasts suggest earnings could rise by 27% to around 26p per share this year, restoring dividend cover.

My view

Robert Walters' 2023 results value the business with an EBIT yield of around 8%, by my calculations. This looks potentially attractive to me, given the group's strong cash position and the expectation that 2023 may have been a low point for profits.

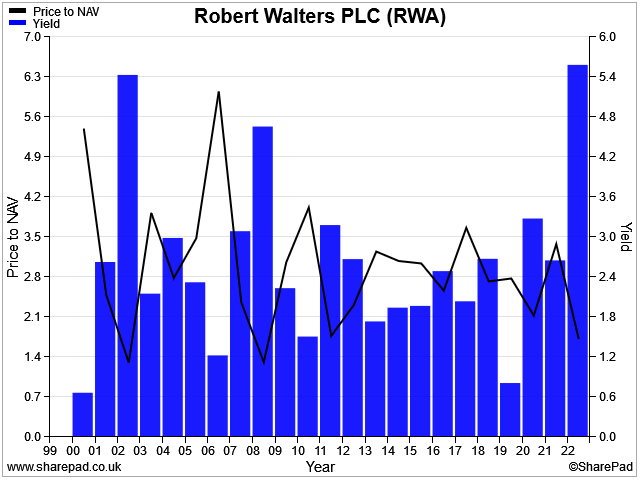

I'm also interested to note RWA's price-to-book value is currently lower than at any time since 2008. The 5.5% dividend yield – which looks sustainable to me – is also the highest (i.e. cheapest) since 2008:

A very cyclical business like this is not necessarily best-suited as a buy-and-hold investment and may require trading to maximise returns.

By way of comparison, this SharePad chart compares the total returns from an investment in Robert Walters with those from Unilever over the last 23 years or so.

A buy-and-hold investment in RWA would have delivered half the shareholder return generated by staid old Unilever over the same period, including dividends:

Despite this caveat, I continue to think that Robert Walters looks attractive at the moment. I'd consider buying the shares for my portfolio at this level.

Inchcape (INCH)

"Outlook for FY 2024 - another year of growth, albeit moderated"

2023 full-year results / Mkt cap: £2.7bn

FY24 forecast dividend yield: 5.5%

Inchcape is an automotive distribution group that generates the majority of its profits from providing distribution services to car manufacturers in markets they don't choose to serve directly themselves.

In essence, I see Inchcape as an outsourcing service that allows car manufacturers to delegate activities such as localisation, pricing, management of dealership networks and much more.

I last looked at Inchcape in October, when I provided a slightly longer introduction to the business and expressed some concern about the lack of 2024 guidance in the otherwise in-line Q3 update:

"My main concern is the lack of guidance for 2024. I think there's a risk that as the supply chain backlog unwinds, underlying demand for new cars might be weaker next year. This could hit Inchcape's earnings."

Fast-forward five months and here is the 2024 outlook statement (my bold):

"FY 2024 is expected to be another year of growth, albeit moderated, with the Group maintaining prudent expectations for recovery in FY 2024 in certain markets, which are weaker than previous years."

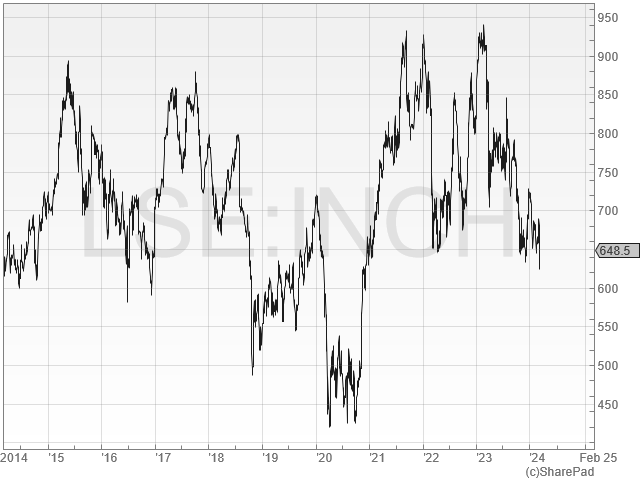

The market didn't warm to this update and Inchcape shares are now trading at levels seen 10 years ago.

While I don't think this is a business that deserves a premium rating, I do think Inchcape shares may offer some value at this level:

2023 results summary: Inchcape's results were in line with forecasts and looked fairly reassuring to me:

- Revenue up 41% to £11.4bn, including the acquisition of Derco (see below)

- Organic revenue up 12%

- Operating margin of 5.4% (2022: 4.9%)

- Pre-tax profit up 24% to £413m

- Earnings from continuing operations up 7% to 65.6p per share

- Dividend per share up 18% to 33.9p

- Net debt exc. lease liabilities up 59% to £601m, due to acquisitions

Derco: this was a large (£1.3bn) acquisition of a Latin American distribution group that completed in January 2023. The deal was funded with a mix of cash and shares and contributed £267m to Inchcape's net debt last year.

Integration progress so far seems to be positive. The company says that cost savings of £21m were achieved last year, en route to total annualised savings of £50m.

Cash integration costs are expected to be £70m over three years, so significant savings are needed to justify this investment.

Derco is said to have contributed an operating margin "towards the top end of 5%-7% range" last year.

Inchcape's management were also able to free up some working capital with a "c.£200m excess inventory reduction".

Cash flow/debt/profitability: distributors are generally low margin businesses, but when well managed they can generate attractive returns on capital employed and strong cash flow. My dividend portfolio includes two such companies.

In this case, my calculations suggest Inchcape generated a 19% return on capital employed last year.

This strong result suggests to me that the debt and equity issuance required to fund last year's acquisition spree has provided a decent return on investment, at least, initially.

Cash flow is a little harder to unpick. Excluding acquisition-related payments, I estimate 2023 free cash flow of around £448m.

However, this result benefited from a one-off £200m inventory reduction related to Derco. Stripping this out gives an underlying figure of £248m, which would represent 88% conversion from net profit of £283m – not a bad result, in my view.

Net debt exc. leases of £601m looks a little high to me, for this business. Net interest costs rose from £30m to £151m last year, suggesting to me that peak borrowing may have been significantly higher than year-end net debt.

The company says that its capital allocation decisions will prioritise deleveraging this year and I think this is should be possible, assuming end markets aren't weaker than expected.

One possible solution to deleveraging might be the potential sale of the group's UK retail operations, which was reported in January. An updated note from broker Zeus available on Research Tree suggests such a sale could generate proceeds of £180m-£252m.

Outlook: I've already shared the company's outlook statement above – in short, growth is expected to moderate this year and some markets could be weaker.

Consensus forecasts suggest adjusted earnings could rise by 3% to 87.4p per share this year, with a dividend of 36p per share. That would put Inchcape on a 2024 P/E of 7.5, with a 5.5% dividend yield.

My view

Inchcape generated more than 40% of its distribution revenue in the Americas last year, with a further 31% from Asia-Pacific countries. Europe and Africa made up the remainder.

In my view, Inchcape shares have become a play on the economies of Latin America and Asia.

China is also a factor – the company has a growing number of partnerships with Chinese car manufacturers who are starting to export more actively than in the past.

I don't have a crystal ball for 2024, but on balance I think Inchcape looks like a decent contrarian choice at current levels. A reduction in debt and continued earnings growth could justify a higher rating, in my view, while the dividend looks reasonably safe to me.

Nichols (NICL)

"Identification of surplus cash in order to return to shareholders during 2024"

2023 full-year results / Mkt cap: £377m

FY24 forecast dividend yield: 2.9%

This soft drinks group's main brand is Vimto. It's not cyclical and isn't really a value share, but I think this stock could offer relative value at the moment, given its defensive quality credentials.

Nichols is still recovering from the impact of the pandemic and some other issues, but I think the business is making decent progress with its stated strategy.

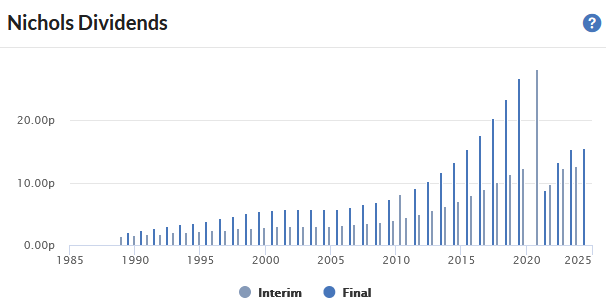

2023 results summary: the appeal of this type of business is its potential for delivering steady, incremental growth and strong profitability. Prior to the pandemic, Nichols hadn't cut its dividend since its flotation in 1986, according to Stockopedia data:

Correction: The section below was corrected to reflect that family John Nichols retired as chairman last year after 51 years with the business.

Following John Nichols' retirement as chairman last year, there is no longer a family member at the helm of this business. However, the Nichols family remain significant shareholders. I would imagine they are hoping for a return to the steady performance of the past.

I think that Nichols' 2023 results provide some confidence this might be possible:

- Revenue up 3.5% to £170.7m

- Operating margin: 13.1%

- Adjusted pre-tax profit up 8.7% to £27.2m

- Adjusted earnings up 1.9% to 56.4p per share

- Reported earnings up 58% to 50.3p per share

- Dividend up 1.8% to 28.2p per share

- Net cash up 19% to £67m

I've included adjusted earnings, as last year featured a hefty £11m of adjusting items. Hence the adjusted figure gives a more realistic measure of underlying progress over the last year, in my view.

Last year's sales growth was given a particular boost by strong growth in the group's international sales, which rose by almost 17%. Vimto is popular in Muslim countries during Ramadan, but the company is aiming to expand this reach.

Net cash: one thing that isn't adjusted is the net cash position of £67m. Nichols reports no debt and benefited from £2m of interest income on its cash last year – adding nearly 10% to its operating profits.

Surplus cash? Management say that work is being done to assess forward cash requirements and identify whether surplus cash can be returned to shareholders in 2024.

Cash flow/profitability: Nichols reports the following performance metrics prominently in its results:

- Free cash flow up 43% to £20.9m

- Return on capital employed of 23.3%

I am encouraged by the company's prominent use of return on capital employed (ROCE) and free cash flow as performance metrics. I'm even happier that both of the figures specified in the results match my own calculations exactly.

In my experience, management often succumbs to the temptation to include some favourable adjustments. It's to Nichols' credit that it doesn't, in my view.

Outlook: management commentary sounds cautiously optimistic to me. 2024 is said to have "started well", with performance in line with expectations.

The company is confident it can deliver "further strategic progress accross its business in 2024".

There's also the potential of an additional cash return, if management identify surplus cash within the company's large net cash position.

Broker consensus forecasts suggest adjusted earnings could rise by 6% to around 60p per share this year, supporting a 7% increase in the dividend of 30p per share.

That prices the stock on 17 times forward earnings, with a 2.9% yield.

My view

Nichols' valuation doesn't look excessive to me, if the company can maintain last year's improved profitability and return to steady, incremental growth.

Last year's free cash flow gives the stock a free cash flow yield of 5.5%, covering the dividend twice.

Stripping out net cash from the market cap gives the stock a cash-adjusted P/E of 14, which also doesn't look expensive.

I would want to research the company's brands, market share and future strategy more closely before considering an investment. But my view on Nichols is positive and I might consider buying at this level.

Roland Head

Disclosure: at the time of publication, Roland owned shares in Unilever.

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.

Member discussion